Are you feeling the pinch of rising interest rates on your loans? You're not alone; many individuals and businesses are seeking effective strategies to mitigate these increasing costs. In this article, we'll explore a tailored letter template designed to help you secure a mitigation loan that could ease your financial burden. Join us as we dive deeper into this topic and discover ways to protect your finances!

Purpose of the loan

Mitigating rising interest costs serves as a crucial financial strategy for businesses facing escalating borrowing expenses. This loan aims to provide essential funding, enabling companies to lock in lower interest rates and stabilize their financial positions. By addressing potential cash flow disruptions caused by increased lending rates, businesses can sustain operations and support growth initiatives. The anticipated outcome includes maintaining a healthy operating margin, ensuring liquidity for day-to-day expenses, and fostering long-term strategic investments. Ultimately, the focus remains on safeguarding the company's financial health amidst fluctuating market conditions.

Financial details and projections

The rising interest costs have become a significant concern for businesses, influencing financial stability and growth projections. For instance, a 2% increase in interest rates can elevate annual loan repayments substantially, potentially adding thousands of dollars in costs. A company with a $1 million loan at a 4% interest rate faces $40,000 in yearly payments. Conversely, with a 6% rate, payments soar to $60,000, reflecting a 50% increase. Projections indicate that maintaining a stable cash flow is vital, necessitating strategic planning for interest rate fluctuations. Engaging with financial institutions, such as banks or credit unions, for mitigation loans specifically designed to combat rising interest costs is crucial. These loans can provide lower fixed rates or refinancing options, helping businesses maintain profitability while navigating an unpredictable economic landscape. Monitoring market trends and interest rate forecasts ensures informed decisions, ultimately supporting long-term financial health.

Mitigation strategy for interest costs

Rising interest rates can significantly affect the financial landscape for businesses seeking loans. Implementing effective mitigation strategies is crucial for managing these increasing costs. One approach involves securing fixed-rate loans, which can shield borrowers from future rate hikes. Utilizing interest rate swaps is another strategy, allowing businesses to exchange fixed rates for variable ones, potentially lowering their expenses when rates stabilize. Additionally, maintaining a strong credit profile can lead to better interest rates; improving credit scores and reducing debt-to-income ratios can enhance loan applications. Exploring lender options, including credit unions and community banks, may yield competitive rates. Proactively refinancing existing high-interest loans can also serve as a strategy to reduce overall costs. Engaging a financial advisor to navigate these options can result in tailored solutions for specific business needs.

Collateral and security information

Rising interest rates exert considerable pressure on borrowers, leading to increased cost of servicing loans for both consumers and businesses. Financial institutions provide collateral and security measures to mitigate these rising interest costs, ensuring that they can recover funds in case of default. Common forms of collateral include real estate properties (often appraised over $200,000) and vehicles (typically valued above $10,000) that serve as guarantees for loan repayment. Additionally, secured loans may require personal guarantees or corporate guarantees from businesses, which can enhance the lender's recourse options. In some cases, financial institutions may seek additional forms of security, such as liens on inventory or receivables, further protecting their investment. Proper documentation (including titles and deeds) must be provided to establish ownership and enforceability of these collateral agreements.

Timeline and repayment plan

The rising interest costs can significantly impact personal and business finances, necessitating strategic mitigation through loans specifically designed for this purpose. A well-structured timeline for these financial instruments often spans over several years, with monthly or quarterly repayment schedules tailored to individual cash flow capabilities. Key factors include fixed or variable interest rates influencing total repayment amounts over 5 to 15 years, depending on the loan terms offered by financial institutions. Prepayment options may be available, allowing borrowers to reduce outstanding balances early. Detailed repayment plans outline principal and interest allocations, ensuring financial clarity and encouraging responsible fiscal management. Regular reviews of budget adjustments can further enhance the effectiveness of such mitigation loans, potentially alleviating stress from rising costs in economic environments characterized by fluctuating inflation rates.

