Are you navigating the world of non-profit funding? Understanding the nuances of loan applications can be a game-changer for your organization. In this article, we'll break down essential tips and provide a clear letter template to craft your response effectively. So, let's dive in and set the stage for your financial successâread on to discover more!

Applicant Information

The Applicant Information section of a non-profit loan application encompasses key details pertinent to the organization seeking financial assistance. This includes the official name of the non-profit organization, typically reflecting its mission or purpose, such as "Community Health Initiative." Address information (including the street address, city, state, and zip code) provides a physical location for correspondence and verification. The Federal Employer Identification Number (EIN), a unique number assigned by the IRS, helps in identifying tax-exempt status. Contact details should include the primary contact person's name (preferably the Executive Director or Finance Officer), their title, phone number, and email address, ensuring effective communication regarding the application process. Additional information, such as the organization's website and a brief description of its mission and programs, further contextualizes its impact and community role, essential for the evaluation of the loan request.

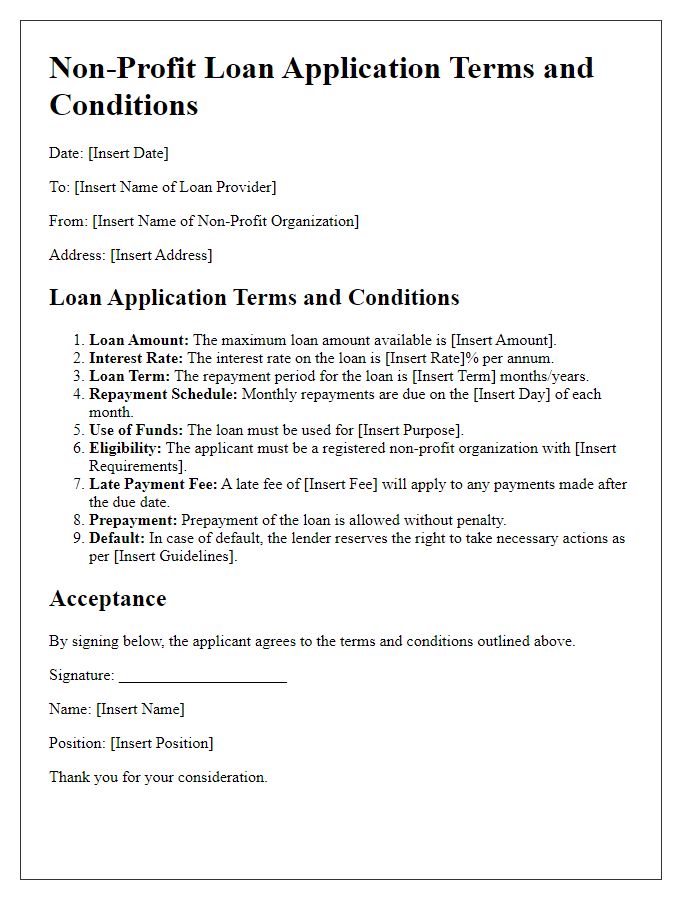

Loan Request Details

The loan request details include critical information about the funding needs for the non-profit organization, including the specific amount requested, which is often in the range of thousands to millions of dollars, depending on the project's scale. The intended purpose of the loan, such as funding outreach programs or facility upgrades, plays a significant role in detailing how the funds will impact community services. Additionally, the application should present a clear repayment plan, often structured over several years, outlining the expected revenue streams or fundraising efforts that will ensure timely loan repayment. Key supporting documents, such as financial statements or project proposals, help strengthen the credibility of the request, providing insight into past performance and future projections.

