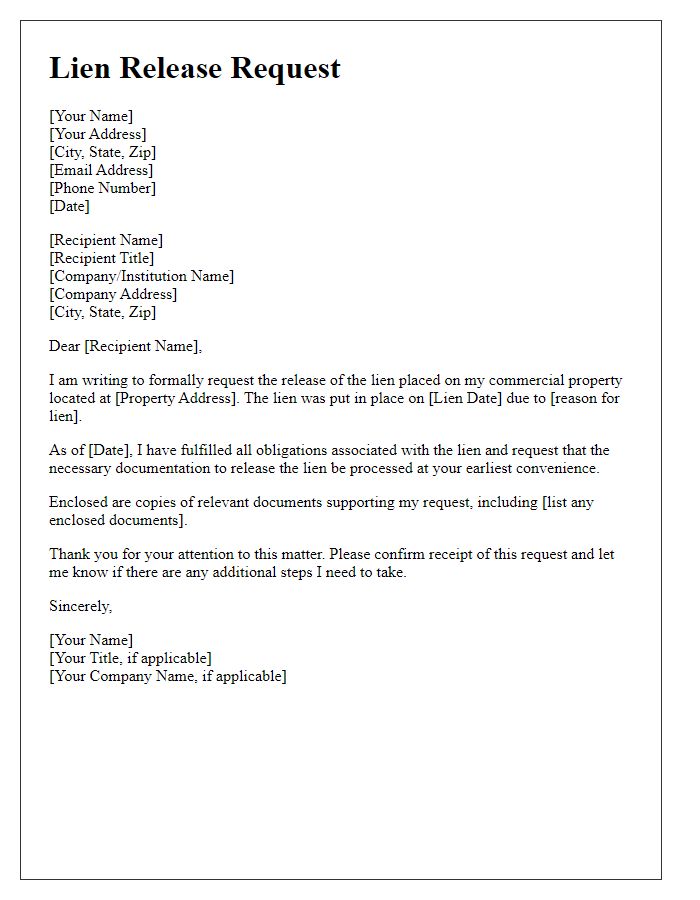

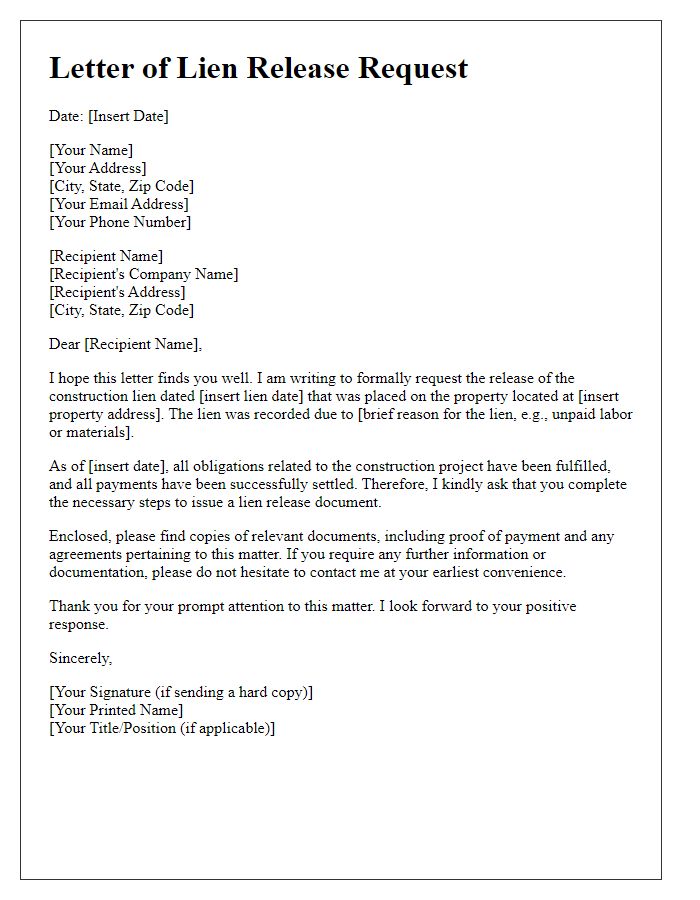

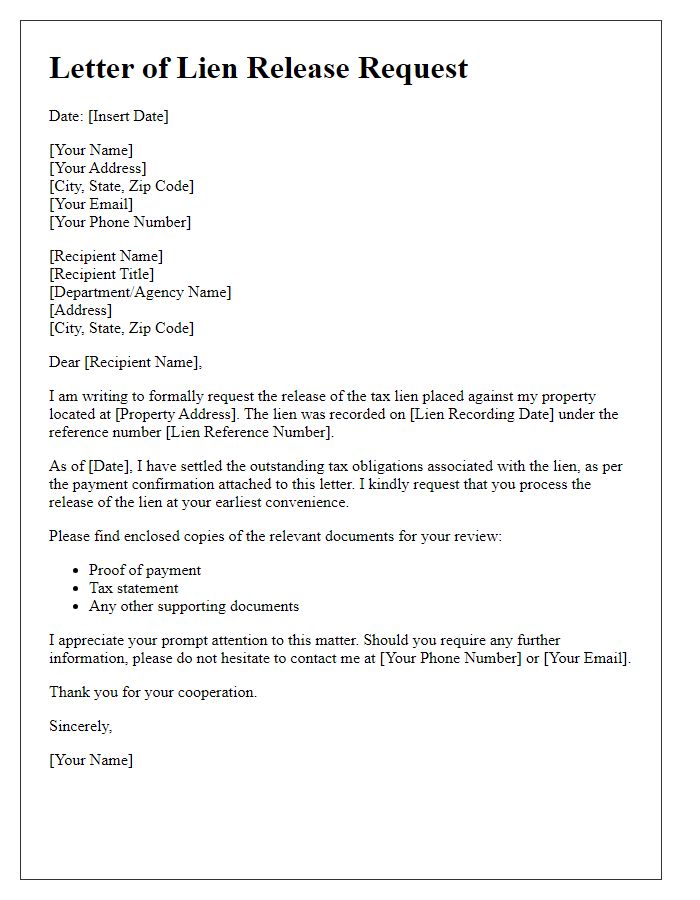

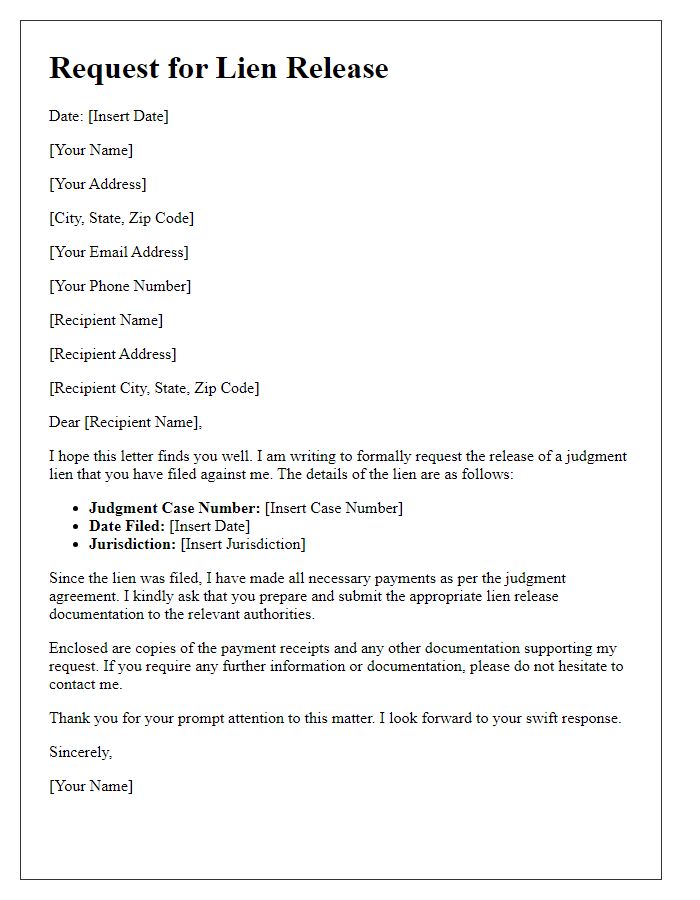

Are you looking to navigate the process of a lien release request? Understanding the necessary steps and required documentation can sometimes feel overwhelming, but it doesn't have to be. In this article, we'll walk you through a simple letter template that will make your request clear and professional. Join us as we break it down and empower you to take the next step toward financial freedom!

