Are you navigating the complexities of a physician's loan application? Whether you're a recent graduate or a seasoned professional, updating your loan application can seem daunting. The good news is that with the right guidance and an effective letter template, the process can become much smoother. Stick around as we dive into essential tips and examples to help you effortlessly craft your update!

Clear Subject Line

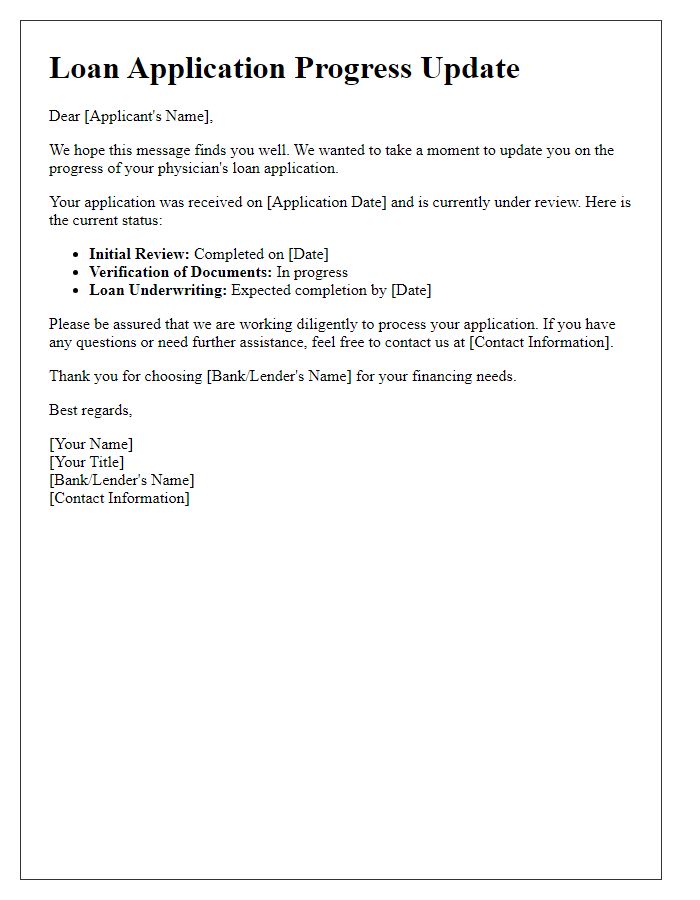

An update on the physician's loan application process is essential for maintaining communication with lending institutions. The application status may involve various factors such as approval timelines, required documentation, or changes in financial circumstances. Key details include interest rate adjustments (often varying from 3% to 5% depending on credit scores), loan amounts (commonly ranging from $100,000 to $400,000), and specific lending institutions (like banks or credit unions specializing in physician loans). This timely update can ensure that all parties are informed about necessary next steps or required documents, helping to streamline the lending process.

