Are you considering tapping into the equity in your home but unsure where to start? A home equity loan can be a smart financial choice, allowing you to leverage your property's value for various needs. In this article, we'll explore the benefits, potential uses, and essential steps to secure a home equity loan that best suits your situation. So, grab a cup of coffee and read on to learn how you can make the most of your home's equity!

Interest Rate Details

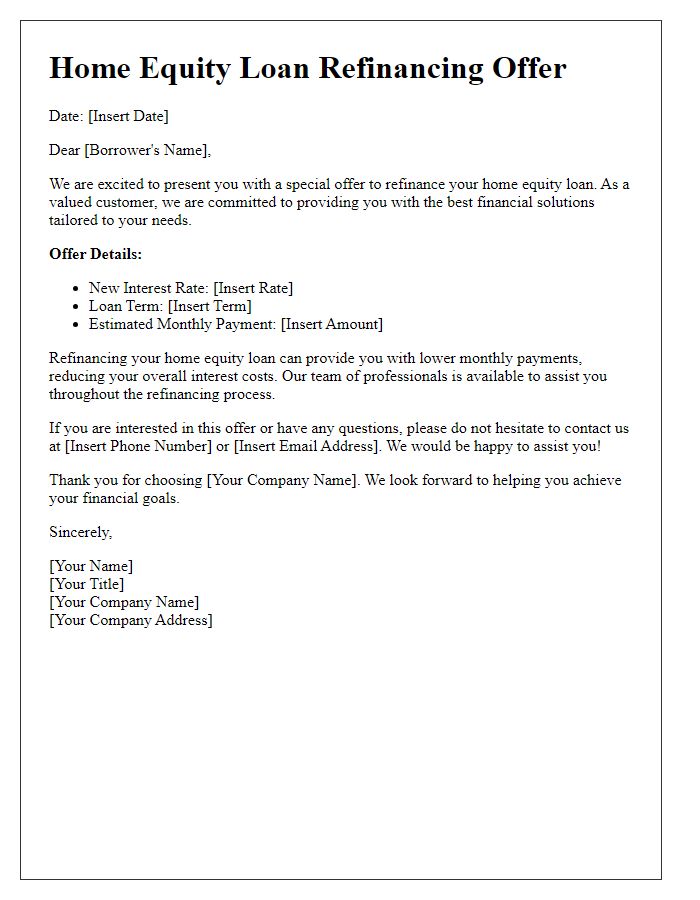

Home equity loans provide homeowners an opportunity to leverage their property value for financial needs. As of October 2023, average interest rates for home equity loans typically range between 5% and 9%. Factors affecting interest rates include credit scores (typically 740 and above for favorable rates), loan-to-value ratios (commonly below 80%), and market conditions. Fixed-rate home equity loans offer predictability with consistent monthly payments over terms usually spanning 5 to 30 years. Variable-rate options may start lower but can fluctuate based on market indices, showcasing potential risks as rates change. Understanding these nuances equips borrowers to make informed financial decisions when considering a home equity loan.

