Are you navigating the intricate world of fixed repayment loans? Whether you're aiming to finance a new venture or consolidate existing debts, understanding the nuances of fixed repayment options can be a game-changer for your financial strategy. These loans provide predictable monthly payments, making budgeting a breeze and helping you avoid unexpected financial surprises. Curious to dive deeper into the benefits and best practices? Keep reading to discover how fixed repayment loans can work for you!

Personalization and Customer Details

Fixed repayment loans provide stable financial options for borrowers, allowing for predictable monthly payments over the loan term. Common loan types include personal loans, auto loans, and mortgage loans, with typical terms ranging from 1 to 30 years. Interest rates can vary based on credit scores, often between 3% to 7% for qualified borrowers. Lenders such as banks and credit unions may require a credit check and income verification. Fixed repayment loans help customers manage budgets and avoid unexpected financial strain, ensuring they can plan expenses accordingly. The repayment schedule often includes principal and interest payments, creating a structured path to loan completion.

Loan Amount and Term

Fixed repayment loans provide borrowers with a defined loan amount and a set term, ensuring predictable monthly payments. Typically, loan amounts can range from $1,000 to $50,000, depending on the lender's policies. Common terms last from 1 to 5 years, influencing the overall interest paid. Interest rates often vary based on factors like credit score and market conditions, usually falling between 5% and 15%. Repayment schedules are structured, enabling borrowers to budget effectively; payments cover both principal and interest, ultimately leading to complete loan payoff at term end, promoting financial stability and goal attainment.

Fixed Interest Rate and APR

Fixed repayment loans, such as personal loans or mortgages, offer borrowers stability through fixed interest rates, ensuring consistent monthly payments. Specifically, these loans typically feature an Annual Percentage Rate (APR) that reflects the true cost of borrowing, incorporating not only the interest rate but also any associated fees, which may range from 1% to 5% of the loan amount. Borrowers can benefit from predictability, knowing their payment obligations will remain unchanged throughout the loan term, which may vary from 5 to 30 years, depending on the loan type. This structure allows individuals to plan their finances effectively, mitigating the risk of fluctuating interest rates that can accompany variable-rate loans.

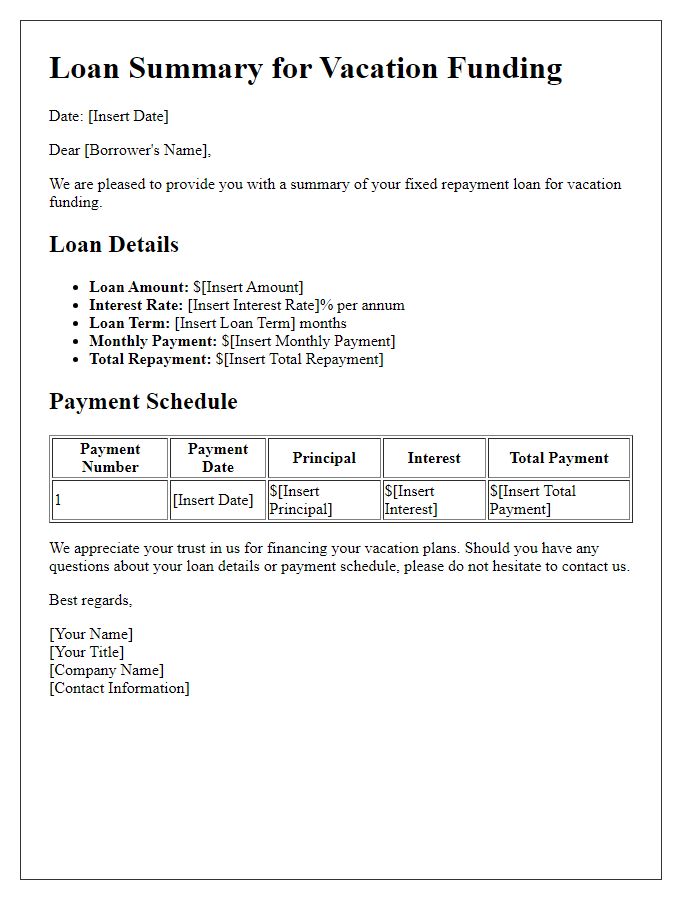

Repayment Schedule and Due Dates

Fixed repayment loan options provide borrowers with a clear understanding of their financial commitments. These loans, often used for purposes such as home purchases or education, feature a predetermined repayment schedule that outlines monthly due dates, typically ranging from 15 to 30 years. Borrowers can expect consistent payments, which remain unchanged throughout the loan term, simplifying budgeting processes. Due dates are strategically set, often aligning with the borrower's income schedule, such as the first of each month. This predictability allows individuals to prepare financially, ensuring they can meet obligations on time and avoid late fees or negative impacts on credit scores. Interest rates usually vary based on market conditions or lender policies, influencing overall loan costs.