Evaluation Criteria

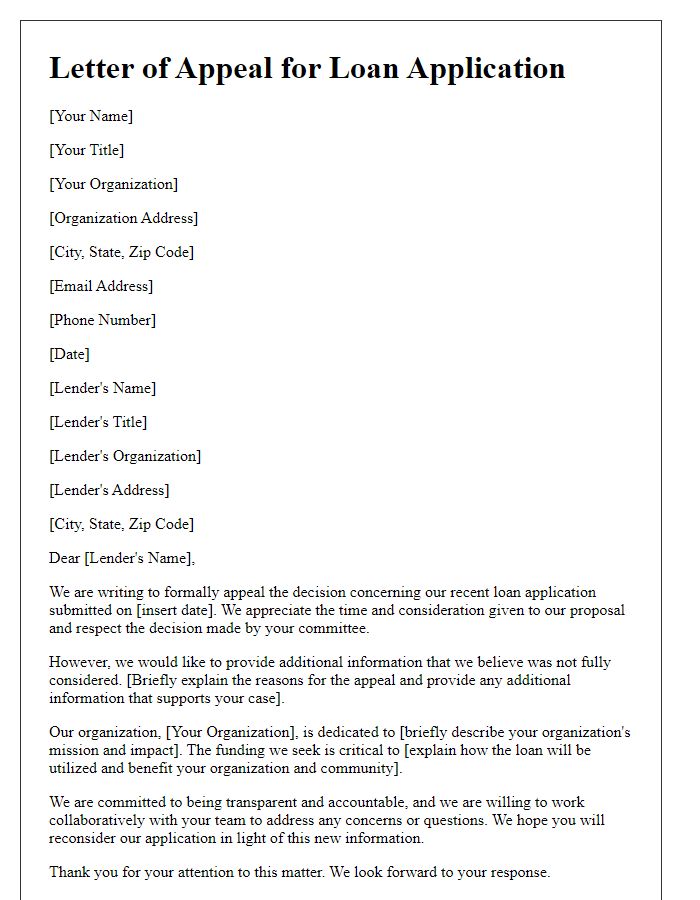

Non-profit organizations often seek funding through loans to support their community projects. The evaluation criteria for a non-profit loan application typically include a thorough review of financial stability, community impact projections, capacity for repayment, and adherence to the organization's mission. Financial stability involves assessing the organization's balance sheet, income statements, and cash flow forecasts, with emphasis on sustainability and growth potential. Community impact projections evaluate the projected benefits of the proposed project, including the number of beneficiaries and anticipated outcomes. The capacity for repayment focuses on the organization's revenue sources, funding diversity, and overall fiscal responsibility. Additionally, alignment with the organization's mission ensures that the project furthers the goals of the non-profit and addresses community needs effectively. Robust applications demonstrate not only a sound financial plan but also a strategic vision for positive community change.

