Are you feeling overwhelmed by your mortgage payments? If you're struggling to keep up with high monthly costs, a principal reduction program could be your lifeline. This program offers a way to lower the total amount owed on your home, making your payments more manageable and your financial future brighter. Curious to learn how it works and how you can take advantage of it? Keep reading for more insights!

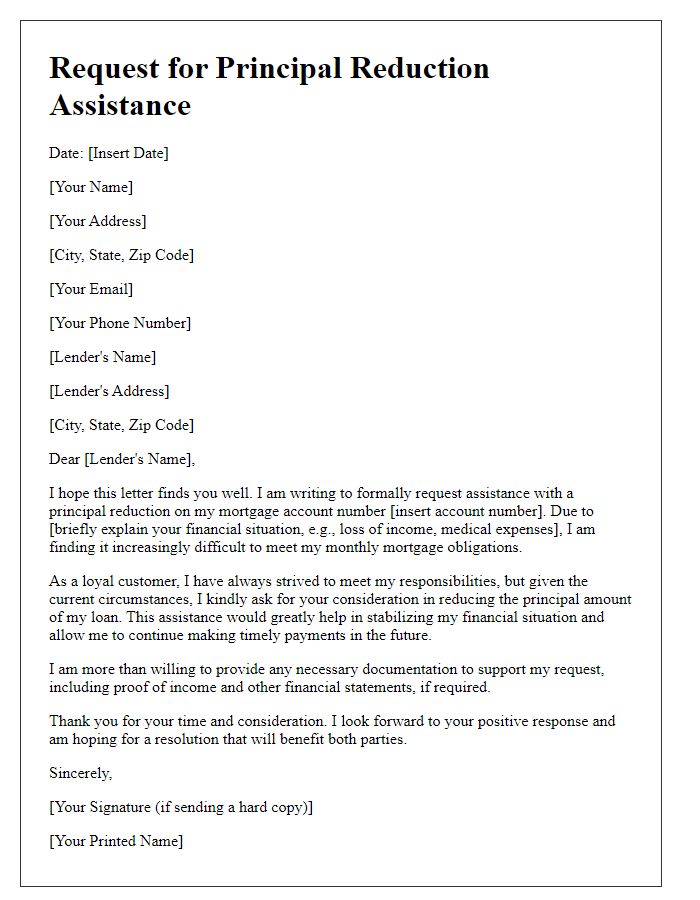

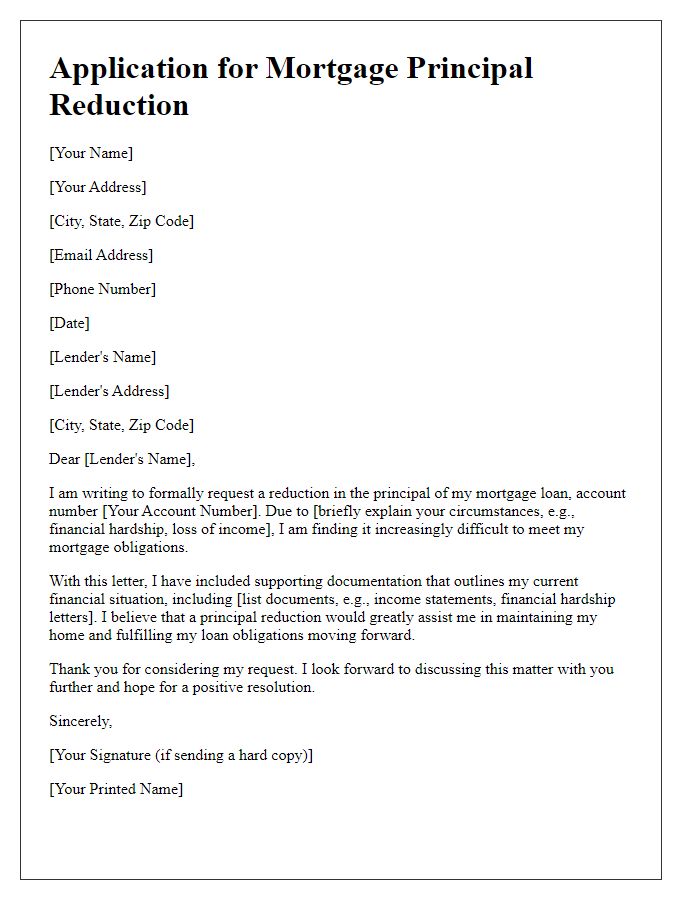

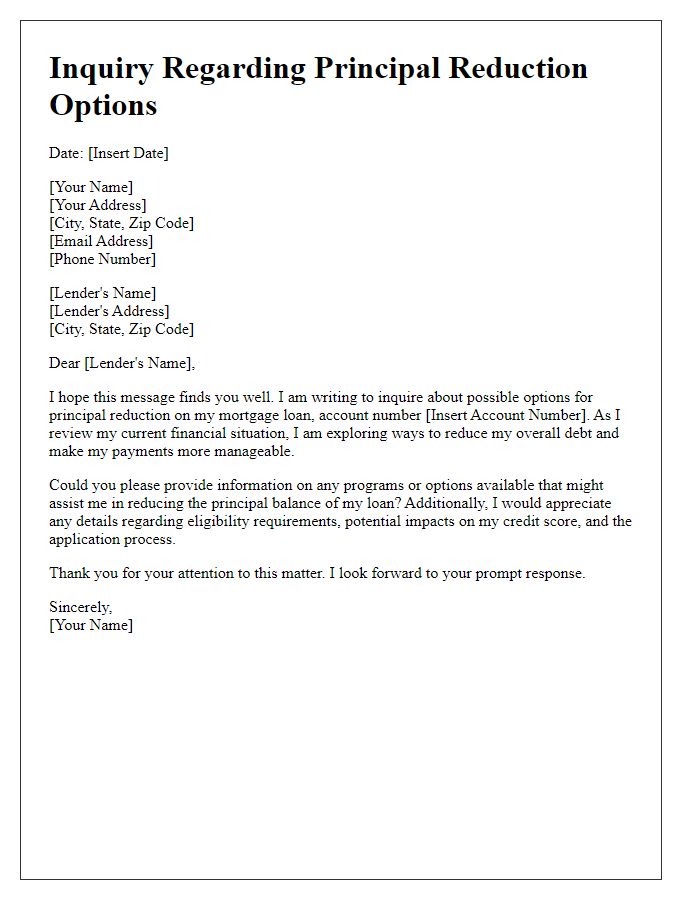

Borrower's personal and financial information

The Principal Reduction Program assists homeowners facing financial difficulties by adjusting the remaining mortgage balance to make payments more manageable. Participants typically provide detailed personal information, including name, address, social security number, and contact details. Financial disclosures include monthly income, employment status (such as self-employed or salaried), and pertinent financial obligations like credit card debt or student loans. The program often requires documentation of hardship, such as unemployment letters, medical bills, or other financial strain evidence, to validate the need for assistance. Lenders review this information carefully to determine eligibility and potential adjustment amounts, ultimately aimed at sustaining homeownership and preventing foreclosure.

Loan account details and current terms

The principal reduction program can significantly impact mortgage loan agreements. Homeowners with loans such as Fixed-Rate Mortgages or Adjustable-Rate Mortgages could see a decrease in their total loan principal, affecting overall interest payments over time. Loan account details should include the original loan amount, current principal balance, interest rate--typically between 3% to 6%--and loan term, often spanning 15 to 30 years. Current terms may involve monthly payment amounts, escrow accounts for taxes and insurance, and potential penalties for prepayment, which vary by lender. Additionally, eligibility for programs can depend on factors such as the borrower's credit score--usually 620 or above--and the distress status of the mortgage, requiring documentation of financial hardship. Understanding these details helps in navigating options for reducing loan principal effectively.

Explanation of financial hardship

