Welcome to our latest competitive performance benchmarking report, where we dive into the exciting landscape of industry standards and highlights. In this report, we will explore how your performance stacks up against key competitors, providing valuable insights that can drive your strategic decisions. We believe understanding these metrics is crucial for staying ahead in today's fast-paced market. So, grab a cup of coffee and join us as we unravel the details that could transform your competitive edgeâread on to discover more!

Clear Objective Definition

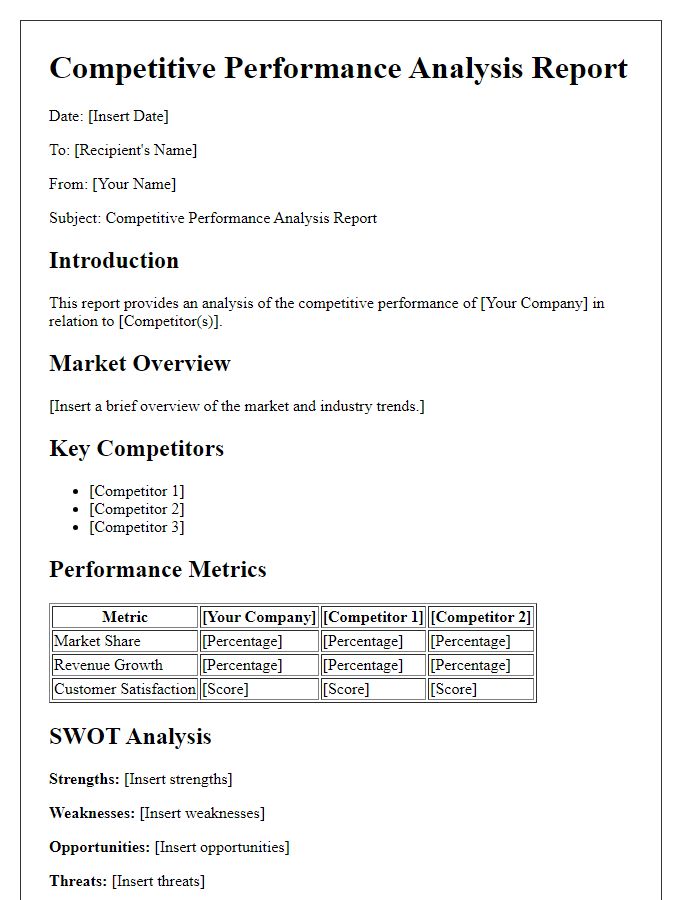

Clear objective definition is crucial for competitive performance benchmarking. Establishing precise goals enables companies to take effective measurements against industry leaders, such as Global Fortune 500 firms. Detailed identification of key performance indicators (KPIs), such as revenue growth rates (typically 5%-15% in mature sectors) or customer satisfaction levels (a target of 85% or higher), facilitates targeted analysis. The use of standardized metrics enables organization comparability across different sectors, including technology (e.g., software development firms) or retail (e.g., e-commerce giants like Amazon). Well-defined objectives serve as a foundation for strategic planning, ensuring that data collected is relevant and actionable.

