Are you baffled by the insurance disbursement process? You're not alone! Understanding the ins and outs of how claims are processed and payments are made can seem overwhelming. In this article, we'll break down the steps involved and clarify any confusion, so you can feel confident navigating your insurance claimsâkeep reading to learn more!

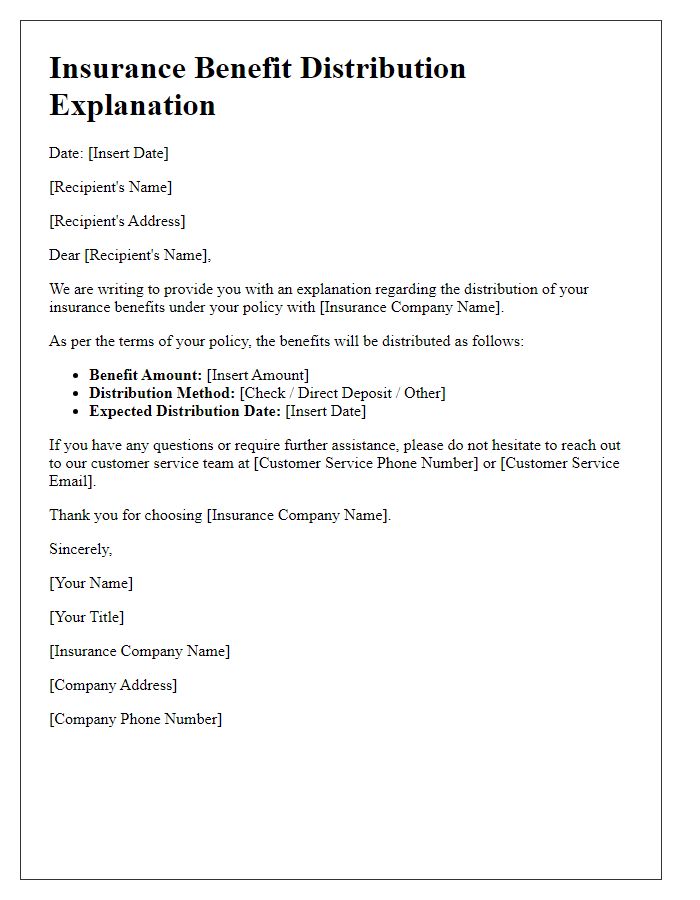

Clear Policy Details

Insurance disbursement processes are critical for policyholders needing timely financial support. Clear policy details outline coverage limits, deductibles, and specific exclusions crucial for understanding claim eligibility. For instance, health insurance policies might specify coverage amounts for various medical treatments, such as $10,000 for hospital stays or a $500 limit for outpatient surgeries. Car insurance policies often detail liability coverage amounts, such as $100,000 per person, and the importance of collision and comprehensive coverage in mitigating out-of-pocket costs during auto accidents. Homeowners insurance may specify coverage for specific events, like natural disasters (e.g., floods, earthquakes) that may have distinct deductibles or limits. These clear guidelines ensure policyholders are informed about their entitlements and the claim process, enhancing transparency and efficiency in financial assistance.