Terms and Conditions

Fixed repayment loans offer borrowers consistent monthly payments over a set period, typically ranging from 2 to 10 years. These loans, often secured against assets like homes or vehicles, generally have fixed interest rates varying from 5% to 15%, depending on the borrower's creditworthiness and the lender's policies. Terms and conditions encompass key information, including repayment schedules, late payment penalties, and conditions for early repayment without incurring additional fees. Furthermore, borrowers must be aware of potential fees for loan origination, which can range from 1% to 3% of the loan amount, and insurance requirements that may be stipulated by lenders. Understanding these conditions is crucial for effective financial planning and avoiding unanticipated costs during the loan tenure.

Letter Template For Fixed Repayment Loan Options Samples

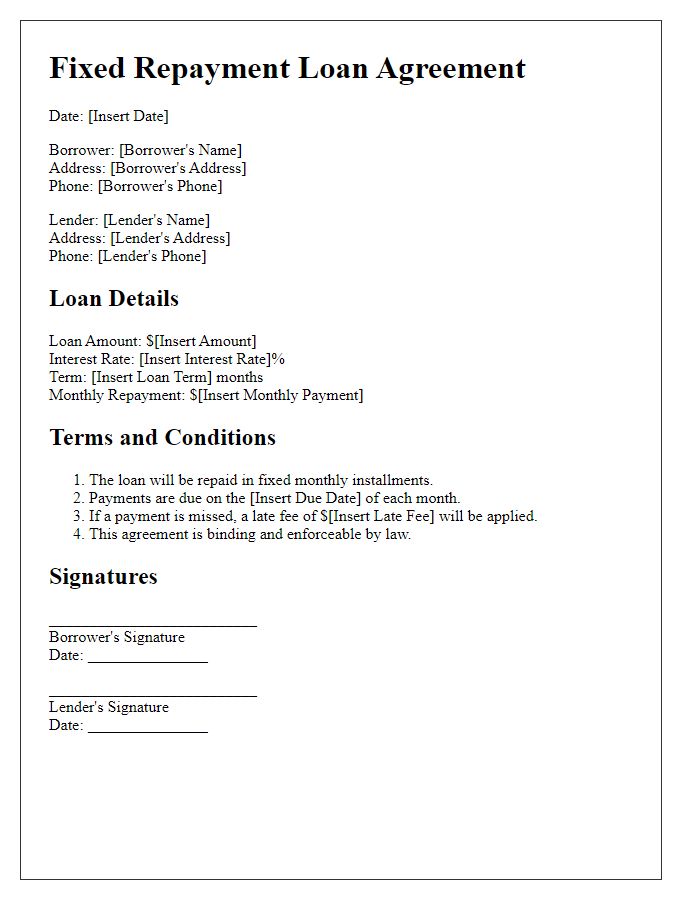

Letter template of fixed repayment loan agreement for personal financing.

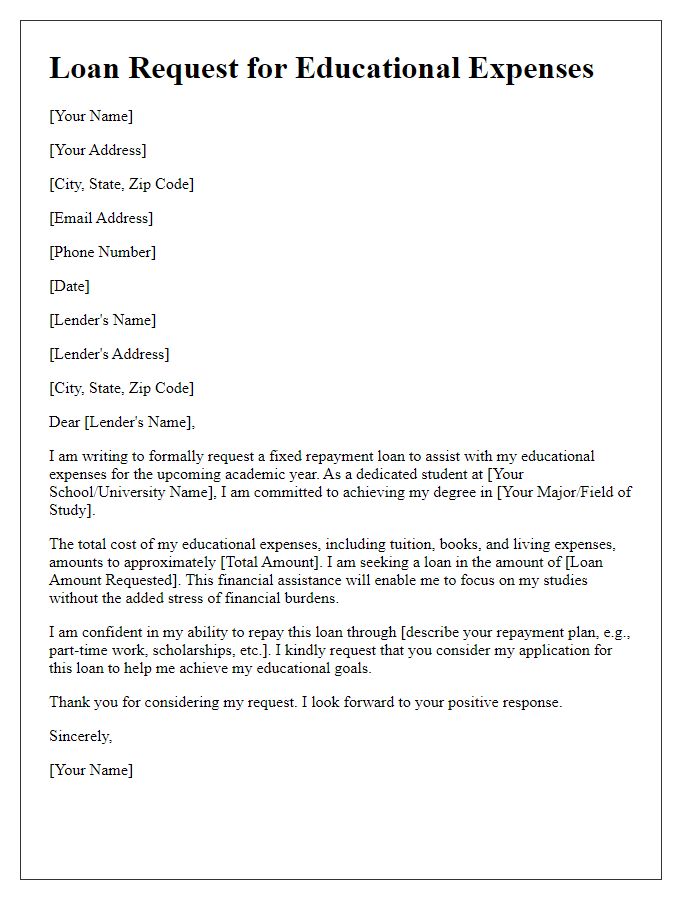

Letter template of fixed repayment loan request for educational expenses.

