Are you finding it difficult to keep track of your mortgage escrow analysis? You're not aloneâmany homeowners face the same challenge as they navigate the complexities of mortgage management. Understanding your escrow analysis is key to ensuring that your payments align with your property taxes and insurance. If you're curious about how to simplify this process and ultimately enhance your financial peace of mind, keep reading for valuable insights!

Accurate Account Information

Mortgage escrow analysis is a critical process for managing property tax and homeowners insurance payments. Frequent audits of homeowner accounts, particularly those with adjustable-rate mortgages, ensure accurate data reflecting changes in taxes or insurance premiums. Homeowners must regularly review detailed statements showcasing the breakdown of escrow accounts, which can fluctuate annually. Timely notifications about adjustments provide clarity and transparency within financial transactions, preventing future discrepancies. Moreover, consistent communication regarding account information strengthens the relationship between homeowners and mortgage servicers, promoting trust in the overall loan management process.

Detailed Escrow Analysis Explanation

The mortgage escrow analysis provides vital insight into the financial management of homeowners' property expenses, including insurance premiums and property taxes. Typically conducted annually, the analysis ensures that the collected escrow payments align with those expenses, which can vary significantly based on location, such as in California with its high property taxes compared to states like Florida. An accurate analysis (often conducted by financial institutions) helps prevent shortfalls, which then could lead to insufficient funds during critical payments. The analysis also projects future expenses, adjusting monthly contributions accordingly, ensuring homeowners have adequate reserves in their escrow account. Frequent reassessment can help mitigate changes in the housing market or insurance rates, providing homeowners peace of mind regarding their financial obligations.

