Are you looking to obtain a certified mortgage document but feel overwhelmed by the process? You're not alone; many individuals find navigating this paperwork puzzling. In this article, we'll break down the steps you need to take to request your certified mortgage documents efficiently and successfully. So, let's dive in and simplify this journey togetherâread on to discover the essential tips!

Proper Salutation and Contact Information

The Certified Mortgage Document Request represents a formal inquiry directed toward a financial institution or mortgage lender regarding specific documentation related to a mortgage agreement. This request often includes vital details such as the full name of the borrower, loan number (for identification purposes), property address, and the date when the mortgage was executed. Clear and concise contact information should be provided, including phone numbers and email addresses, enabling the recipient to respond promptly and accurately. Utilizing an appropriate salutation, such as "Dear [Lender's Name]," sets a professional tone and establishes the seriousness of the request, enhancing the chances of a swift response.

Clear Subject Line

Certified mortgage document requests require attention to detail and clarity to ensure timely processing. A clear subject line such as "Request for Certified Mortgage Documents - [Your Name or Loan Number]" helps the recipient quickly identify the purpose of the email. Essential details include the full name of the borrower, the mortgage account number (typically a 10 to 12-digit identifier), and the specific documents needed (such as the original mortgage agreement, amortization schedule, or pay-off statement). Ensure to mention relevant timelines, such as a desired response date, to facilitate efficient handling of the request.

Account Details and Mortgage Information

To obtain certified mortgage documents, borrowers need to provide specific account details. Important information includes the mortgage account number, which uniquely identifies the loan, and the full name of the mortgage holder as listed on the loan documents. Additionally, precise contact information such as the mailing address and phone number associated with the account must be included to facilitate communication. The loan amount, interest rate, and the original loan date also play a crucial role in identifying the correct documents needed, along with any relevant reference numbers provided by the lender. Finally, a request statement should clearly express the intent to receive copies of certified documents, which may include the loan agreement, payment history, and any modification agreements.

Specific Request for Certified Documents

Certified mortgage documents serve as crucial records for homeowners, financial institutions, and legal professionals, detailing the specifics of a mortgage transaction. These documents, including the promissory note, mortgage deed, and closing disclosure, contain important information such as loan amounts, interest rates, repayment terms, and property details. Homeowners requesting certified copies often need them for refinancing processes, legal disputes, or estate planning. The request process typically involves identifying the lending institution, specifying the documents needed, and providing personal identification for verification. Accurate submission of this request ensures prompt access to these essential financial documents, facilitating smoother transactions and legal proceedings.

Signature and Contact Details for Follow-up

Certified mortgage document requests require accurate signatures and clear contact details for effective follow-up. The signature, generally located at the bottom of the document, ensures authorization and validity, while the contact details should include the homeowner's full name, mailing address, phone number, and email address. These elements facilitate communication with mortgage lenders or servicing companies, ensuring prompt receipt of requested documents. Accurate information minimizes delays, especially important in time-sensitive situations such as refinancing or legal inquiries. Properly detailing this information can expedite processes within institutions like Bank of America or Wells Fargo.

