Are you confused about prepayment penalties and why they exist? You're not alone! These penalties can often catch borrowers off guard, adding unexpected costs to your mortgage or loan. In the following article, we'll break down what a prepayment penalty is, why lenders impose them, and how to navigate your optionsâso grab a cup of coffee and let's dive in!

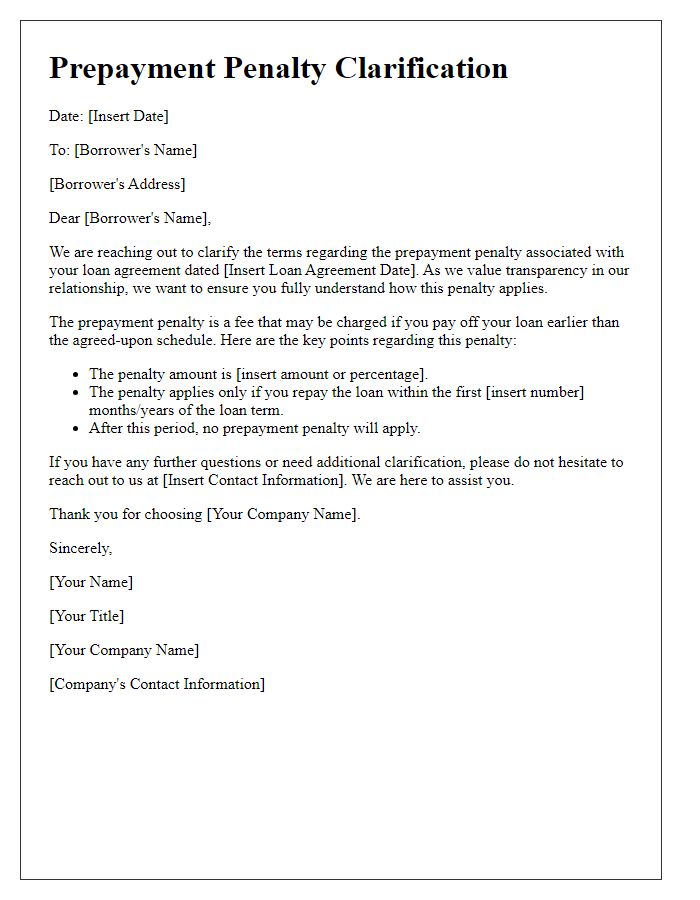

Loan Agreement Details

Loan agreements often include prepayment penalties that serve as financial deterrents for borrowers to pay off their loans early, particularly mortgage loans or personal loans. These penalties can range from a percentage of the remaining balance to a fixed dollar amount, typically applied within the initial few years of the loan, such as the first five years. Lenders implement these clauses to recover lost interest revenue, which is particularly significant with longer-term loans, such as 30-year fixed mortgages. Borrowers should be aware that prepayment penalties can vary between lenders and loan types, making it essential to review the loan agreement thoroughly before signing. Understanding these terms can prevent unexpected costs in events of refinancing or selling the property.

Prepayment Penalty Conditions

Prepayment penalties serve as a deterrent for borrowers who wish to pay off their loans earlier than agreed, typically found in mortgage agreements or other long-term loans. These penalties often occur during the first few years of the loan, varying in percentage, commonly ranging from 2% to 5% of the remaining balance. The prepayment penalty period can last from 1 year to 5 years after the loan's origination date, depending on lender policies. Notification of these conditions should include the significance of awareness regarding how paying off the loan early can lead to financial repercussions. Understanding the need for a prepayment penalty helps borrowers avoid unexpected costs and fosters informed financial decision-making.