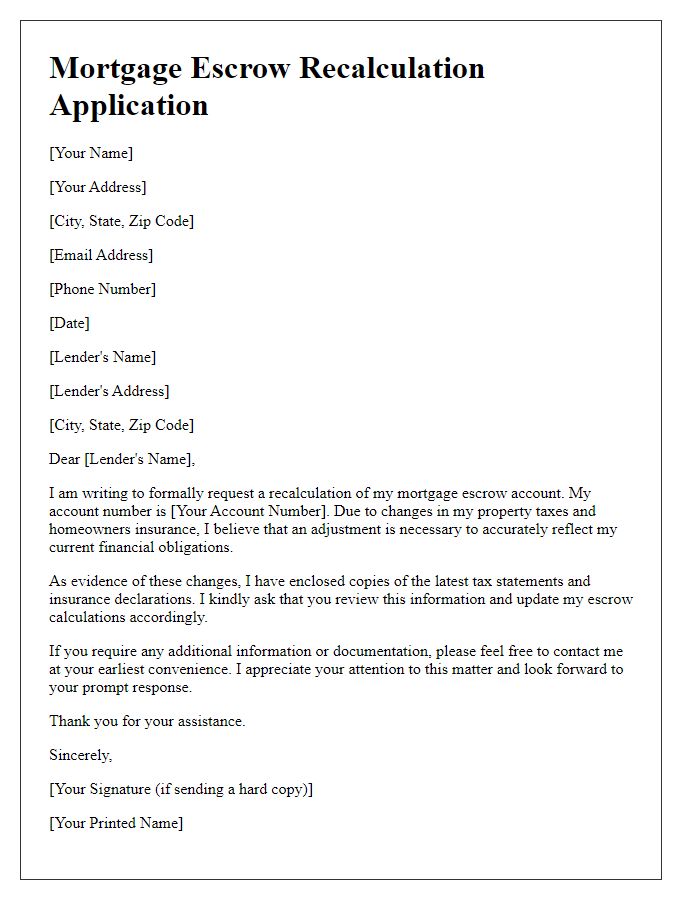

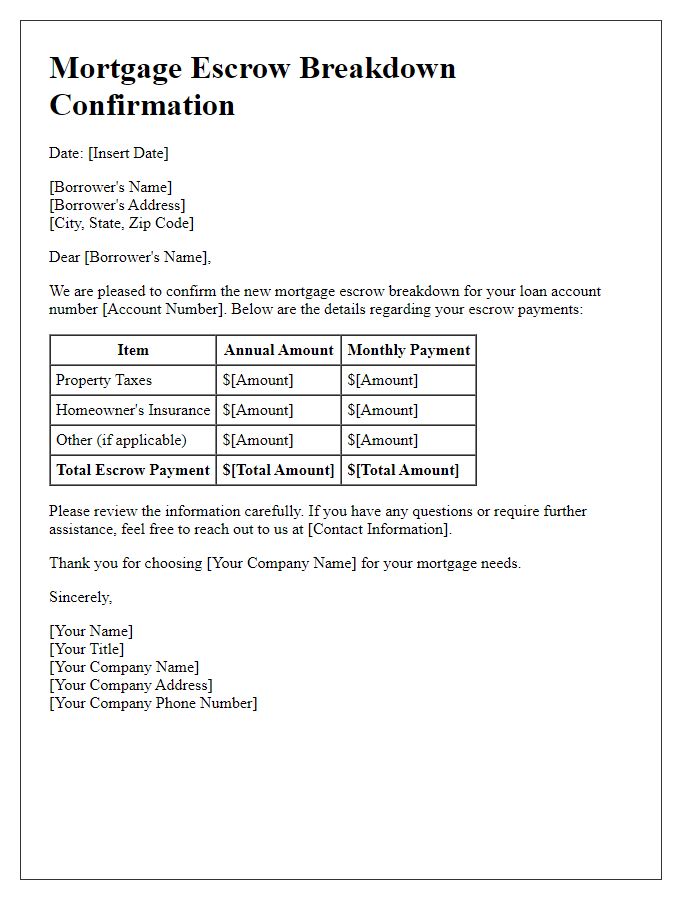

Updated Payment Breakdown

The updated mortgage escrow analysis provides a comprehensive breakdown of monthly payment adjustments reflecting changes in property taxes and homeowners insurance premiums. This detailed analysis outlines the allocation of funds designated for various expenses, including the estimated annual property tax of $2,500 and homeowners insurance premium of $1,200. The total monthly escrow payment, after recalculating and considering these adjustments, amounts to $307, ensuring adequate funds are available for disbursement to the taxing authority and insurance provider. It is essential to review this updated analysis to understand how these changes will impact overall mortgage payments and to ensure sufficient funding throughout the escrow period.

