Are you a young adult navigating the world of loans for the first time? Whether you're considering student loans, personal loans, or a car loan, understanding your options is crucial to making informed financial decisions. It can feel overwhelming, but with the right guidance and tips, you can approach borrowing with confidence. Read on to discover essential advice that can help you take control of your financial future!

Purpose and Intent

Navigating young adult loans can be daunting for recent graduates and first-time borrowers. Understanding the purpose of loans, such as student loans for education expenses, personal loans for emergencies, or auto loans for purchasing a vehicle, is crucial. Borrowers should consider interest rates, often ranging from 3% to 10% depending on credit scores, and repayment terms that typically span 5 to 15 years. Locations, such as community banks or credit unions in urban areas like New York or Los Angeles, may offer competitive rates and personalized guidance. Awareness of federal loan options, such as Direct Subsidized or Unsubsidized Loans available through the Department of Education, can greatly impact financial stability post-graduation. Strategic planning, including budgeting for monthly payments, is necessary to avoid pitfalls like accumulating debt or defaulting. Resources like financial literacy workshops or online calculators can aid in making informed decisions.

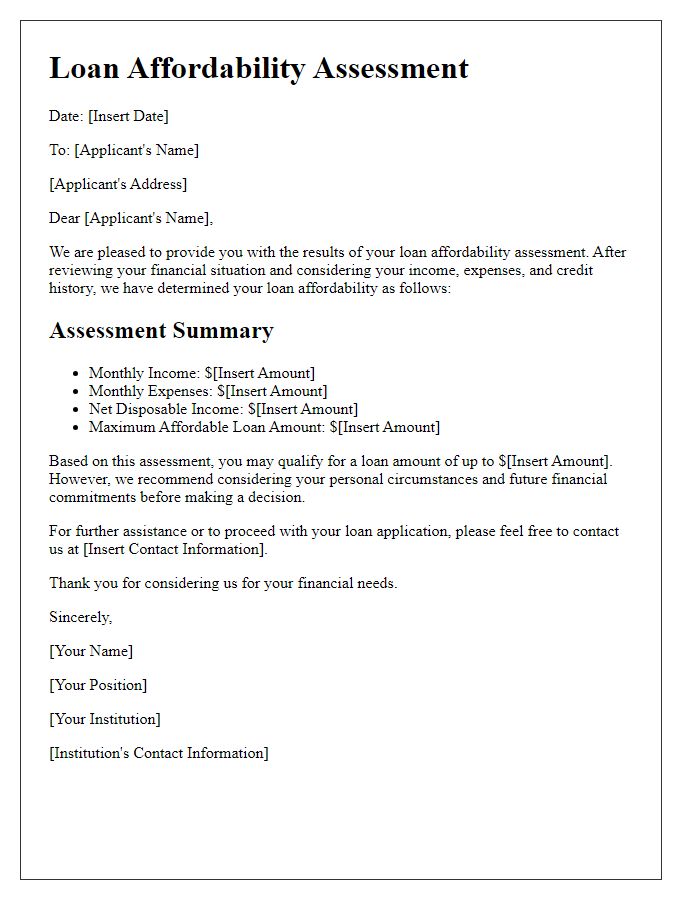

Loan Amount and Terms

Determining the ideal loan amount and understanding the terms associated with it is crucial for young adults entering the financial landscape. Many institutions offer student loans, personal loans, and auto loans with varying amounts, typically ranging from $1,000 to $50,000 depending on the borrower's needs and creditworthiness. Interest rates fluctuate based on the lender, credit score, and market conditions, often seen between 4% and 12% for education-related loans. Loan terms frequently span from 3 to 10 years, impacting monthly payments (which can range from $100 to over $500) and total repayment amounts. Familiarity with fixed versus variable interest rates further enables young borrowers to make informed choices that align with their long-term financial goals. Understanding these elements can empower young adults to navigate loan options confidently while maintaining financial stability for their futures.

Repayment Options

Young adults seeking financial aid often encounter various repayment options for student loans, including federal and private loans. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, offer a range of repayment plans, including Income-Driven Repayment (IDR), which adjusts monthly payments based on income and family size. For instance, the Revised Pay As You Earn (REPAYE) plan caps payments at 10% of discretionary income, with potential loan forgiveness after 20 or 25 years. Private loans, often from banks or credit unions, may have more rigid repayment structures, typically requiring fixed monthly payments or variable interest rates. Additionally, options like deferment or forbearance provide temporary relief in case of financial hardship, though accruing interest during these periods can increase total loan costs. Understanding these choices is crucial for responsible financial planning in managing educational debts.

Interest Rates

Interest rates for youth loans, particularly student loans or personal loans, generally range from 3% to 12% depending on several factors like credit score, loan type, and lender policies. Federal student loans in the United States typically have fixed rates set annually, for example, 5.28% for undergraduate students disbursed in the 2021-2022 academic year. Factors like income level, repayment plans, and whether the loan is subsidized or unsubsidized also play crucial roles in determining overall costs. Timing is essential; monitoring economic indicators such as the Federal Reserve's interest rate adjustments can provide insights into potential fluctuations in borrowing costs. Understanding the long-term implications of accrued interest can significantly affect repayment strategies, thereby influencing financial stability in the future.

Financial Responsibility and Planning

Financial responsibility and planning are essential aspects of managing young adult loans effectively. Young adults in the age range of 18-30 often face the challenge of understanding loan structures, including interest rates and repayment terms. A Federal student loan, for instance, typically offers fixed interest rates, varying by year of borrowing, which can range between 3.73% and 6.28% for undergraduates. Creating a budget that accounts for monthly payments along with living expenses can help prevent default and maintain a positive credit score, which is crucial for future financial endeavors. Engaging with financial advisors or using online platforms like Mint can provide personalized strategies for loan repayment, ensuring a balanced financial future. Additionally, understanding the implications of deferment and forbearance can protect loan holders from immediate financial strain while still maintaining responsibility for their debts.

Letter Template For Young Adult Loan Advice Samples

Letter template of financial guidance for young professionals seeking loans

Letter template of essential tips for young adults applying for personal loans

Letter template of step-by-step loan application guidance for young adults

Comments