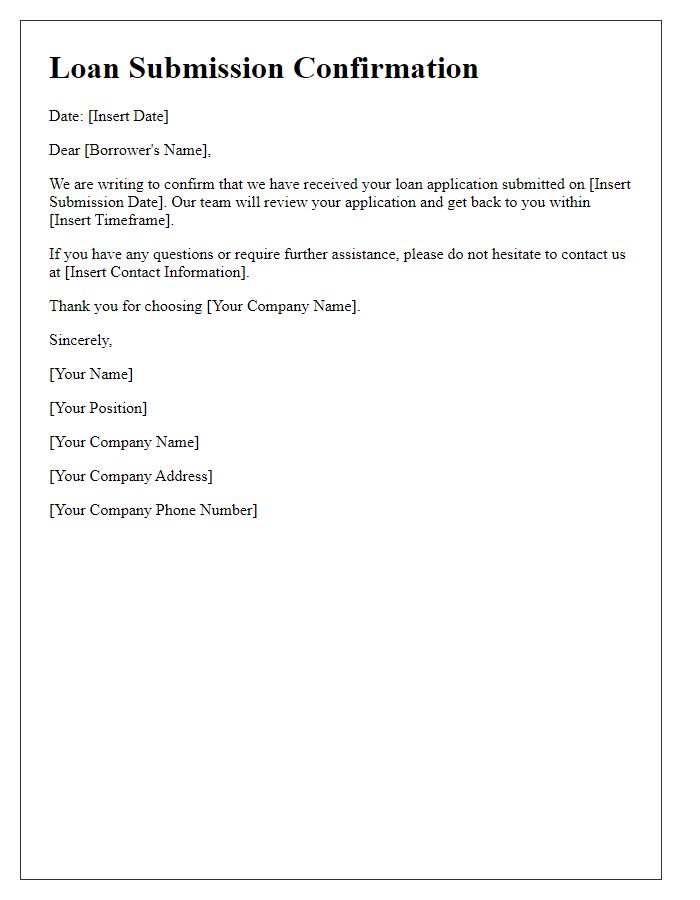

Are you preparing to submit your loan documentation and feeling a bit overwhelmed? You're not alone! Many individuals find the process daunting, but with the right template, it can be smooth and straightforward. In this article, we will guide you through a user-friendly letter template specifically designed for loan documentation submission, making it easier than ever to get your financial needs in order. So, let's dive in and simplify the process together!