Letter Template For Certified Mortgage Document Request Samples

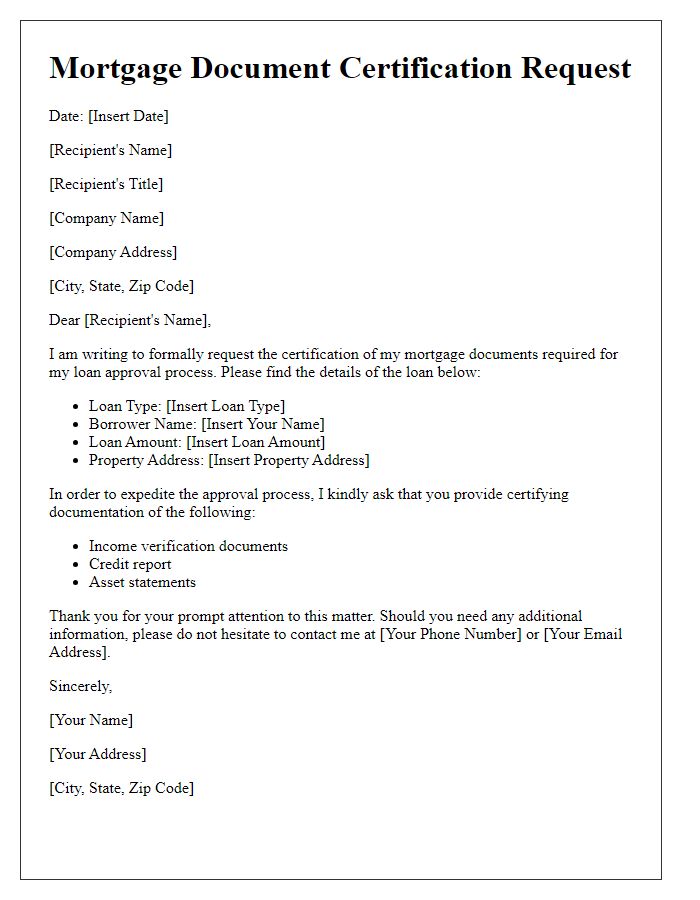

Letter template of mortgage document certification request for loan approval.

