Are you a small business owner looking to expand your operations or invest in new equipment? Securing the right loan can be a game-changer, providing you with the capital needed to take your business to the next level. In this article, we'll explore a sample letter template that can simplify your loan application process and help you present your case effectively. Ready to dive in and learn how to craft the perfect loan offer letter?

Clear and concise subject line

Small business loans offer crucial financial support for startups and established enterprises. Lenders, such as banks and credit unions, typically offer amounts ranging from $5,000 to over $2 million, catering to diverse business needs. Terms can vary significantly, with repayment periods extending from 1 to 10 years, depending on the loan type. Eligibility often requires demonstrating a viable business plan and a credit score above 650, which can influence interest rates and approval timelines. Small businesses can utilize these loans for various purposes, including inventory purchases, equipment financing, and operational expenses, ultimately fostering growth and stability within the community.

Personalization with recipient's name and business details

A small business loan offer can greatly enhance growth opportunities for entrepreneurs in various sectors. Financial institutions often provide funding options tailored to specific needs, such as working capital, equipment purchase, or expansion. Businesses may receive offers ranging from $10,000 to $500,000, depending on creditworthiness and years of operation. For example, a cafe owner in San Francisco (known for its vibrant food scene) may seek funding to renovate their space or upgrade equipment. Timely access to funds can lead to increased revenue, improved services, and enhanced customer experience. Additionally, the loan terms often vary, with options for fixed or variable interest rates and repayment periods up to 10 years, allowing for flexible financial planning.

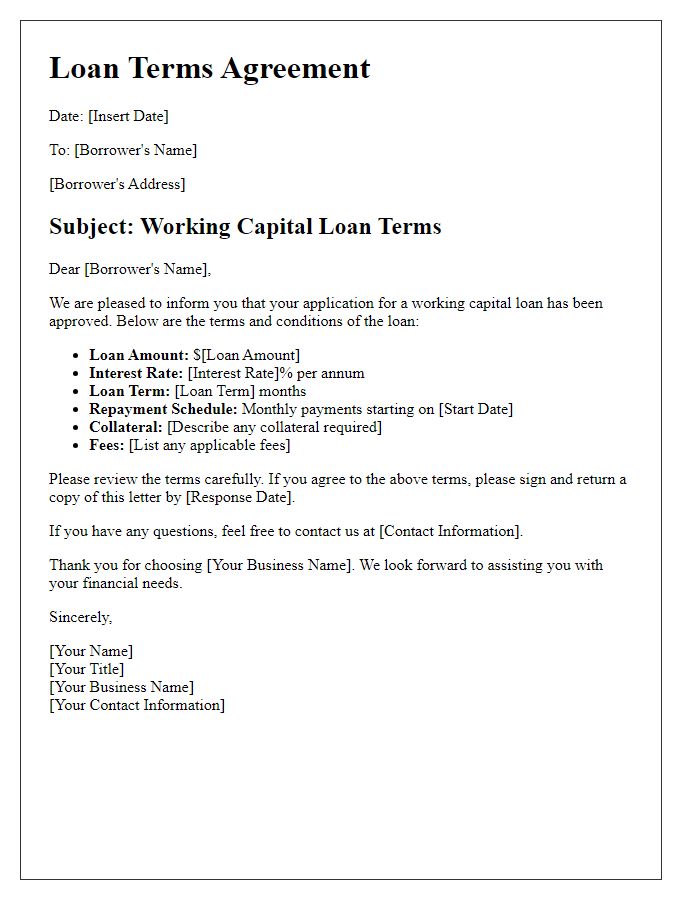

Detailed loan offer terms and conditions

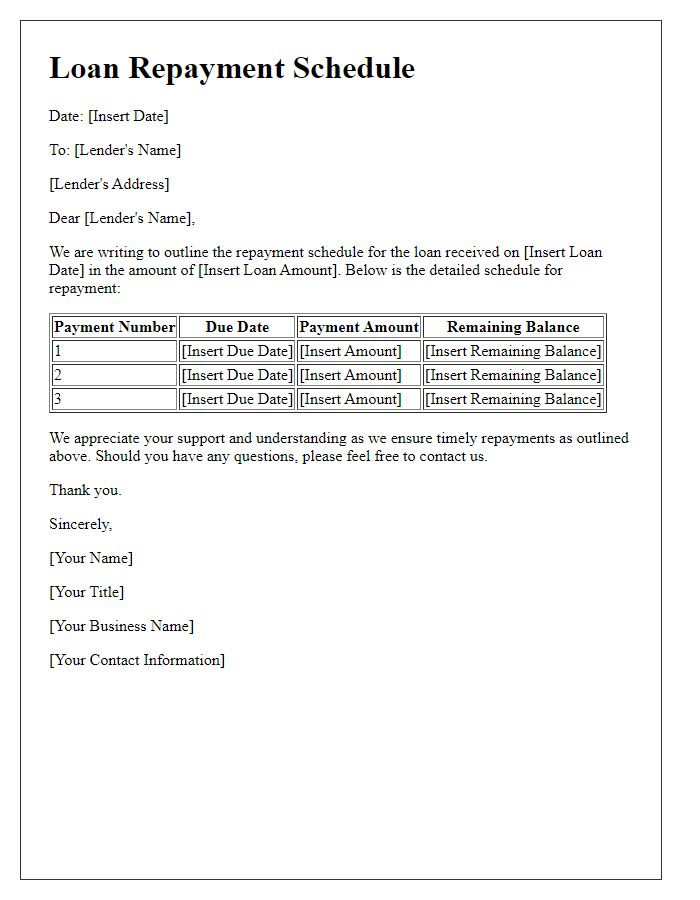

A small business loan offer outlines essential financial terms and conditions designed to support entrepreneurs in expanding their operations. The principal amount, often ranging from $5,000 to $500,000, depends on the business's financial standing and purpose, such as equipment purchase or working capital. Interest rates typically vary between 6% to 30%, influenced by the creditworthiness of the borrower and market conditions. Loan terms generally span from 1 to 7 years, with monthly repayment schedules that require careful cash flow management. Borrowers may need to provide personal guarantees or collateral, including real estate or business assets, to mitigate lender risk. Additionally, fees such as origination fees (generally 1% to 5% of the loan amount) and prepayment penalties may apply, impacting overall loan costs. Transparency in these terms ensures business owners make informed decisions to facilitate growth and sustainability.

Benefits and advantages of the loan

Accessing a small business loan can significantly enhance operational flexibility and financial growth opportunities for entrepreneurs. Immediate capital injection allows for crucial investments in inventory (essential for retail operations), equipment upgrades (important for manufacturing efficiency), or marketing initiatives (vital for brand visibility). Low-interest rates (often ranging from 3% to 7% depending on creditworthiness) can reduce the overall cost of borrowing, enabling better cash flow management. Additionally, repayment terms can be customized (ranging from one year to ten years), providing businesses with the ability to align repayment schedules with revenue cycles. A small business loan can also boost creditworthiness, establishing a solid financial reputation that attracts future investors and partners. Such loans often support job creation, which positively impacts the local economy and community.

Call to action with contact information

A compelling small business loan offer can greatly enhance financial opportunities. Businesses often seek loans ranging from $10,000 to $500,000 to support various needs, including capital for expansion, inventory purchase, or operational expenses. Timely and effective funding is crucial in a competitive market like the United States, where over 30 million small businesses operate. Interested entrepreneurs should reach out promptly to explore financing options tailored to unique business goals. Contact us at (555) 123-4567 or email info@smallbusinessloan.com to take the next step toward achieving your business aspirations.

Comments