Are you a military member looking for financial options that cater specifically to your unique situation? Understanding military personnel loan benefits can open doors to secure funding for education, home purchases, or unexpected expenses. These benefits are designed to support you in achieving your goals while easing the financial burden often faced by service members. If you want to learn more about how these benefits can work for you, keep reading!

Introduction of Military Service

Military service, encompassing duty in armed forces branches such as the Army, Navy, Air Force, Marine Corps, and Coast Guard, plays a crucial role in protecting national security and upholding peace. Members of the military face unique challenges, including frequent relocations, extended deployments, and potential impacts on civilian life, making financial support essential. Various loan benefits, such as the Military Lending Act (MLA) and the Servicemembers Civil Relief Act (SCRA), offer critical assistance, ensuring lower interest rates and protections against aggressive collection tactics. These benefits aim to ease financial burdens while ensuring service members maintain focus on their mission rather than financial stress.

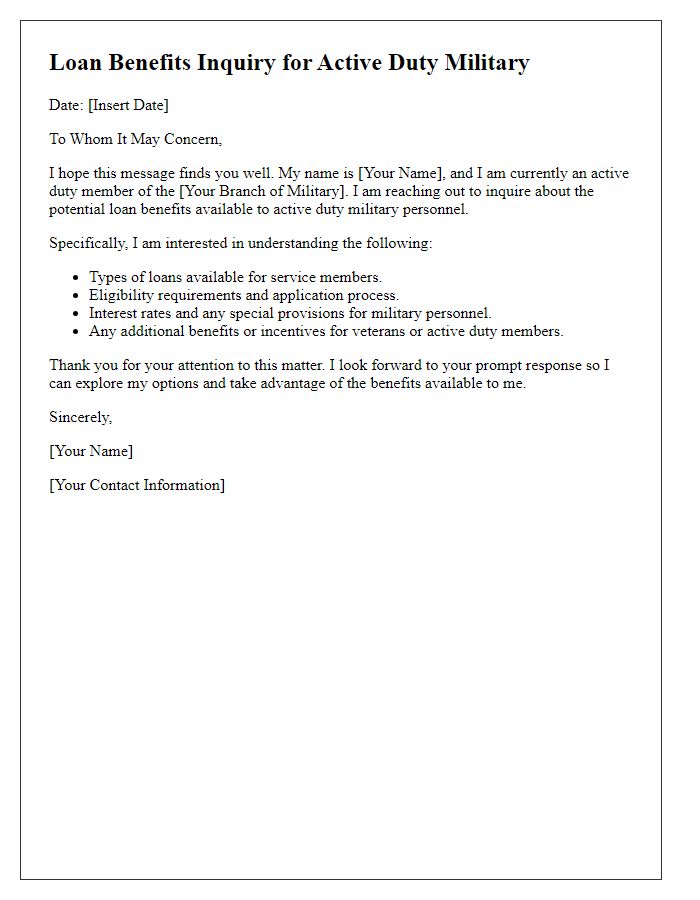

Overview of Loan Benefits

Military personnel can access a variety of loan benefits designed to support financial stability and readiness during and after service. The VA Home Loan program, managed by the U.S. Department of Veterans Affairs, provides eligible veterans and active-duty members access to zero-down payment mortgages, eliminating the need for private mortgage insurance. Additionally, Service members Civil Relief Act (SCRA) offers interest rate caps on loans for active-duty personnel, preventing financial strain during deployments. Credit unions and banks often provide specialized personal loans with reduced interest rates specifically for military members, recognizing unique financial circumstances. Furthermore, deployed service members can take advantage of flexible repayment options, ensuring they maintain financial health even when away from home. Programs like the Military Family Assistance Fund offer emergency financial assistance to cover unexpected expenses, reinforcing the commitment to the well-being of service members and their families.

