Are you feeling a bit confused about your revolving loan account? You're not alone; many people find the ins and outs of these financial tools a little tricky to navigate. Whether you're unsure about interest rates, payment options, or how to effectively manage your credit, we're here to help clarify things for you. So, grab a cup of coffee, and let's dive into the detailsâread on to learn more!

Account Details

A revolving loan account, such as a line of credit, provides borrowers with flexible access to funds up to a specified limit, allowing multiple withdrawals and repayments. The account details typically include an account number (unique identifier), available credit limit (the maximum amount accessible), outstanding balance (amount owed), interest rate (percentage charged on the borrowed amount), and minimum payment (required monthly payment). Borrowers need to monitor their account usage, as high utilization rates can negatively impact credit scores. Payment history also plays a crucial role, affecting future borrowing capabilities. Regular communication with the financial institution, such as a bank or credit union, is essential for understanding terms and managing the account effectively.

Clarification Purpose

A revolving loan account, often associated with credit lines and credit cards, allows borrowers to draw, repay, and borrow again up to a predetermined limit. Understanding the key components of a revolving loan account is crucial for effective financial management. Typically, the credit limit represents the maximum amount that can be borrowed at any time, which may range from a few hundred to several thousand dollars depending on the lender's assessment of creditworthiness. The interest rate, often variable, affects the cost of borrowing, fluctuating based on market conditions and borrower risk profiles. Monthly payments are usually calculated based on the outstanding balance, which can lead to varying repayment amounts. Additionally, using more than 30% of the available credit limit may impact the borrower's credit score negatively, as credit utilization is a significant factor in credit scoring models. Understanding the terms, fees, and repayment structure is essential for maintaining a healthy financial profile while managing a revolving loan account responsibly.

Specific Transaction Queries

The revolving loan account, typically associated with financial institutions like banks or credit unions, can offer flexibility in borrowing, usually in the form of a credit line. Specific transaction queries may arise regarding individual withdrawals and payments related to this account. For instance, a recent transaction dated August 15, 2023, showed a withdrawal of $500 at an ATM located in Downtown Chicago, which raised questions about additional fees or interest calculations. Moreover, payments made towards the principal amount, like the recent $200 transaction processed on August 30, 2023, may need clarification on how they impact the remaining balance. Understanding these transactions is crucial for effective financial management, especially when dealing with terms specified in agreements, such as annual percentage rates (APRs) and service fees, potentially exceeding 20%.

Current Payment Status

The current payment status of a revolving loan account can significantly impact financial health. Typically, revolving loan accounts, such as credit cards or home equity lines of credit (HELOCs), allow borrowers to withdraw funds up to a credit limit. Monthly payment obligations usually depend on the outstanding balance. A current outstanding balance of $5,000 could incur a minimum payment of $150 based on a 3% repayment rate. Timely payments within the grace period prevent late fees, which can average $35, and protect the borrower's credit score, usually monitored through agencies like FICO. Regular payments can also improve the borrower's credit utilization ratio, a key metric, ideally maintained below 30%. Understanding the nuances of these payment obligations is crucial for maintaining financial stability and achieving long-term goals.

Contact Information

When discussing revolving loan accounts, understanding the contact information associated with them is crucial. Revolving loan accounts, often linked to credit cards and lines of credit, require accurate details for effective communication. Lenders, such as banks or credit unions, typically provide specific phone numbers for customer service inquiries, often found on statements or websites. Email addresses dedicated to account support may also exist, ensuring customers can clarify any queries. Physical addresses for loan servicing departments can be important for sending documents or payments. Accurate contact information dictates the efficiency of resolving account issues, facilitating inquiries related to payment terms, interest rates, and credit limits.

