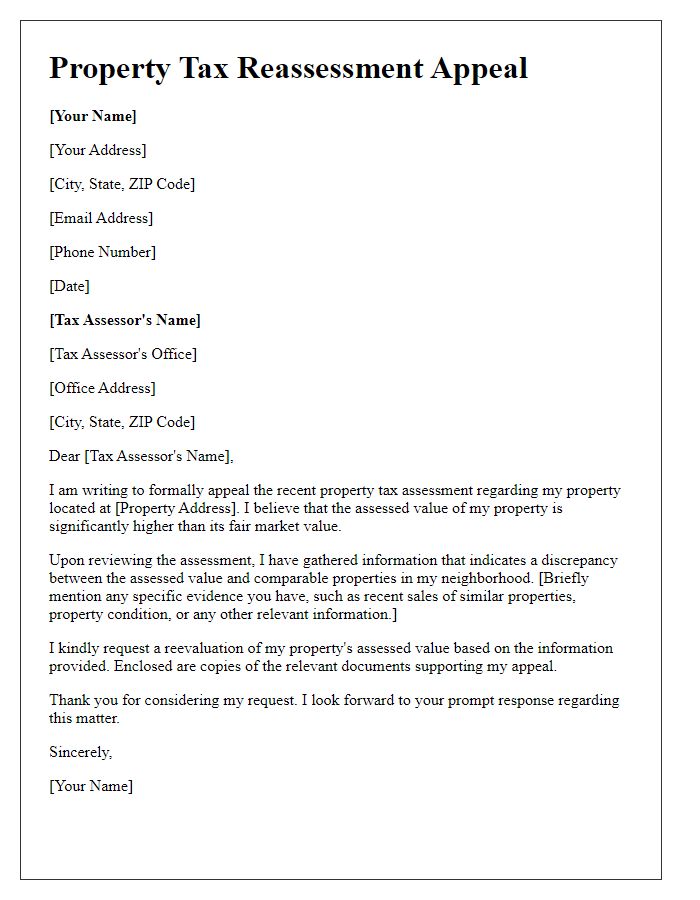

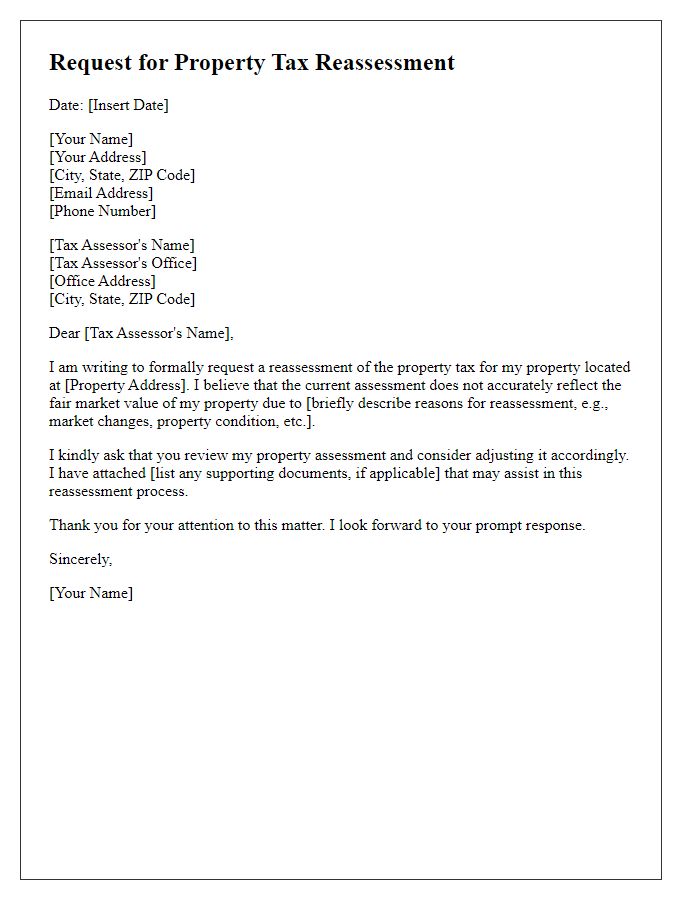

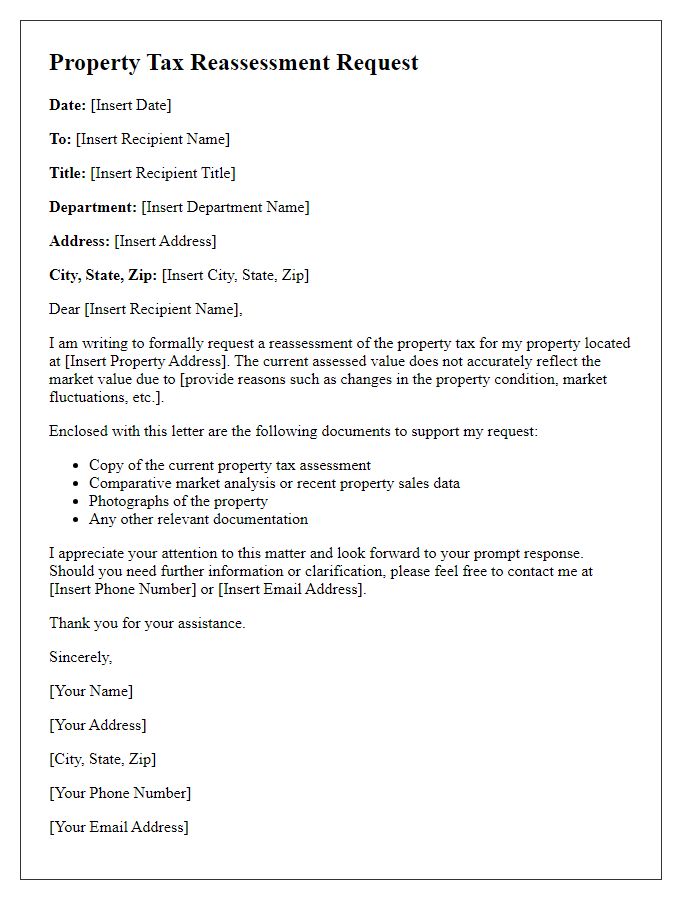

Are you feeling overwhelmed by your property tax bill? If so, you're not aloneâmany homeowners find themselves in the same situation and are unsure of how to navigate the reassessment process. Crafting a well-structured letter can make all the difference in effectively communicating your concerns and initiating a review. Read on to discover a comprehensive letter template that will guide you through this essential step towards potentially lowering your property taxes.

Property details and identification.

Property tax reassessment requests require specific property identification details to facilitate accurate evaluation by tax authorities. Property identification number (PIN) serves as a unique identifier for the property, typically assigned by the local tax assessor's office. Address (including street name, city, and ZIP code) provides a physical location reference essential for identifying the exact parcel under review. Lot size in square feet or acres indicates the extent of the property, which can influence assessed value. Property type (e.g., residential, commercial, agricultural) categorizes the property and often determines tax rates. Ownership details, including the property owner's name, ensure that the correct individual or entity is requesting reassessment. Recent property appraisal value reflects market conditions and can argue for a lower tax assessment. Surrounding neighborhood information and proximity to amenities or public services (such as schools and parks) may also impact property value assessment considerations.

Current assessed value and contested value.

Property tax reassessment can significantly impact homeowners depending on the evaluated market value of their property. The current assessed value, established by local taxing authorities (often municipalities), influences property taxes and is based on factors such as recent sales in the neighborhood, location, and property size. Homeowners may contest this assessed value, especially if they believe it exceeds the fair market value. Contested value refers to the amount a homeowner argues should be the correct assessment, often backed by recent comparable sales or independent appraisals. Engaging in this process may require submitting formal appeals to local property assessment boards or commissions, providing necessary documentation to support the contested amount.

Evidence supporting reassessment (comparative sales, appraisal).