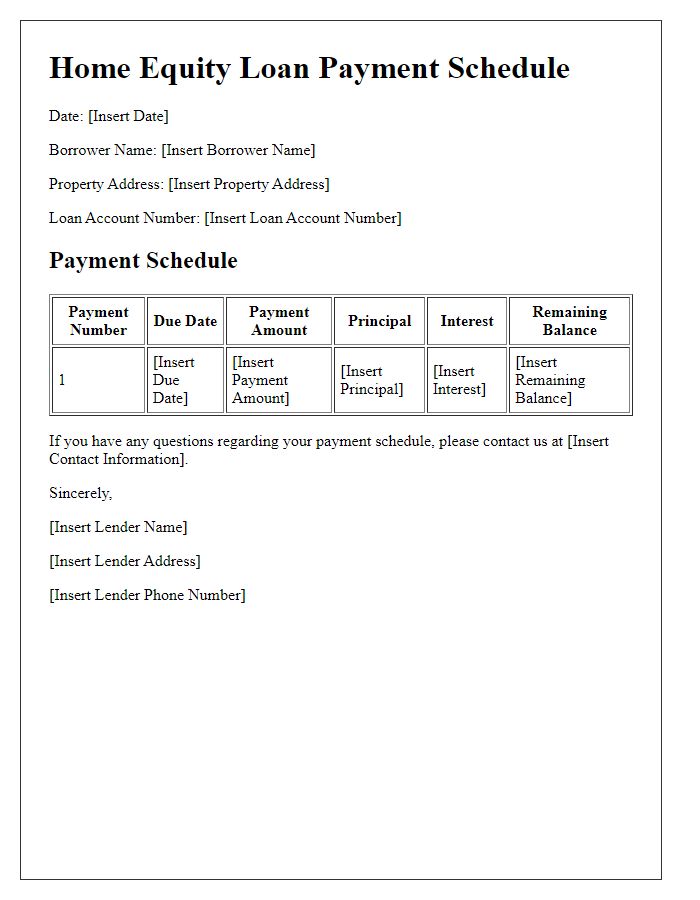

Loan Amount and Terms

Home equity loans provide homeowners with a financial option to leverage the equity accumulated in their properties. For example, a typical loan amount might range from $10,000 to $100,000, depending on the home's value and the remaining mortgage balance. Terms for these loans usually span 5 to 30 years, affecting monthly payment amounts. Interest rates are often fixed, typically between 3% and 8%, offering predictability in repayments. The loan-to-value ratio, a crucial metric, generally should not exceed 80%, ensuring responsible borrowing against property worth. Calculating potential payments helps homeowners understand the financial implications clearly. Always consider lender fees and closing costs when assessing total expenses associated with home equity loans.

Eligibility Requirements

Home equity loan offers typically entail specific eligibility requirements to ensure qualified applicants receive access to funds based on their property value and creditworthiness. Common criteria include a minimum credit score threshold, often set at 620 for competitive rates. Lenders frequently require a loan-to-value (LTV) ratio of 80% or lower, ensuring that homeowners have significant equity--typically calculated by subtracting the outstanding mortgage balance from the home's current market value. Alongside these financial metrics, potential borrowers may need to demonstrate a stable income, usually verified through recent pay stubs or tax returns. Additional factors such as employment history, debt-to-income ratio (generally recommended at 43% or less), and the overall economic conditions of the region, such as housing market trends, can also influence eligibility. Proper documentation, including proof of homeowners insurance and property tax records, may also be mandated during the loan application process.

Application Process

Home equity loans provide homeowners access to funds backed by their property's equity, a financial resource often utilized for major expenses like home renovations, education, or debt consolidation. The application process typically involves several key steps, including an initial online inquiry or phone call to a lending institution, such as a bank or credit union, which can vary in interest rates typically ranging from 3% to 7%. Homeowners must complete a formal application, often including documentation of income, proof of ownership through property deeds, and a current property appraisal that determines the home's value--this step is crucial as it defines the available equity. Lenders will evaluate the borrower's credit score, usually requiring a minimum credit score of 620, which impacts loan terms and conditions. Approval timelines can vary, often taking between two weeks to a month depending on lender efficiency and applicant responsiveness. Upon approval, a closing process occurs where all loan documents, including disclosure forms, are signed, finalizing the loan agreement.

Contact Information

Home equity loan offers provide homeowners with financial options to leverage their property's value. Typically, lenders assess the equity percentage in residential properties, which is calculated by subtracting the remaining mortgage balance from the current market value. This loan type is popular among homeowners in the United States, particularly in regions with rising real estate prices, such as California and New York. Applicants often need to provide detailed information, including credit scores above 620 and stable income documentation, to qualify for competitive interest rates that usually range between 3% to 7%. Additionally, offered loan amounts can vary significantly based on the home's appraised value and lender policies, with loans commonly ranging from $10,000 to $100,000.

Comments