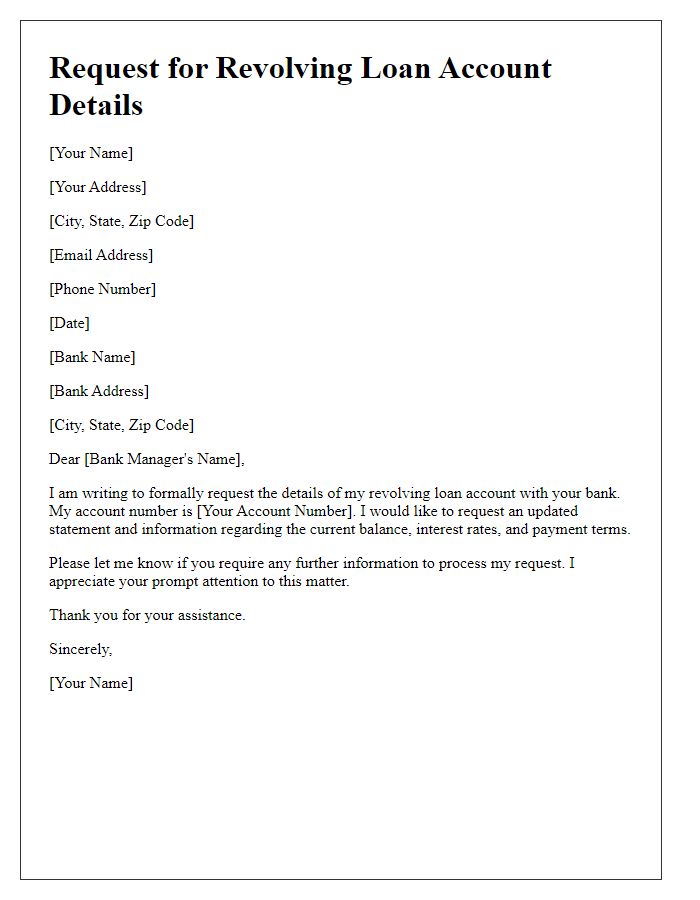

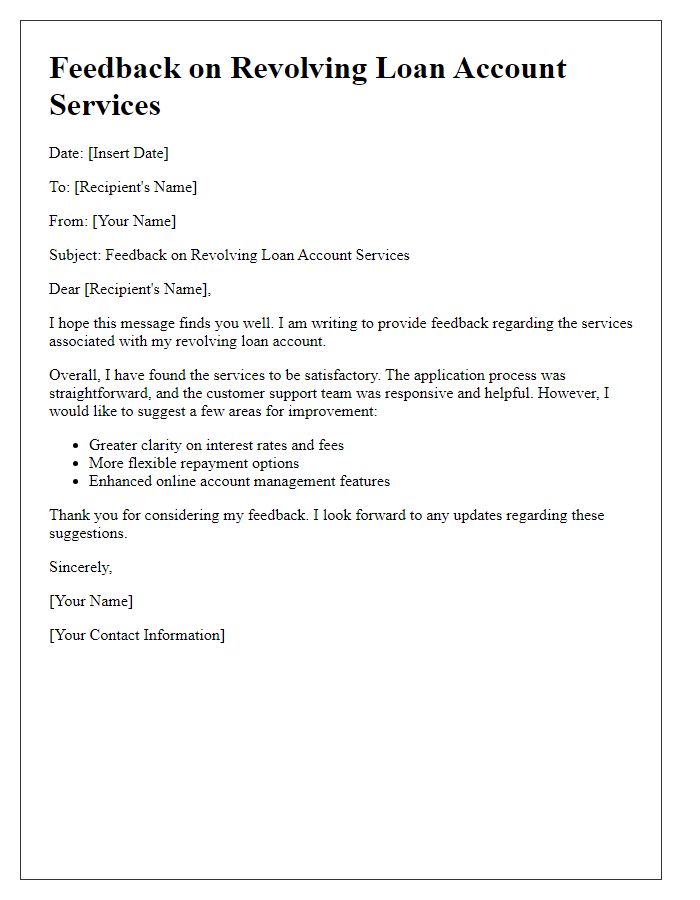

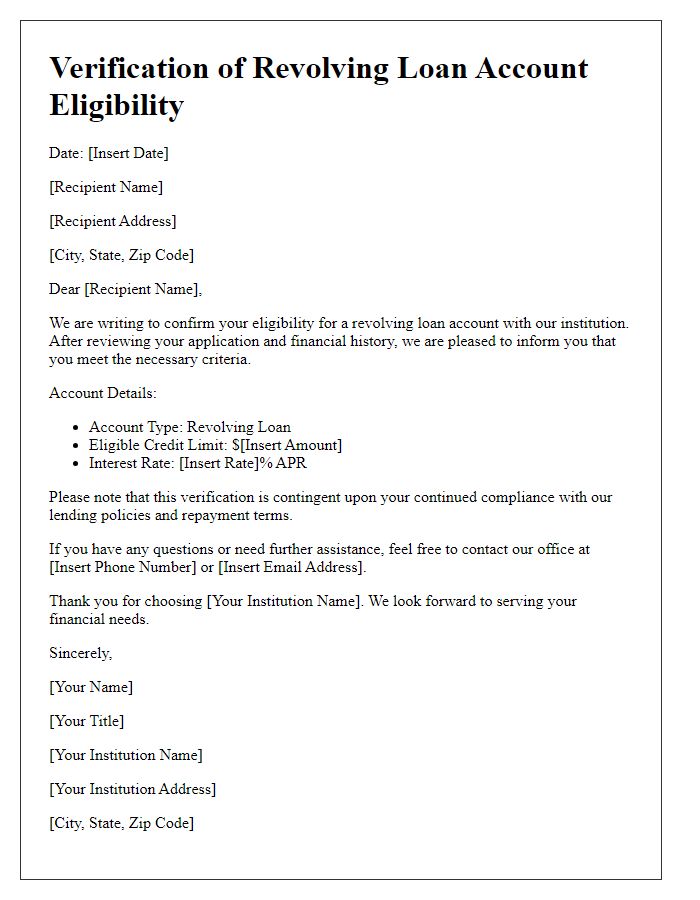

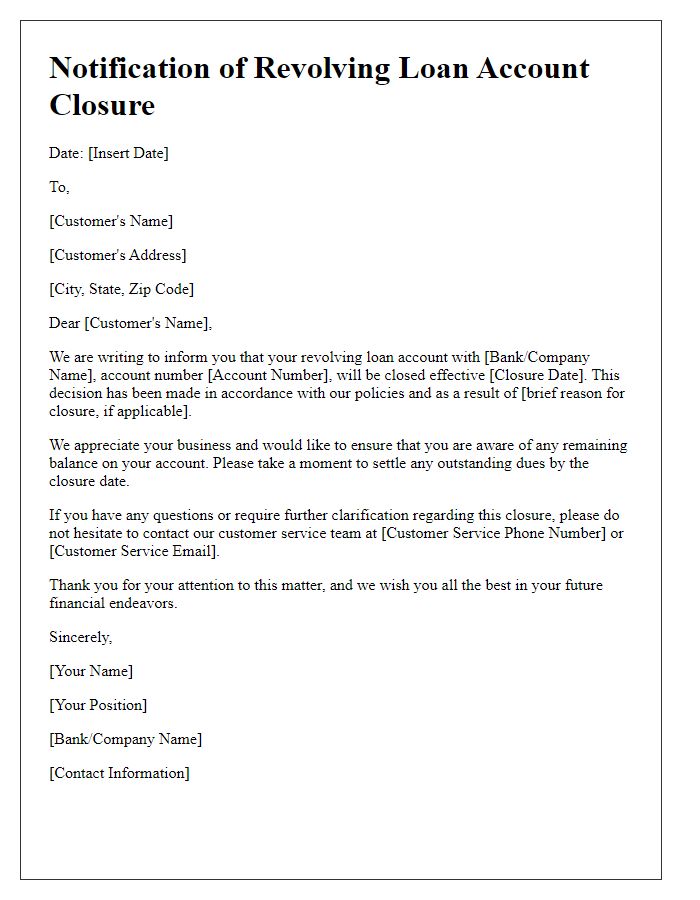