Selection of Benchmarking Metrics

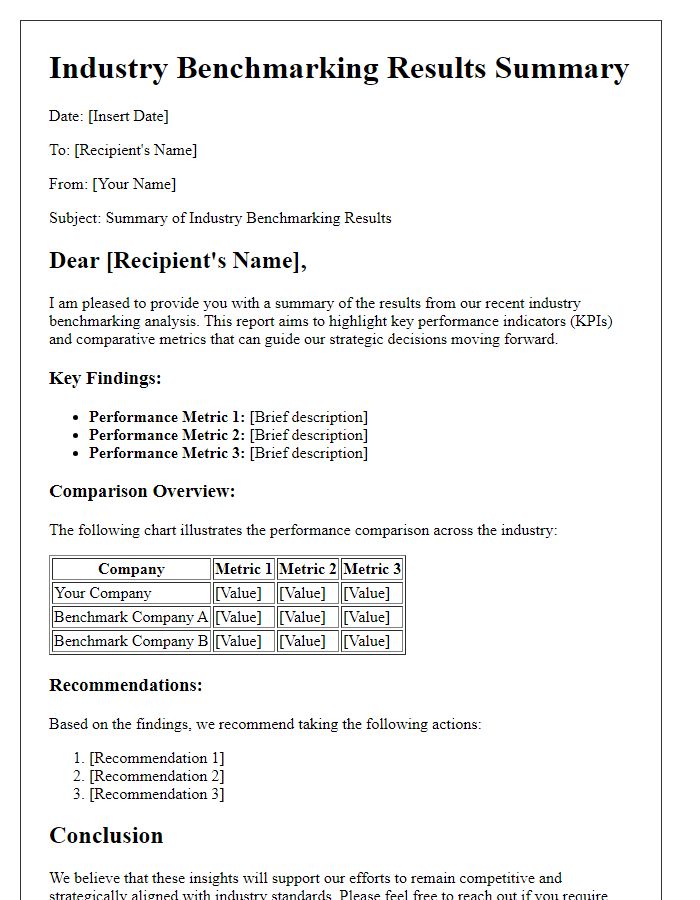

The selection of benchmarking metrics plays a crucial role in evaluating competitive performance for organizations in industries such as technology, finance, or manufacturing. Key metrics, including Return on Investment (ROI), Net Promoter Score (NPS), and Customer Acquisition Cost (CAC), provide quantifiable insights into operational efficiency and customer satisfaction. For instance, organizations measuring ROI often analyze financial returns relative to expenses over a fiscal year, while those tracking NPS gauge customer loyalty and satisfaction on a scale of -100 to +100. Additionally, industry-specific standards like manufacturing cycle time, typically measured in hours or days, reflect process efficiency and productivity. By integrating these metrics into performance comparisons, companies can effectively identify areas for improvement, optimize resource allocation, and enhance overall competitiveness in rapidly evolving markets.

Data Collection Methodology

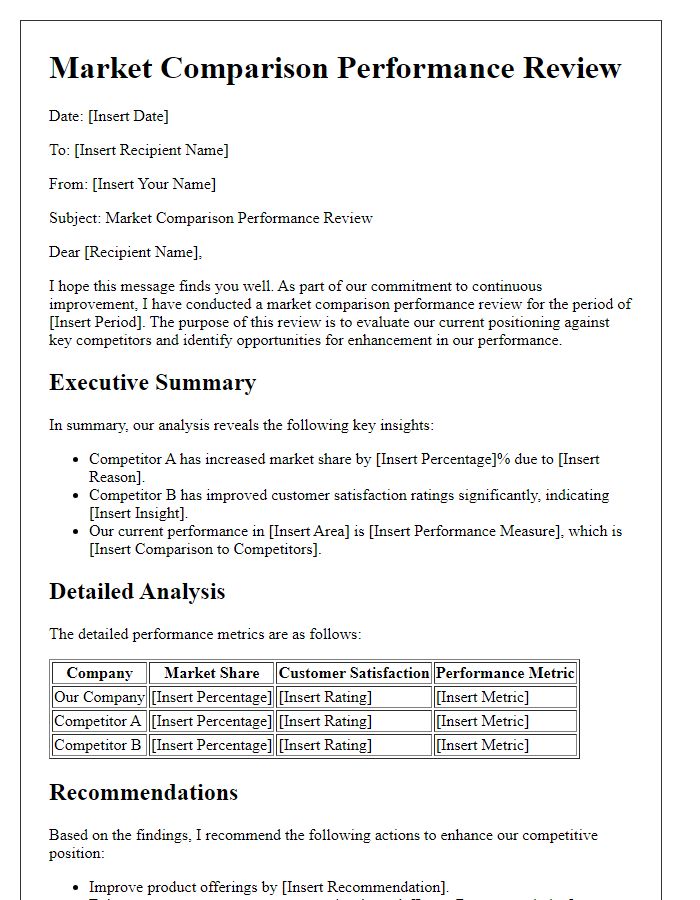

The data collection methodology for the competitive performance benchmarking report involved a systematic approach utilizing qualitative and quantitative research techniques. Primary data sources included surveys administered to industry stakeholders across sectors such as technology, finance, and healthcare, ensuring a diverse representation of perspectives. Secondary data was gathered from reputable sources, including market research reports and academic journals, to establish reliable benchmarks. Specific performance metrics analyzed included operational efficiency, revenue growth rates, and customer satisfaction scores, with data points sourced from financial statements of leading competitors such as Apple, Amazon, and Microsoft. The analysis also incorporated timeframes, focusing on fiscal years 2021 to 2023 to capture recent trends and shifts in market dynamics. Thorough data validation processes ensured accuracy, providing a robust foundation for insightful conclusions and strategic recommendations.

Comparative Analysis Framework

A competitive performance benchmarking report evaluates various entities within the marketplace, focusing on criteria such as productivity, efficiency, and market share. This framework often includes metrics like revenue growth rates (percentage increase over the previous fiscal year), customer satisfaction scores (measured on a scale from 1 to 10), and operation costs (expressed in millions of dollars). The analysis may also involve industry-specific factors, such as technological advancements (innovative tools or systems adopted), regulatory compliance (specific laws or standards applied to the industry), and talent acquisition strategies (number of employees hired and retention rates). Understanding these benchmarks provides valuable insights into competitive positioning and identifies areas for improvement within organizations.

Insights and Recommendations

The competitive performance benchmarking report provides valuable insights and data-driven recommendations for companies seeking to enhance operational efficiency and market positioning. Key performance indicators (KPIs) such as revenue growth percentages, customer satisfaction scores, and market share analysis are essential in evaluating relative performance within specific industries, such as technology or retail. The report includes a comparison of financial metrics, operational efficiencies, and strategic initiatives across top competitors, such as Company A and Company B, focusing on their respective market territories like North America and Europe. It highlights areas for improvement, such as product development timelines and digital marketing strategies, aiming to elevate overall competitiveness in fast-paced markets. Organizations can leverage these insights to drive strategic planning and resource allocation, ensuring alignment with industry best practices and customer expectations.

Comments