Navigating the world of insurance claims can often feel overwhelming, but fear not! This article will guide you through the essential steps for crafting a clear and effective letter template for your insurance claim submission. From understanding the necessary components to ensuring your claim is processed efficiently, we've got you covered. So, grab a cup of coffee, and let's dive into the details to simplify your claim experience!

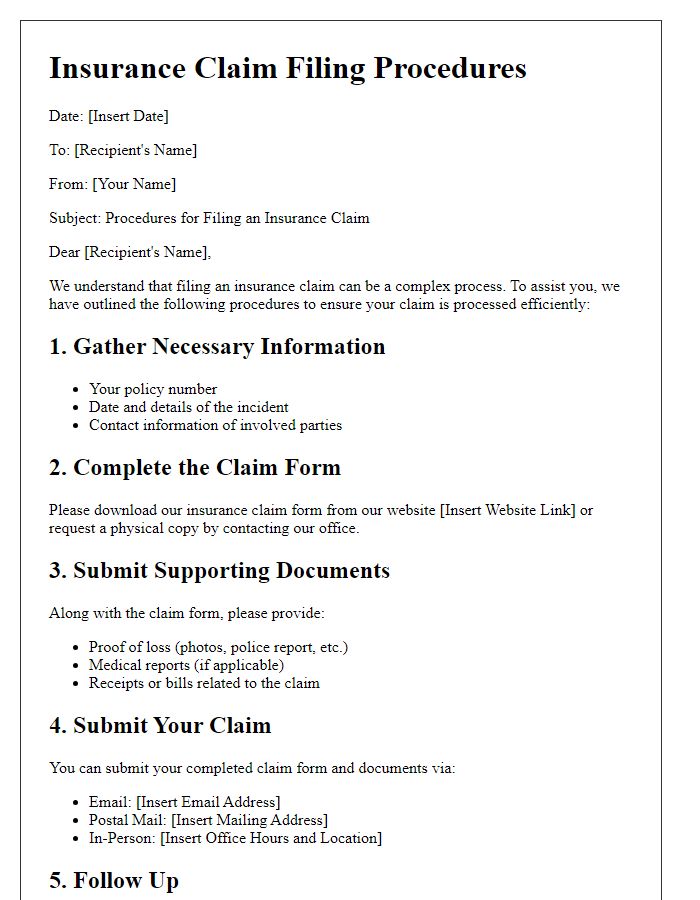

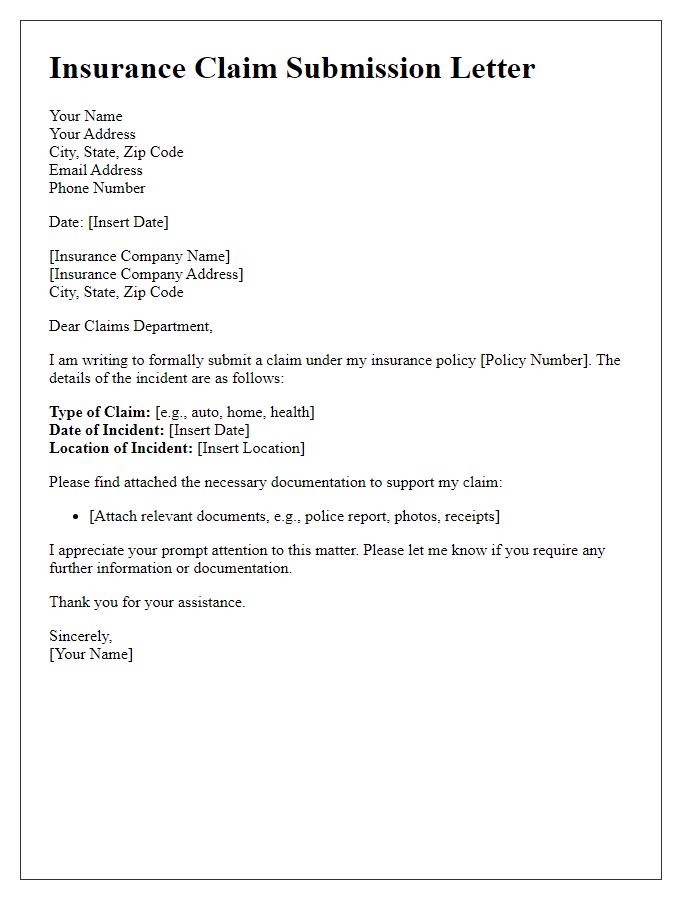

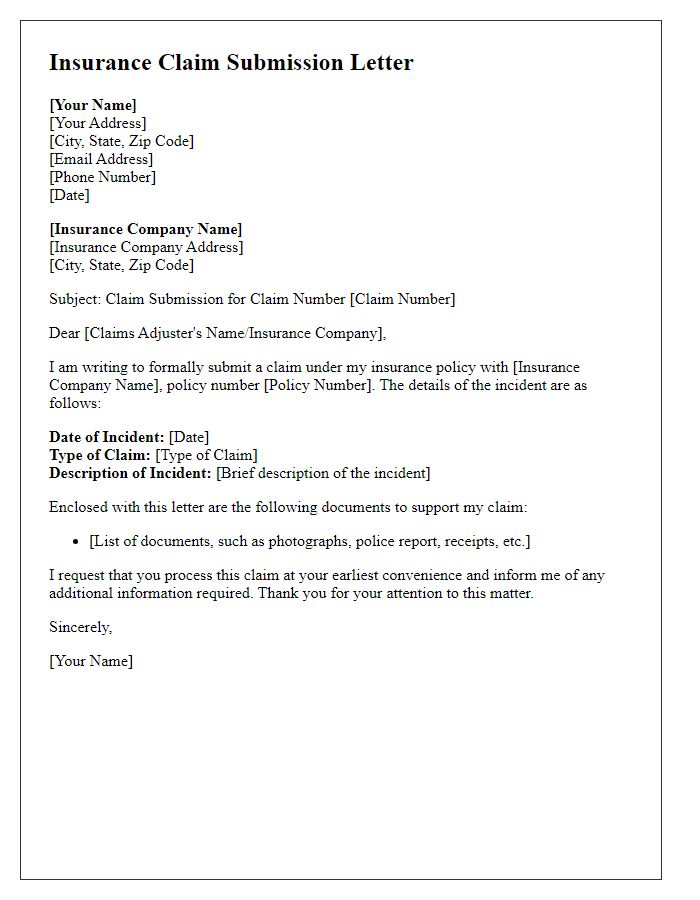

Policy Number and Coverage Details

When submitting an insurance claim, provide essential information such as policy number. Policy numbers typically consist of 10-15 alphanumeric characters unique to each insured individual or entity. Coverage details outline the specific protections, including property damage, liability, or medical expenses, provided by the policy. This information ensures that the claim is processed accurately, aligning with the terms set during policy issuance. Including this information expedites the claims process, helping insurers evaluate claims efficiently based on the outlined coverage. Ensure all documentation supports the claim, reflecting current circumstances and losses incurred.

Incident Description and Date

Submitting an insurance claim requires a detailed incident description along with the date of the occurrence. Providing a clear and concise account of the event, including the location such as the city or state (e.g., New York City, NY), is crucial. Specify the exact date, including the month, day, and year (e.g., June 15, 2023). Mention critical details such as the nature of the incident--whether it involved a vehicle collision, property damage from a natural disaster like Hurricane Ida, or theft. Including any witness accounts or police report numbers can enhance the credibility of the claim. Lastly, attaching relevant documentation such as photographs or repair estimates will facilitate the claims process with the insurance provider.