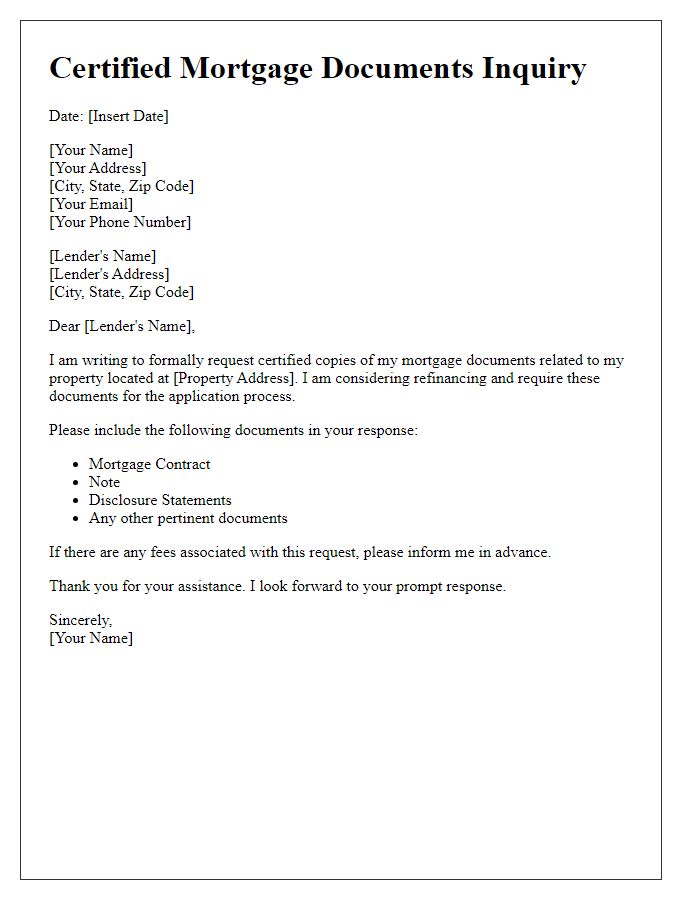

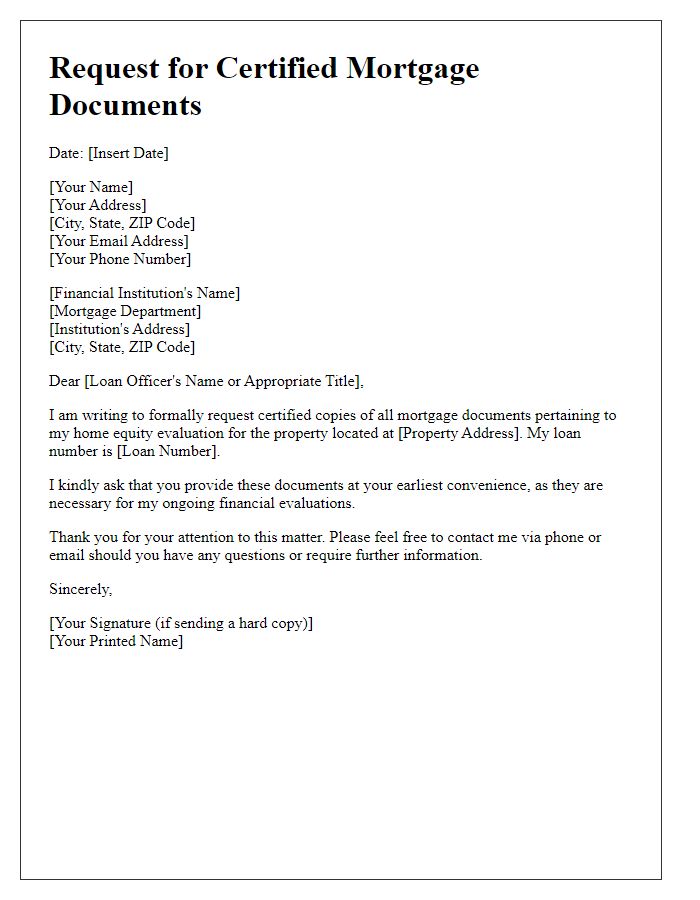

Letter template of certified mortgage documents inquiry for refinancing purposes.

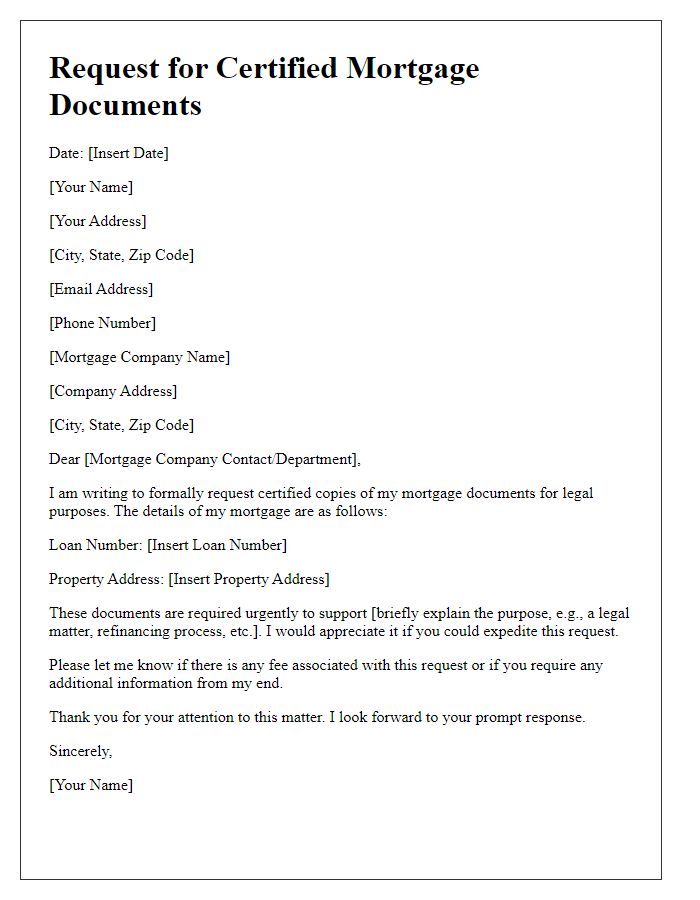

Letter template of request for certified mortgage documents for legal purposes.

