Are you exploring the world of tailored financing loan solutions but feeling overwhelmed? You're not alone! With so many options available, finding the perfect fit for your financial needs can seem daunting. Ready to simplify the process and discover how customized loan solutions can work for you? Let's dive in together!

Personalization and Client Information

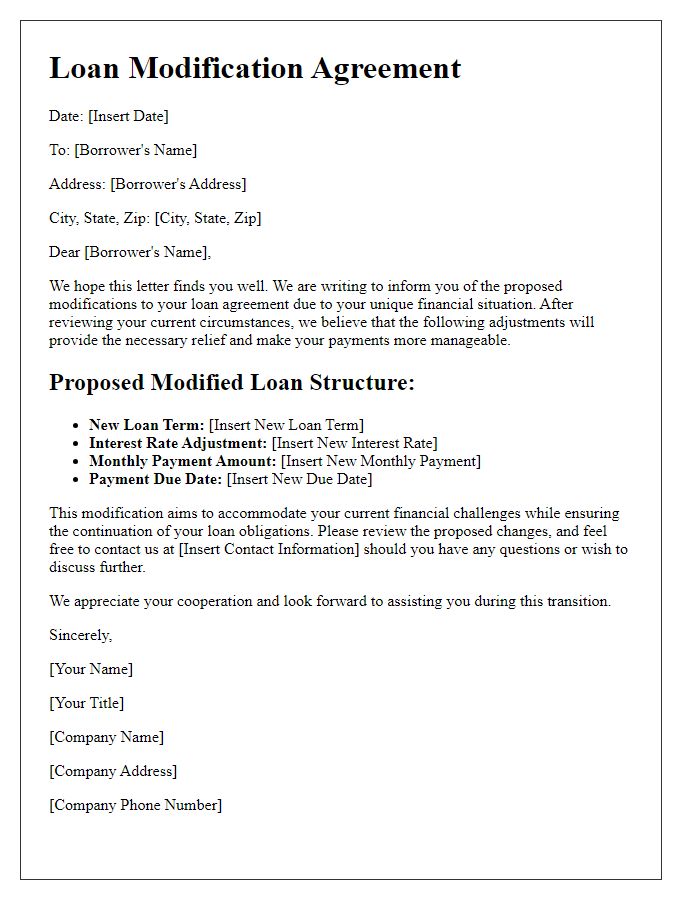

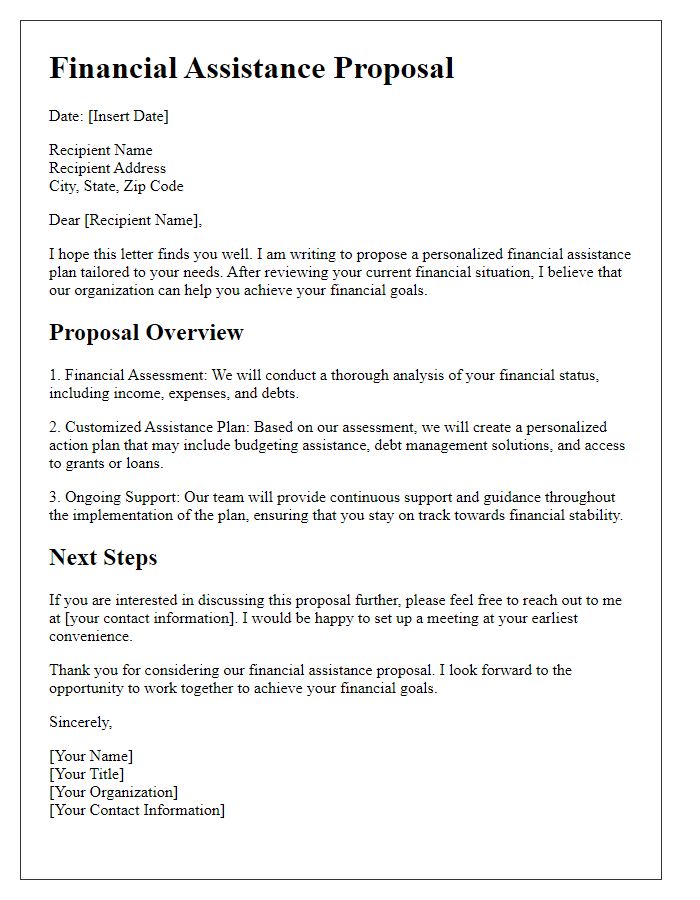

Tailored financing loan solutions are designed to meet the specific needs of clients seeking customized financial assistance. These solutions often involve personalized assessments based on individual financial situations, including income levels, credit scores, and unique borrowing objectives. Lenders utilize advanced algorithms to analyze client information (such as debt-to-income ratios and employment stability) to propose optimal loan amounts and terms that align with borrowers' goals. In regions like California, where housing markets can be volatile, personalized financing options can significantly impact clients' ability to secure favorable mortgage rates. Understanding the nuances of each client's financial landscape enables lenders to offer competitive interest rates, flexible repayment plans, and specialized programs, enhancing customer satisfaction and fostering long-term relationships.

