When it comes to applying for a loan, the anticipation can be both exciting and nerve-racking. Unfortunately, not all applications end in approval, and communicating a loan rejection can be a delicate matter. It's important to convey the decision with empathy while providing clear reasons, ensuring that the applicant understands their options moving forward. If you're looking for a well-crafted letter template to help with this sensitive communication, read on for our helpful guide!

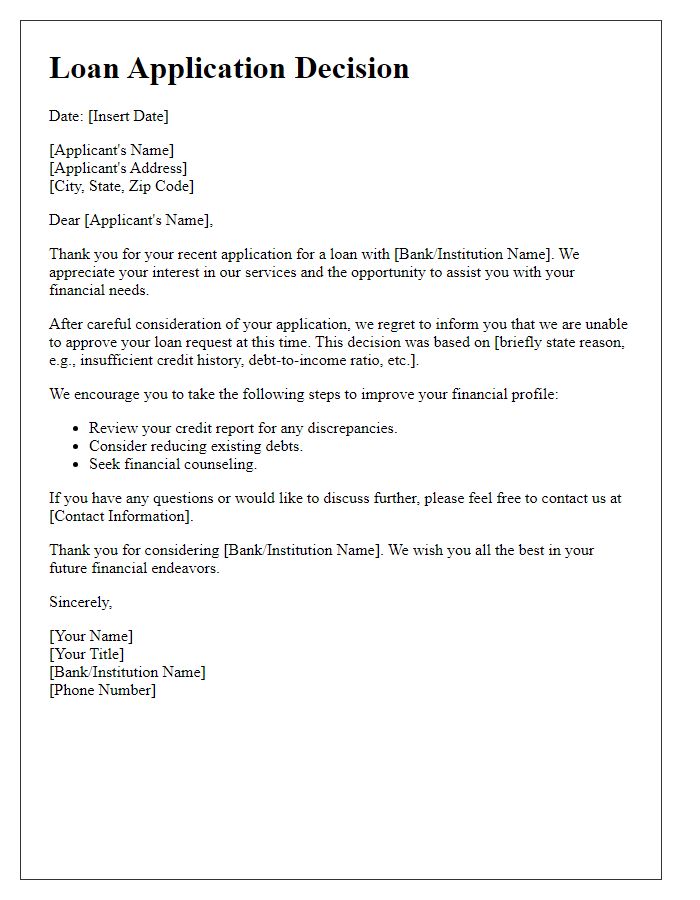

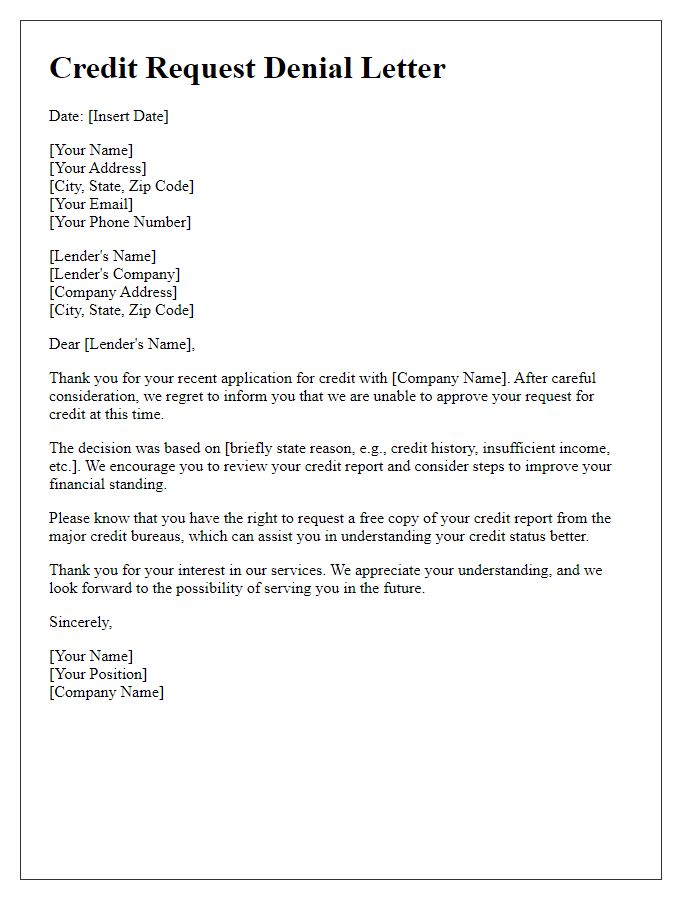

Clear Subject Line

Loan applications undergo a thorough evaluation process, and several criteria impact the final decision. Insufficient credit score ranges (typically below 620 for conventional loans) often lead to rejections. Debt-to-income ratios exceeding the recommended 43% can also hinder approval chances. In addition, inconsistent employment history (such as frequent job changes within the last two years) raises red flags for lenders. Lastly, inadequate documentation (missing tax returns or bank statements) can impede the verification of financial stability, resulting in unfavorable outcomes for prospective borrowers.

