Are you navigating the tricky waters of collections and looking for the right template to refer your accounts to a collection agency? Writing a professional letter can make all the difference in communicating your needs clearly and effectively. With the right structure and tone, you can ensure your message resonates with the agency, setting the stage for a smooth partnership. If you're ready to streamline your collections process, keep reading to discover our comprehensive guide to crafting the perfect referral letter!

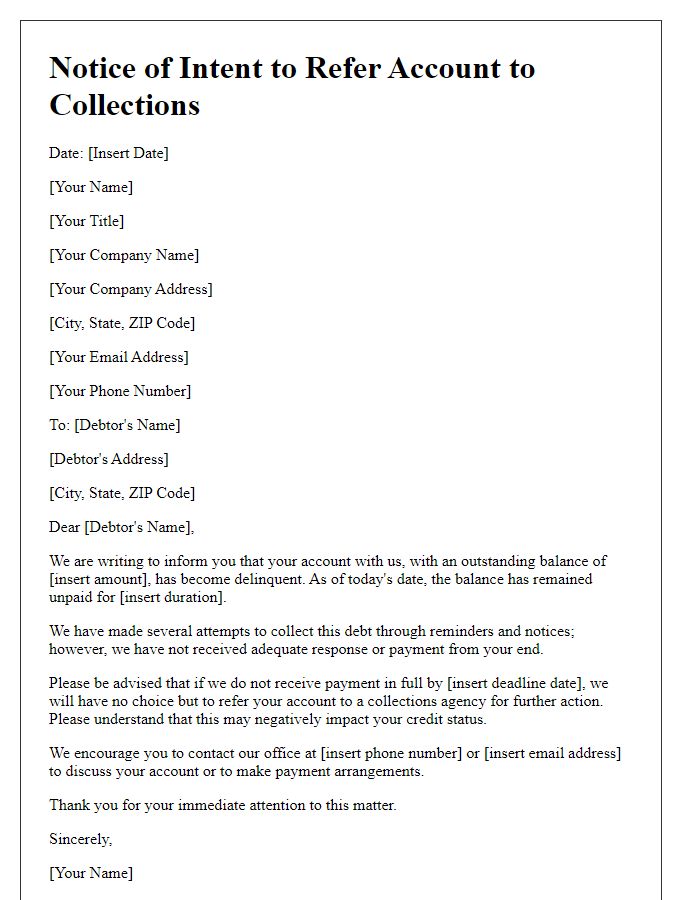

Clear Identification of Debtor and Creditor

The process of referring a debtor to a collection agency requires clear identification of both the debtor and creditor. The debtor, often an individual or business entity failing to settle an outstanding financial obligation, should be correctly identified using full legal name, address, account number, and other pertinent information. This ensures accurate tracking and management of the debt. The creditor, typically a service provider or lender owed money, must also be clearly identified, including their business name, address, and contact information. Details such as the specific amount owed, due date, and any relevant invoice numbers should accompany the referral to facilitate effective collection efforts. Proper documentation is crucial to comply with regulations and ensure transparency throughout the collection process.