Letter Template For Revolving Loan Account Clarification Samples

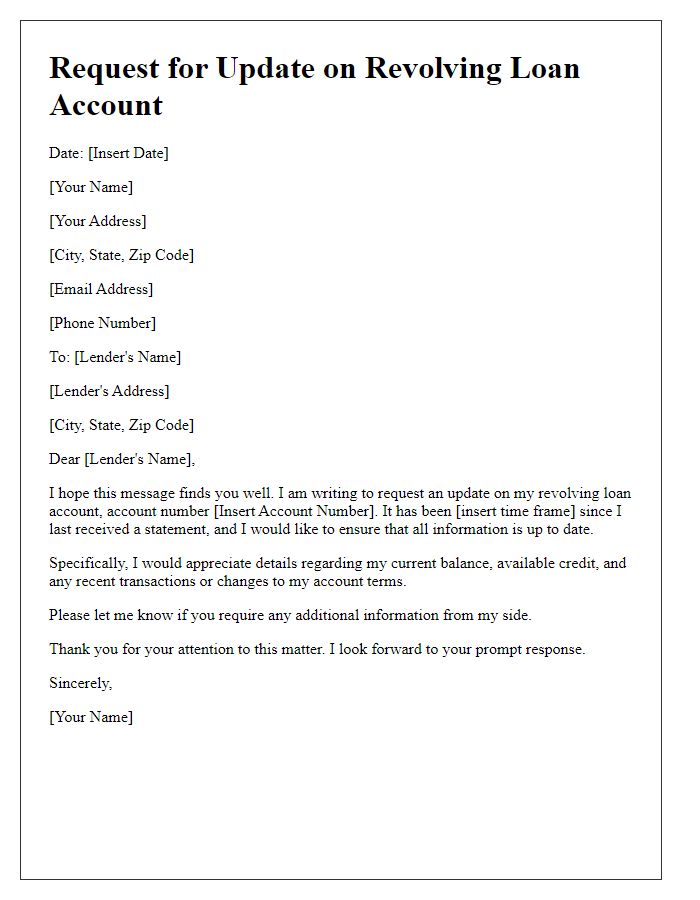

Letter template of update request for