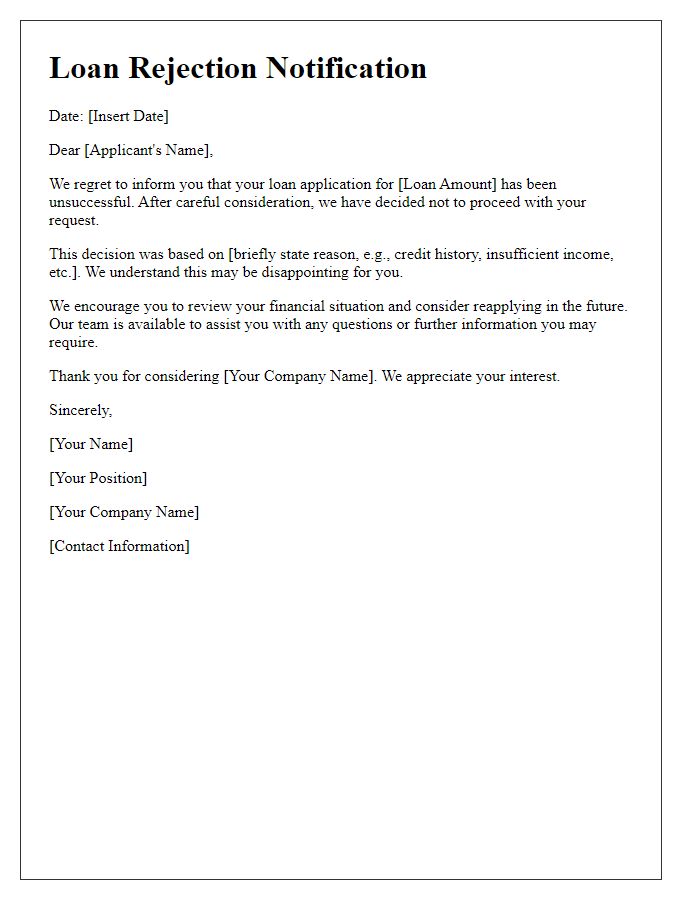

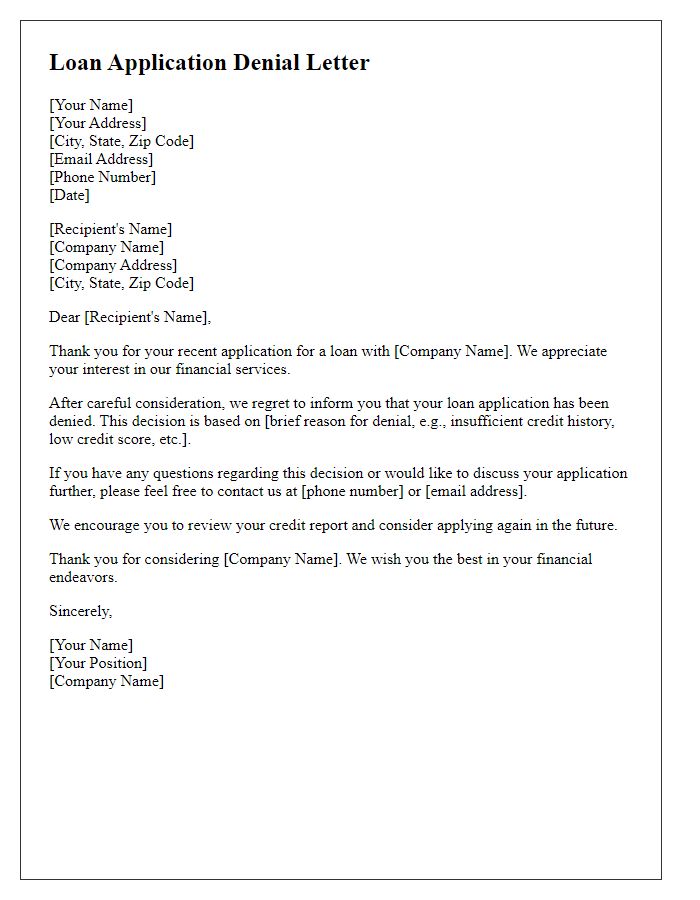

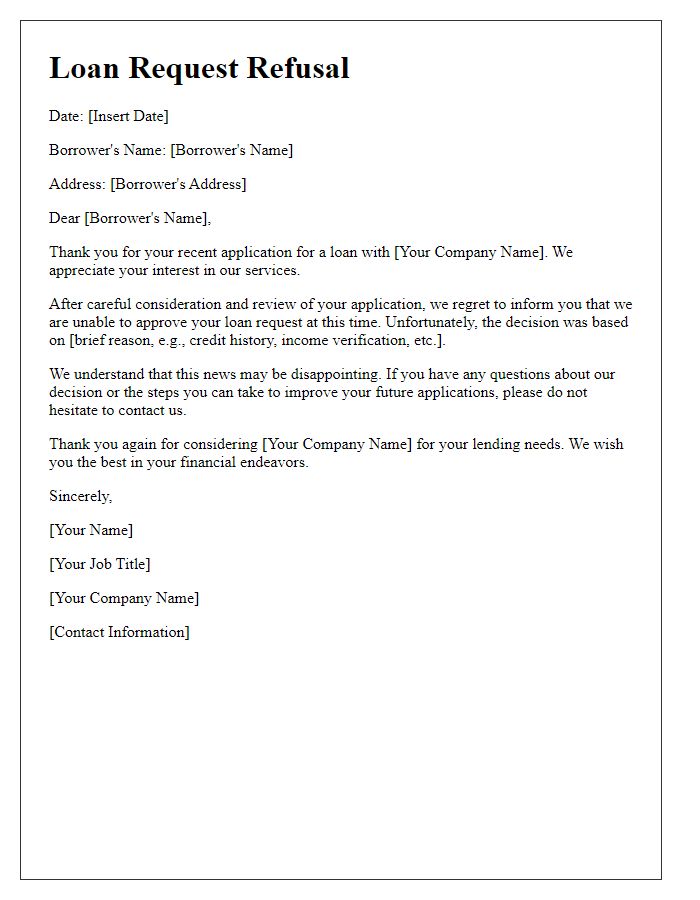

Personalized Greeting

Loan rejection communications should maintain a professional tone while also conveying empathy. A personalized greeting can set the right tone for such a message. Begin with the recipient's name, ensuring you spell it correctly, to establish a connection. Incorporate a phrase that acknowledges their effort and time spent on the loan application process. This can help soften the impact of the rejection and show that their situation was considered thoughtfully. For example: "Dear [Recipient's Name], thank you for taking the time to submit your loan application and for considering [Company Name] as your financial partner.

