Are you feeling frustrated with your recent municipal property tax assessment? You're not alone; many homeowners often find themselves questioning the accuracy of these evaluations. In this article, we'll guide you through the process of appealing your property tax assessment, ensuring you understand your rights and options. Ready to take the first step? Let's dive in and discover how you can take charge of your property taxes!

Property Identifiers and Assessment Details

Municipal property tax assessments can greatly impact homeowners' financial obligations, especially in locations like New York City or San Francisco where property values fluctuate significantly. Property identifiers, such as the Assessor's Parcel Number (APN) or the Tax Identification Number (TIN), are essential for accurately identifying the specific property under review. Detailed assessment information, including the assessed value based on recent market trends and comparable sales in the neighborhood, plays a crucial role in the appeal process. Homeowners may want to include data on nearby properties, such as their square footage or sale prices from the last six months, to support their case for an adjustment. Additionally, referencing local assessment guidelines, which vary by municipality, can provide necessary context and bolster the appeal's legitimacy.

Grounds for Appeal (such as inaccuracies or discrepancies)

An appeal for municipal property tax assessment may stem from inaccuracies in property value estimations that significantly impact tax obligations. For example, an assessment that overestimates the property's square footage, such as inaccurately reporting 2,500 square feet instead of the actual 2,000 square feet, can lead to inflated tax bills. Additionally, discrepancies in recent comparable sales, like properties within the same neighborhood in Springfield that sold for 20% less, can highlight unfair assessment practices. Furthermore, failing to account for property conditions, such as outdated infrastructure or required repairs, can misrepresent overall value. Detailed comparisons of local market trends and recent property sales data are crucial for substantiating an appeal, aiming for a fair reassessment by the municipal tax authority.

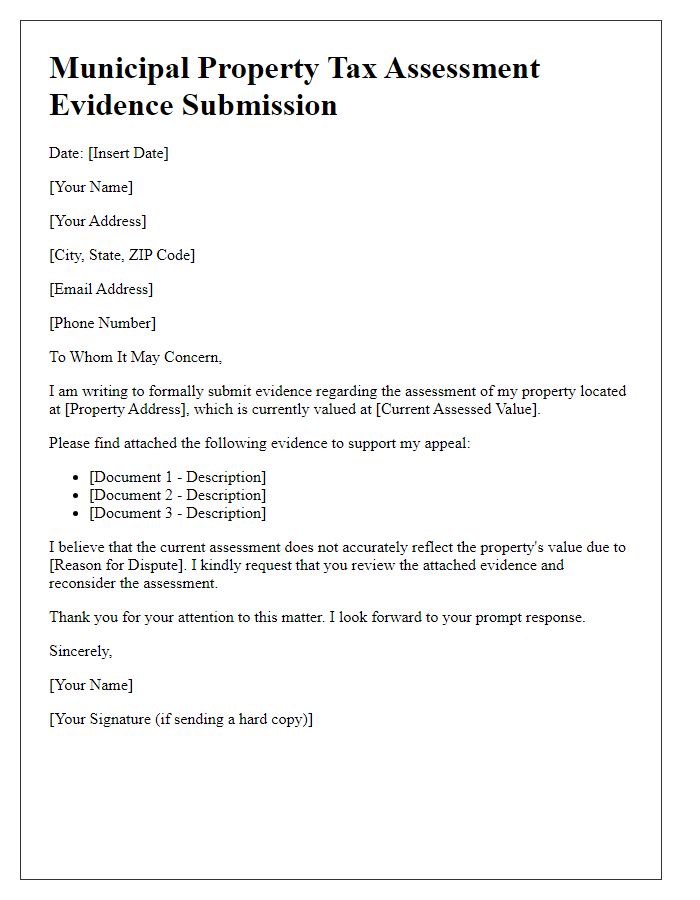

Supporting Evidence (comparable properties, appraisals)

When preparing a municipal property tax assessment appeal, gathering supporting evidence is crucial for a compelling case. Comparable properties, also known as "comps," should be identified based on key characteristics, including proximity (within one mile of the subject property), square footage (similar range, ideally within 10%), and sale date (within the last 12 months) to ensure relevance. Furthermore, obtaining professional appraisals from certified real estate appraisers can provide documented evidence of market value, highlighting discrepancies in the municipality's assessment. This evidence, alongside photographs of the property, condition assessments, and neighborhood statistics, creates a robust argument to challenge inflated property tax assessments effectively.

