Are you looking to amend your payment schedule but unsure how to start? Crafting the right letter can make all the difference in ensuring a smooth process. In this article, we'll walk you through a simple yet effective template that clearly communicates your needs while maintaining a professional tone. So, let's dive in and explore how you can easily amend your payment arrangements!

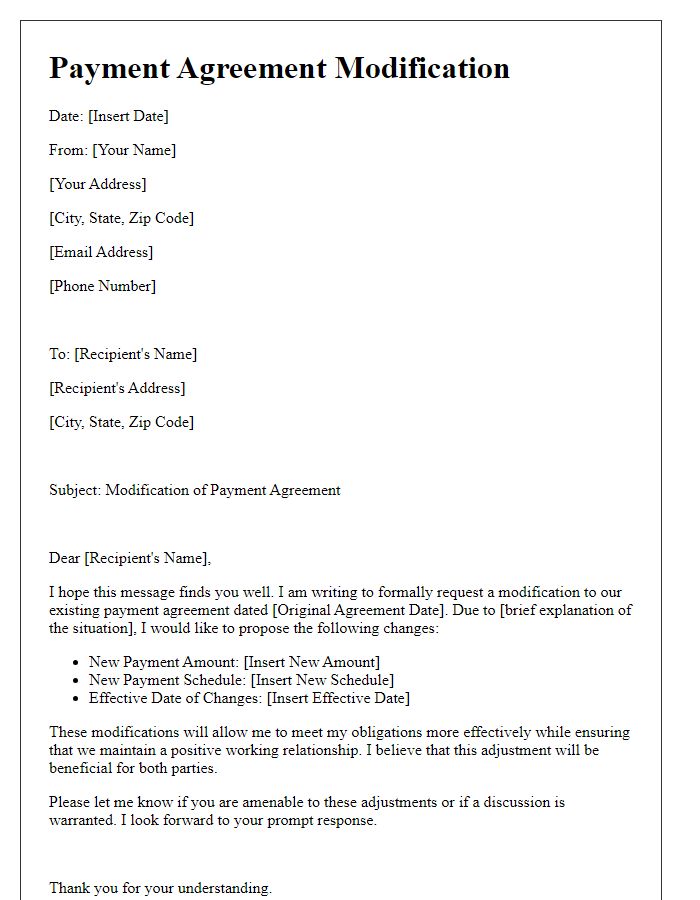

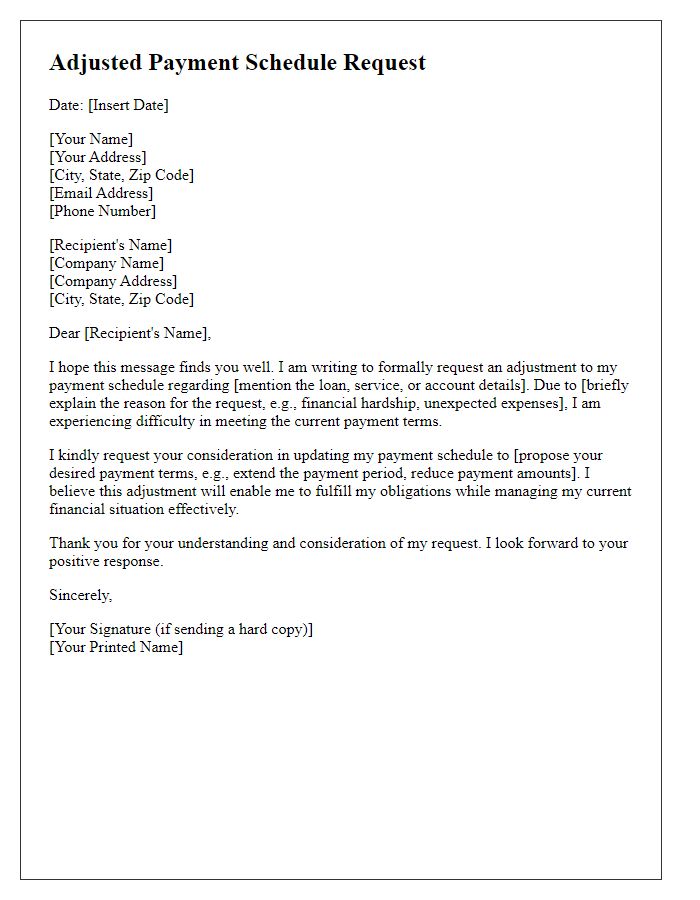

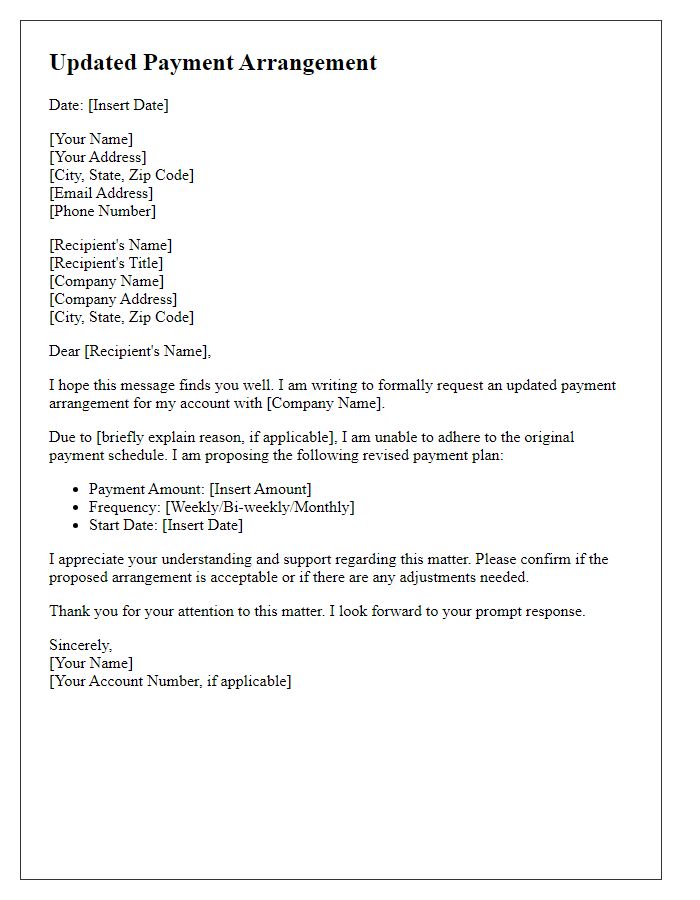

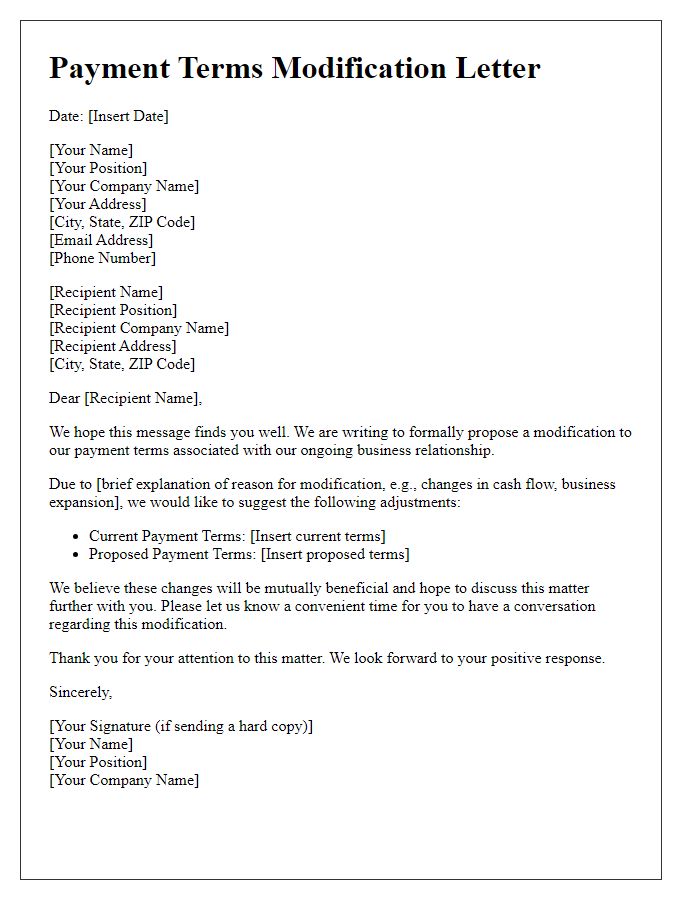

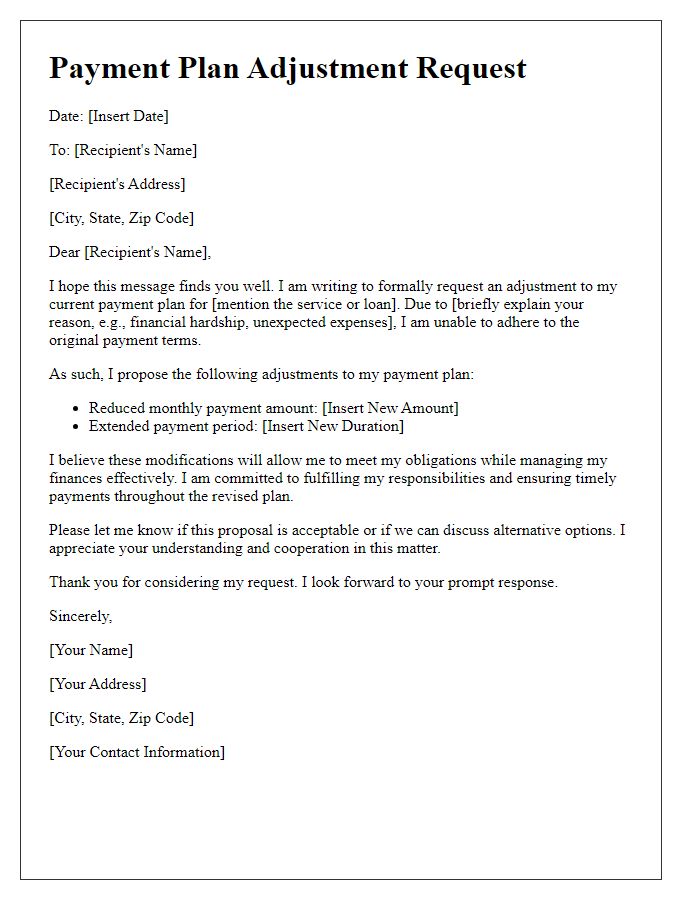

Clear Title and Subject Line

A payment schedule amendment is often necessary for adjusting financial obligations to better reflect the current circumstances of parties involved. Parties may have predetermined payment intervals, such as monthly or quarterly, which need to be modified due to changes in income, unexpected expenses, or altered agreements. The amendment might specify new payment amounts, adjusted deadlines, or altered payment methods, ensuring clarity and compliance. Essential details include the original agreement date, specific changes to the payment terms, and the signatures of all involved parties, solidifying the new agreement. These elements enhance transparency and maintain a clear record of the agreed changes.

Accurate Recipient Information

Accurate recipient information is crucial for effective communication regarding payment schedule amendments. Details such as the recipient's full name, contact number, and emailing address ensure the message reaches the intended party without delay. Additionally, including pertinent information like the company name and billing address contributes to clarity and eliminates confusion during transactions. Accurate data helps prevent miscommunication, such as sending sensitive financial information to the wrong recipient, which can lead to delays and possible legal ramifications. Finally, confirmed recipient information fosters trust, reliability, and professionalism in financial dealings.