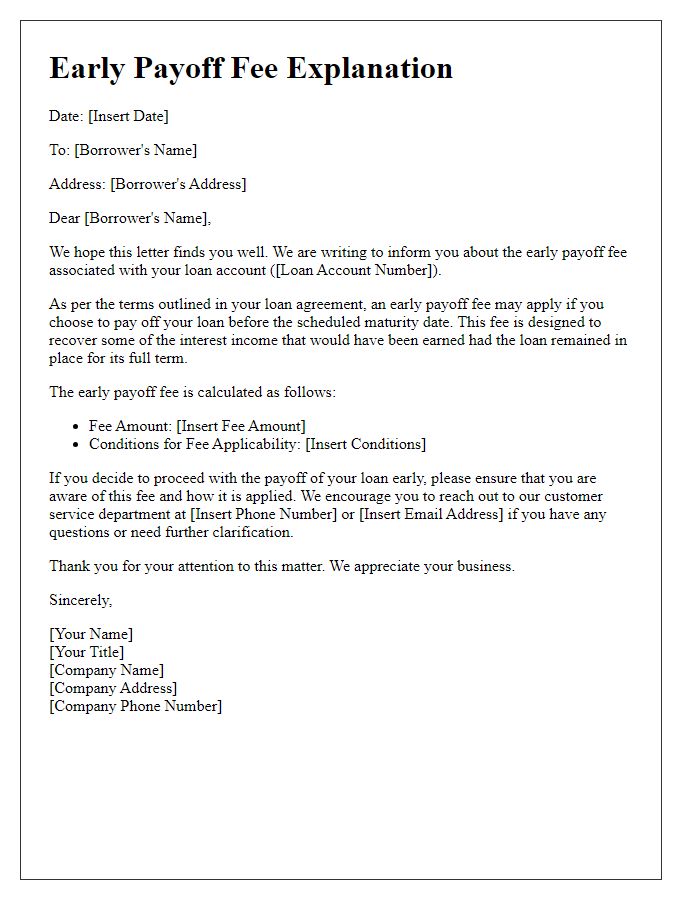

Calculation Method for Penalty

Prepayment penalties are fees charged by lenders when a borrower pays off a loan early, typically before the maturity date. These penalties are calculated based on the remaining balance of the loan at the time of prepayment, often expressed as a percentage of that balance. For example, if a borrower with a remaining loan balance of $100,000 faces a prepayment penalty of 3%, the fee would amount to $3,000. Different lenders may use varying calculation methods, such as a fixed percentage, a diminishing percentage over time, or a formula based on interest savings. Additionally, some loans may have specific terms where penalties decrease after a certain period, incentivizing borrowers to stay longer. Understanding the exact calculation method is essential for borrowers considering early loan termination to avoid unexpected costs.

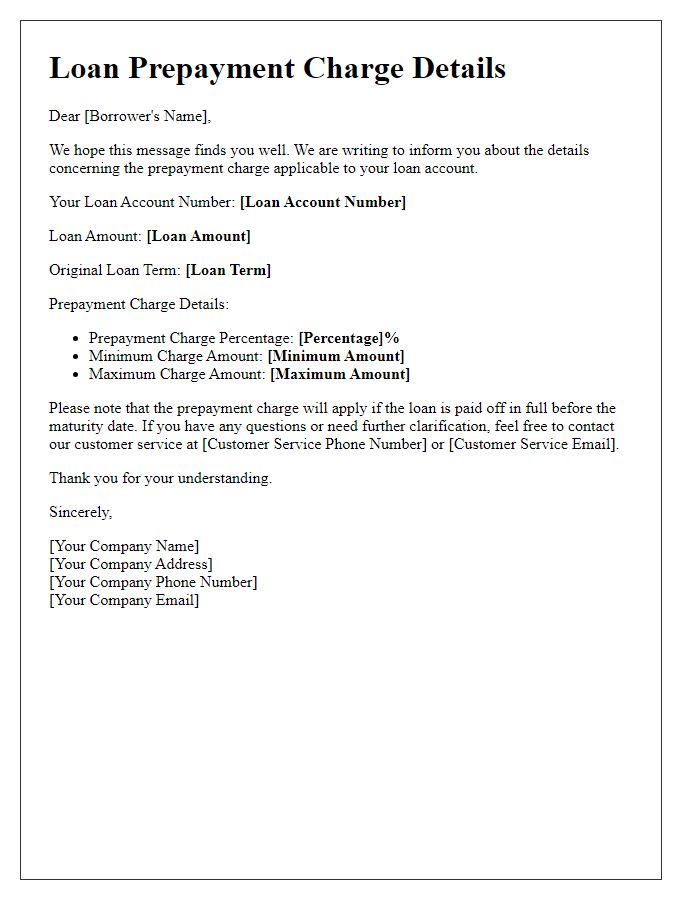

Borrower Rights and Obligations

Prepayment penalties can significantly impact borrowers navigating their financing options, especially with loans such as mortgages or personal loans. These fees, which can range from a certain percentage of the remaining loan balance (often 2% to 5%) or a specified number of months' interest, apply when borrowers pay off their loans early, ahead of the agreed schedule. Lenders impose such penalties to mitigate potential losses incurred from early repayment. Borrowers have the right to be fully informed about the terms of these penalties, typically outlined in the loan agreement, including the duration during which the penalty applies. Awareness of these obligations is crucial, as it influences financial planning and decision-making regarding refinancing or early loan payoff scenarios. Understanding the implications of prepayment penalties allows borrowers to make informed choices aligned with their financial goals.

Contact Information for Further Inquiry

Prepayment penalties apply to certain loan agreements, particularly mortgages, where borrowers face fees for paying off their loan early. These penalties typically amount to a percentage of the remaining loan balance, ranging from 1% to 5% depending on the lender's terms. Such fees are designed to protect lenders from financial loss due to the early termination of the loan, as they expect to earn interest over the full term. Borrowers are encouraged to review their loan contracts and payment plans carefully, particularly during the first few years when penalties may be more common. Understanding the specific conditions of these penalties can help prevent unexpected charges during financial transitions or refinancing opportunities. For further inquiries, borrowers can reach out directly to their lender's customer service department to clarify terms and conditions related to prepayment penalties.

Comments