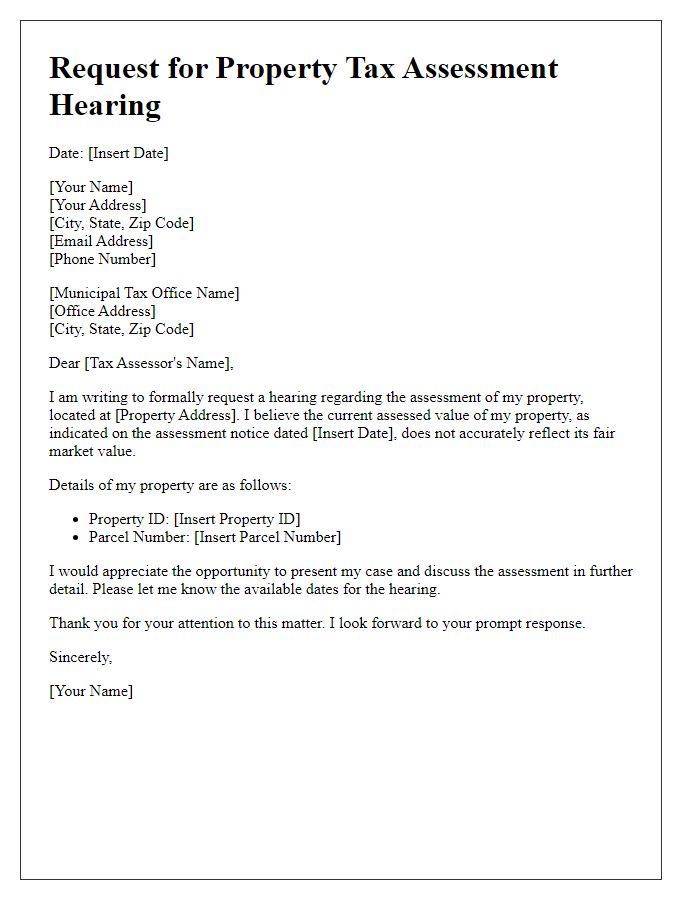

Request for Re-evaluation or Adjustment

Municipal property tax assessments often require a thorough review when property owners believe their assessments do not accurately reflect their property's market value. An effective appeal should address critical factors such as the assessed value, the property's recent sales history, comparable properties in the area, and any unique features affecting valuation. For example, if a residential property located in Springfield (population 160,000) was assessed at $300,000 but similar homes recently sold for $250,000, a compelling argument for re-evaluation may focus on discrepancies in property comparisons. Supporting documentation, including recent appraisals, photos, and statements regarding neighborhood developments, can significantly strengthen the appeal. Timely submission--typically within 30 days of receiving the assessment notice--is crucial to ensure the municipal tax authority considers the request for adjustment.

Contact Information and Desired Outcome

Municipal property tax assessments serve as crucial instruments for local governments in determining property values to calculate tax obligations. When property owners believe their assessments do not accurately reflect their property's market value, they may seek to file an appeal. Key details include property identification numbers (PIN), the assessment year, and specific valuation methods used by local assessors. Property owners usually aim to reduce their assessed value, thereby lowering tax liabilities. To strengthen their appeals, they often provide comparative market analyses (CMA), evidence of recent sales of similar properties, and assessments from neighboring properties. Understanding the local municipal code and procedural timelines for appeals is essential for successful outcomes.

