Are you a senior executive considering a loan to fuel your next big move? Understanding the nuances of executive loans can be a game-changer in achieving your financial goals. Whether it's for personal investment or business expansion, tailoring your loan strategy to your unique position can maximize your benefits. Join me as we explore some key insights and tips to navigate this process effectively!

Professional Tone

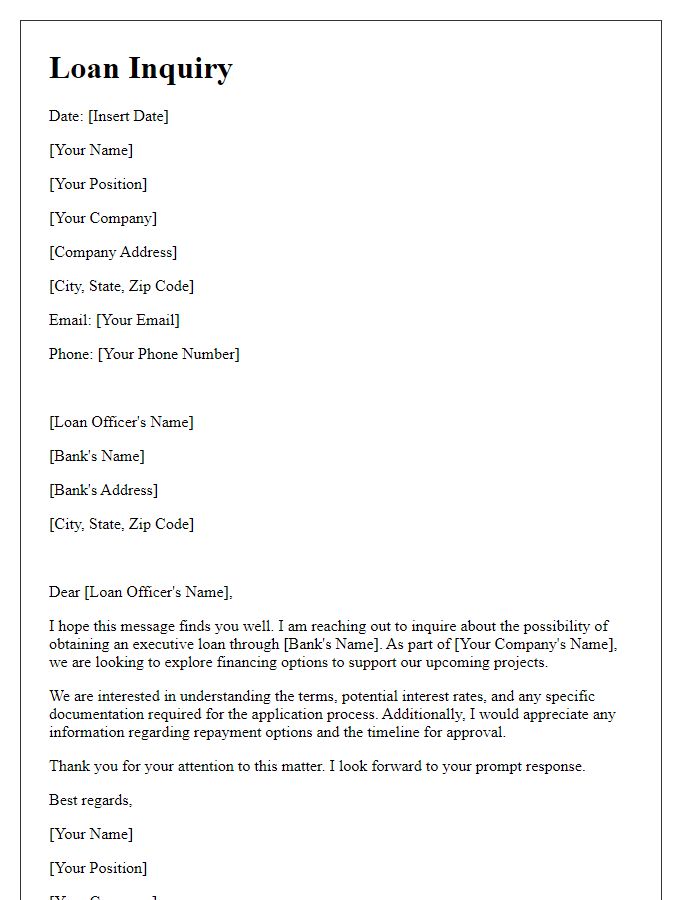

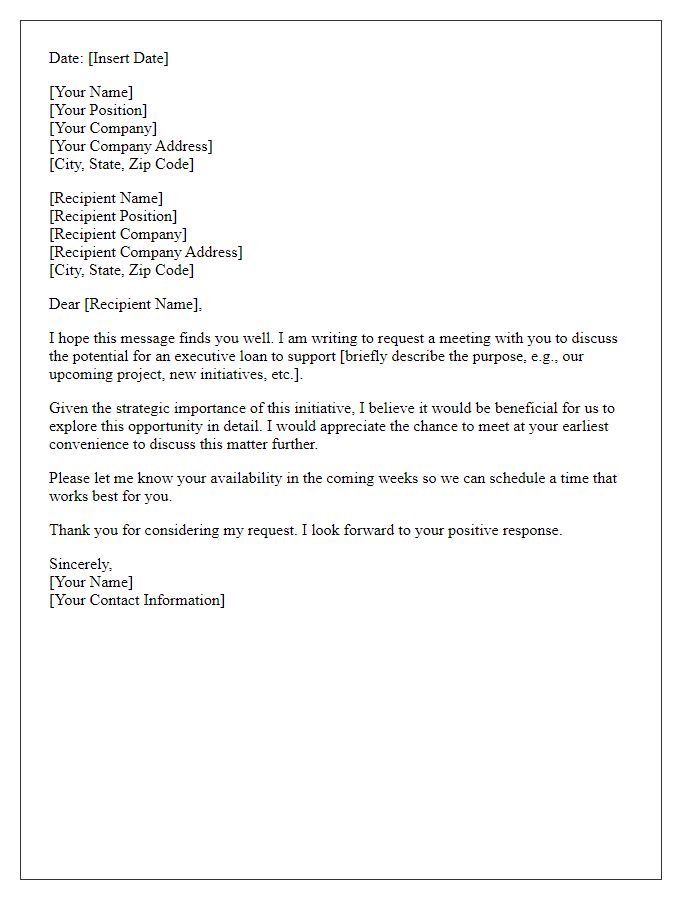

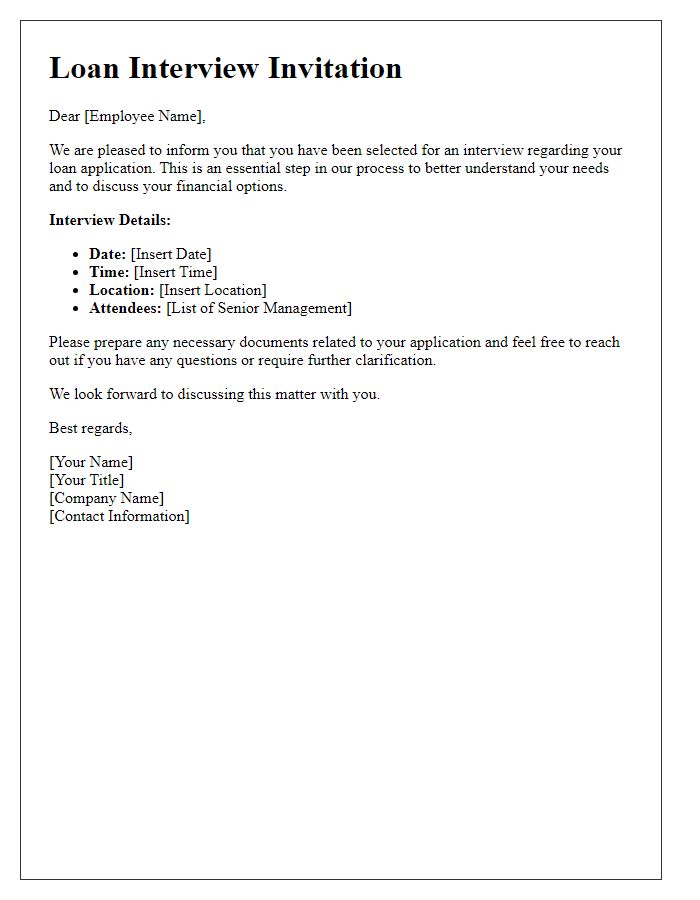

A senior executive loan consultation necessitates personalized financial analysis, aligning loan structures with corporate growth strategies. Understanding interest rates, typically ranging from 3% to 7% depending on creditworthiness, is crucial. Executives must assess potential impacts on cash flow, ensuring alignment with organizational goals. Evaluating loan duration, often between 5 to 10 years, is vital for managing long-term obligations. Market conditions, particularly in volatile sectors such as technology or energy, can significantly influence loan feasibility. Additionally, engaging with reputable financial institutions increases the likelihood of favorable terms and conditions, enhancing overall financial stability. Risk management strategies should be incorporated, emphasizing the need for thorough due diligence in investment decisions.

Personalization

Personalized loan consultations can significantly enhance the financial strategies for senior executives in high-stakes corporate environments. Each consultation tailors financial solutions to specific executive profiles, taking into account factors such as income levels, existing debt obligations, and investment portfolios. This customization leverages data analytics to assess creditworthiness, ensuring competitive interest rates and flexible repayment options. Furthermore, understanding the unique financial challenges faced by executives, such as stock options or fluctuating bonuses, allows for strategic planning that maximizes long-term wealth growth. For executives in technology hubs like Silicon Valley or New York City, regional economic trends might also influence the consultation, providing insights into real estate investments or tax strategies aligned with local market conditions.

Clear Purpose