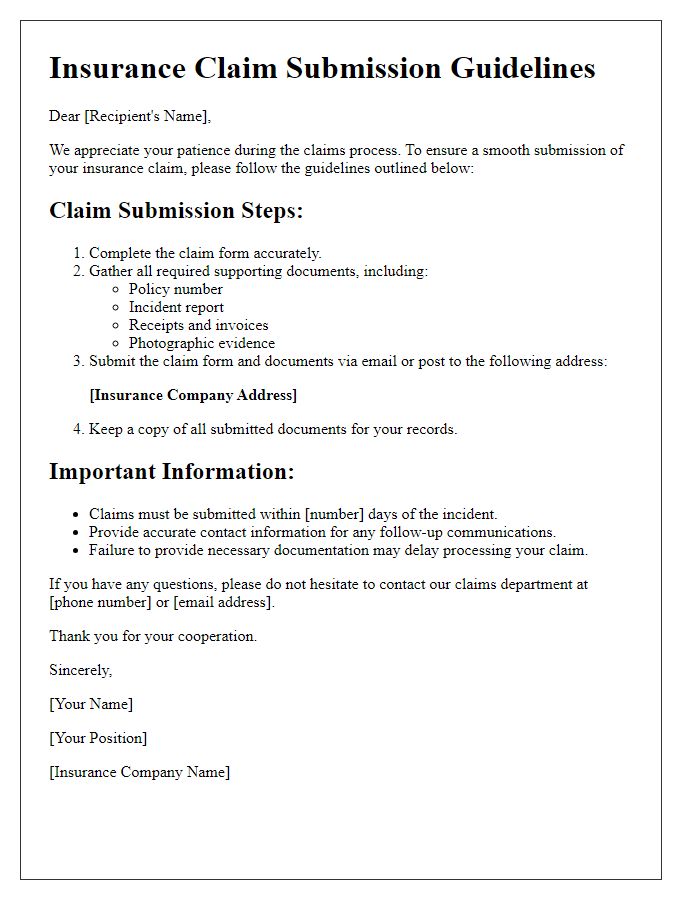

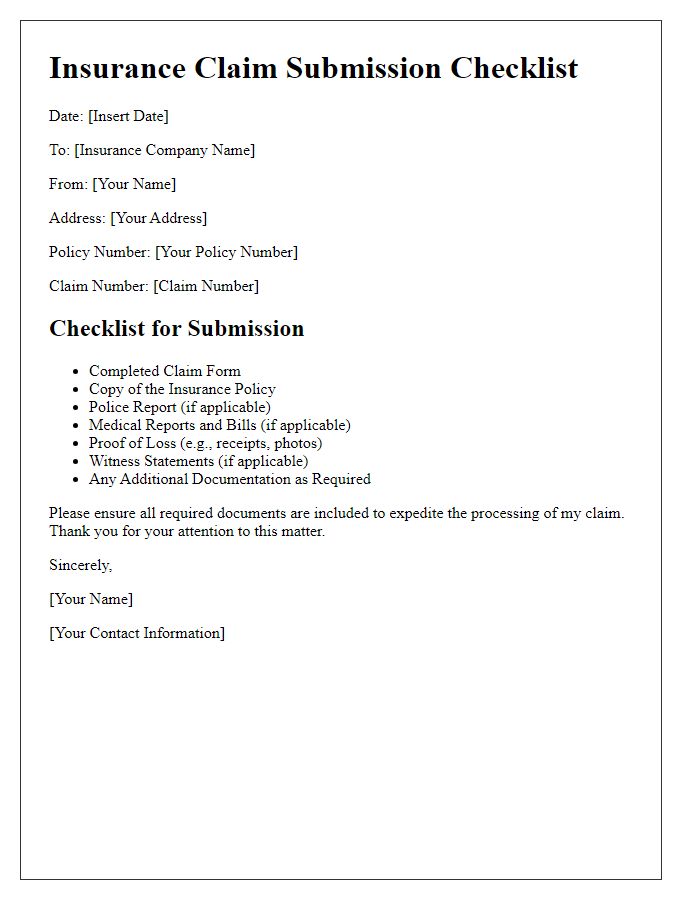

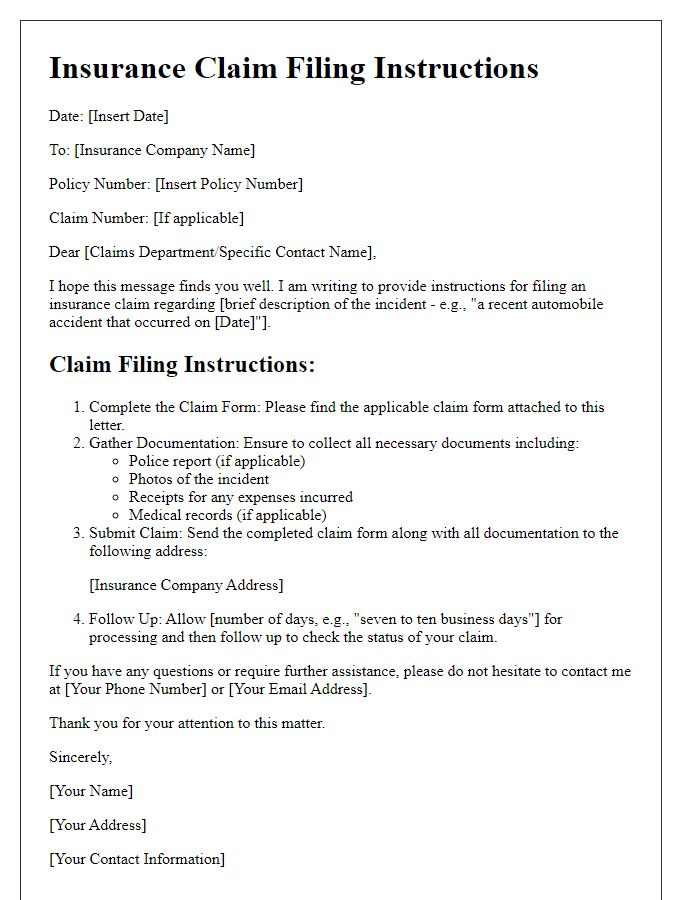

Documentation and Evidence Required

Insurance claim submission requires thorough documentation and evidence to support the claim. Essential documents typically include the claim form (detailing the nature of the claim) and incident reports (official documents generated by authorities, such as police reports for accidents). Additionally, evidence such as photographs (showing damage or loss), receipts (verifying ownership or purchase value), and medical bills (for health-related claims) are crucial. Furthermore, any witness statements (providing third-party accounts) and correspondence (communication with insurance representatives) strengthen the case. All documents should be clear, legible, and well-organized to facilitate an efficient review process.

Contact Information and Communication Preferences

Clear contact information is essential for the efficient processing of insurance claims. Policyholders should provide full name, address, phone number, and email address to ensure accurate communication. Preferred communication methods must be stated clearly; options may include telephone calls, emails, or postal mail. Specifying times for contact availability (e.g., weekdays between 9 AM and 5 PM) can further streamline communication. Additionally, including claim reference numbers (unique identifiers for tracking claims) helps claim agents efficiently locate policyholder information, expediting the claims process. Proper documentation submission channels, such as online portals or dedicated fax lines, should also be mentioned for ease of access.

Submission Deadline and Follow-Up Instructions

Insurance claim submissions require adherence to specific deadlines and procedures to ensure timely processing. Claims must be submitted within 30 days from the date of the incident, while additional documentation, such as police reports or medical records, may be requested within a week of the initial claim. Keep copies of all submissions for your records. Follow-up can be done via the claims hotline (usually a designated number provided by the insurance company) after 14 days to inquire about the status of your claim. Email communication may also be utilized for inquiries, ensuring the claim reference number is included for quicker processing.

Comments