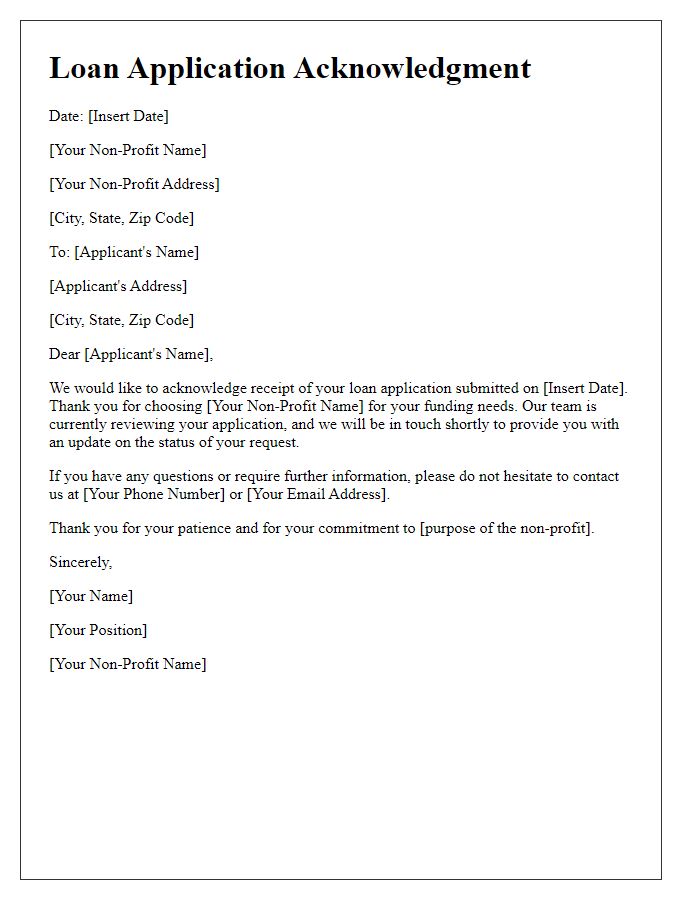

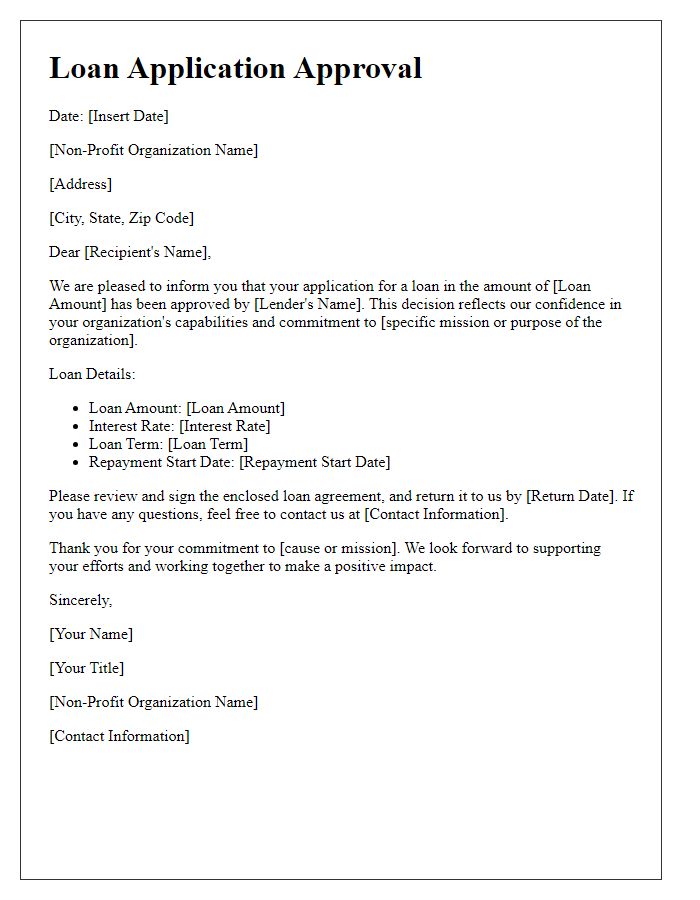

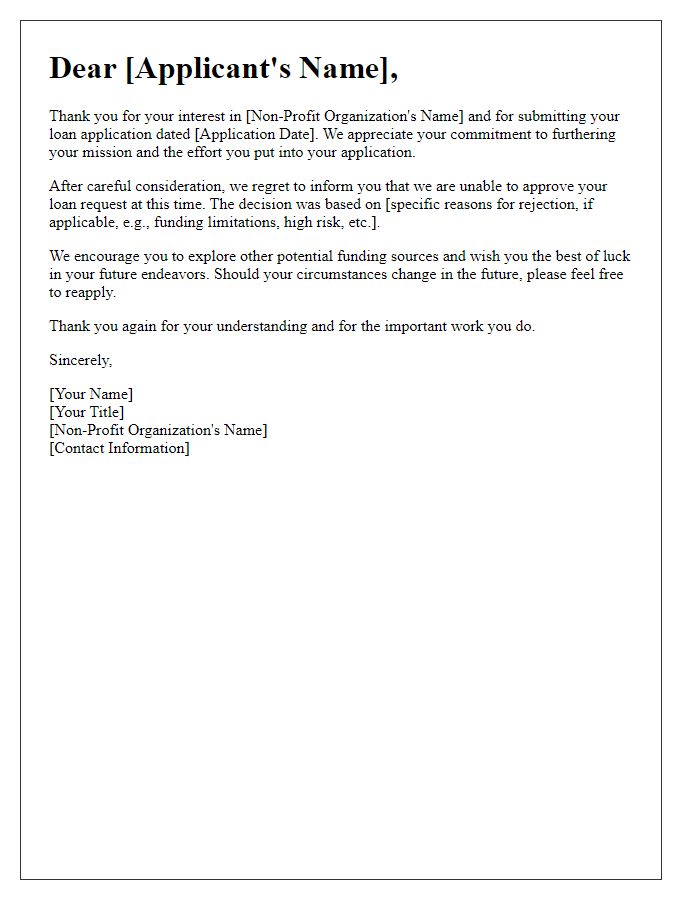

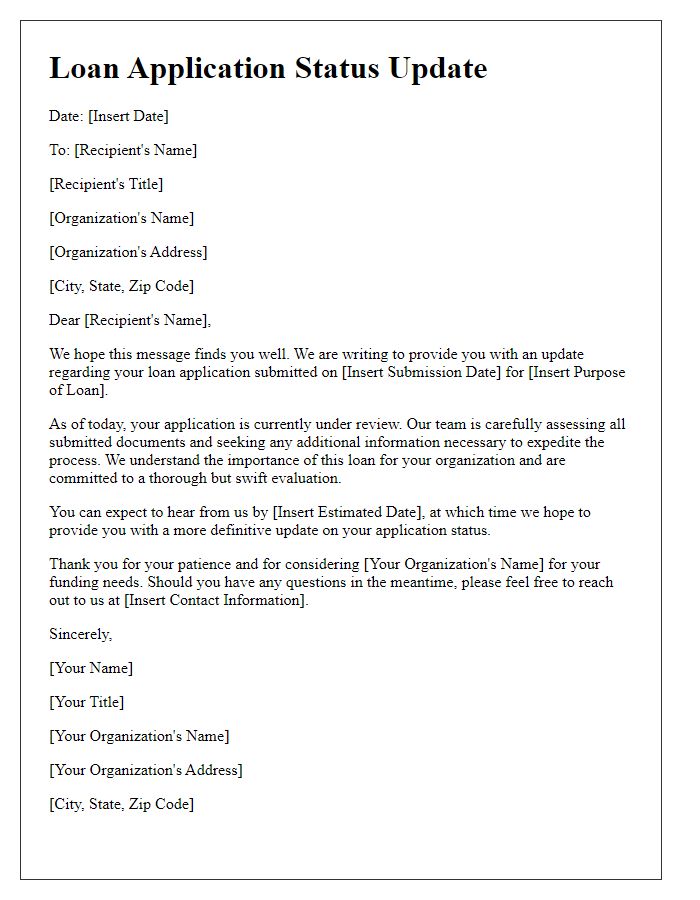

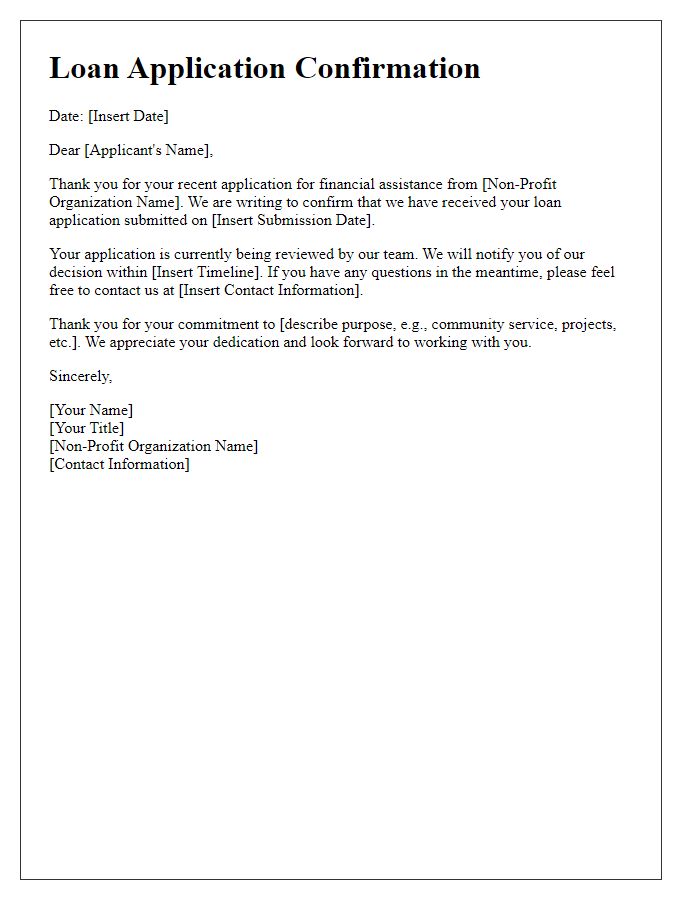

Approval Status

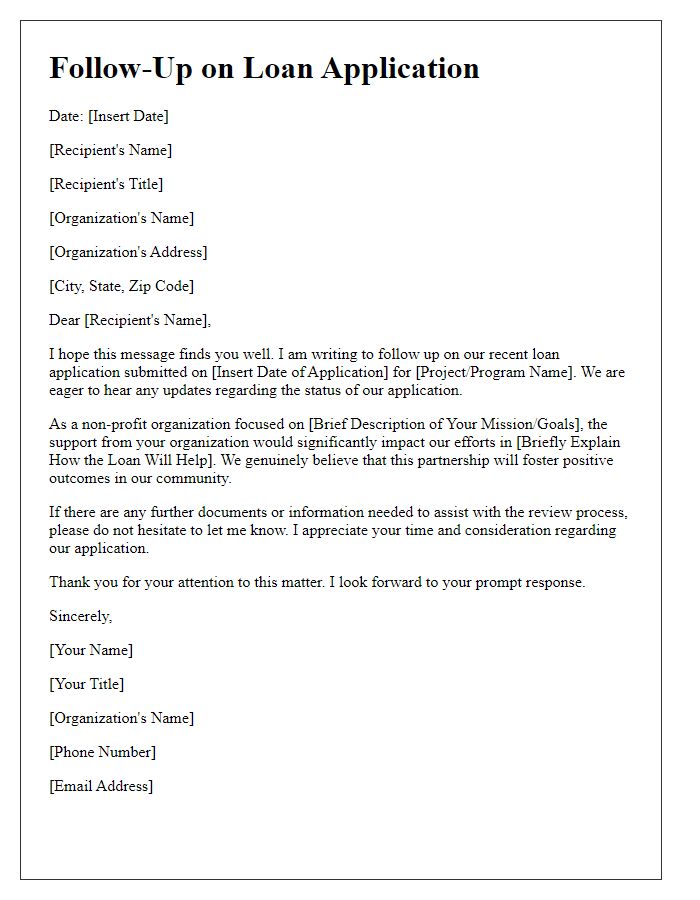

Non-profit organizations seeking loan approval for community projects often await critical updates regarding their application status. The loan approval notification indicates crucial financial support for initiatives aimed at improving local services or facilities. Successful applicants may receive confirmation via official correspondence, detailing the approved loan amount, repayment terms, and any specific conditions associated with the funding. This information plays a vital role in project planning and execution, assisting non-profits in budgeting and allocating resources effectively. Furthermore, the approval represents a significant endorsement of the organization's mission, reinforcing community trust and stakeholder engagement in areas such as education, housing, and healthcare.

Contact Information

The contact information section of a non-profit loan application response is crucial for establishing clear communication with the lending organization. Essential details include the non-profit's full legal name, such as "Green Future Initiative," which serves as the organization's official identifier. The physical address should specify the registered location, such as "123 Eco Lane, Springfield, IL 62704," ensuring clarity for any correspondence. The primary contact person's name, such as "Jane Doe," is vital, along with her job title, for example, "Executive Director," which highlights the individual responsible for managing the loan. Providing a direct phone number, for instance, "(555) 123-4567," and an email address like "jane.doe@greenfuture.org" facilitates prompt communication and follow-up questions from the lender.