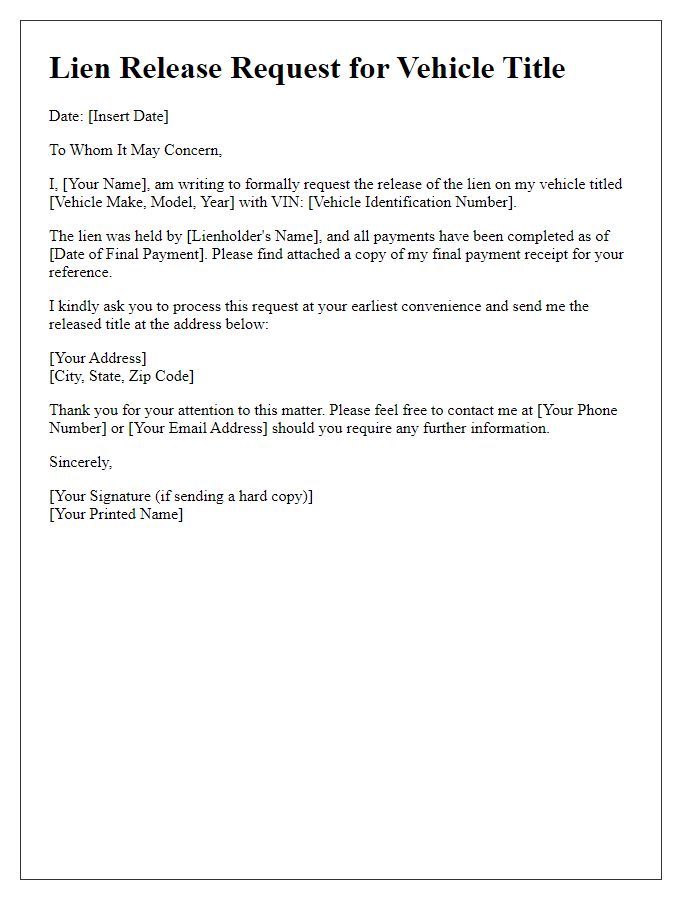

Legal description and details of the property

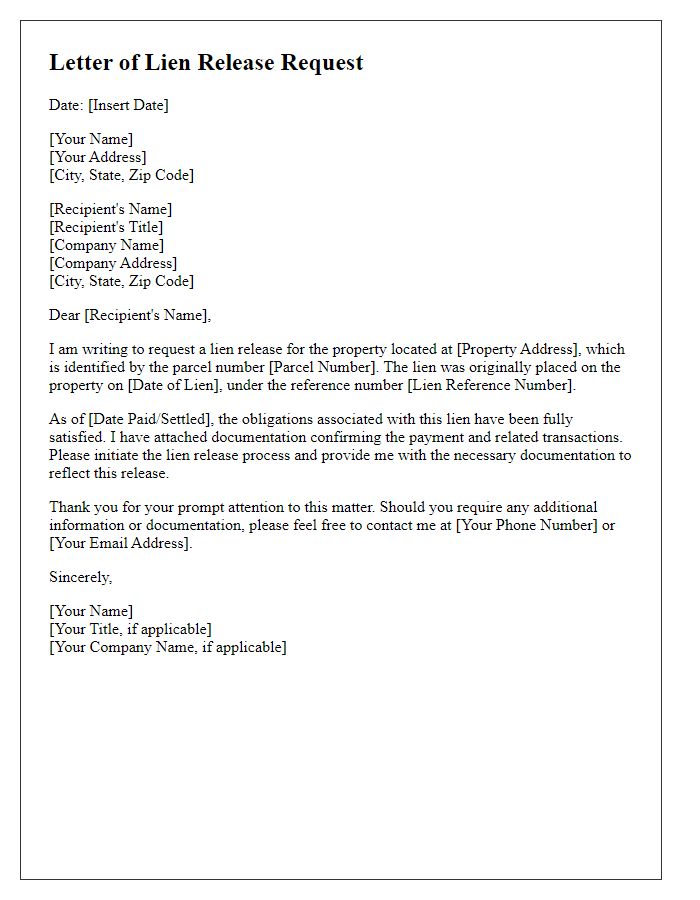

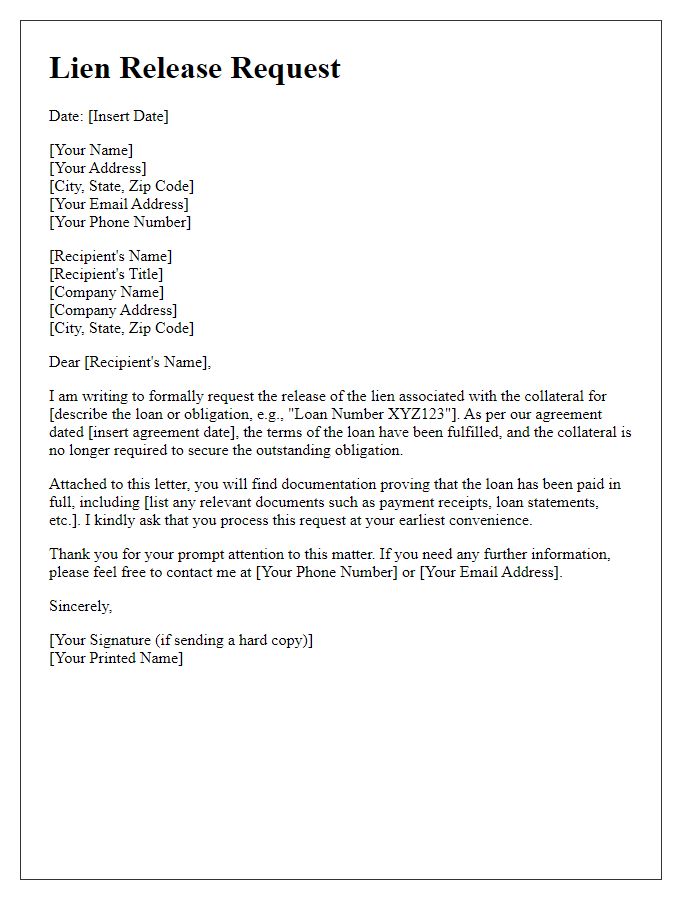

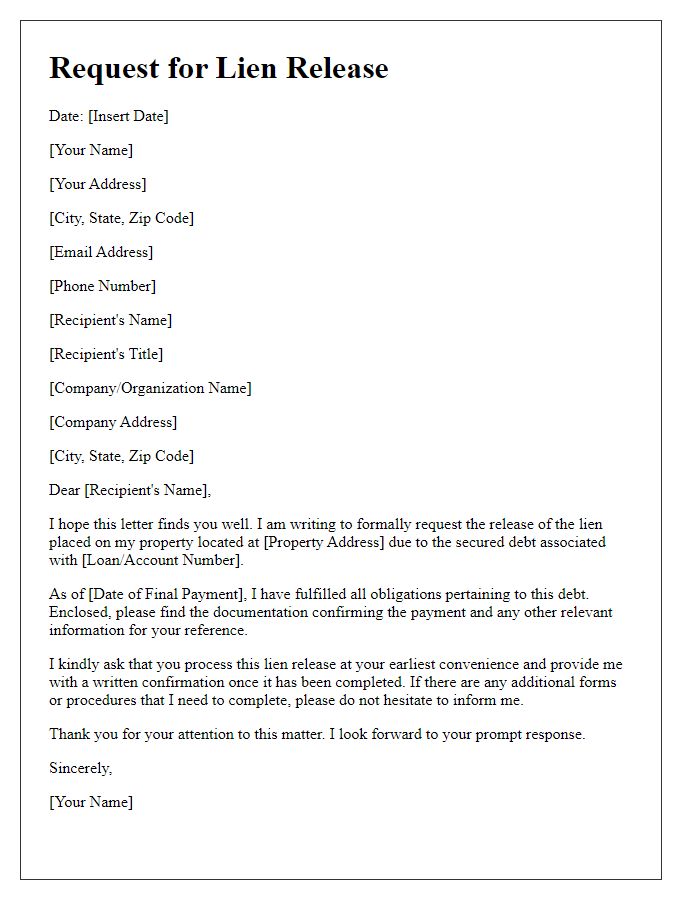

A lien release request needs to include essential information regarding the legal description of the property, such as the parcel number (often referenced in local government records), the address (including city and zip code), and other unique identifiers that clearly delineate the property. Additionally, it's paramount to state the nature of the lien (for example, a mortgage lien, tax lien, or mechanic's lien) along with the date it