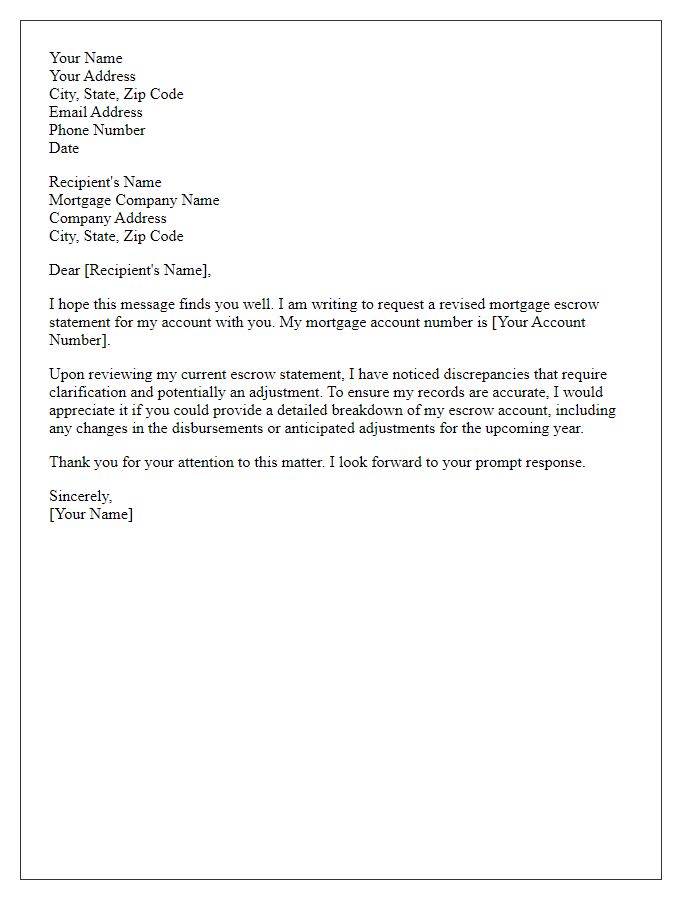

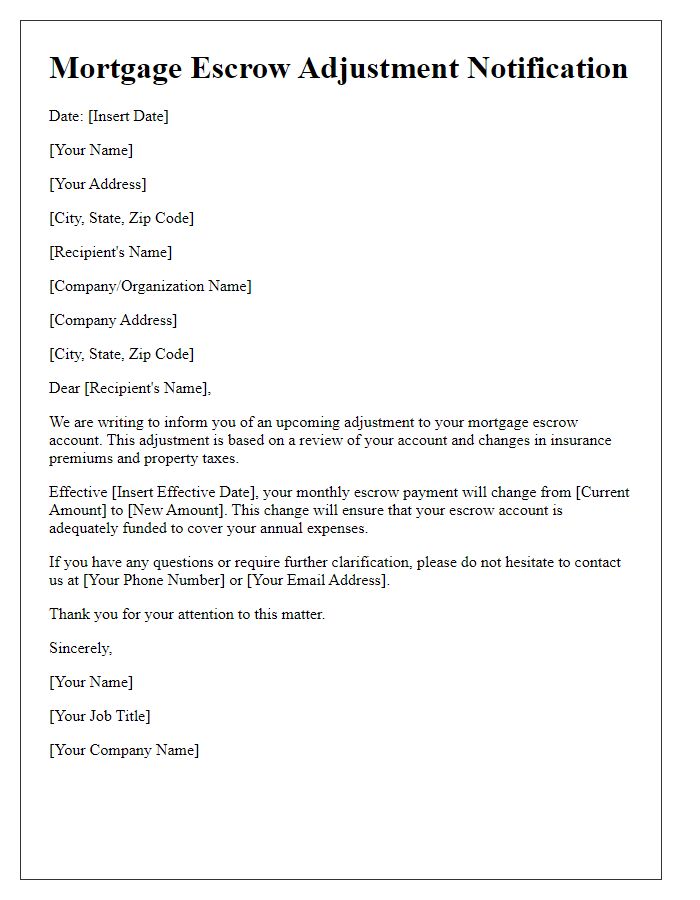

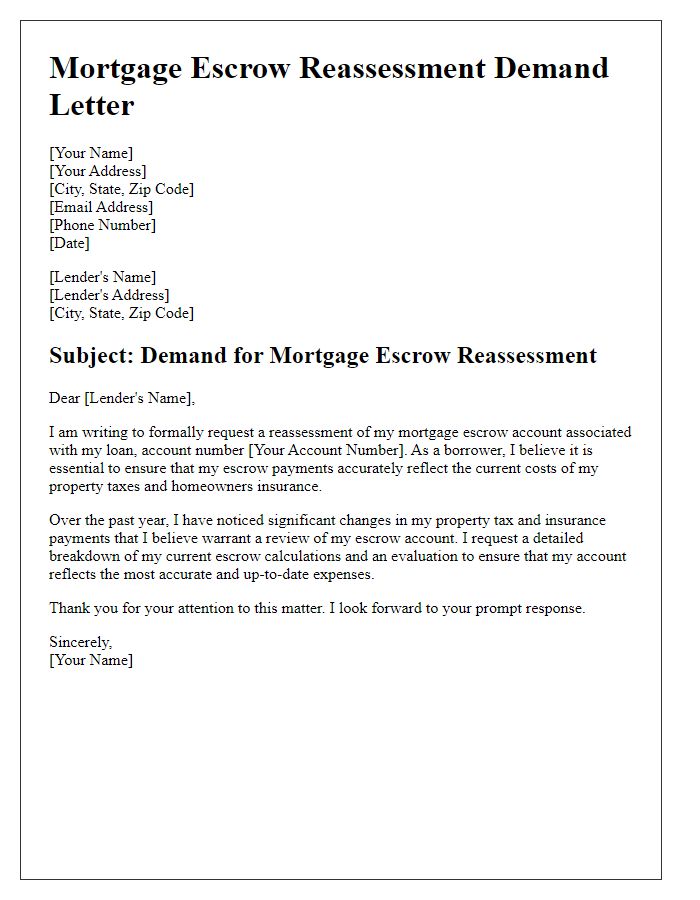

Clear Communication on Changes

Reissuing a mortgage escrow analysis necessitates clear communication regarding changes to the escrow account, which manages property taxes and homeowners insurance. Escrow accounts typically adjust annually, impacting monthly payments. For instance, if property taxes in California increase by 3% due to local government assessments, the escrow analysis reflects this change, ensuring that sufficient funds are allocated. Additionally, premiums for homeowners insurance might rise following natural disaster claims, necessitating review and adjustment in payment schedules. The mortgage servicer must provide detailed statements outlining adjustments, anticipated costs, and revised monthly payment amounts to maintain transparency and facilitate understanding for homeowners.

Contact Information for Queries

Reissuing mortgage escrow analysis involves a detailed review of the account that holds funds collected by the lender to pay property taxes and insurance premiums. Homeowners, particularly those with fixed-rate mortgages or adjustable-rate mortgages, often require clarity on these figures. For inquiries related to the analysis, borrowers can reach the mortgage servicing department at (800) 555-0199, which operates Monday to Friday from 9 AM to 5 PM EST, or via email at servicer@mortgageloan.com. The physical address for correspondence is 1234 Finance Road, Suite 100, Moneytown, NY 12345. It's essential for homeowners to ensure timely communication to prevent disruptions in their escrow payments.