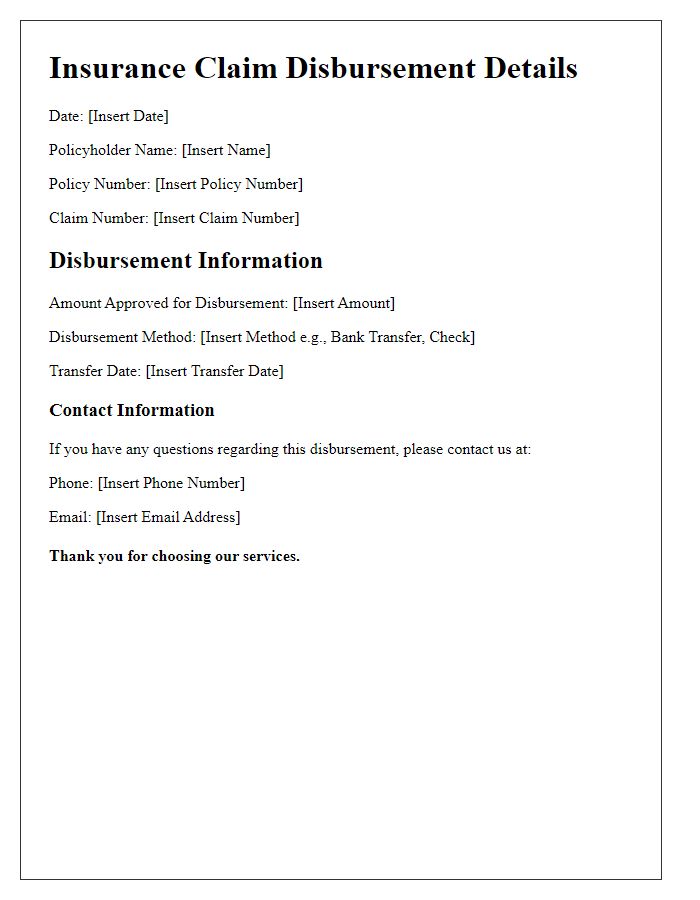

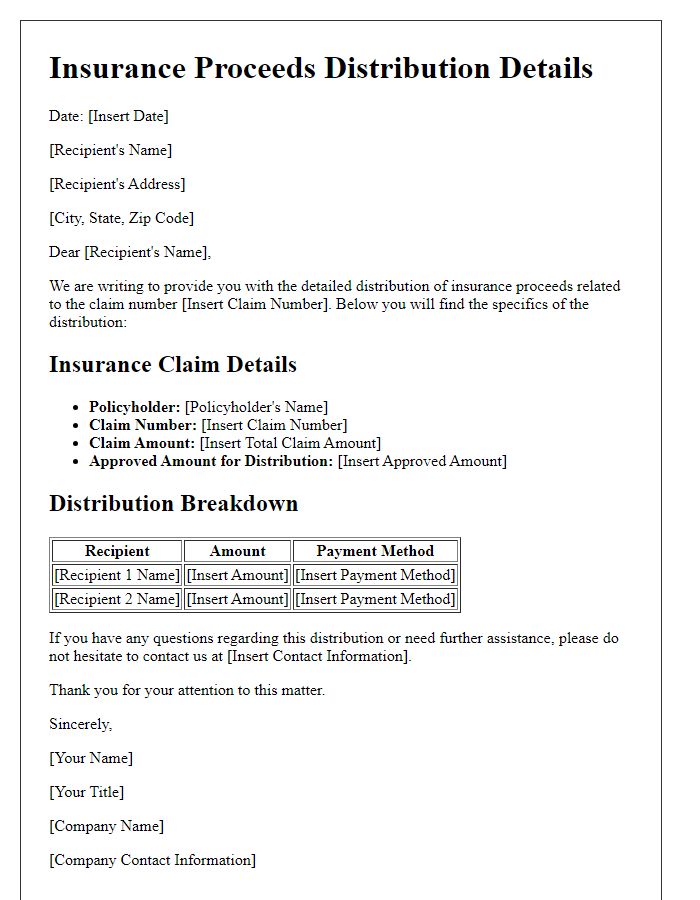

Claim Reference Number

Insurance disbursement regarding Claim Reference Number can involve multiple steps and detailed procedures. The initial submission of the claim (documented on [Date of Claim Submission]) included necessary documentation such as the police report, medical records, and photographs of the damaged property. Following a thorough review by the claims adjuster assigned to the case, the insurer evaluated the damages incurred, summing up the total amount eligible for disbursement, which was calculated at [Amount]. The disbursement process commenced on [Date of Disbursement Initiation], with funds allocated through [Payment Method, e.g., bank transfer or check]. The claimant, identified as [Claimant's Name], can expect to receive updates on the payment status through the provider's online portal or via direct contact with the claims department.