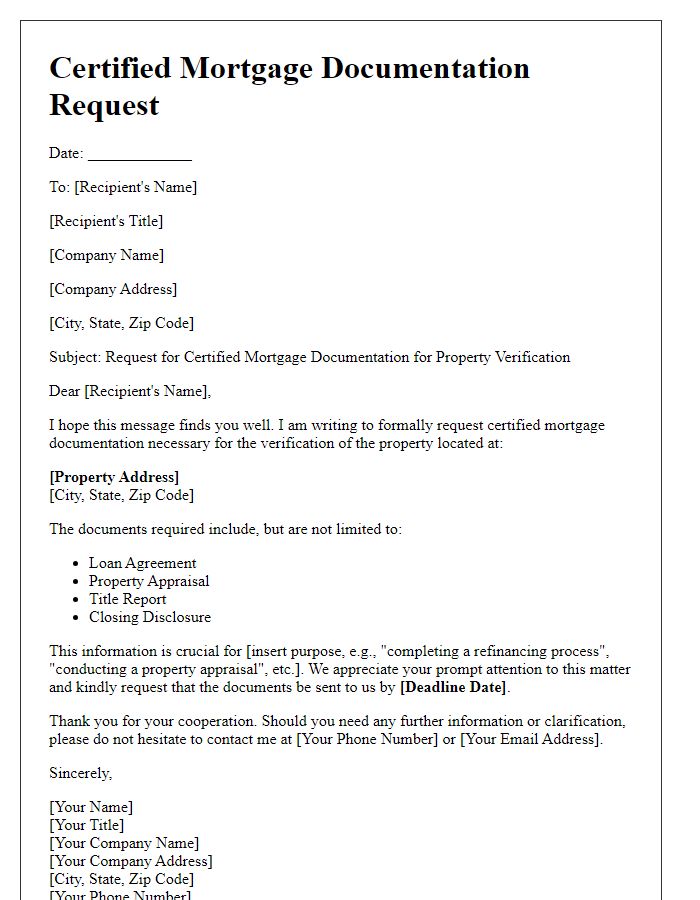

Letter template of certified mortgage documentation request for property verification.

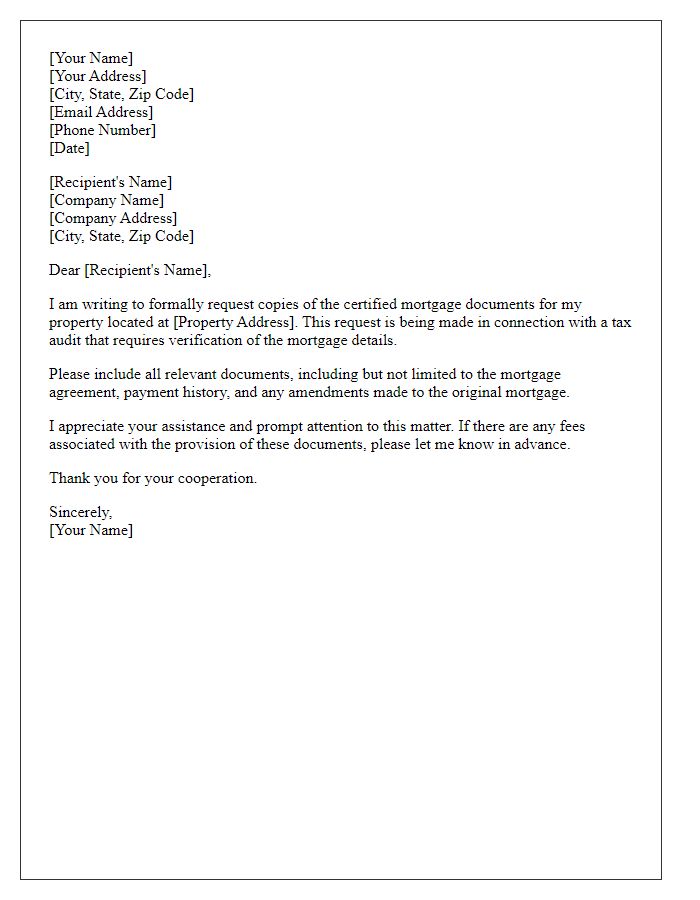

Letter template of request for copy of certified mortgage documents for tax audit.