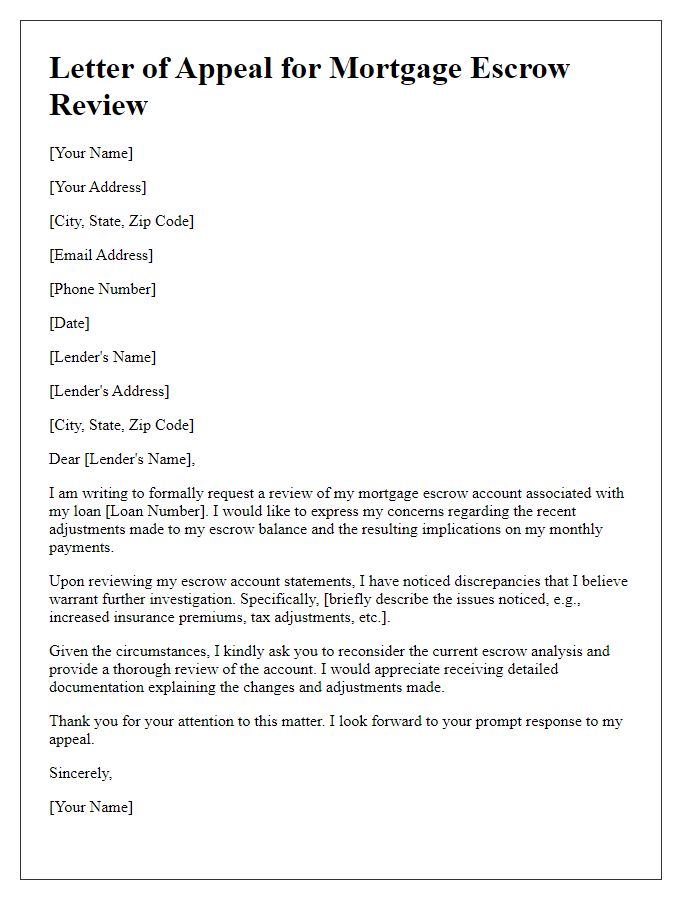

Letter Template For Reissuing Mortgage Escrow Analysis Samples

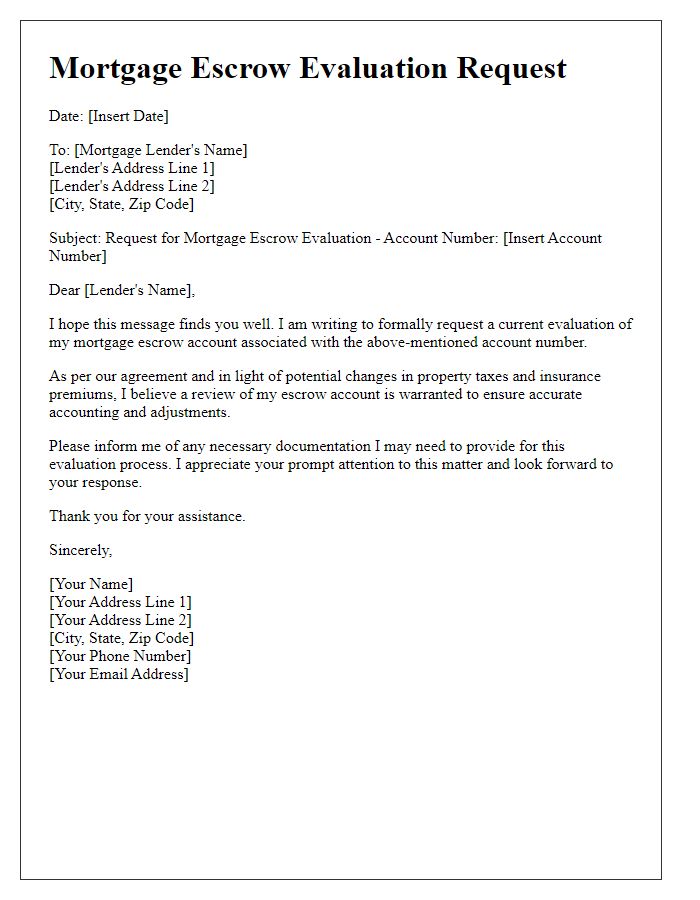

Letter template of correspondence for current mortgage escrow evaluation

Comments