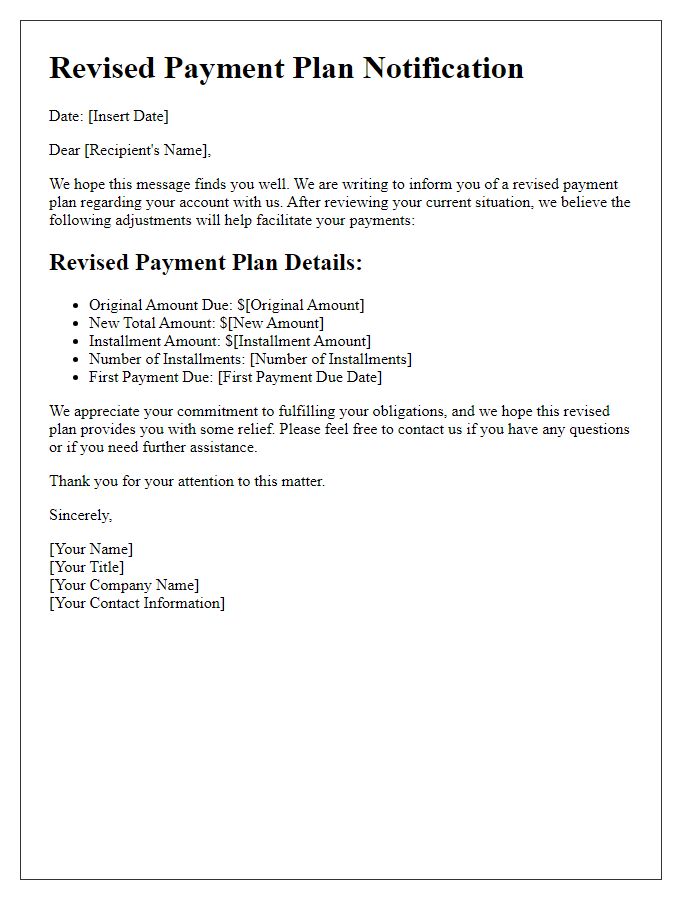

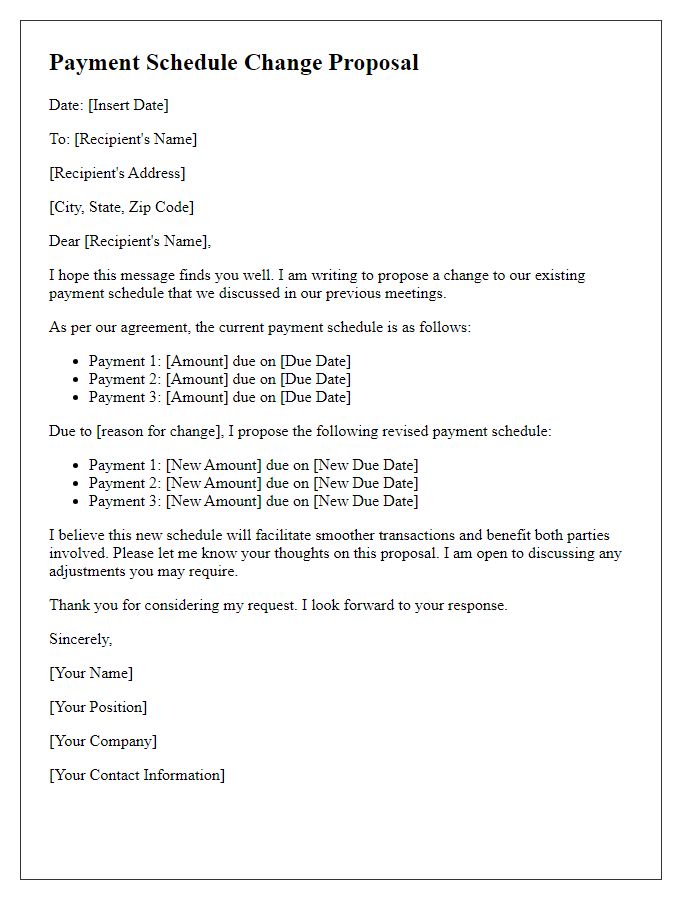

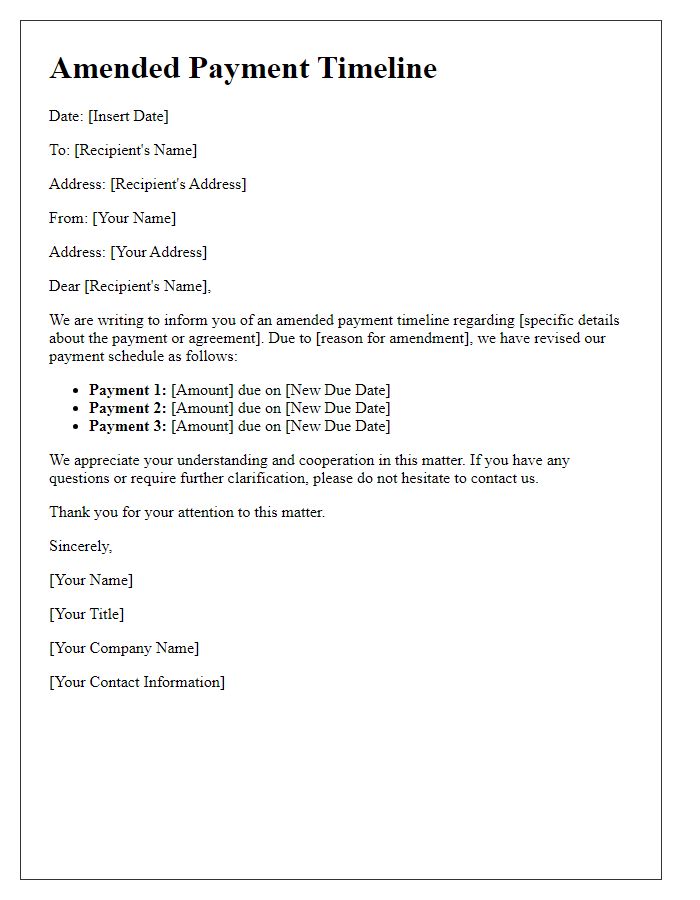

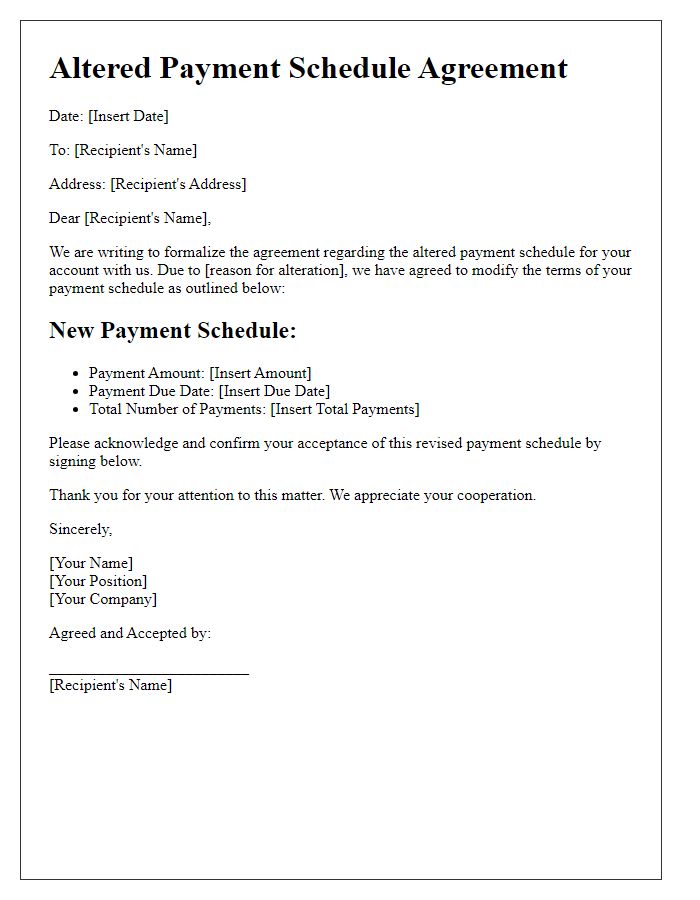

Detailed Payment Schedule Changes

The detailed payment schedule amendment outlines specific changes made to the original agreement between parties regarding financial obligations. The original due date for the first payment (previously set for January 15, 2023) has been adjusted to February 1, 2023, to accommodate unexpected cash flow issues. Subsequent payments, initially structured to occur biweekly, will now be adjusted to a monthly schedule, with the second payment due on March 1, 2023. This amendment provides a comprehensive overview, highlighting the total amount owed ($12,000), along with the revised terms spread over six months instead of the original three-month period. Each payment will now be $2,000, ensuring that both