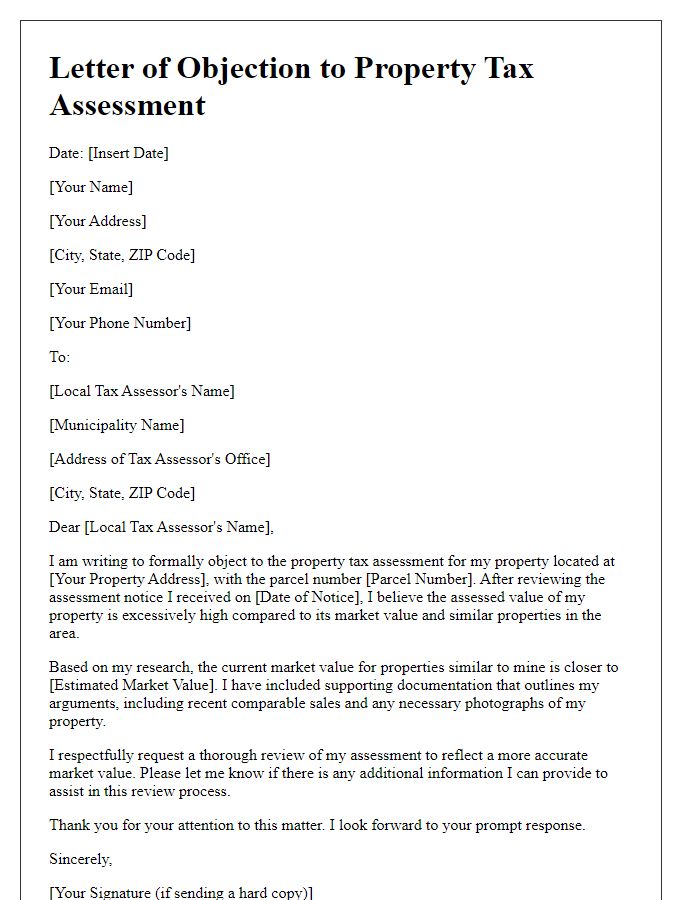

Letter Template For Municipal Property Tax Assessment Appeal Samples

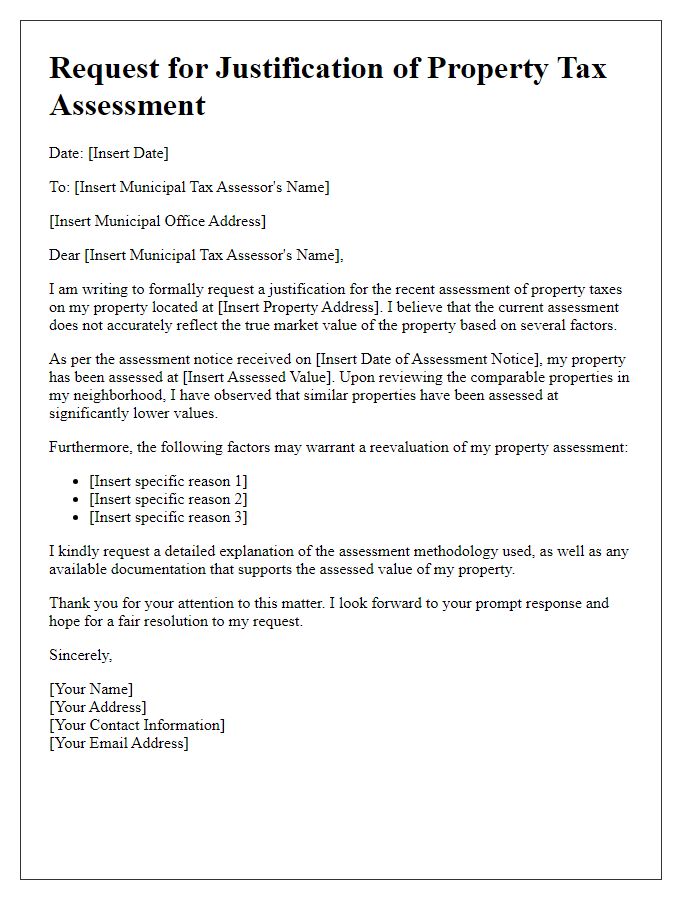

Letter template of municipal property tax assessment justification request

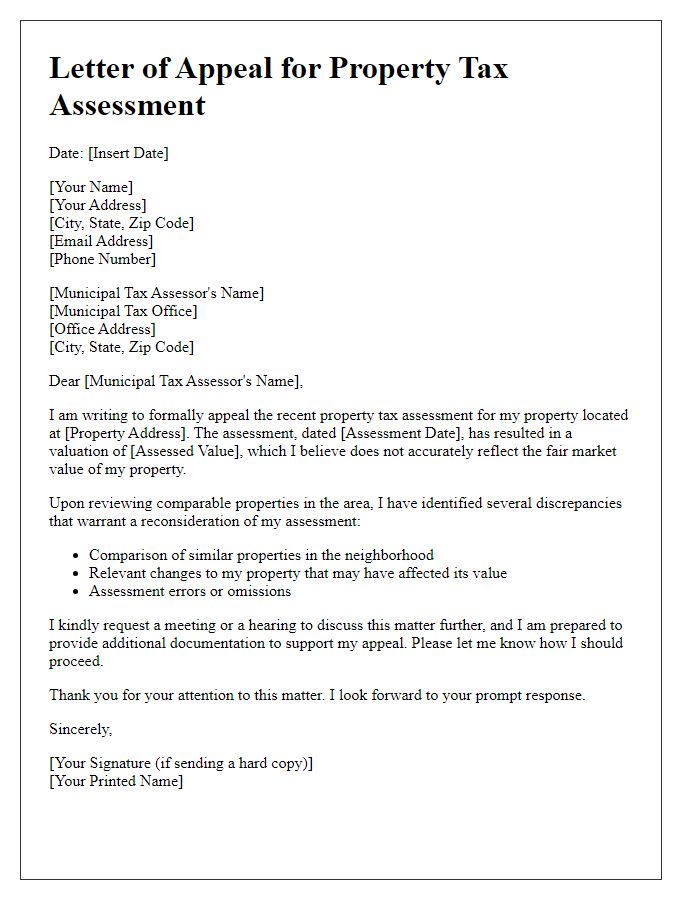