was recorded, which can be found in the county recorder's office documentation. The request should also reference the lender or lienholder's name, providing their contact information for further correspondence. Clarity in detailing these elements ensures a smooth and efficient lien release process.

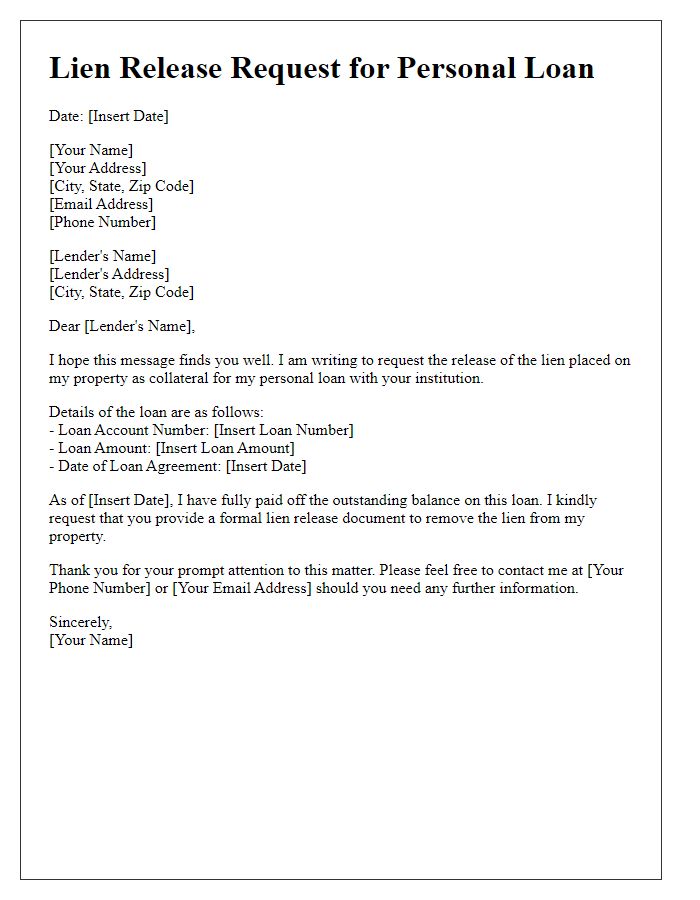

Accurate account and loan identification

A lien release request must include accurate account and loan identification details to ensure efficient processing. The account number associated with the loan should be clearly stated, such as a personal identification number (PIN) or bank account number relevant to the loan, facilitating identification within financial databases. The loan identification number, which is typically a unique alphanumeric code assigned during the loan origination process, must also be provided. This ensures that the specific loan transaction, possibly involving real estate or vehicle financing, is correctly referenced. In addition, including the borrower's full name, address, and contact information is crucial for verification purposes, helping financial institutions locate the correct records swiftly. Such thorough identification decreases the chances of processing delays due to miscommunication or improper documentation.