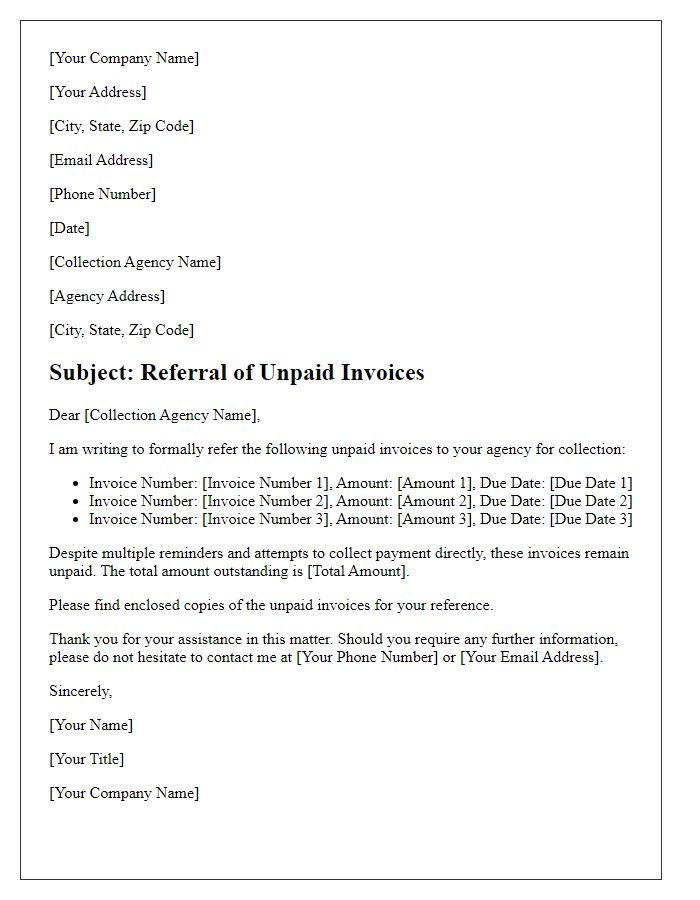

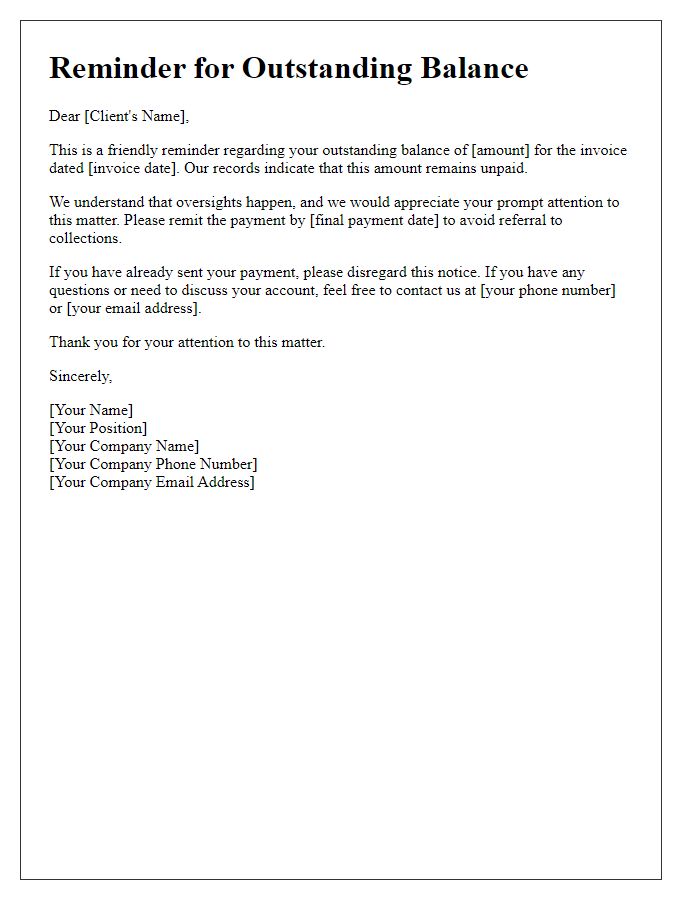

Detailed Account Information and Balance

Delinquent accounts can severely impact financial stability for businesses in various industries, necessitating timely collection efforts. Accurate account information, including debtor details such as the full name, address, and contact number, is essential for effective communication. The account balance, which should include any outstanding amounts, late fees, and interest charges, informs the collection agency of the total debt owed (e.g., a balance of $1,200 after 90 days of non-payment). Providing specific details such as the original invoice date, payment terms, and previous communications can help streamline the collection process. Additionally, highlighting the reasons for referral, such as repeated unsuccessful collection attempts or disputes, enhances clarity for the agency, ultimately expediting recovery efforts.