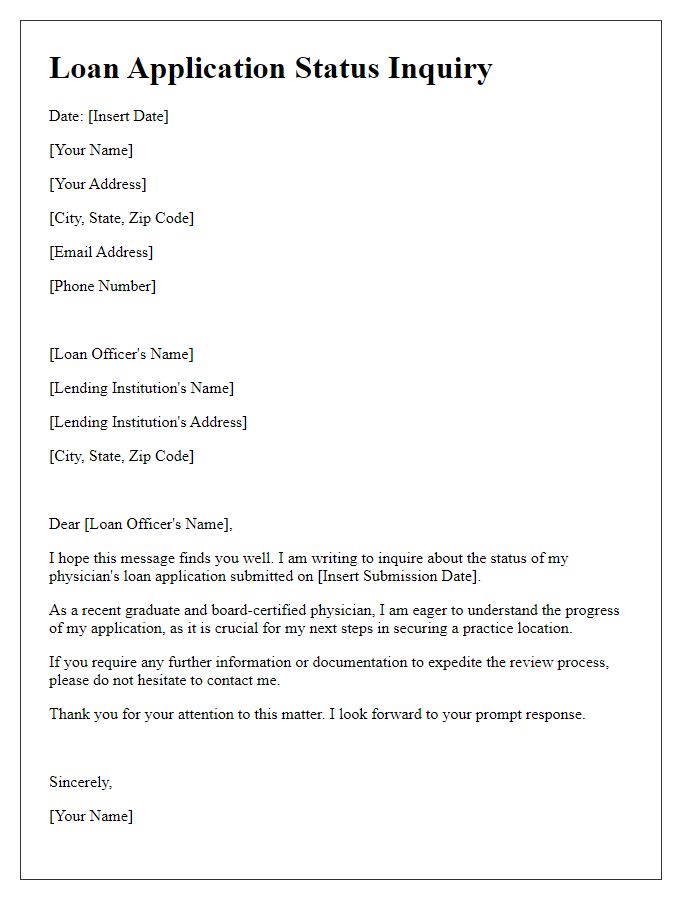

Applicant's Personal Information

The physician loan application process requires precise personal information to evaluate eligibility effectively. Applicants must provide full names, including middle names, along with date of birth for identity verification purposes. Accurate Social Security Numbers are essential for credit checks, while current addresses, including city, state, and ZIP codes, are necessary for residency validation. Contact numbers, preferably mobile, allow lenders to streamline communication. Medical schools attended, including graduation dates and degrees earned (like Doctor of Medicine or Doctor of Osteopathic Medicine), contribute vital education background information. Alongside, applicants need to list current employment details, such as the hospital or clinic name, position, and start date, to enhance their professional history assessment. Completion of this section is pivotal for timely loan processing and approval.