The property tax reassessment process hinges on a comprehensive evaluation of comparative sales data and professional appraisals to establish a more accurate market value for real estate properties. Recent comparative analysis (conducted between January 2022 and December 2022) of similar residential properties in neighborhoods like Oakwood Grove and Maple Hill reveals substantial fluctuations in property sales prices, with average sale prices increasing by approximately 15%. An independent appraisal from a certified real estate appraiser indicates that the property's current estimated market value significantly exceeds the assessed value presented by the local taxing authority. Detailed attention to recent sales (three or more comparable properties sold within the last six months) is crucial, especially properties with similar square footage and amenities, which sold in the range of $350,000 to $400,000, far surpassing the offered tax assessment of $310,000. This evidence supports the argument for a reassessment based on current market trends and fair valuation principles.

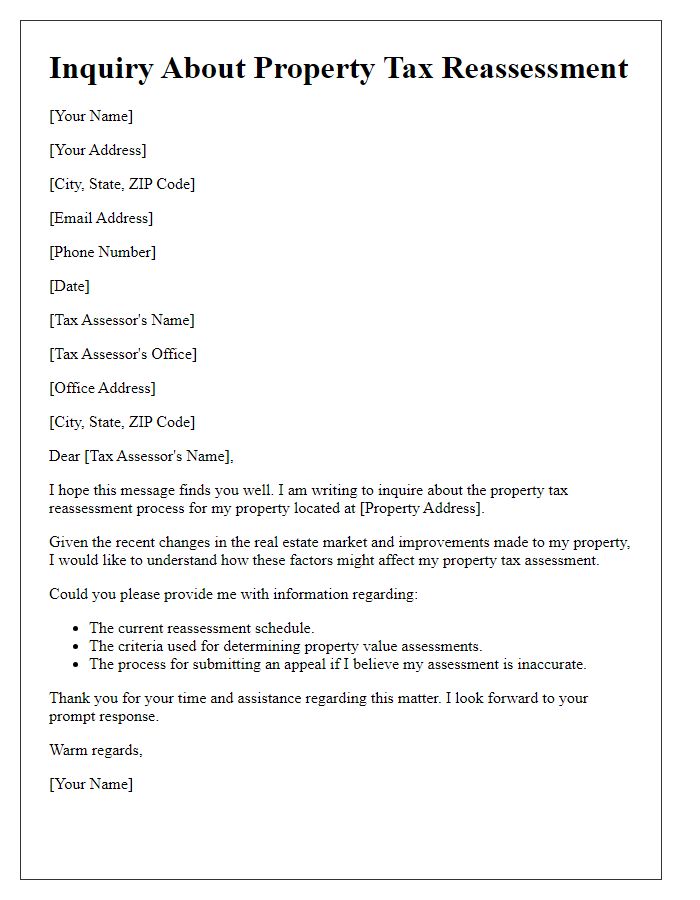

Request for reassessment schedule.

Property tax reassessment can significantly impact homeowners' financial responsibilities in municipalities across the United States, especially in counties like Cook County, Illinois, where property values fluctuate based on market dynamics. To better understand these changes, residents often seek a reassessment schedule from their local tax authority, typically the county assessor's office. This formal request highlights the importance of timely information about valuation dates, assessment periods, and opportunities for public input. Understanding the reassessment timeline can help homeowners prepare for potential adjustments in their property tax bills, which would affect their annual budget and financial planning. Residents become eligible for appeals or exemptions that could alleviate tax burdens, making knowledge of the reassessment schedule essential for informed financial decision-making.