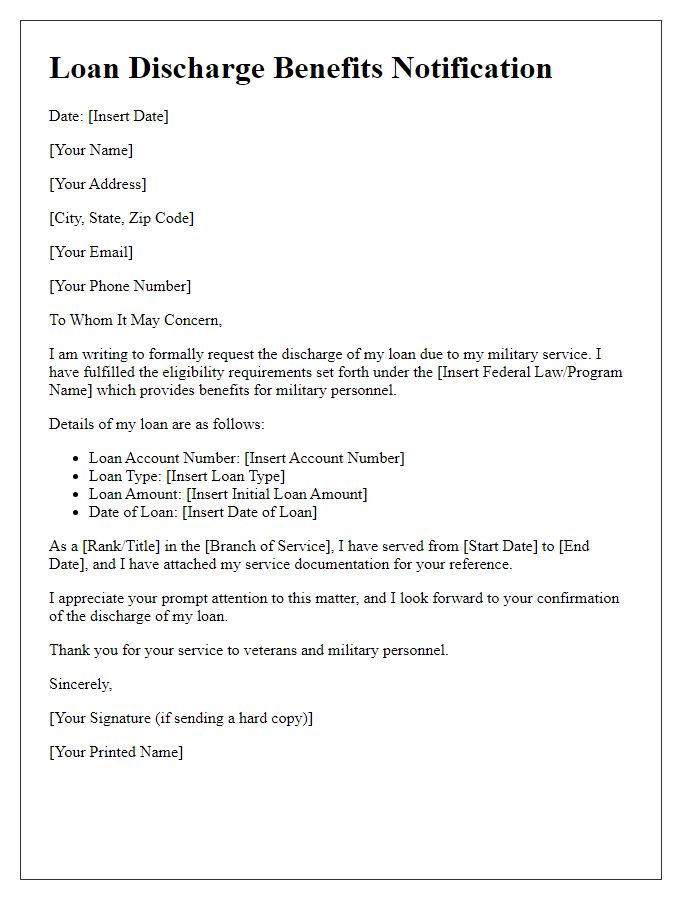

Eligibility Criteria

Eligibility criteria for military personnel loans depend on several factors, generally including service status, rank, and financial history. Active-duty members (e.g., U.S. Army, Navy, Air Force, Marine Corps, Coast Guard) must present proof of service, often through military identification or orders. Additionally, veterans with honorable discharge certificates are also eligible. Specific loans may require a minimum time in service or a certain rank (e.g., E-5 or above) to qualify. Creditworthiness is assessed through credit scores (typically above 620), alongside existing debt-to-income ratios (ideally below 36%). Some lenders may offer favorable terms based on service-related hardships (such as deployment). Each financial institution may have unique policies, emphasizing the importance of reviewing individual lending requirements.