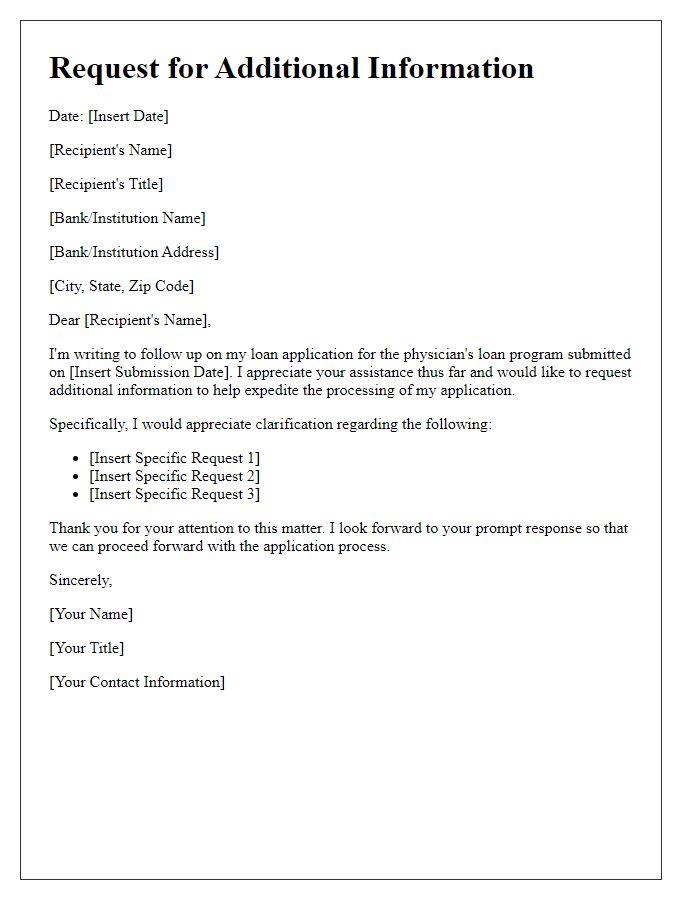

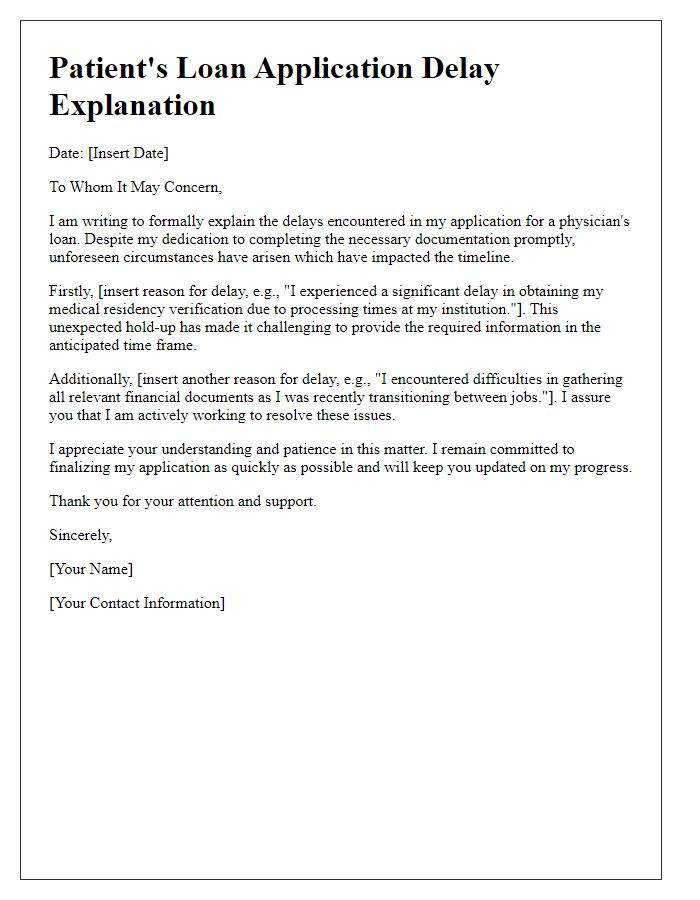

Loan Details and Status Inquiry

Professional communication regarding physician's loan status is vital for maintaining clarity in financial transactions. The physician loan, tailored for medical professionals, often features specific terms such as competitive interest rates (often between 3% to 5%), minimal down payment requirements (sometimes as low as 0%), and extended repayment periods (up to 30 years). Frequent updates are essential, especially when lenders evaluate applications for information accuracy, financial stability, and creditworthiness. Additionally, understanding the types of supporting documents required--like proof of residency program enrollment or employment verification--can streamline the process and expedite loan approval decisions. Ensuring timely updates can significantly impact cash flow, enabling physicians to manage educational costs more efficiently as they transition into their professional careers.