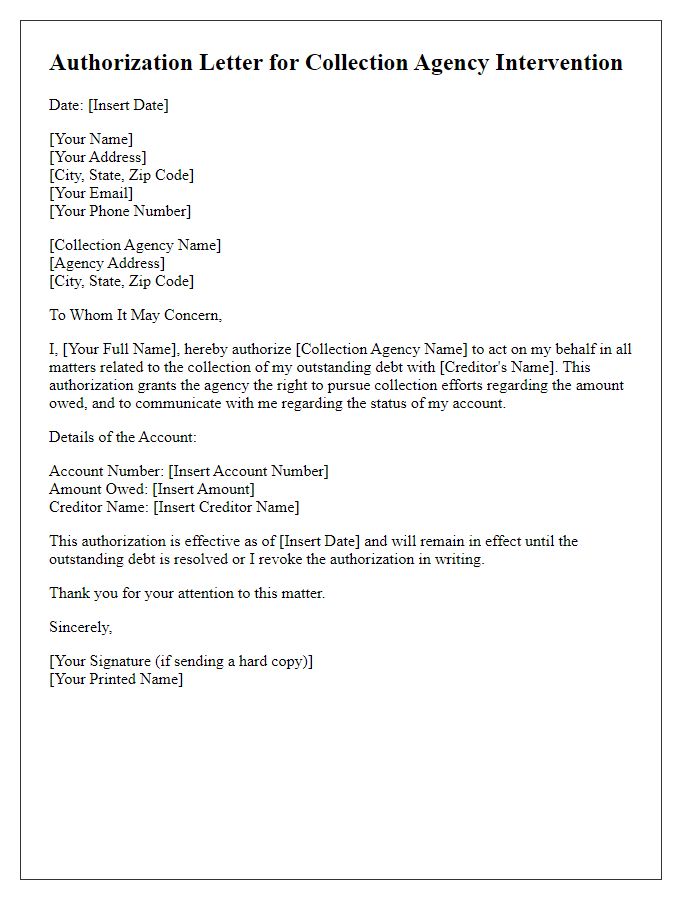

Authorization for Agency Action

Collection agencies often play a critical role in the recovery of outstanding debts. The process begins with an Authorization for Agency Action, which allows the agency to pursue collections on behalf of the creditor. The document typically includes essential details such as the creditor's name, contact information, and the debtor's account number. Specific amounts due must be clearly stated, ensuring compliance with regulations. Dates of the original contract and last payment are significant too, reflecting the timeline of the debt. Terms governing the collection process, including permissible actions and reporting requirements, must be explicitly outlined to protect both the creditor's interests and the debtor's rights. Proper authorization ensures that each action taken is legally sanctioned, facilitating efficient recovery efforts.

Legal Compliance and Regulatory Information

Collection agencies must adhere to the Fair Debt Collection Practices Act (FDCPA), which governs their behavior regarding debt collections. Compliance with state regulations is essential, considering variations in laws across jurisdictions, such as the Texas Debt Collection Act. Agencies must also be aware of the Consumer Financial Protection Bureau (CFPB) guidelines, ensuring transparency and ethical practices in their operations. Regular training programs on regulations are critical for agency staff to mitigate legal risks and maintain proper documentation of communications with debtors. Failure to comply may result in severe penalties, including fines and legal actions, underscoring the importance of commitment to legal standards in debt recovery practices.