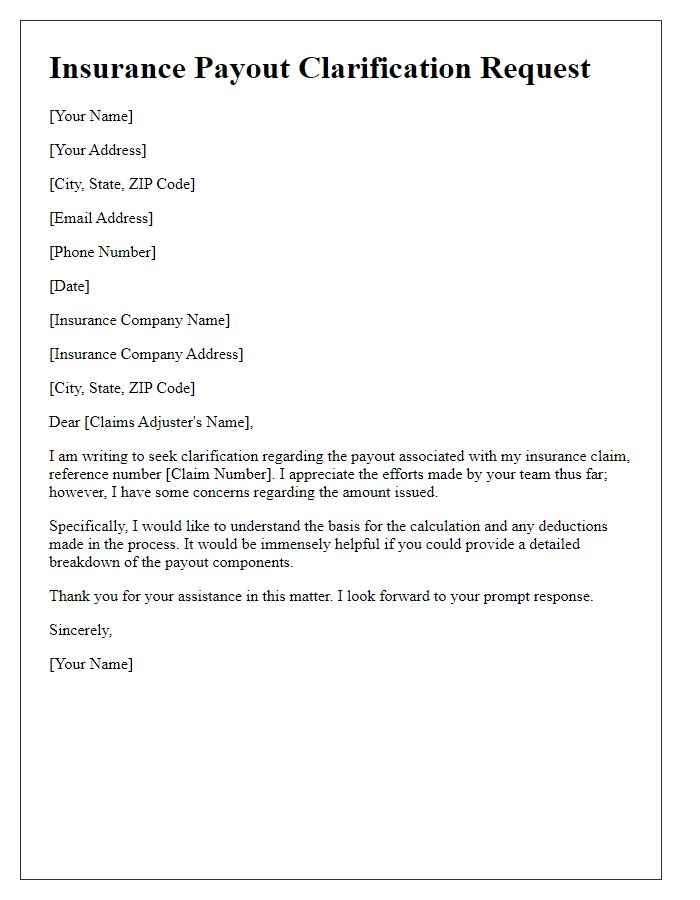

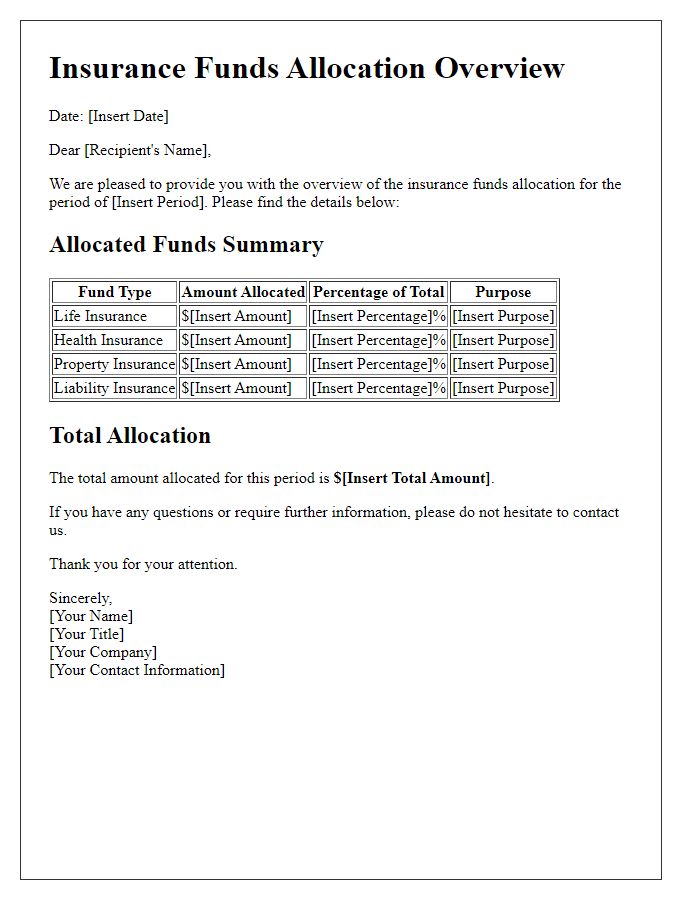

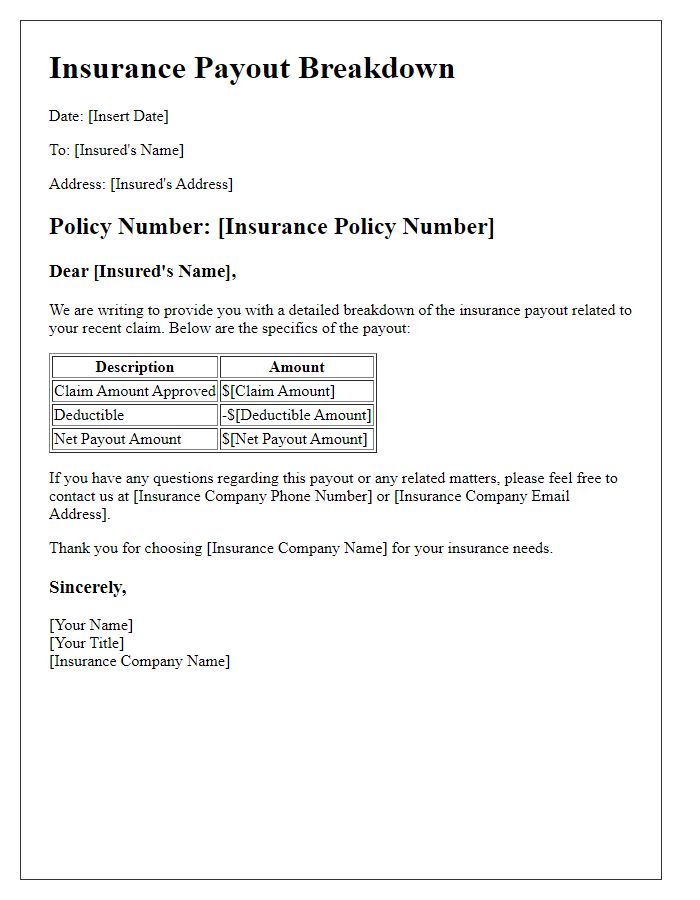

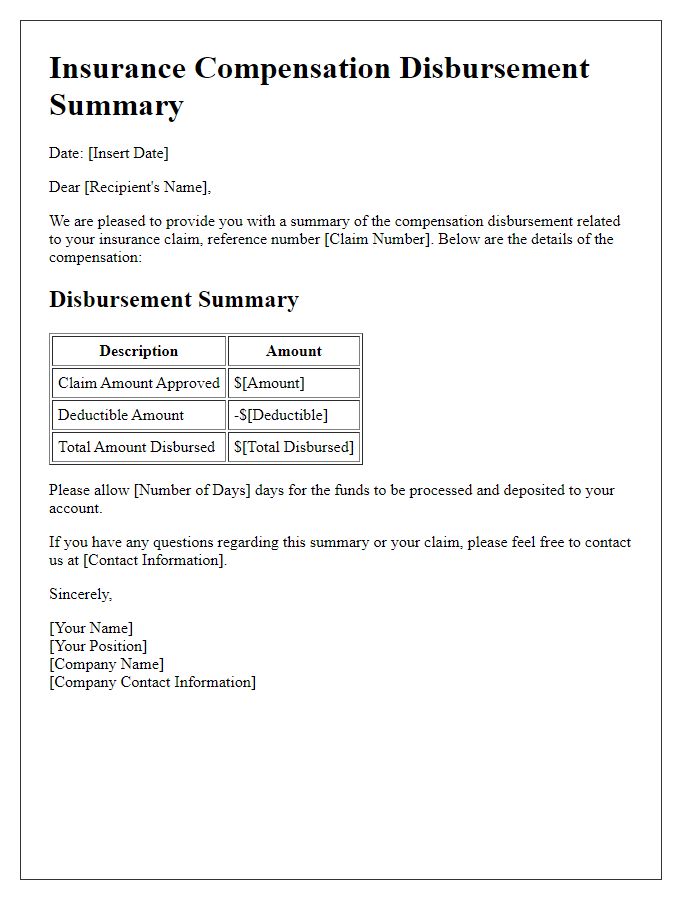

Explanation of Disbursement Amount

Insurance disbursement amounts refer to the funds allocated to policyholders after the assessment of insurance claims. Typically, these amounts are determined based on the total value of the covered loss, taking into account policy limits, deductibles, and specific coverage terms. For instance, a homeowner's insurance claim for storm damage may result in a disbursement reflecting the repair costs minus the deductible specified in the policy. Documentation such as receipts, repair estimates, or loss assessments provided by a claims adjuster play a crucial role in establishing the exact disbursement figure. Furthermore, the disbursement process involves compliance with industry regulations and the insurer's internal protocols to ensure prompt and fair payment to the policyholder.

