Are you a retired individual seeking a solution to your financial needs? Whether it's for home renovations, unexpected medical expenses, or simply to enjoy your golden years, we understand that securing a loan can be a daunting task. That's why we're excited to introduce our special loan offers designed specifically for retirees, making the borrowing process easier and more accessible. Curious to learn more about the benefits and terms of our retirement-friendly loan options? Keep reading!

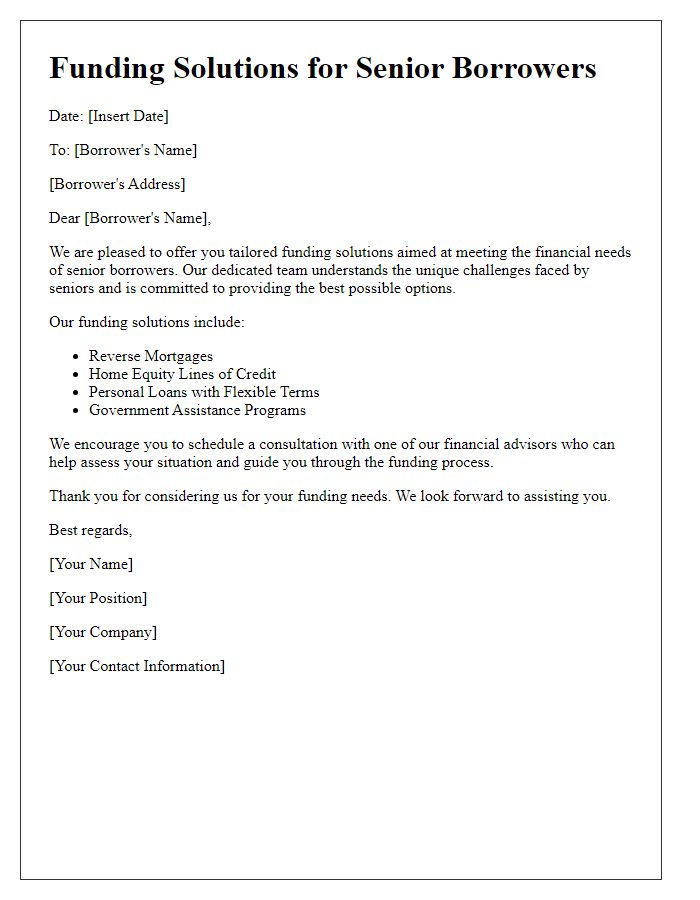

Personalization and Recipient Information

Retirement can bring financial challenges, especially when unexpected expenses arise. A tailored loan offer for retired individuals aims to assist with these situations, providing financial support with consideration for fixed income sources like pensions or Social Security benefits. Key features of such a loan include competitive interest rates, flexible repayment terms, and no prepayment penalties, making it adaptable to diverse financial situations. Additionally, the application process often simplifies essential requirements, ensuring accessibility for retirees. This personalized offer emphasizes understanding the unique financial landscape of retirement, encouraging peace of mind and financial stability during these years.

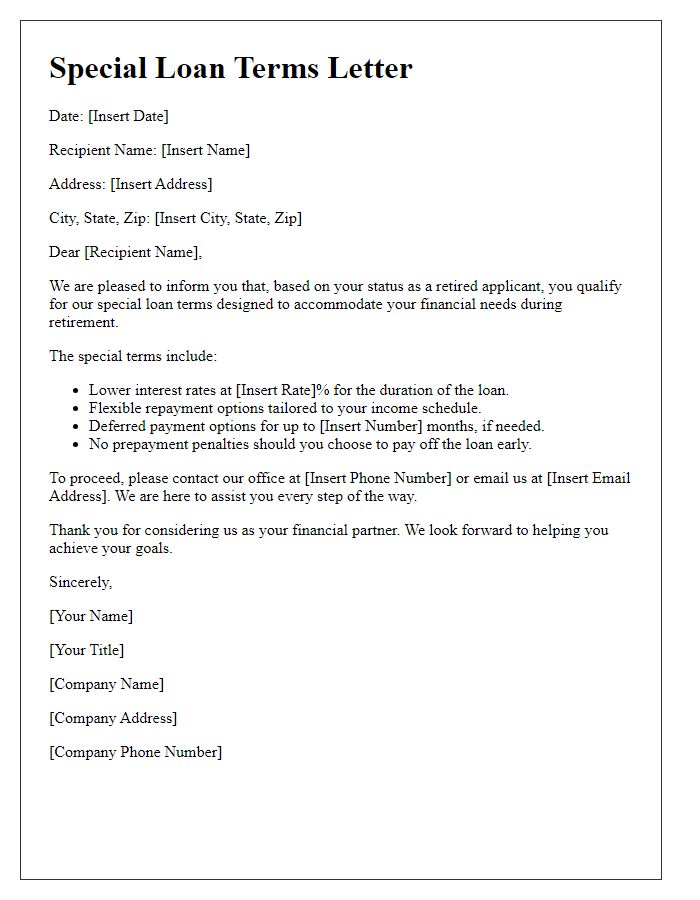

Loan Terms and Conditions

Retirement financing options often include specific terms and conditions that cater to retired individuals seeking loans. Common offerings include fixed interest rates ranging from 5% to 8%, typically based on the borrower's credit score and income sources such as pensions or social security. Loan amounts may vary from $1,000 to $50,000, depending on financial stability and repayment capability. The loan duration typically spans from 12 months to 5 years, allowing retirees to choose a term that aligns with their financial planning. Additionally, there may be provisions for early repayment without incurring penalties. Important considerations include mandatory documentation, such as proof of income and identification, alongside an assessment of debts to ensure responsible lending practices.

Financial Stability Evidence

Retired individuals can utilize financial stability evidence to access loan offers, including retirement accounts like 401(k) or IRAs (Individual Retirement Accounts). Lenders look for proof of consistent income sources, such as pensions or Social Security benefits, which average around $1,500 per month in the United States. Additionally, asset documentation including savings accounts or property equity can enhance credibility. Financial statements, typically featuring net worth calculations that detail assets versus liabilities, serve as crucial indicators of repayment ability. Credit scores, ideally above 700, demonstrate reliability to lenders and can significantly influence loan terms and interest rates. Understanding these factors can empower retirees to secure favorable loan options that cater to their financial needs.

Benefits and Special Offers

Retired individuals often seek financial stability, and various loan offers can provide them with essential support. Personal loans tailored for seniors, typically available through established banks or credit unions, often feature lower interest rates (around 5% to 10% annually) compared to standard loans. Lenders may offer special considerations, such as flexible repayment plans that accommodate fixed incomes, often derived from retirement savings or pensions. Additionally, no prepayment penalties can exist, allowing retired borrowers to pay off loans early without incurring extra costs. Some institutions may also provide a dedicated customer service team trained to address the unique financial needs of retirees, ensuring that assistance is readily available throughout the loan process. Various promotional periods, including introductory rates or reduced fees for veterans, may also enhance the appeal of these offerings.

Contact Information and Support Options

Retirement loans specifically designed for senior citizens provide unique financial support opportunities tailored to the needs of the elderly population. Options include fixed-rate loans that ensure predictable monthly payments and flexible terms accommodating varying income sources, such as pensions. Many financial institutions offer dedicated customer service lines and online resources to assist retirees in navigating their loan options. Additionally, workshops and informational seminars empower retirees with knowledge about managing loans effectively. Notable organizations, such as AARP, provide valuable insights and advocacy for fair loan practices for senior citizens.

Comments