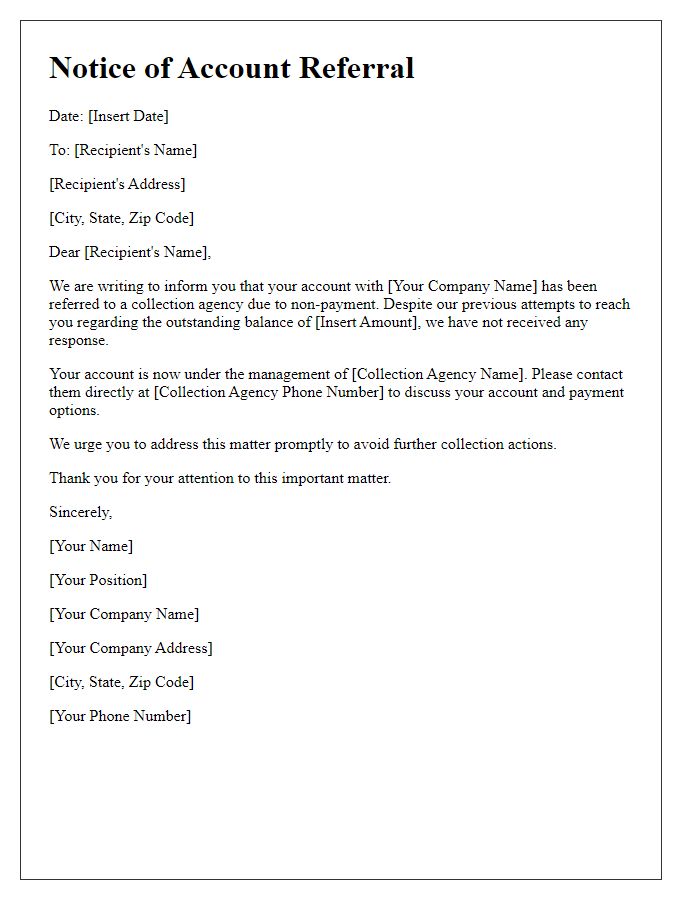

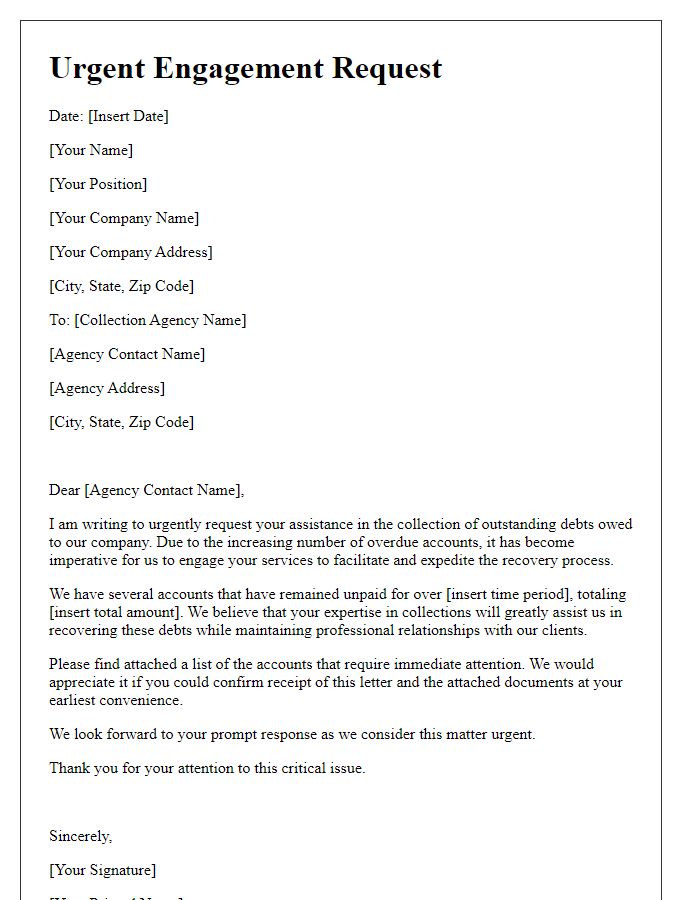

Contact Information for Both Parties

When referring a debt to a collection agency, ensure to include detailed contact information for both the creditor, the entity owed money, and the debtor, the individual or business that owes the debt. For the creditor, include entities such as companies or institutions (e.g., XYZ Corporation, a technology firm based in New York, NY, address: 123 Tech Lane, NY 10001, phone: (123) 456-7890, email: info@xyzcorp.com). For the debtor, provide their full name or business name, address (e.g., John Doe, 456 Maple Street, Springfield, IL 62704), phone number (e.g., (987) 654-3210), and any available email addresses (e.g., johndoe@email.com) to ensure efficient communication. Documenting these details accurately is crucial for a smooth referral process.