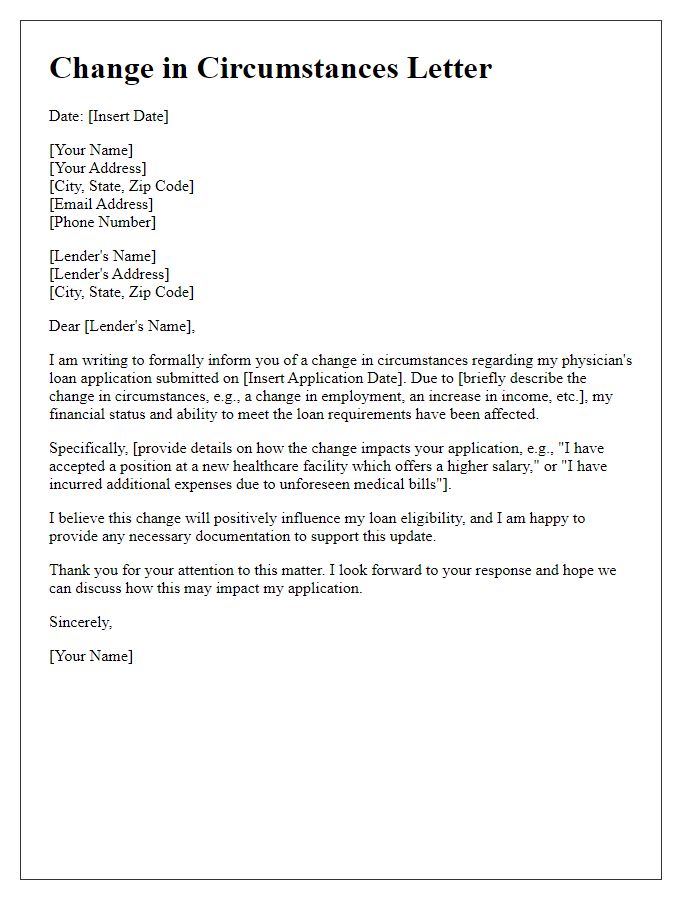

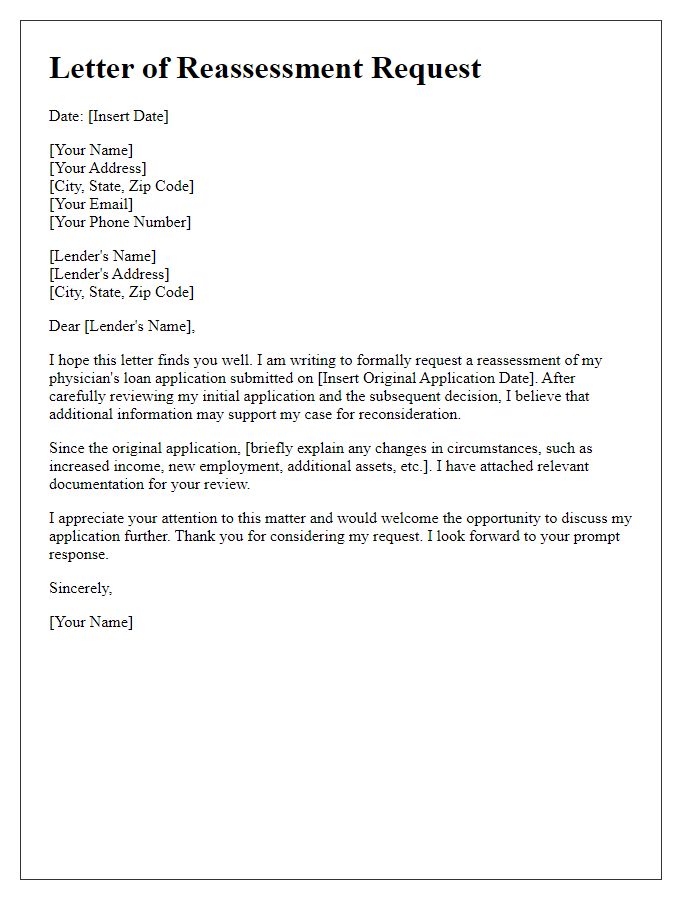

Justification and Supporting Documentation

Physician's loan applications require comprehensive justification and supporting documentation to enhance approval chances. Key documents include proof of residency training completion, typically a residency certificate from accredited institutions, verification of board certification or eligibility from relevant boards such as the American Board of Medical Specialties (ABMS), and current employment verification letters from hospitals or clinics, ensuring job security. Additionally, recent tax returns or W-2 forms from the past two years demonstrate financial stability. Loan applicants must also provide updated credit reports, reflecting their credit history and score, allowing lenders to assess risk accurately. Detailed personal statements outlining future career plans and income projections can strengthen the application, highlighting potential for financial growth in fields such as family medicine, cardiology, or neurology.

Contact Information for Further Communication

When a physician submits a loan application, it's crucial to provide accurate contact information to ensure seamless communication with lenders. Key details include full name, preferred phone number, and email address for immediate updates regarding the application status. Providing an alternate communication method, such as a secondary phone number or mailing address, may facilitate additional avenues for correspondence. Additionally, specifying the best times for contact can help avoid delays in communication, ensuring that important information regarding processes or required documents is received promptly. Regularly checking and updating this information is essential, particularly if significant life changes, such as relocations or professional transitions, occur during the application period.

Letter Template For Physician'S Loan Application Update Samples

Letter template of physician's loan application request for additional information

Comments