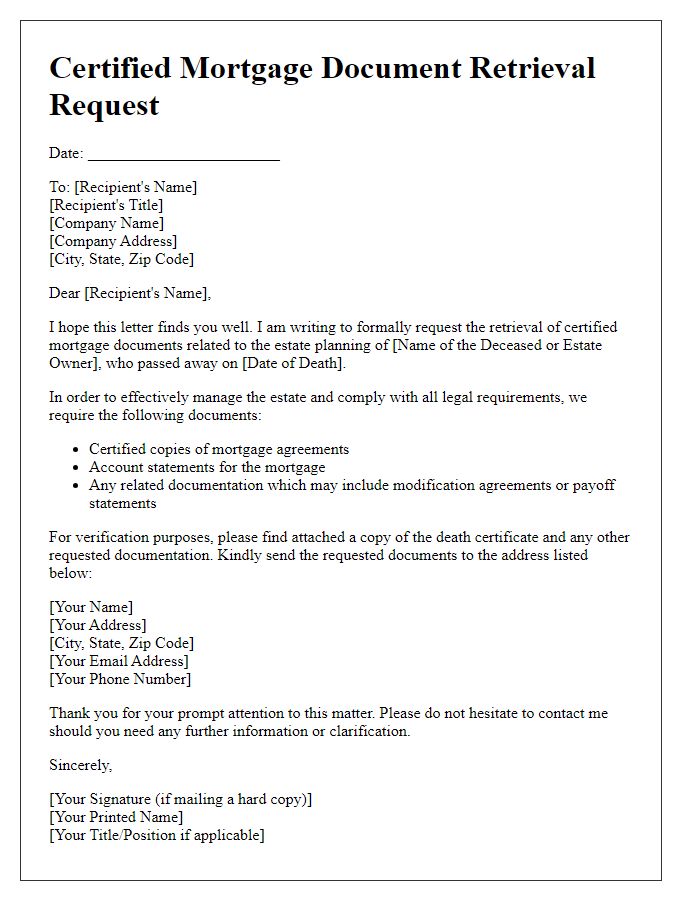

Letter template of certified mortgage document retrieval request for estate planning.

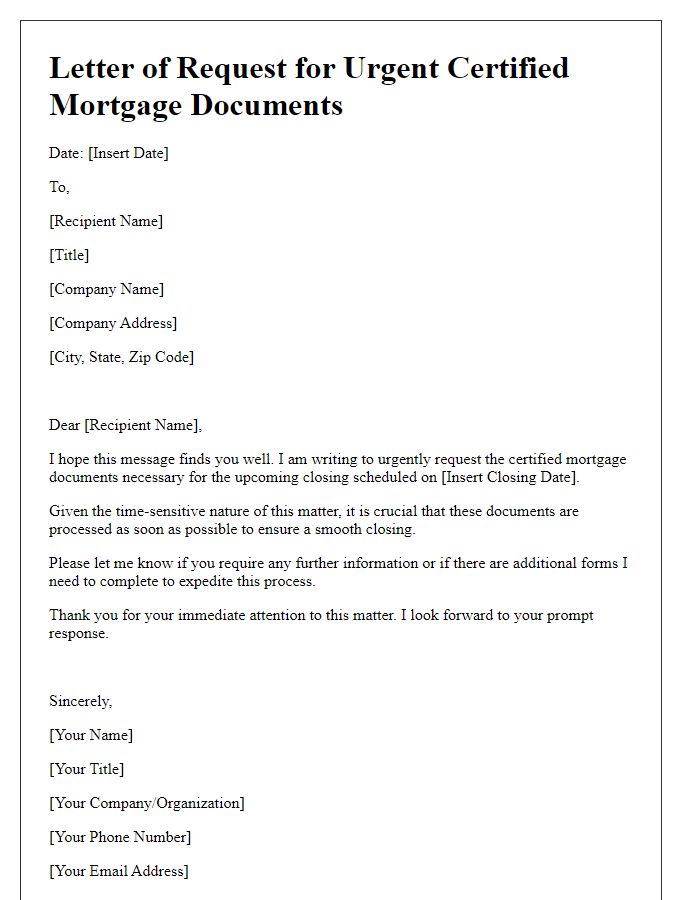

Letter template of request for urgent certified mortgage documents for closing.

