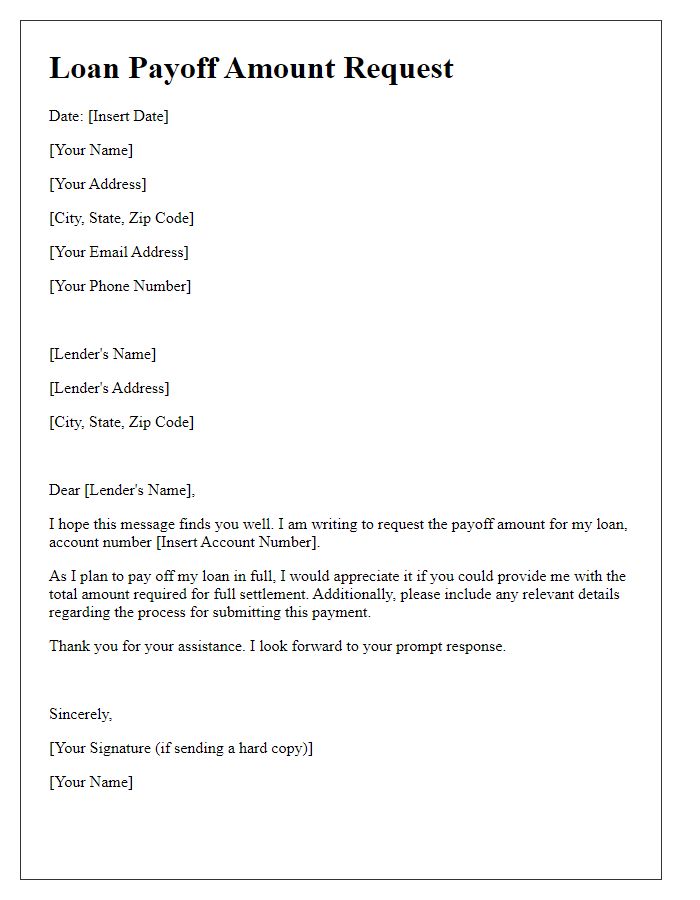

Are you considering paying off your loan early but unsure about the payoff amount? Knowing the exact figure can make a significant difference in your financial planning and help you save on interest payments. In this article, we'll guide you through the process of requesting a loan payoff amount with a simple letter template. Stick around to discover how easy it can be to take control of your finances!