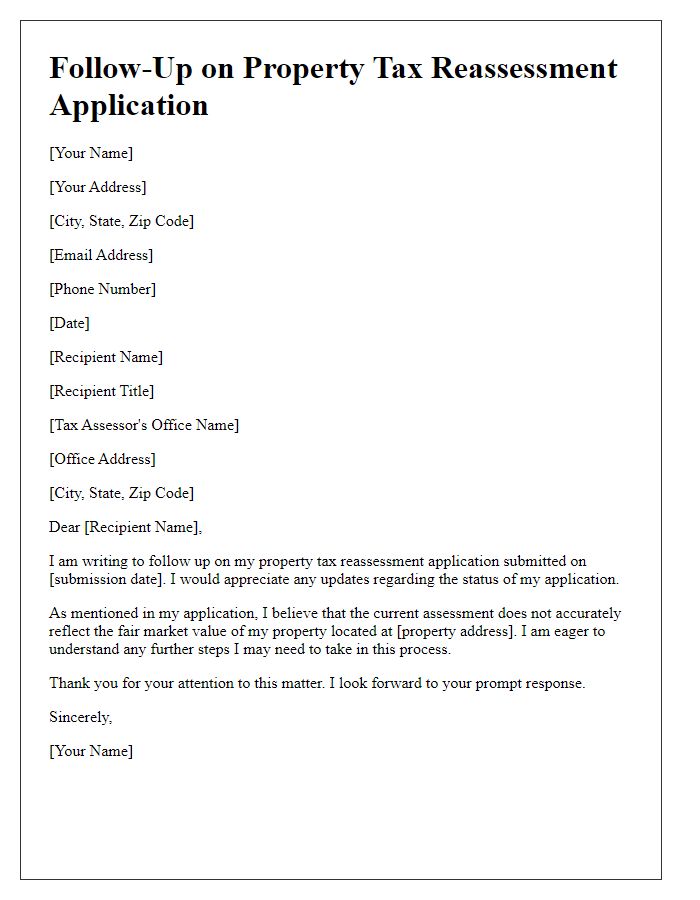

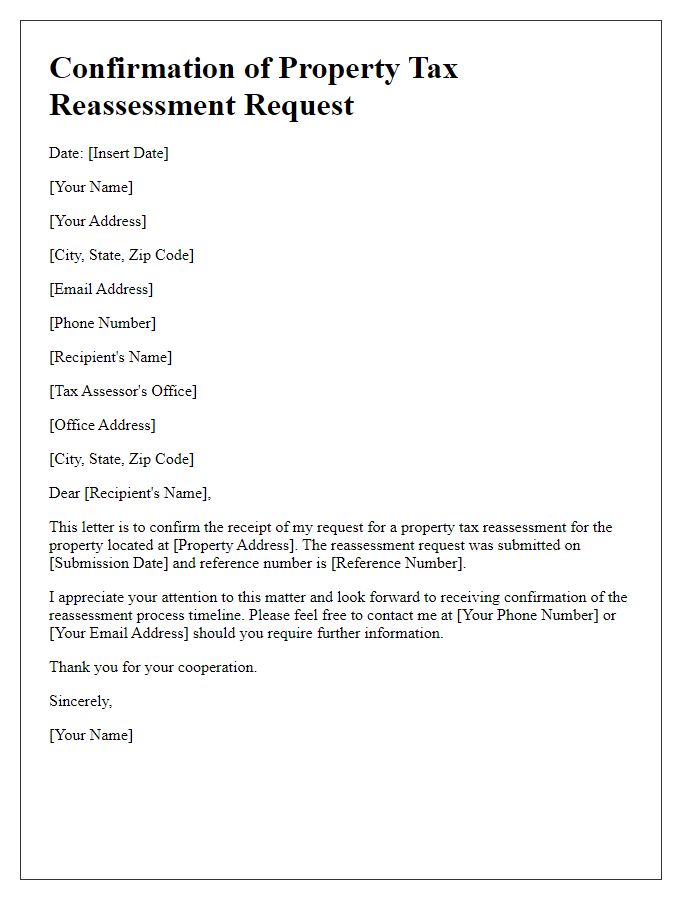

Contact information for follow-up.

Property tax reassessment notifications can significantly impact homeowners' financial obligations. Residents in cities like Seattle may appeal their property assessments annually, often affecting thousands of dollars in taxes. The assessment process typically begins in January, with notices sent out by the local assessor's office (e.g., King County Department of Assessments). Vital contact information for follow-up inquiries includes phone numbers, email addresses, and office locations, which are critical for homeowners looking to clarify or contest their assessments. Deadlines for submitting appeals usually fall in April, giving residents a narrow window to gather evidence supporting their claims, such as recent property sales or improvements made to their homes.

Comments