Financial hardship often presents significant challenges for homeowners struggling to meet mortgage obligations, particularly during times of economic downturn. Such difficulties might arise from unexpected events like job loss (with unemployment rates sometimes exceeding 10% during recessions), medical emergencies (with average hospital bills reaching thousands of dollars), or family crises that strain resources. Households may experience reduced income levels, making it difficult to cover monthly expenses, including mortgage payments which can average between $1,500 to $2,000. The inability to maintain timely payments can lead to increased stress and the risk of foreclosure, further complicating the financial landscape. Seeking assistance through principal reduction programs can offer much-needed relief, allowing homeowners to stabilize their situation and secure their financial future.

Request for specific principal reduction and justification

The principal reduction program seeks to alleviate the financial burden on homeowners struggling with their mortgage payments amidst economic challenges. This program can provide substantial relief by reducing the overall principal balance of a mortgage loan. For example, homeowners facing difficulties due to unemployment rates soaring past 10% or unexpected medical expenses can formally request a reduction. Justification for such requests may include documented financial hardship, market analysis indicating decreased property values like a 15% drop within a year, or proofs supporting loss of income. Participating lenders, often associated with federal programs, review each case meticulously to ensure a fair process. Providing comprehensive documentation, including tax returns and bank statements, enhances the chances of approval, potentially resulting in lower monthly payments and a more manageable financial situation for the homeowner.

Supporting documents and evidence

The principal reduction program aims to alleviate financial burdens on homeowners experiencing hardships. Essential supporting documents include proof of income, which may consist of recent pay stubs, tax returns from the previous year, and bank statements demonstrating monthly earnings. Homeowners should also provide documentation of the hardship, such as unemployment benefits statements, medical bills indicating unexpected expenses, or divorce decrees impacting financial stability. Additionally, evidence of the current mortgage, including loan statements and property tax assessments, is vital for validating the request for principal reduction. The program, established during the housing crisis of 2008, has assisted thousands of individuals across various states, leading to more sustainable homeownership. A comprehensive application package can streamline the review process, increasing the chances of approval for assistance.

Comments