Are you considering an expatriate loan program but feeling a bit overwhelmed by the details? You're not aloneânavigating financial options while living abroad can be challenging, but it doesn't have to be! In this article, we'll break down everything you need to know about expatriate loan programs, from eligibility requirements to application processes. So, grab a cup of coffee and let's dive inâread on to discover the key insights that could help you make the most of your international experience!

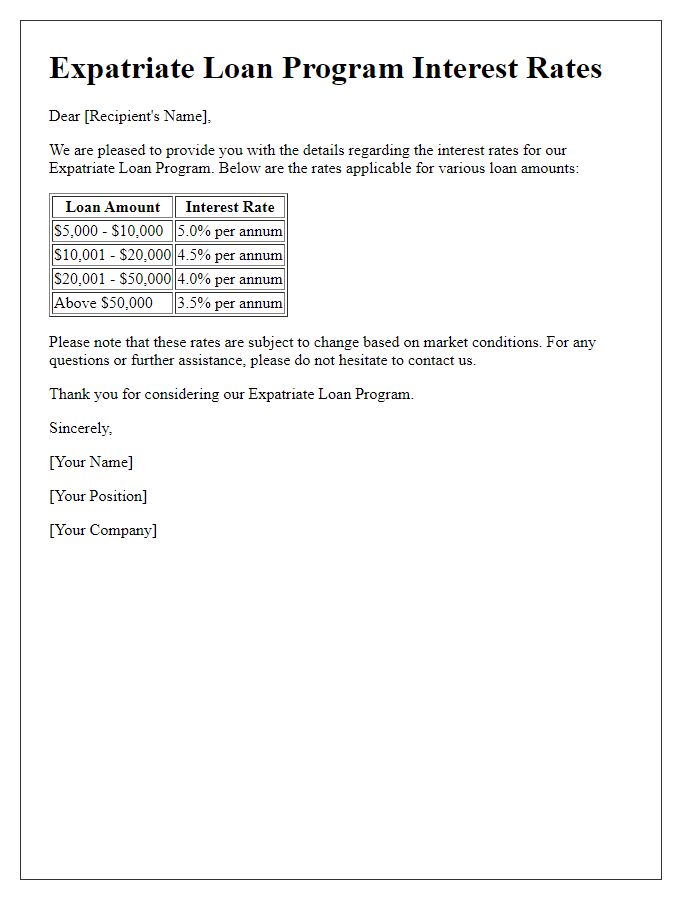

Loan Interest Rate

The expatriate loan program typically offers competitive loan interest rates designed to accommodate international borrowers. Interest rates can vary significantly based on factors like credit history, income, and the specific financial institution. For instance, the average interest rate for expatriate loans may range from 3% to 7% annually, depending on the lender's policy and current market conditions. Additionally, some institutions may provide fixed rates, providing stability in monthly payments, while others may offer variable rates that adjust with market fluctuations. Noteworthy financial institutions, such as HSBC and Citibank, often cater specifically to expatriates, ensuring tailored services and favorable terms. Understanding these rates is crucial for expatriates seeking financial support while living abroad.

