Are you currently navigating the complex world of mortgage loan applications? It can often feel overwhelming, but with the right information and a clear plan, you can make the process much smoother. In this article, we'll provide you with an easy-to-follow letter template to update your mortgage loan application, ensuring that you can communicate effectively with your lender. So, let's dive in and simplify your journey towards securing that dream home!

Application Reference Number

Mortgage loan applications undergo thorough evaluations, enabling potential homeowners to secure financing for properties. Application Reference Numbers serve as unique identifiers for each request, facilitating streamlined communication between applicants and lending institutions. Regular updates are often provided by mortgage lenders, ensuring applicants stay informed about their loan status. These updates may include information regarding underwriting processes, required documentation, and estimated timelines for approval. Clear, concise notifications help applicants manage expectations while making necessary preparations for home purchases, which can range from first-time buyers to seasoned investors navigating intricate financing options.

Updated Income and Financial Information

The updated income and financial information plays a crucial role in the mortgage loan application process. This encompasses details such as total annual income (including salaries and any additional sources like bonuses or investments), which must be accurately reported to reflect financial stability. Current employment status, along with the recent pay stubs from the last three months, highlights job security. Additionally, the updated details on outstanding debts, such as credit card balances and car loans, provide insight into the debt-to-income (DTI) ratio, a critical factor for lenders when assessing borrowing capacity. Recent bank statements showcasing savings can strengthen the application by demonstrating the applicant's ability to cover the down payment and closing costs, thereby enhancing overall creditworthiness.

Loan Number and Loan Amount

A mortgage loan application update is essential in ensuring transparent communication with lenders, specifically regarding the Loan Number, identifying the unique tracking code linked to the application, and the Loan Amount, representing the total sum requested for property financing. Accurate details are crucial, as discrepancies may delay processing times or affect approval outcomes. Loan Numbers generally consist of a combination of alphanumeric characters and are often assigned by the lender for organizational purposes, while Loan Amounts must align with property valuations to demonstrate creditworthiness and financial planning stability. Providing updated figures can facilitate timely adjustments in the underwriting process, critical for securing favorable interest rates or terms tailored to individual financial situations.

Recent Credit Score and Credit Report

A recent credit score plays a crucial role in the mortgage loan application process, impacting interest rates and approval likelihood. For example, a score above 740 is often classified as excellent, leading to favorable lending terms. Updated credit reports, containing detailed information about financial behavior, are typically obtained from major credit bureaus such as Experian, TransUnion, and Equifax. These reports encompass critical data, including payment history, credit utilization ratios (below 30% is generally preferred), and types of credit accounts held. Lenders analyze this information to assess the borrower's creditworthiness, making it essential to provide accurate, up-to-date documents during the application update process.

Property Address and Appraisal Status

The mortgage loan application update regarding the property located at 1234 Maple Street, Springfield involves essential information about its appraisal status. The property, a two-story, four-bedroom single-family home, underwent an appraisal on August 15, 2023. The appraiser, John Smith, a certified professional with over 15 years of experience, determined the current market value to be $350,000. This valuation reflects recent sales of comparable properties in the Springfield area, which have shown a growth rate of approximately 5% over the past year. The appraisal report indicated no significant repairs needed, ensuring the property meets lender requirements for financing. Regular updates from the mortgage processing team will ensure that all parties remain informed as the loan approval process progresses.

Letter Template For Mortgage Loan Application Update Samples

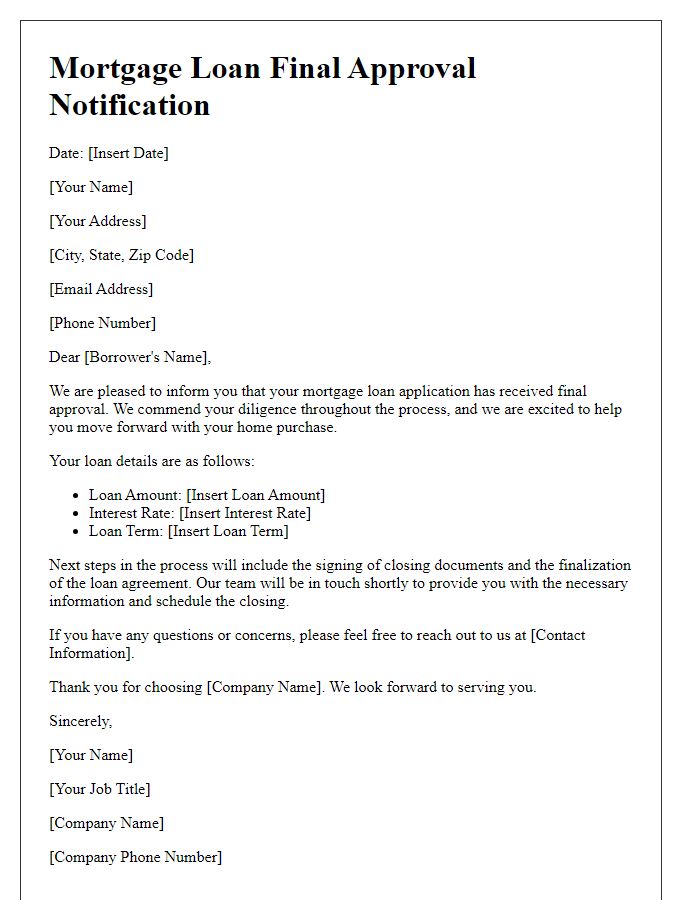

Letter template of mortgage loan application final approval notification

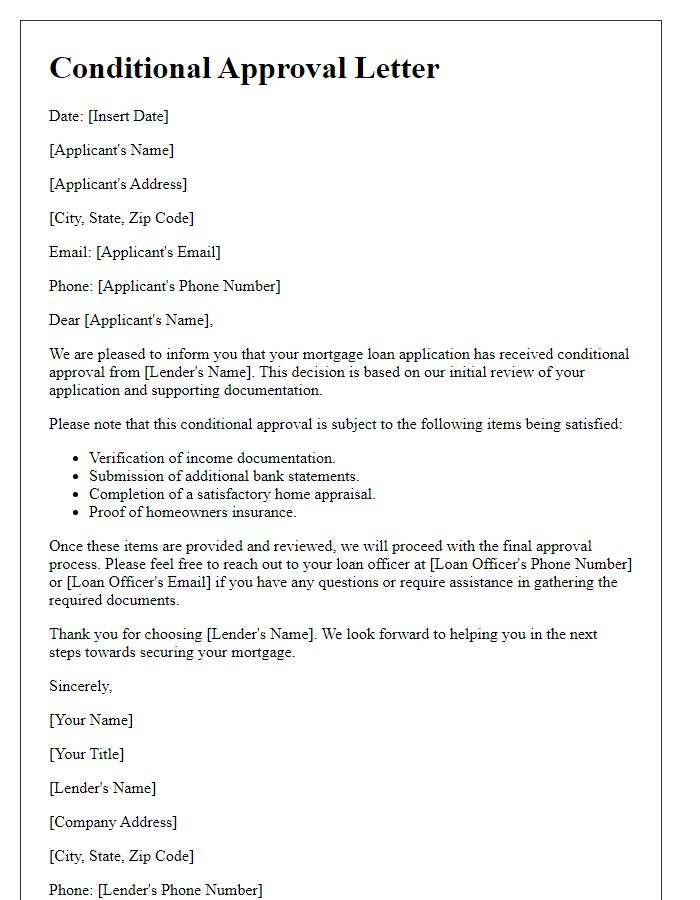

Letter template of mortgage loan application conditional approval letter

Comments