Deductibles and Co-Payments

Understanding deductibles and co-payments is essential in navigating health insurance plans. Deductibles represent the amount (for example, $1,000 or $2,500) that policyholders must pay out-of-pocket before their insurance coverage kicks in. This amount resets annually, meaning each calendar year begins anew for this out-of-pocket cost. Co-payments, on the other hand, are fixed fees (such as $20 or $50) paid at the time of service for specific medical visits or prescriptions. These fees typically vary based on the type of care received, with primary care visits often costing less than specialist consultations. Together, these financial responsibilities can significantly influence overall health care expenditures, making it vital for individuals to fully understand their specific plan details when budgeting for medical services.

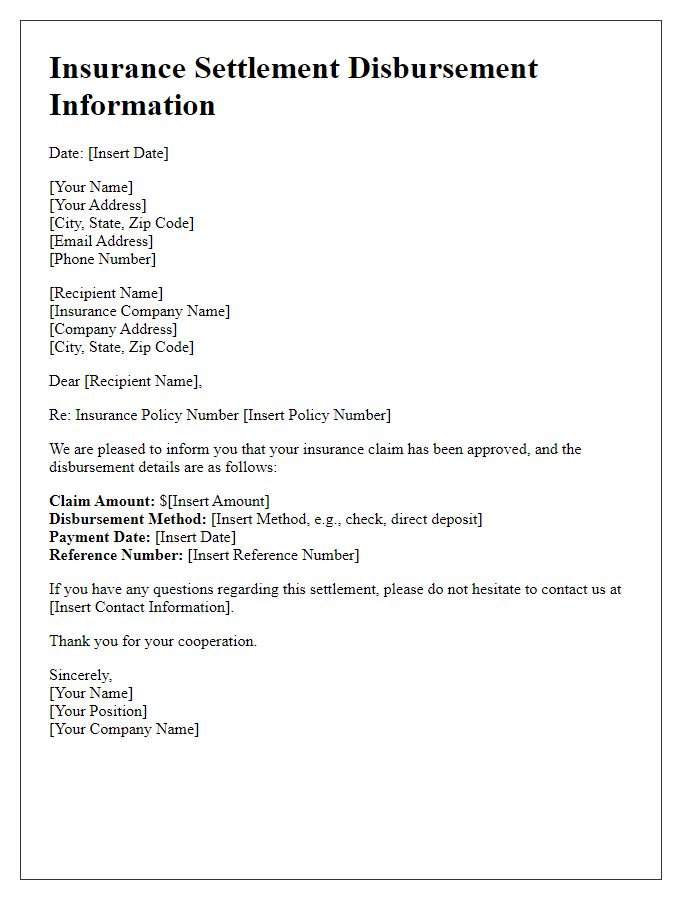

Contact Information for Further Assistance

Important insurance disbursement processes require accurate and timely communication. Insurance policies, compliance with the state regulations, and the specific terms of the policy dictate the steps involved in disbursement. For further assistance, policyholders can reach out to customer service departments of insurance companies, which often operate via phone helplines and online chat services. Contact numbers are typically listed on official websites or policy documents. Email correspondence may also be established for detailed queries. It's essential to provide claim numbers and personal identification details when seeking assistance to expedite the process. Insurance agents, trained to handle queries, can guide policyholders through the disbursement process, ensuring that claims are processed efficiently and addressing any concerns regarding payment schedules or amounts.

Comments