revolving loan account information

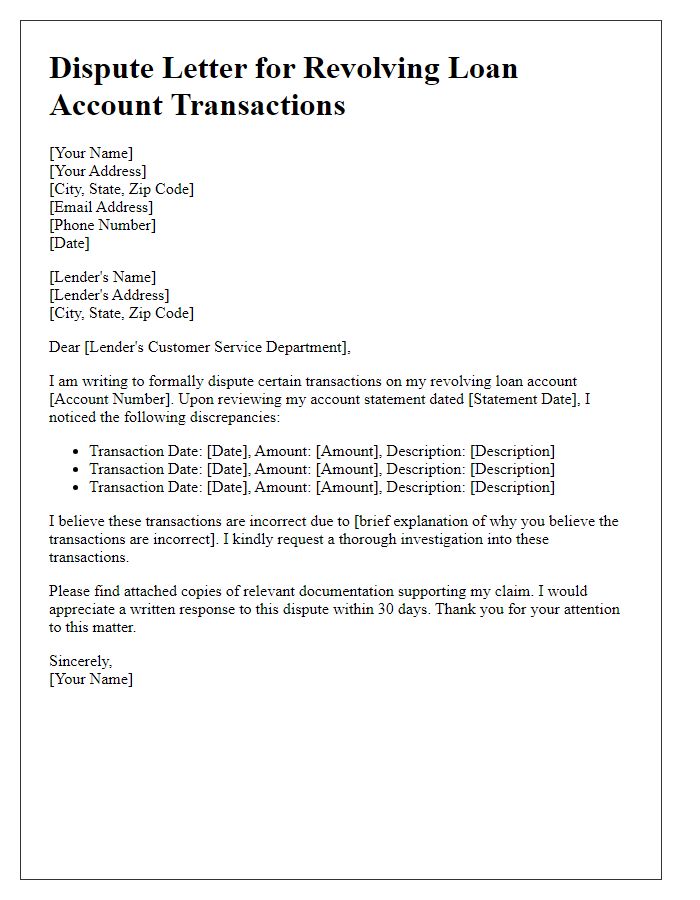

Letter template of dispute regarding revolving loan account transactions

Comments