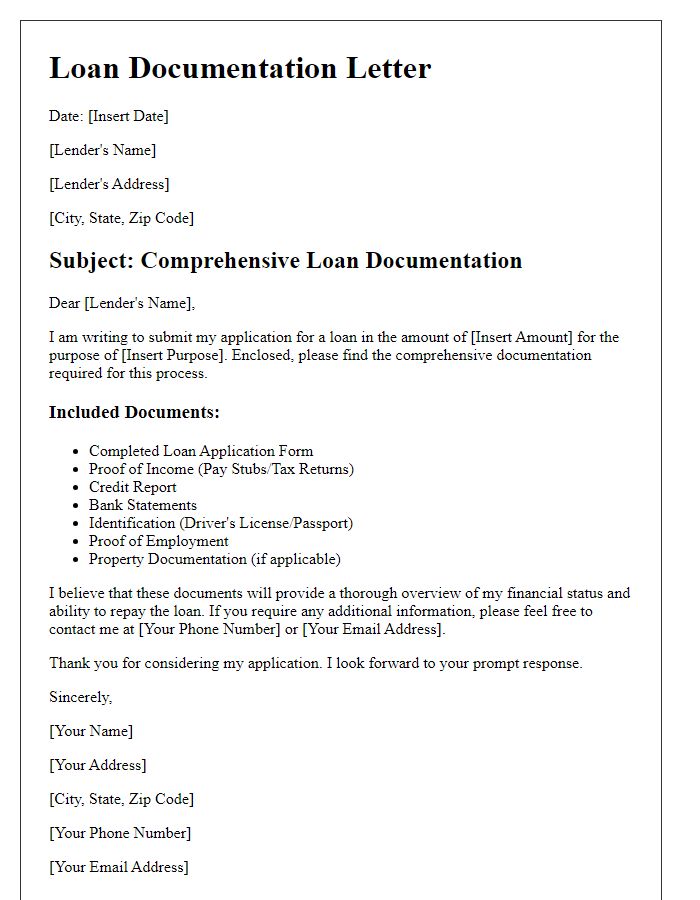

Clear subject line

Loan documentation submission requires careful attention to detail and organization for a smooth approval process. Essential documents, such as the completed loan application form, proof of income (like pay stubs or tax returns), bank statements covering the last three months, and identification verification (such as a driver's license or passport) must be compiled. This process often necessitates adherence to specific lender guidelines, with each institution offering distinct requirements based on the loan type, whether it be a mortgage or a personal loan. Submitting these documents in a timely manner can significantly impact the approval timeline, often defined as 30 to 60 days depending on the lender's processing capacity and the complexity of the financial situation.

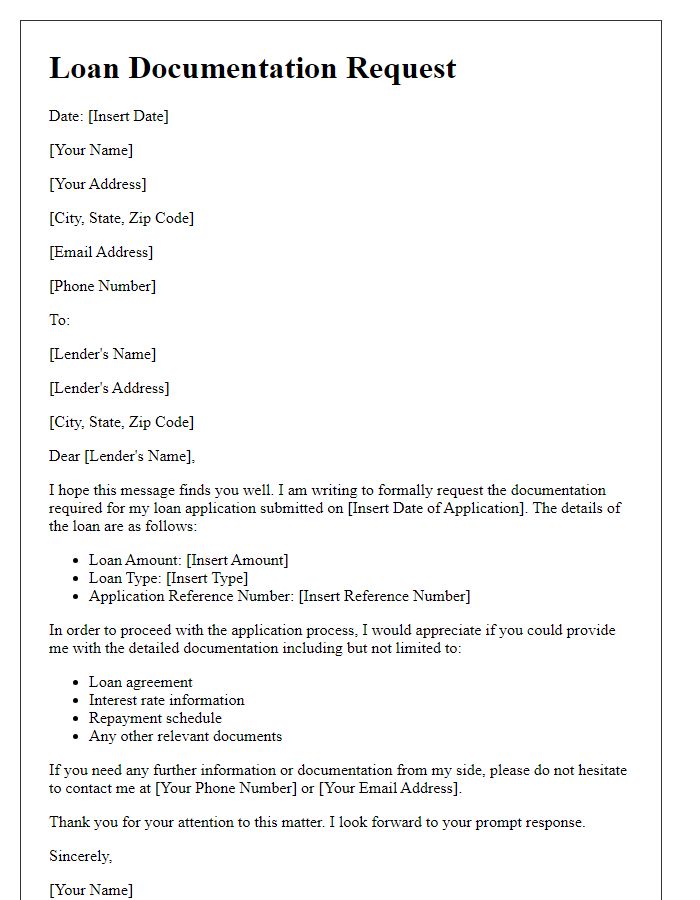

Applicant's personal information

The applicant's personal information is crucial for processing loan documentation efficiently. Full Name (include middle name), Date of Birth (format: MM/DD/YYYY), Social Security Number (SSN for U.S. citizens, crucial for credit checks), Current Address (street, city, state, zip code, ensuring accurate communication), Phone Number (primary contact number), Email Address (essential for digital correspondence), Employment Status (indicating if employed, self-employed, or unemployed), Employer's Name (for verification of income), Annual Income (total income from all sources, necessary for assessing repayment ability), and Financial Obligations (listing all major debts, such as mortgages, car loans, credit cards). Accurate and comprehensive provision of this information can expedite loan approval, ensuring compliance with lending standards.