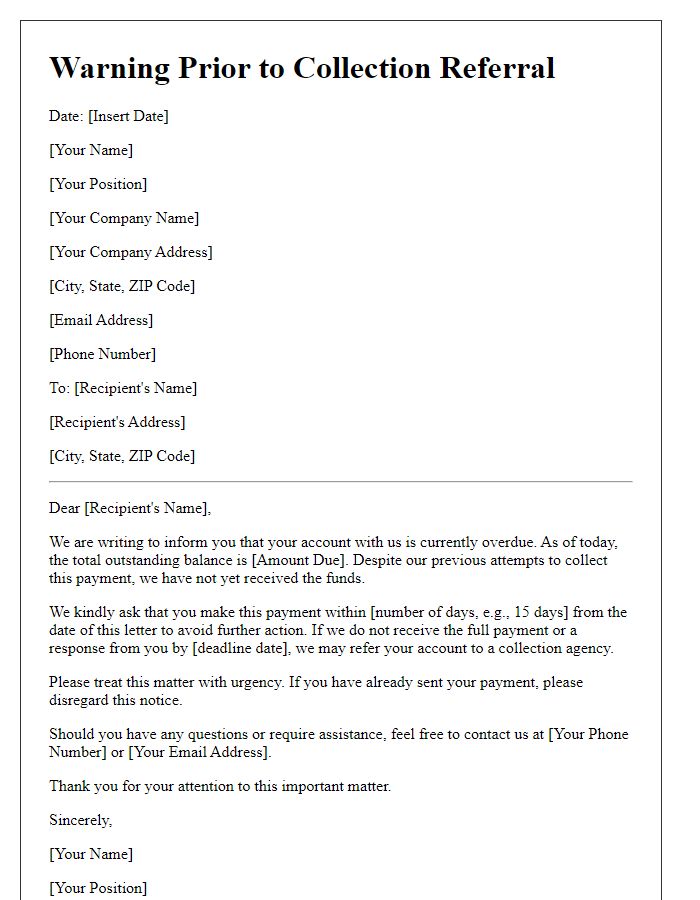

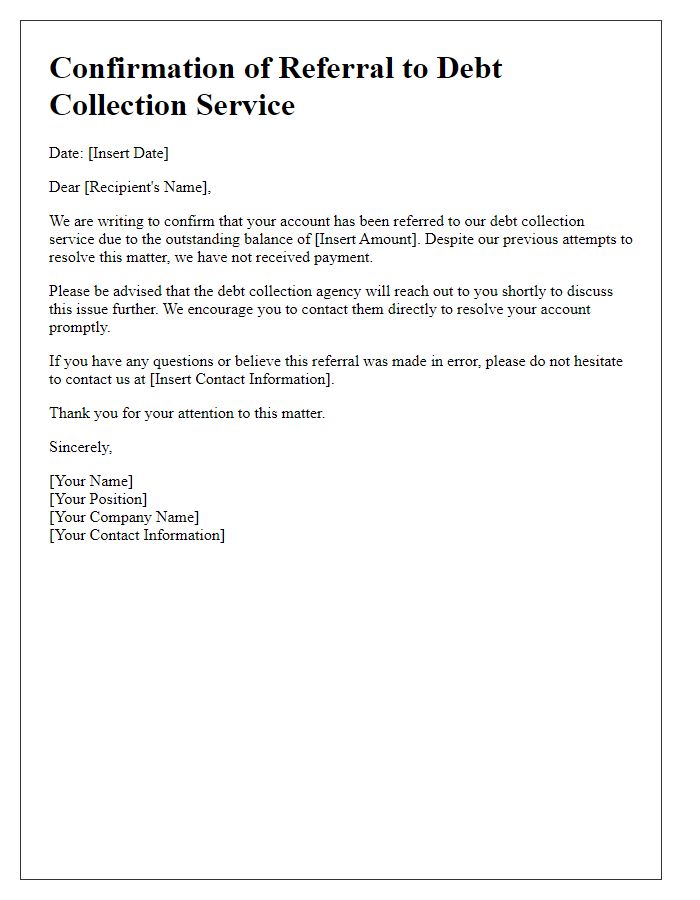

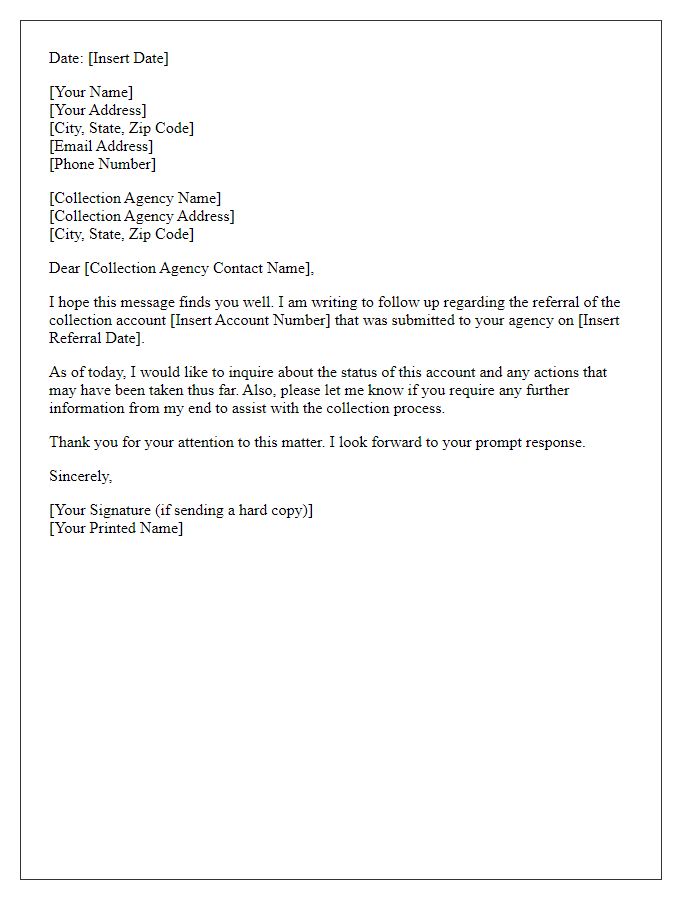

Letter Template For Collection