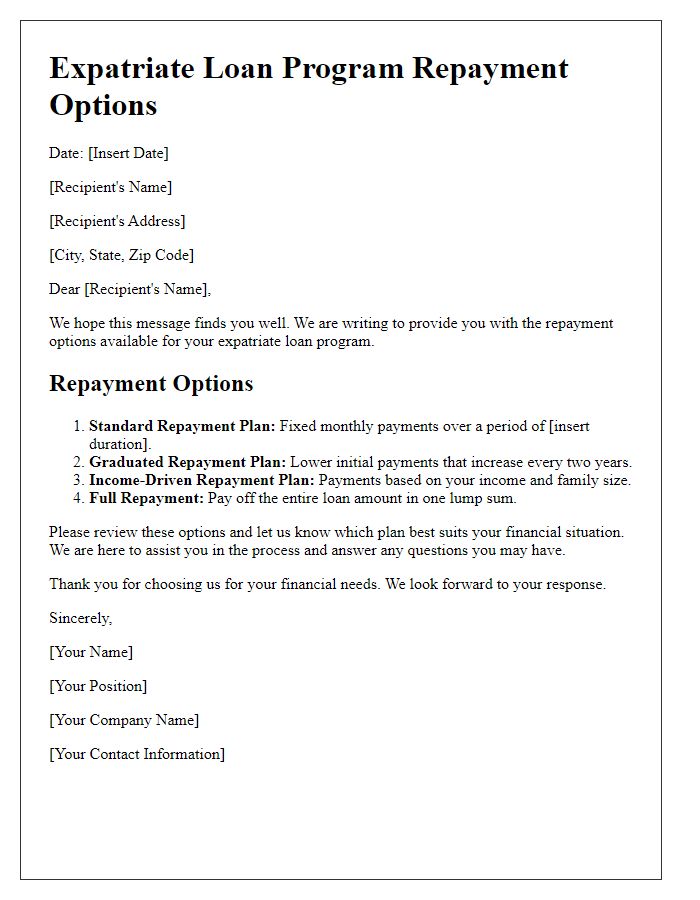

Repayment Terms

Expatriate loan programs typically include various aspects, such as repayment terms. Standard repayment durations can range from 12 to 60 months, depending on the loan amount and the lender's policies. Monthly installments (payment due each month) usually feature fixed interest rates that can vary from 4% to 10% based on factors like credit history and market conditions. Some lenders may provide early repayment options or penalties for paying off the loan ahead of the schedule. Borrowers often need to maintain a minimum balance in their accounts or provide proof of employment overseas to qualify for favorable terms. Currency fluctuations may also impact the repayments if the loan is denominated in a different currency than the borrower's income. Understanding the full scope of terms can help expatriates manage their finances effectively while living abroad.

Eligibility Criteria

Expatriate loan programs commonly require specific eligibility criteria for applicants. Typically, a minimum annual income threshold of $50,000 is necessary, ensuring financial stability for loan repayment. Applicants must possess valid employment contracts from recognized multinational companies, preferably issued in major financial hubs such as New York, London, or Dubai. Additionally, a satisfactory credit score, often above 700, is essential to demonstrate a responsible credit history. Residence status, which should be verified through work visas or resident permits, plays a crucial role in approval processes. Documentation such as bank statements from the last six months, proof of identity (passport), and employment verification letters contribute to a complete application package, ensuring transparency and eligibility evaluation.

Currency Options

The expatriate loan program offers various currency options tailored to the needs of international borrowers. These options include major currencies such as US Dollar (USD), Euro (EUR), and British Pound (GBP) to facilitate seamless transactions across borders. The program aims to accommodate expatriates working in diverse global locations, enabling them to access loans without the burden of currency exchange risks. Additionally, competitive interest rates linked to the chosen currency further enhance affordability and financial convenience. Expatriates can select their preferred currency, ensuring their loan aligns with their income source and financial commitments in their respective host countries. Key entities include multinational corporations (MNCs) and financial institutions providing these tailored services, which facilitate the financial integration of expatriates in local markets while maintaining international financial standards.

Application Process

The expatriate loan program offers international professionals financial assistance tailored for relocation or investment needs. The application process begins with gathering required documents, including proof of income, employment verification, and passport identification. Applicants must submit an online form through the lending institution's official website, carefully providing personal details and financial information. After submission, a credit assessment conducted by the financial institution reviews the applicant's creditworthiness based on criteria such as credit history and income stability. Successful applications typically receive an approval notification within 5 to 10 business days. Following approval, the borrower will need to review and sign the loan agreement, which includes repayment terms and interest rates specific to expatriates. Lastly, funds are disbursed directly to the bank account specified in the application, streamlining access for immediate use.

Comments