parties maintain clarity regarding the new timeline and financial expectations. Additional stipulations for missed payments include a late fee of 5% applicable after 10 days past the due date, emphasizing accountability in this amended payment schedule.

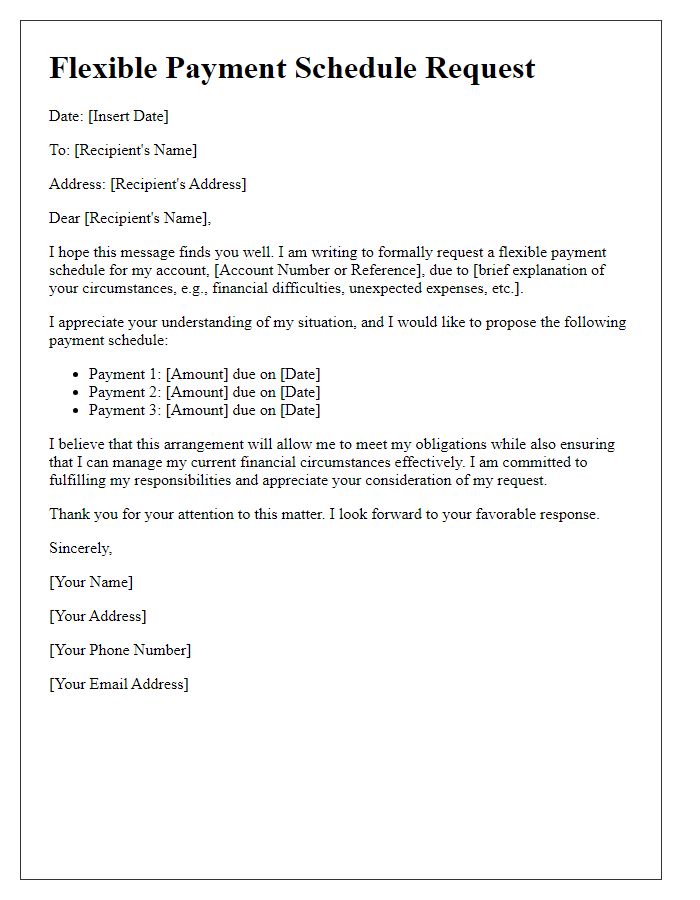

Justification for Amendment

In light of recent financial developments, the request for an amendment to the payment schedule is imperative. The unforeseen economic fluctuations, including a significant rise in inflation rates (currently at 8.6% in the U.S.), have placed considerable strain on budgeting capabilities. Additionally, the impact of the ongoing supply chain disruptions, particularly in sectors heavily reliant on international trade, has caused delays in expected revenues. This situation necessitates a reevaluation of our current obligations to ensure we meet commitments without jeopardizing operational stability. A revised payment schedule would provide needed relief and allow for continued compliance with contractual obligations.

Contact Information for Further Discussion

Amending a payment schedule can involve various stakeholders, including financial institutions, clients, or vendors. It is crucial to provide clear contact information for further discussion regarding the amendment. Including full names, titles (such as Account Manager or Financial Analyst), company name, physical address (like 1234 Business Rd, New York, NY 10001), email addresses (such as name@company.com), and direct phone numbers (including area codes, for example, (555) 123-4567) allows all parties to facilitate effective communication. Highlighting preferred methods and times for communication promotes a smoother negotiation process, ensuring timely discussion and resolution of the payment schedule amendment.

Comments