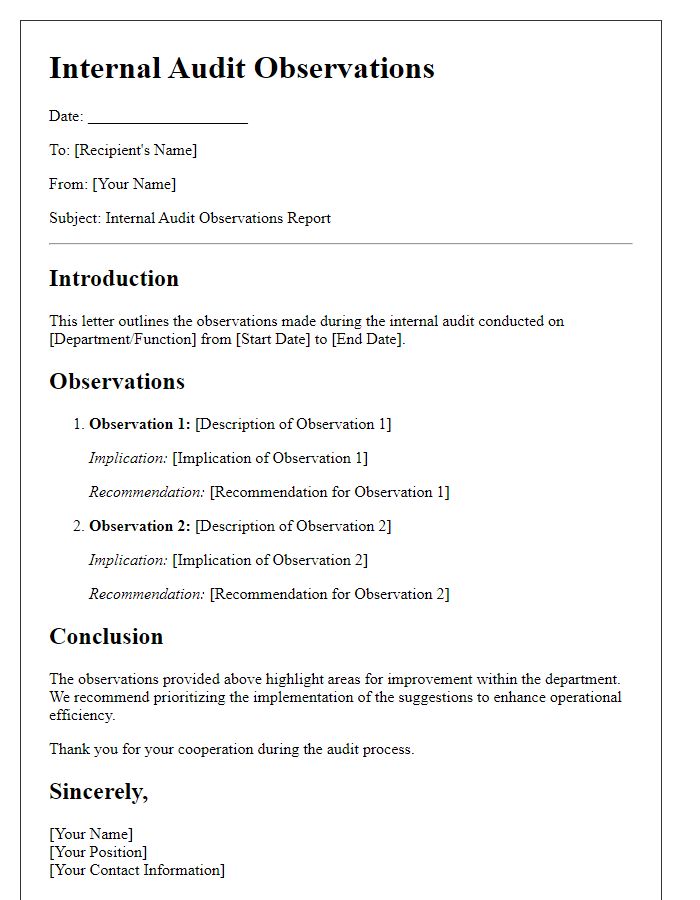

When it comes to internal audits, clear communication is key to ensuring that findings are well understood and actionable. Drafting a letter to address these findings can be a crucial step in fostering transparency and accountability within an organization. In this article, we'll explore effective letter templates that help convey audit insights while promoting a culture of continuous improvement. So, let's dive in and discover how you can craft a compelling message that encourages positive change!

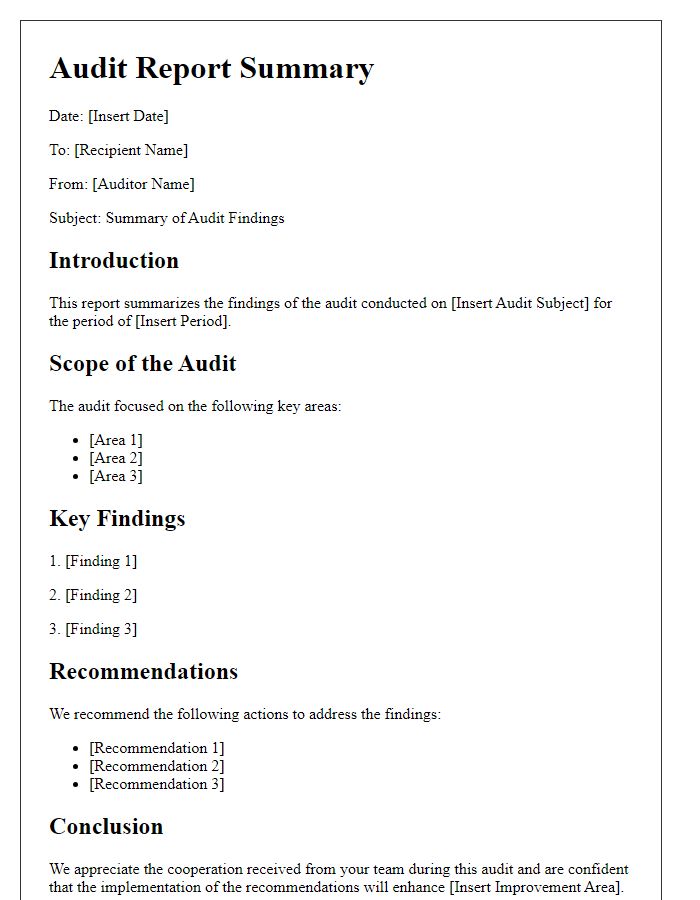

Executive Summary

Internal audit findings reveal critical insights regarding operational efficiency and compliance adherence within the organization. The analysis, conducted over a three-month period (July to September 2023), identified significant areas of improvement in financial reporting accuracy, inventory management controls, and adherence to regulatory standards. Anomalies in data integrity were noted in the accounting department, resulting in potential discrepancies amounting to $150,000. Additionally, inventory audits showcased a 12% overstatement in asset valuation due to incorrect stock assessments. Recommendations include enhancing staff training programs, implementing automated reporting systems, and conducting regular compliance reviews to fortify governance structures. The overarching goal remains to streamline processes, reduce risk exposure, and ensure alignment with industry best practices.