Date of loan payoff or satisfaction

A lien release request is essential once a loan has been fully paid off, ensuring that the legal claim on an asset is relinquished. The date of loan payoff signifies the day when the borrower settles the total amount owed, marking a critical event in the loan lifecycle. Upon satisfying the loan, typically represented by a mortgage or vehicle title, the lender must issue a lien release document, initiating a formal process to eliminate any recorded claims against the property. This document serves as proof that the borrower has fulfilled their obligation, restoring clear ownership rights. Timely submission of this request is crucial to maintaining accurate ownership records and facilitating any future transactions involving the asset.

Contact information for all involved parties

A lien release request involves formal communication to release a claim against a property. Accurate contact information is vital. Include clearly defined sections for all parties involved: for the lien holder, provide the full name or business name, mailing address (including city and state), email address, and direct phone number. For the property owner, ensure to detail the same information. Additionally, consider including the property description, such as the address or parcel number, to provide clarity. Important details such as the original lien amount and relevant dates (like the original lien recording date) should also be incorporated to support the request efficiently. Always maintain a professional tone and structure throughout the document.

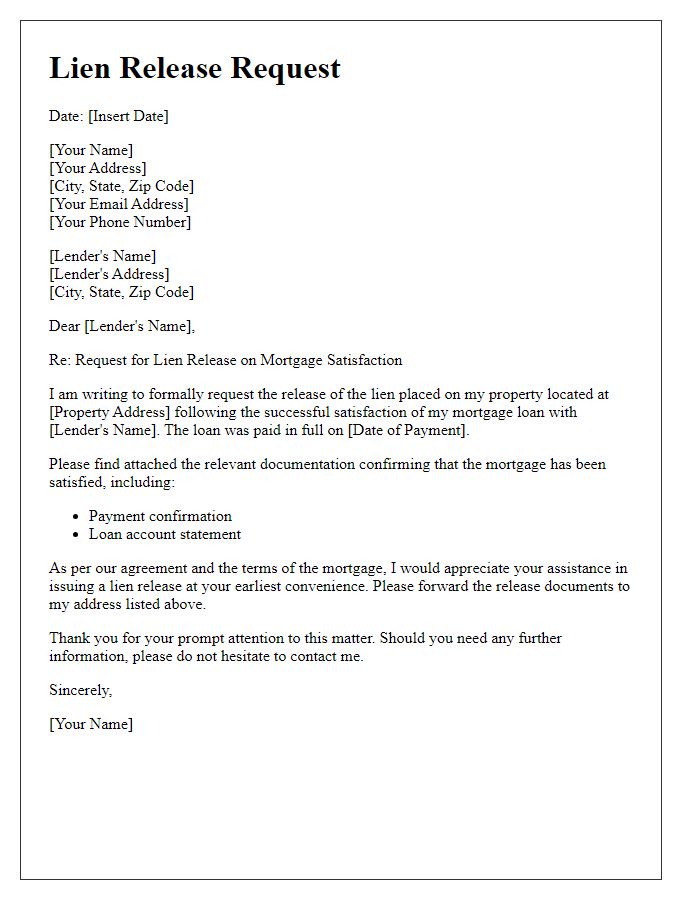

Authorized signatures and notarization

A lien release request must include the property description (address, parcel number) to identify the secured asset correctly. The authorized signatures of the lienholder (individual or company imposing the lien) and the debtor (owner of the property) must be present to validate the document. Notarization is necessary to ensure authenticity, requiring a notary public (a state-authorized official) to witness the signing process, verify identities, and stamp the document with a unique seal. The date of notarization is also crucial, as it impacts the release timing and legal standing. Proper completion of this request facilitates the removal of the lien from public records, allowing the property owner to regain full rights to the property.

Comments