Reason for Rejection

Loan applications often face rejection due to several factors, including credit score. A credit score below 620, often classified as subprime, can indicate higher risk to lenders like banks or credit unions. Additionally, high debt-to-income ratio, typically above 40%, suggests borrowers may struggle to manage debt obligations. Employment stability is crucial; frequent job changes within a year may raise red flags. Insufficient income documentation can weaken an application, especially when lenders require proof of consistent earnings. Furthermore, lack of collateral might limit options for secured loans, resulting in denial for unsecured loan applications.

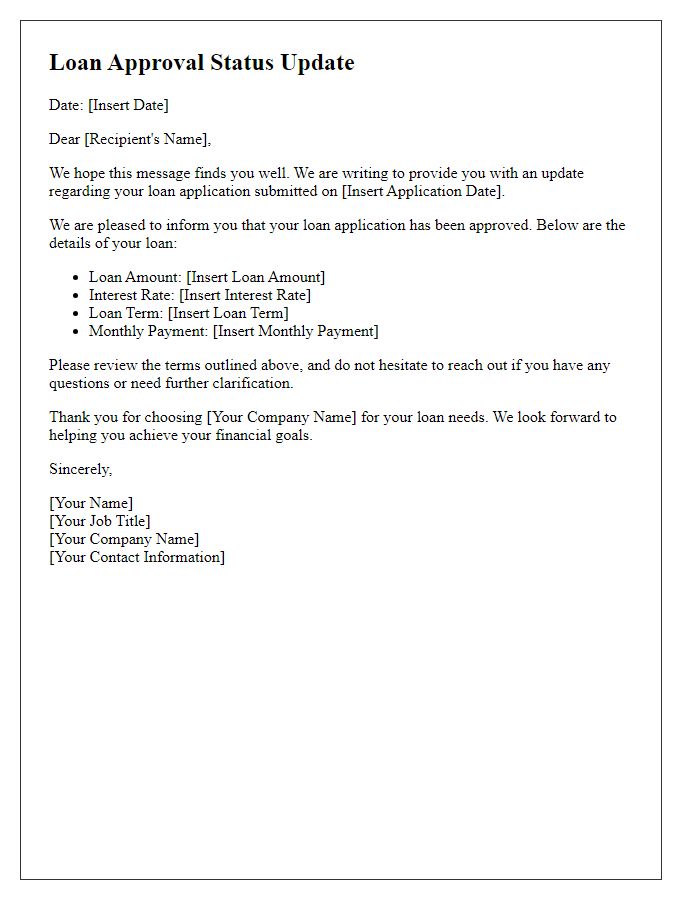

Encouragement to Reapply or Alternative Options

Loan rejection letters often convey disappointment and discourage applicants. However, a well-crafted letter can motivate individuals to explore other options or reapply in the future. Providing encouragement and outlining alternative solutions is essential for maintaining a positive relationship with potential borrowers. Notable factors to include are clear reasons for rejection, potential improvement areas, and insights into alternative financing programs like secured loans or government assistance. Additionally, framing the rejection as a stepping stone toward future acceptance creates a nurturing atmosphere that fosters resilience and continued engagement with financial institutions.

Contact Information for Further Assistance

Loan applications can be rejected for various reasons, including insufficient credit history, high debt-to-income ratio, or missing documentation. For instance, a credit score below 620 may lead to rejection in many traditional financial institutions, such as banks and credit unions. The financial institution may provide a communication pathway, like a dedicated customer service number or email, allowing applicants to seek clarification. Additionally, offering resources for improving financial health, such as credit counseling services and budget planning workshops, can help rejected applicants understand their options. This proactive approach fosters transparency and encourages potential borrowers to reapply in the future when their financial situation improves.

Comments