A senior executive loan consultation focuses on understanding the company's financial needs and available options for securing a loan. The discussion includes evaluating financial metrics such as debt-to-income ratio and cash flow projections, which are pivotal in determining loan eligibility. Factors such as the company's credit rating and the current economic landscape, including interest rates hovering around 4% in 2023, also influence decision-making. Correspondingly, the consultation aims to outline various financing options, including term loans, lines of credit, and alternative lending sources like venture capital. A strategic plan ensures that the loan aligns with the organization's long-term growth objectives, allowing flexibility to adapt to changing market conditions.

Specific Details

In financial transactions, senior executive loan consultations often focus on tailored loan products designed to meet the unique needs of executive borrowers. Elements such as three-year loan terms, interest rates ranging from 4% to 6%, and approval processes involving comprehensive credit assessments are crucial. Locations like New York City, known for its competitive finance sector, often see institutions like JPMorgan Chase and Wells Fargo providing personalized financial services. In addition, specific considerations such as personal liability agreements, tax implications, and the potential for executive compensation packages to influence loan eligibility play significant roles. Documentation required may include income verification from W-2 forms or bonus statements and details regarding existing debt obligations to ensure a thorough evaluation of the executive's financial health.

Call to Action

In the rapidly evolving landscape of corporate financing, securing a loan tailored to specific business needs presents a unique opportunity for growth and innovation. Senior executives must consider various loan products, including secured loans backed by collateral such as real estate or equipment, and unsecured loans that may provide quicker access to capital without collateral requirements. Consultation with financial experts specializing in corporate lending can facilitate informed decisions. Engaging in such discussions often reveals insights into interest rates - currently averaging around 4 to 6 percent for small to mid-sized enterprises - and repayment terms that can range from three to ten years. Executives are encouraged to take proactive steps by scheduling consultations with financial institutions and exploring tailored financing solutions that align with their strategic objectives for business expansion or operational efficiency.

Comments