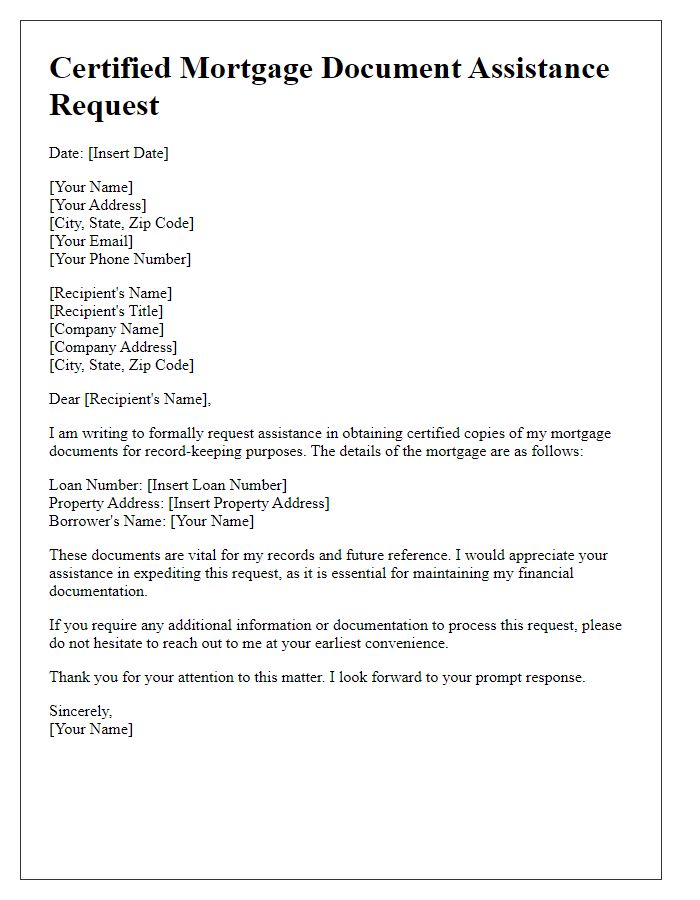

Letter template of certified mortgage document assistance request for record keeping.

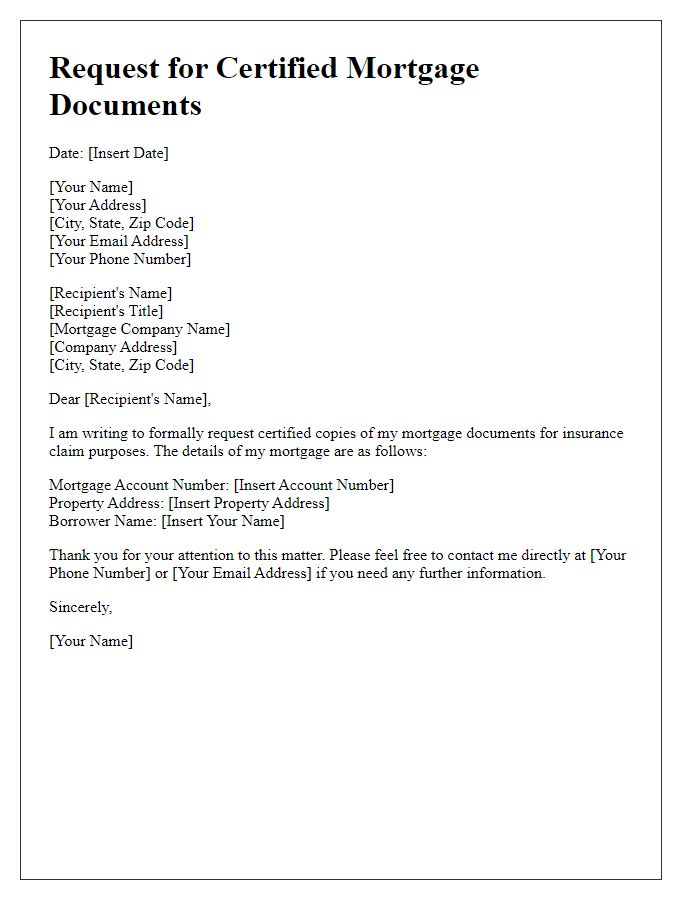

Letter template of request for certified mortgage documents for insurance claims.

Comments