Letter template of municipal property tax assessment reconsideration appeal

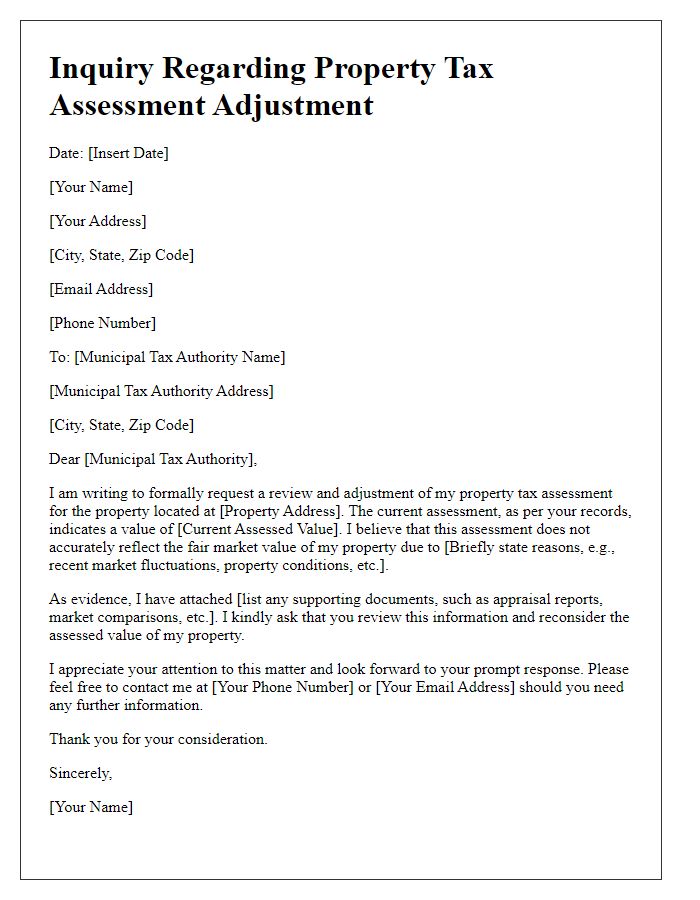

Letter template of municipal property tax assessment inquiry for adjustment

Letter template of municipal property tax assessment consultation request

Comments