Letter Template For Non-Profit Loan Application Response Samples

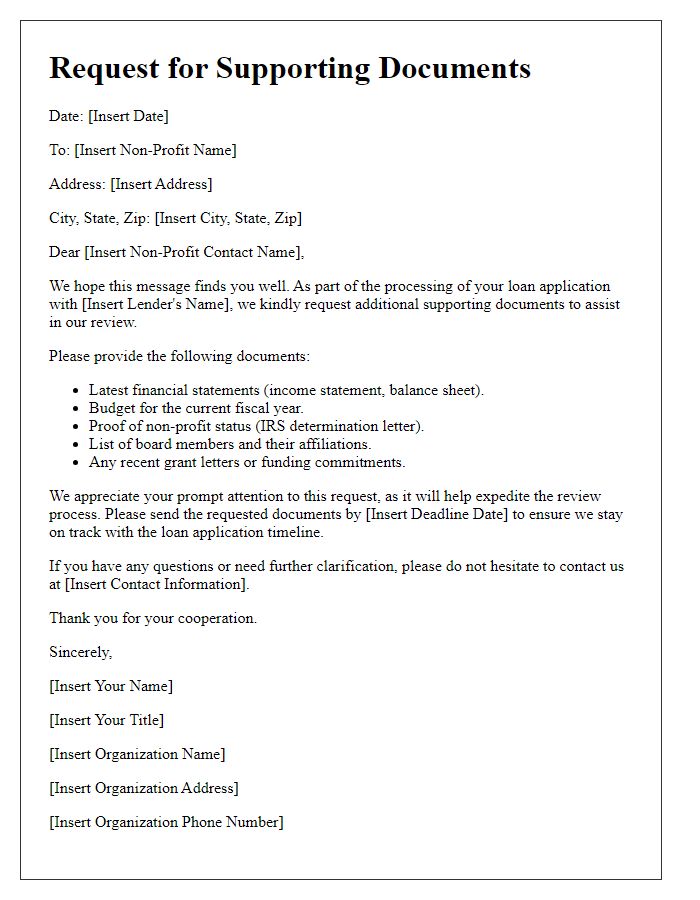

Letter template of non-profit loan application supporting documents request

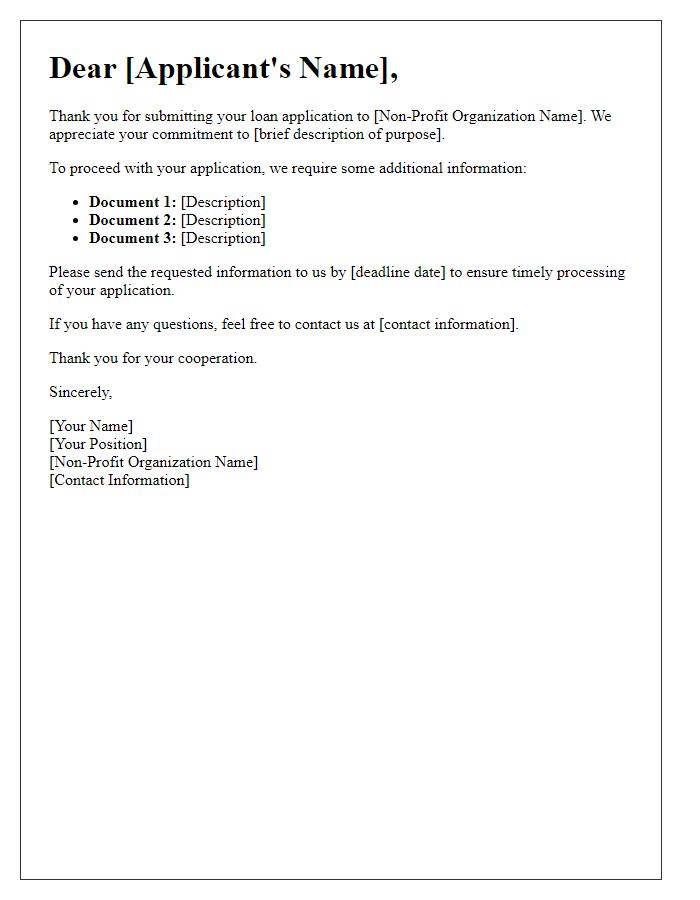

Letter template of non-profit loan application additional information request

Comments