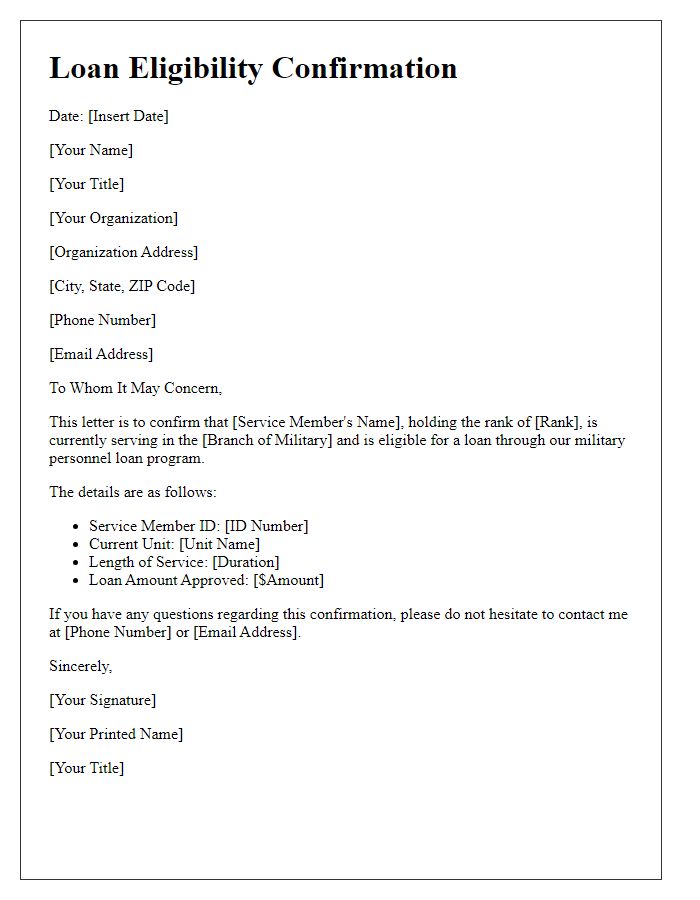

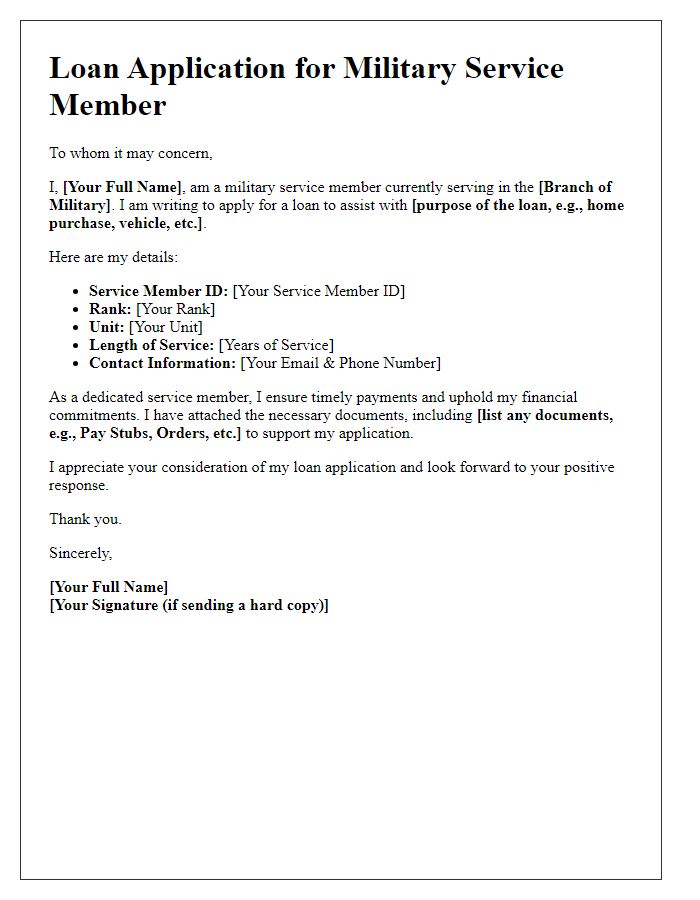

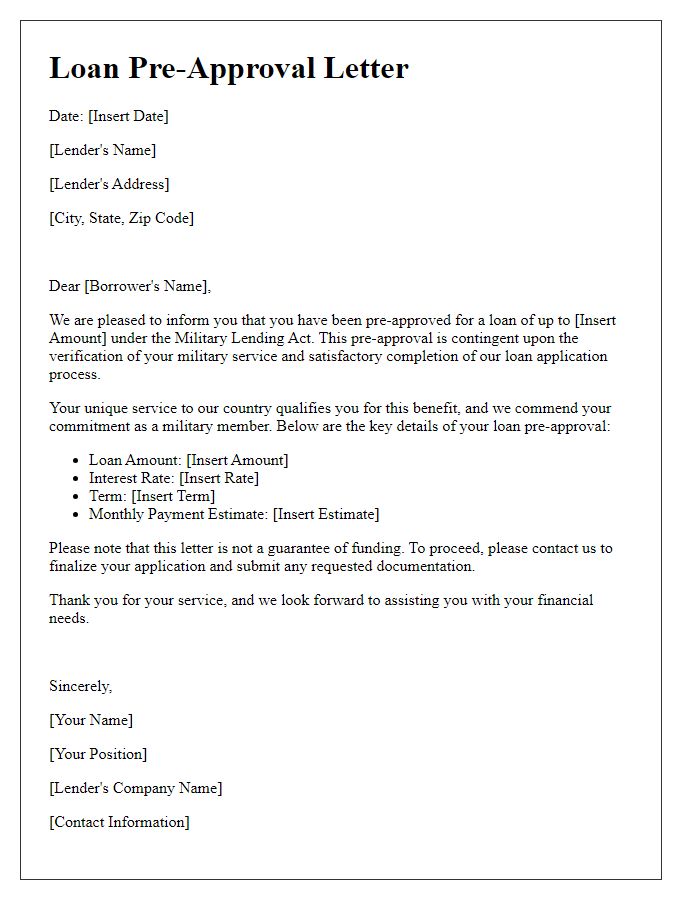

Application Process

The application process for military personnel loan benefits involves several essential steps to ensure eligibility and access to financial support. First, the applicant must provide valid identification, such as a military ID issued by the Department of Defense (DOD), which verifies active duty status. Documentation of service, like deployment orders or a DD Form 214 for veterans, is often required to confirm length of service and eligibility for specific benefits. Additionally, financial documentation, including recent pay stubs from the Defense Finance and Accounting Service (DFAS), may be requested to assess income levels. After compiling the necessary paperwork, the applicant typically submits the application to a designated lender, which might be a bank, credit union, or a specialized military lending institution. Following submission, the lender will review the application and supporting documents, often requiring a credit check. Once approved, terms and conditions will be outlined, including interest rates and repayment periods tailored to align with the unique financial situations of military personnel. Overall, navigating this process with meticulous attention to detail ensures access to favorable loan benefits available for military service members and veterans.

Contact Information for Assistance

Military personnel seeking loan benefits can access dedicated resources for assistance through various channels. The Department of Veterans Affairs provides support services via phone at 1-800-827-1000, ensuring that service members can consult trained representatives knowledgeable about specific loan programs. Additionally, military-focused organizations such as the Military Officers Association of America (MOAA) offer personalized guidance, accessible through their official website or customer service number, catering to unique financial needs. Local military assistance offices, stationed at bases such as Fort Bragg or Camp Pendleton, also serve as vital points of contact, providing in-person support and information regarding eligibility, application procedures, and ongoing benefits.

Comments