Agency Referral Samples

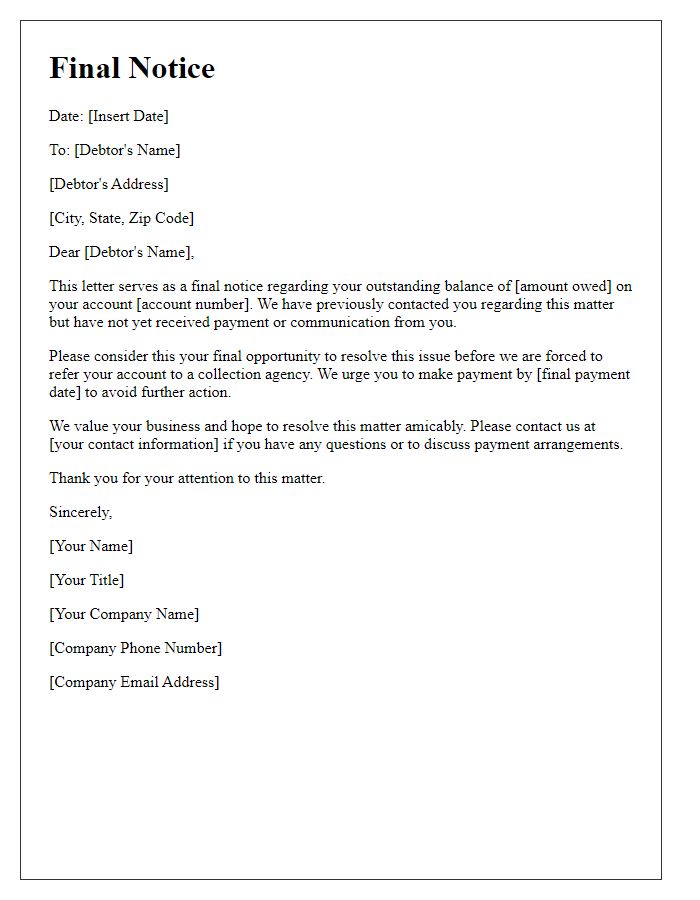

Letter template of notification of account referral to collection agency.

Comments