Objective and Scope

Internal audits focus on assessing the effectiveness and efficiency of organizational processes. The objective includes evaluating compliance with regulations and standards, while identifying opportunities for improvement. Scope encompasses all relevant departments, processes, and systems within the organization, ensuring a comprehensive review. Key areas such as financial reporting, operational controls, and risk management practices are prioritized. Findings from the audit may highlight potential discrepancies, inefficiencies, or areas not aligning with best practices and regulatory frameworks. Addressing these findings can lead to enhanced operational integrity and improved organizational performance.

Methodology and Criteria

Internal audits systematically assess the effectiveness, efficiency, and compliance of organizational processes. Methodology includes data collection techniques such as interviews, document reviews, and observation, ensuring comprehensive evaluation of operational practices. Criteria establish benchmarks for assessing performance, often based on industry standards, regulatory requirements, or organizational policies. For example, the COSO framework (Committee of Sponsoring Organizations of the Treadway Commission) provides a model for evaluating internal controls, while ISO 9001 standards focus on quality management systems. The reliability of findings relies on the auditor's adherence to these methodologies and criteria, ensuring objective, accurate evaluations that facilitate informed decision-making and improve organizational practices.

Detailed Findings and Implications

Internal audit findings revealed significant discrepancies in financial reporting practices at XYZ Corporation. The audit identified a total of $250,000 in unrecorded expenses from Q2 2023, primarily related to travel and entertainment costs, leading to inaccurate profit margins being reported to stakeholders. Furthermore, the review of vendor contracts highlighted non-compliance with company policies, where 15 contracts, amounting to $500,000, lacked proper approvals and renewal documentation. These irregularities could expose the company to financial risks and potential penalties from regulatory bodies such as the Securities and Exchange Commission. Implementing stronger oversight measures and rigorous documentation practices will be crucial in mitigating these risks and enhancing the integrity of the financial reporting process.

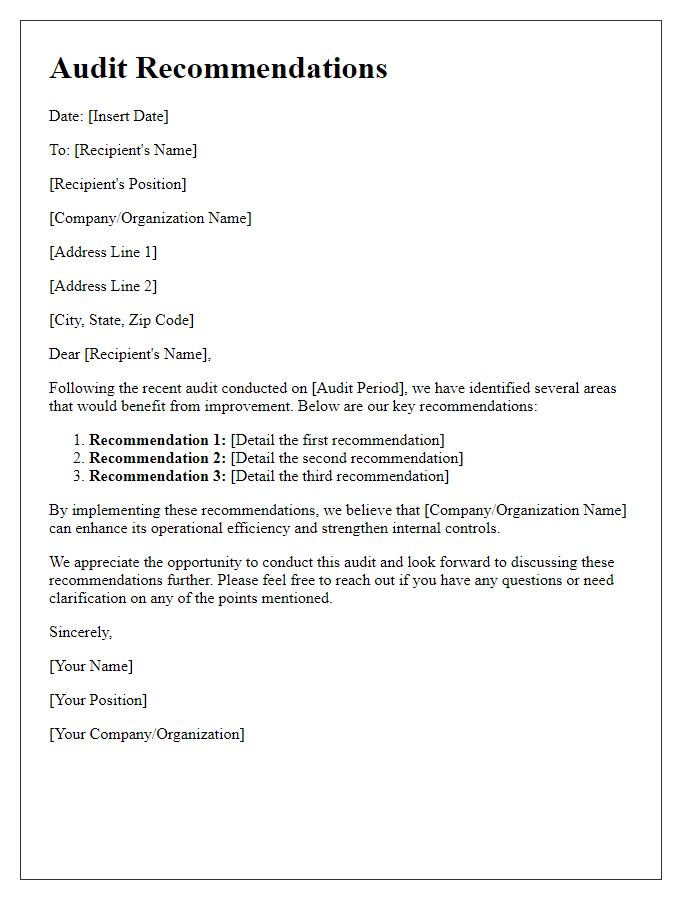

Recommendations and Action Plans

Internal audits often reveal critical insights into organizational processes and compliance. Effective recommendations based on findings can significantly enhance operational efficiency. For example, discrepancies in financial records (typically within accounting departments) may necessitate implementing stricter internal controls, such as automated reconciliation processes, to ensure accuracy and transparency. Action plans should involve clear timelines (often within 30 to 90 days) for the implementation of corrective measures, allocation of responsibilities to specific departments, and regular follow-up reviews to assess progress. Engaging stakeholders (such as department managers and compliance officers) in discussion ensures commitment to necessary changes and fosters a culture of accountability within the organization.

Comments