Loan details summary

Loan documentation involves a comprehensive summary that outlines essential details of the loan agreement. This summary typically includes the principal amount, which is the initial sum borrowed, an interest rate, often expressed as an annual percentage rate (APR), affecting total repayment cost. The term length, which can range from a few months to several years, dictates repayment schedule frequency. The loan purpose, specific to personal needs such as home purchase, education expenses, or business financing, must also be defined. Borrower information includes full name, contact details, and social security number for identification purposes. Additionally, lender details, such as the name of the financial institution and their contact information, are crucial. Lastly, submitted income verification documents, such as pay stubs and tax returns, provide evidence of borrower's ability to repay the loan.

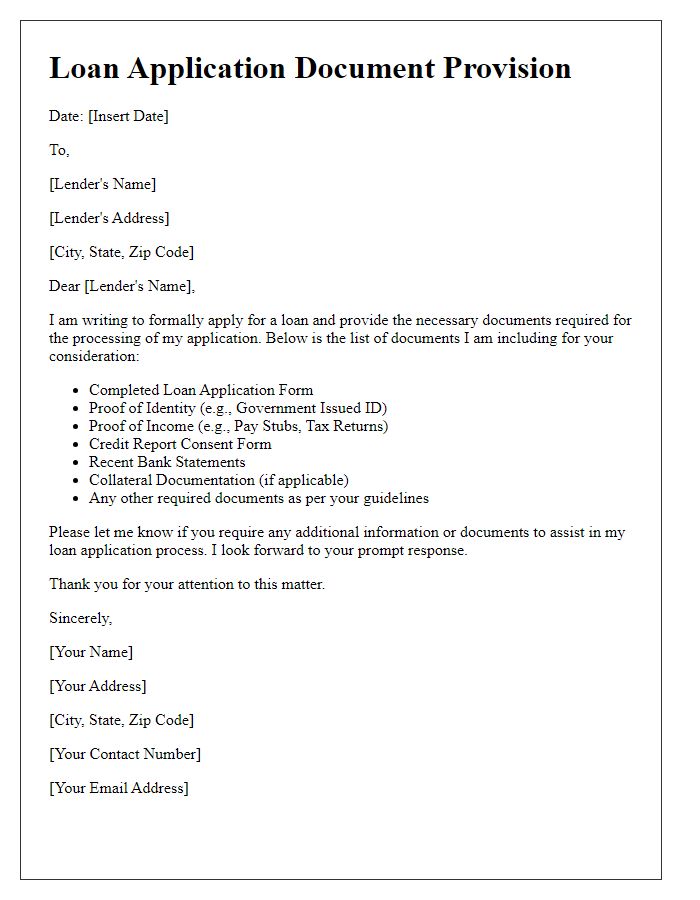

List of attached documents

Loan documentation submission requires careful organization of attached documents to ensure a smooth approval process. Attached documents typically include the Loan Application Form, which provides essential personal and financial details of the borrower. Bank Statements for the last three to six months offer insight into the borrower's financial health and spending habits. Proof of Income documents, such as recent Pay Stubs and Tax Returns, verify employment status and income levels. Additionally, Employment Verification Letters confirm job stability. Credit Reports provide information on the borrower's creditworthiness. Identification Documents, like a Government-Issued ID or Driver's License, establish the identity of the borrower. Property Purchase Agreement is included for real estate loans to outline the terms of the purchase. All these documents should be clearly labeled and organized to facilitate review by lenders.