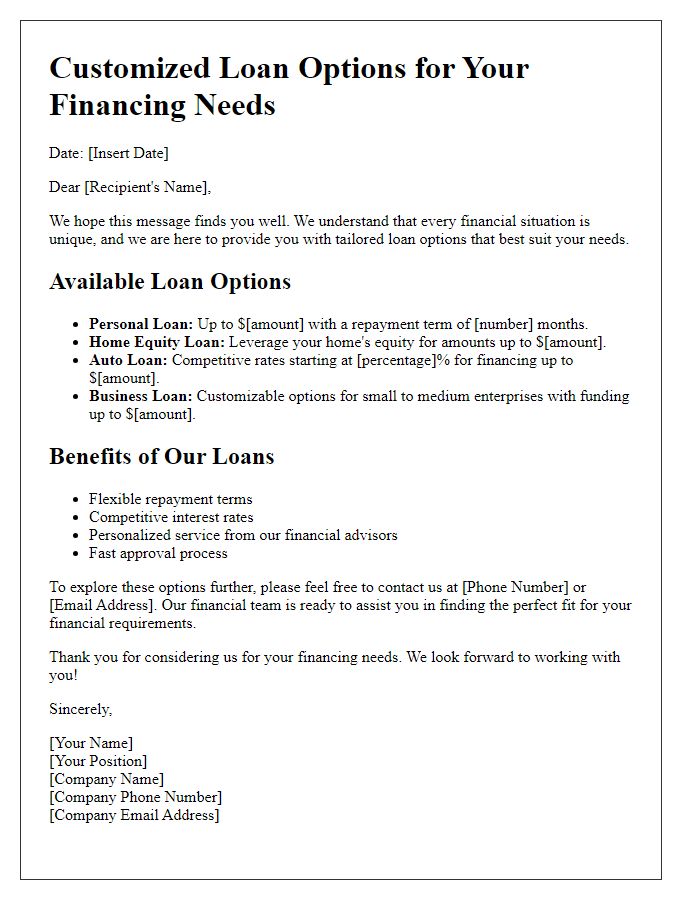

Loan Details and Benefits

Tailored financing loan solutions provide customers with customized loan details and benefits designed to meet individual financial needs. Loan amounts can vary from $5,000 to over $500,000, based on borrowing capacity and creditworthiness. Flexible repayment terms often span from 12 months to 30 years, allowing for manageable monthly payments. Interest rates typically range from 3% to 10%, influenced by current market conditions and individual credit scores. Benefits include personalized financial advice from dedicated loan officers, access to exclusive promotions that can lower overall costs, and streamlined approval processes that minimize paperwork and expedite funding. Additionally, some options may offer deferred payment plans or the ability to consolidate existing debts into a single manageable loan.

Flexibility and Customization Options

Tailored financing loan solutions provide essential flexibility and customization options for borrowers navigating diverse financial needs. Analyzing 2023 financial trends reveals that personalized loan arrangements can enhance accessibility, enabling individuals and businesses to secure amounts ranging from $5,000 to $1 million. In industries like real estate, these financing solutions adapt to varying market conditions, offering adjustable interest rates and repayment terms to accommodate fluctuating income levels. Customization features, such as graduated payment schedules, enable borrowers to align their financial obligations with expected cash flow changes, fostering improved financial stability. Additionally, lenders often incorporate technology-driven platforms, streamlining application processes while maintaining transparency in fee structures and approval timelines, ultimately catering to unique borrower profiles.

Interest Rates and Terms

Tailored financing loan solutions provide customized lending options to meet individual financial needs. Interest rates (as low as 3.5% for qualifying borrowers) play a crucial role in determining the overall cost of borrowing. Flexible terms (ranging from 12 to 60 months) allow borrowers to select a repayment schedule that aligns with their financial capabilities. Different loan types, such as personal loans, auto loans, or home equity loans, may offer varying conditions and benefits. Lenders often assess credit scores (often ranging from 300 to 850) to determine eligibility and interest rates, impacting the total repayment amount significantly. In the competitive market of 2023, borrowers can leverage various lending institutions to secure the most favorable terms for their unique situations.

Call to Action and Contact Information

Tailored financing loan solutions cater to the unique financial needs of individuals and businesses. These customized plans can offer competitive interest rates tailored to the applicant's credit profile and financial situation. Flexible repayment terms, ranging from 12 to 60 months, provide borrowers with manageable payment options that align with their cash flow. Financial institutions emphasize the importance of consultation; contacting a loan officer can help navigate the array of options available. Utilizing various communication channels, such as phone calls or emails, allows potential customers to ask specific questions regarding eligibility, required documentation, and approval timelines, ensuring an informed decision-making process.

Letter Template For Tailored Financing Loan Solutions Samples

Letter template of modified loan structures for unique financial situations

Comments