Letter Template For Rising Interest Cost Mitigation Loan Samples

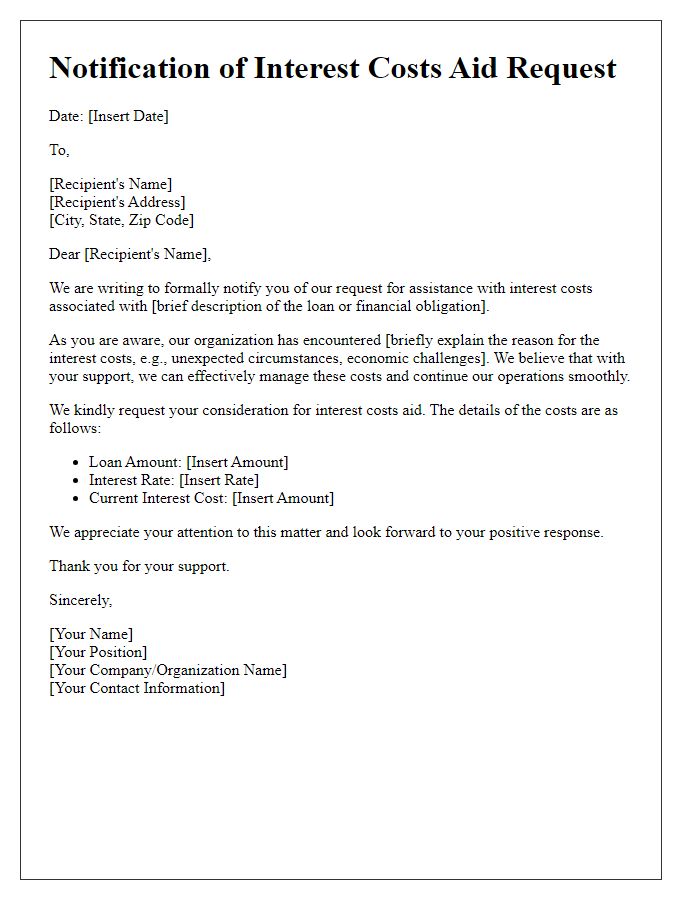

Letter template of inquiry for assistance with increasing interest expenses loan

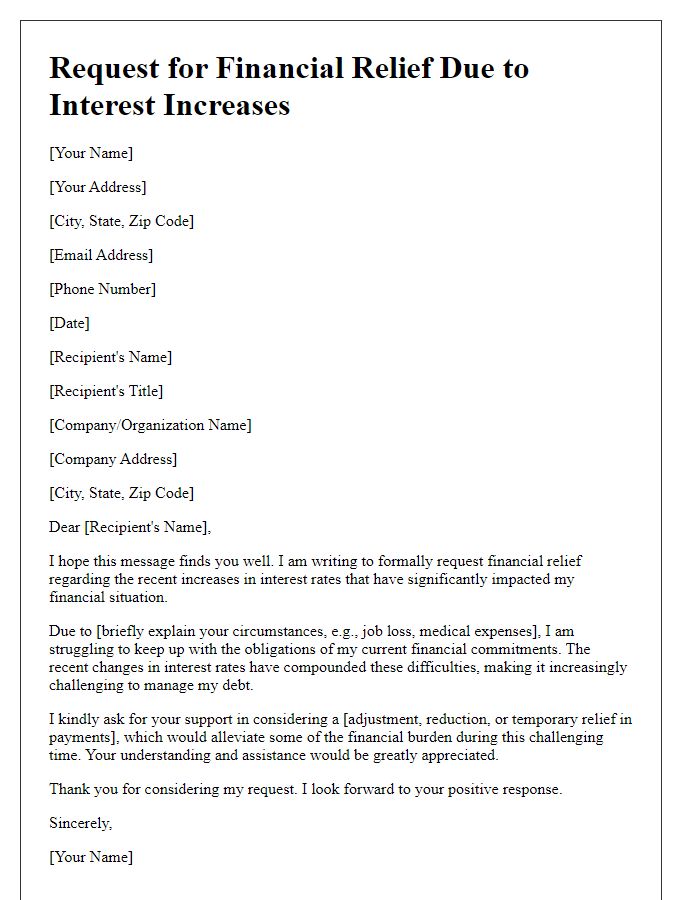

Letter template of appeal for financial support due to interest rate hikes

Letter template of solicitation for aid in managing interest cost pressures

Letter template of demand for loan assistance amid rising interest burdens

Comments