Borrower identification details

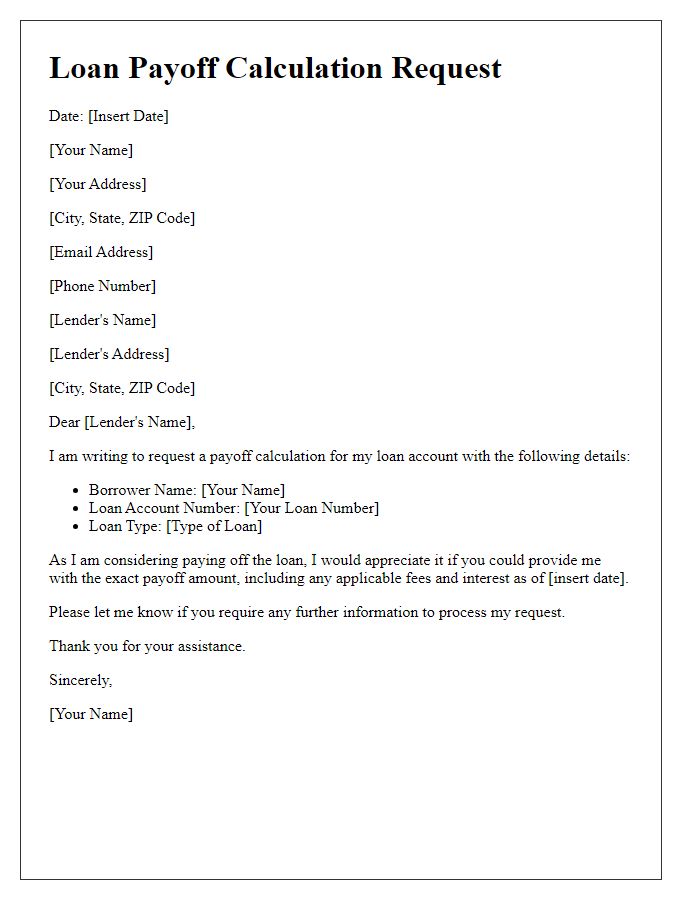

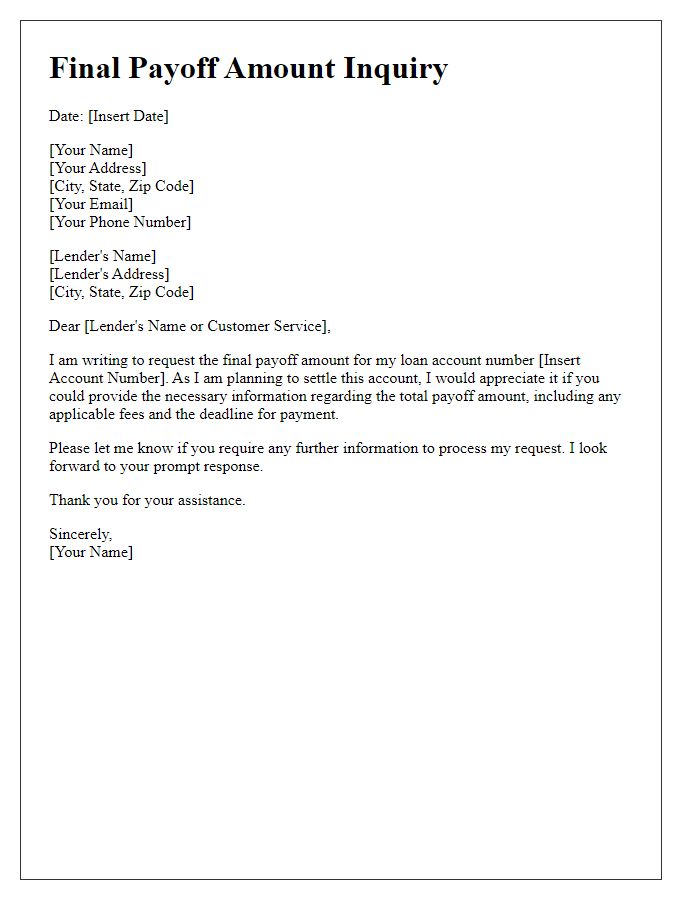

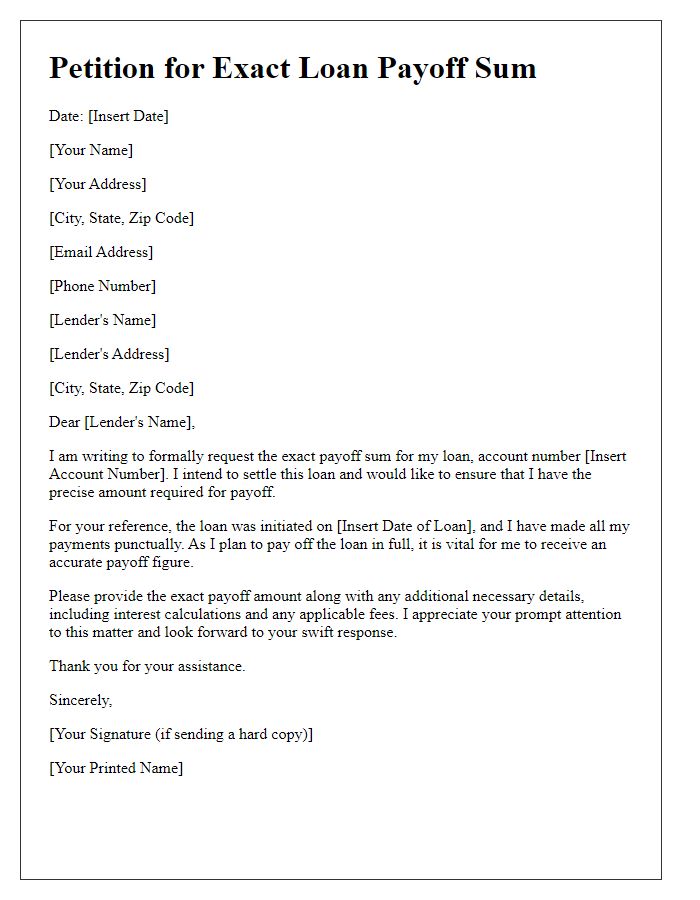

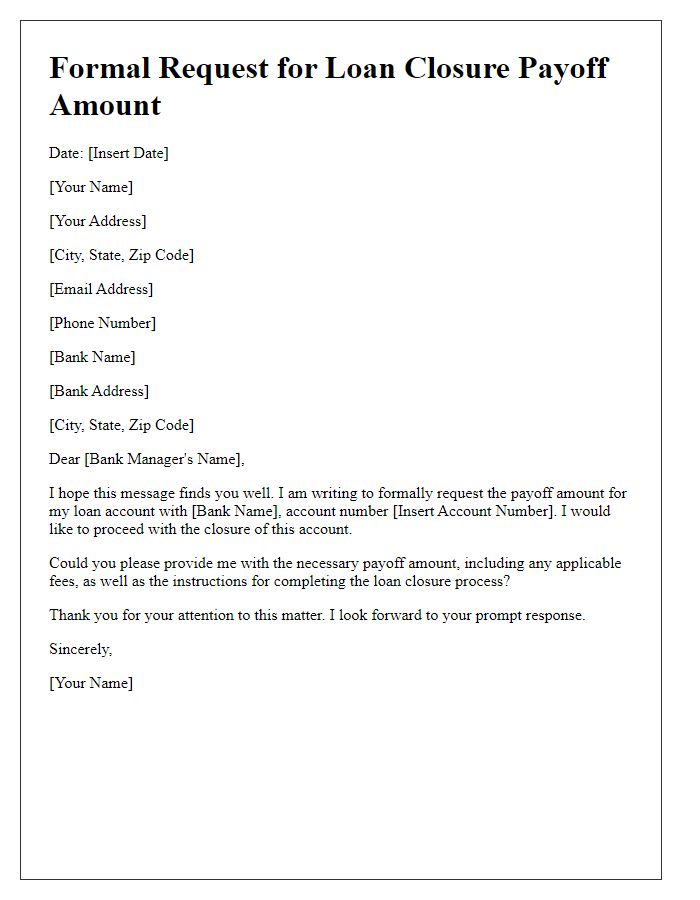

To request the loan payoff amount, the borrower needs to provide specific identification details including the full name (first, middle, last), loan account number (a unique identifier assigned by the lending institution), Social Security Number (usually a nine-digit identifier for verification and fraud prevention), and the loan type (for example, personal loan, mortgage, or auto loan). Additionally, providing the last payment date (the most recent date a payment was made) can assist in confirming the status of the loan, while including contact information such as a phone number and email address ensures efficient communication regarding the payoff amount. This detailed information helps the lender quickly locate the borrower's account and provide an accurate payoff figure, which is crucial for understanding outstanding balances, potential fees, or penalties.

Loan account number

To accurately determine the total loan payoff amount, borrowers must request this information from their lending institution using their specific loan account number. Loan account numbers generally comprise a series of alphanumeric characters unique to each loan, facilitating identification within the lender's system. The payoff amount includes the principal balance, any accrued interest, and potential fees, which can vary significantly across lenders and loan types. For example, a mortgage loan may have different calculations for payoff than an auto loan, and the request typically needs to be made in writing or through a secure online portal.

Request for specific payoff date