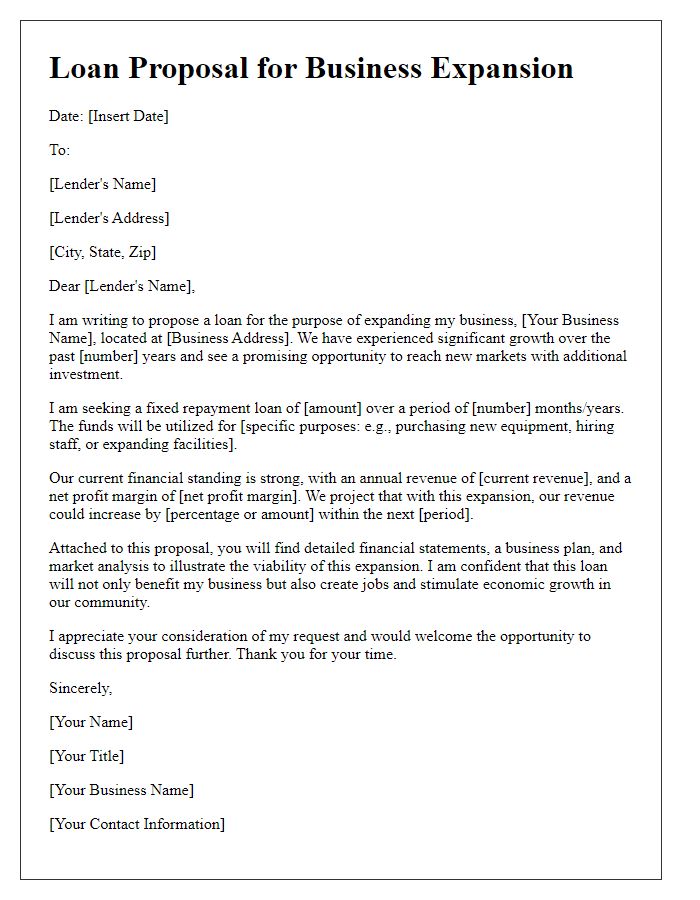

Letter template of fixed repayment loan proposal for business expansion.

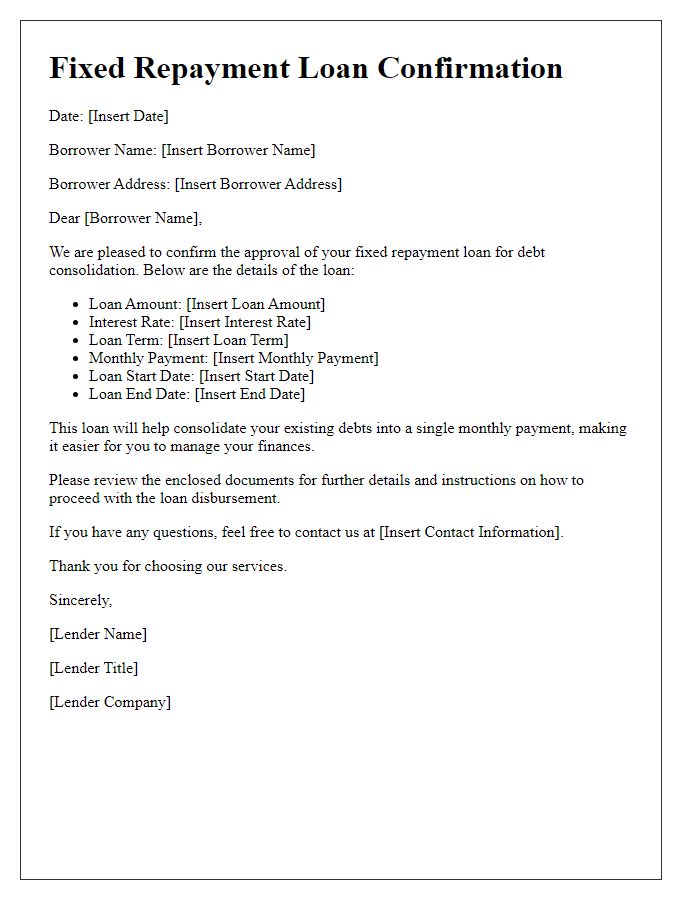

Letter template of fixed repayment loan confirmation for debt consolidation.

Letter template of fixed repayment loan application for medical expenses.

Comments