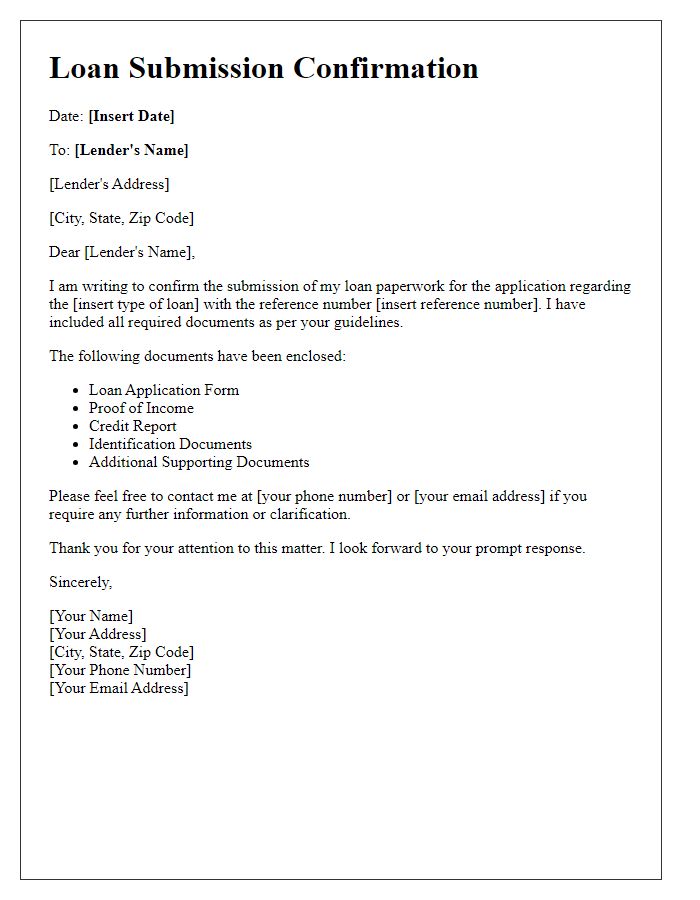

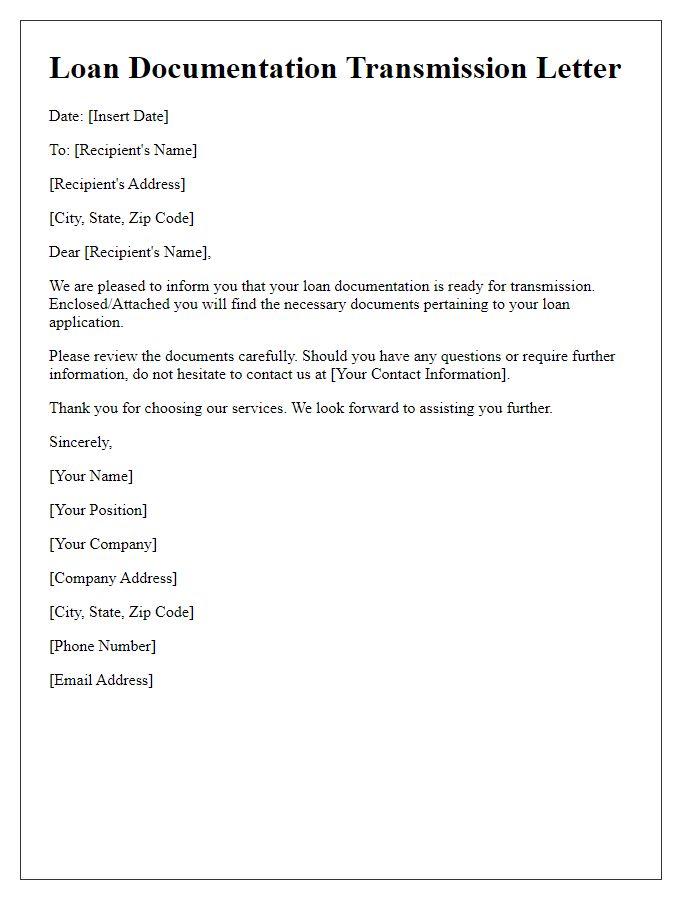

Contact information for follow-up

Loan documentation submission requires precise contact information for efficient follow-up communication. Important details include your full name, clearly indicated loan account number (such as 123456789), email address (for example, yourname@email.com), and direct phone number (preferably a mobile number like (555) 123-4567) to ensure quick responses from the loan officer. Providing a physical mailing address (such as 123 Main St, Cityville, State, Zip) may also be beneficial for any necessary correspondence. Additionally, be sure to include the date of submission, which assists in tracking your application status effectively.

Comments