When borrowers approach their lenders to request a loan payoff amount for a specific date, clear communication is essential. The loan payoff amount refers to the total sum required to settle the remaining balance on the loan, often involving interest calculations up to the requested payoff date, ensuring transparency in the financial transaction. Borrowers should include relevant information such as the loan number, account details, and the date by which they intend to settle the loan, typically expected within a few business days. This process often involves coordination with the lender's customer service or financial department, ensuring all required documentation is submitted timely to facilitate a smooth transaction. A specific payoff date allows for budgeting considerations, paving the way for a clear understanding of financial commitments.

Preferred contact method for response

Requesting a loan payoff amount involves providing essential details to facilitate a swift response. The loan account number, such as 987654321, is critical for accurate identification. A clear request for the total payoff amount, including any applicable fees or interest, needs to be specified. Preferred contact methods for a reply could include an email address like example@email.com or a phone number such as (555) 123-4567. Be sure to specify urgency if applicable, indicating a need for this information within a particular timeframe, such as within 3 business days.

Signature for authentication

The loan payoff amount request involves contacting financial institutions to determine the specific balance required to fully settle an outstanding loan. A written request must include identifying details such as loan account number (e.g., 123456789), borrower name (e.g., John Doe), and type of loan (e.g., mortgage, personal, or auto loan). The request should specify a preferred timeframe for receiving the payoff statement, ideally within 7 business days, to allow for timely financial planning. Additionally, authenticating the request by providing a signature validates the identity of the borrower and ensures that sensitive information is handled securely. Including contact information such as phone number and email address may facilitate prompt communication throughout the loan payoff process.

Comments