Are you navigating the murky waters of unexpected loan service fees? If so, you're not alone, and it can be frustrating trying to make sense of it all. Many people find themselves questioning the legitimacy of these charges and wondering how to address them effectively. Join me as we explore strategies to challenge loan service fees and ensure you're not paying more than you shouldâread on for valuable insights!

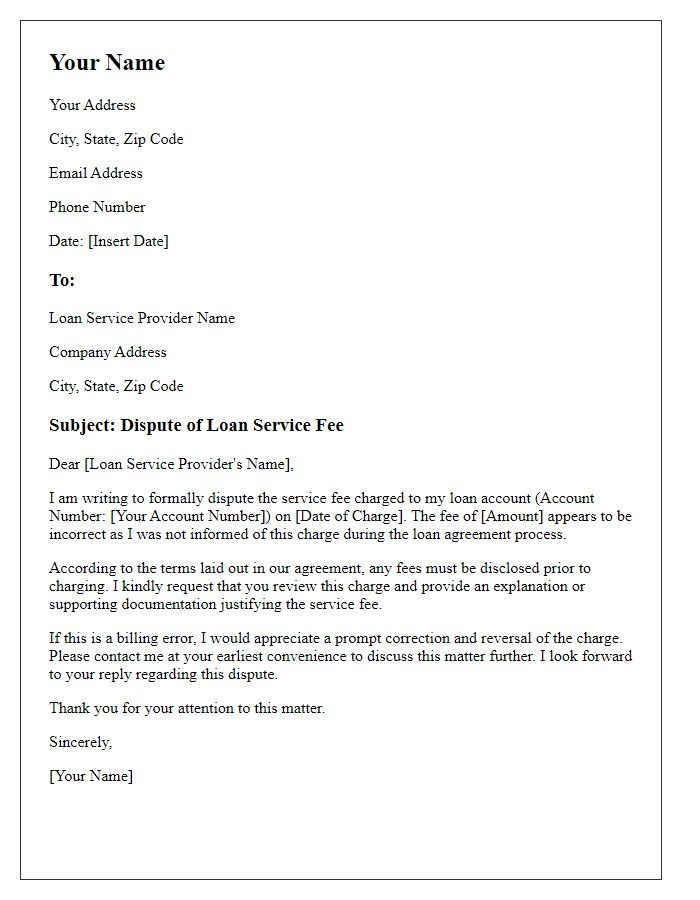

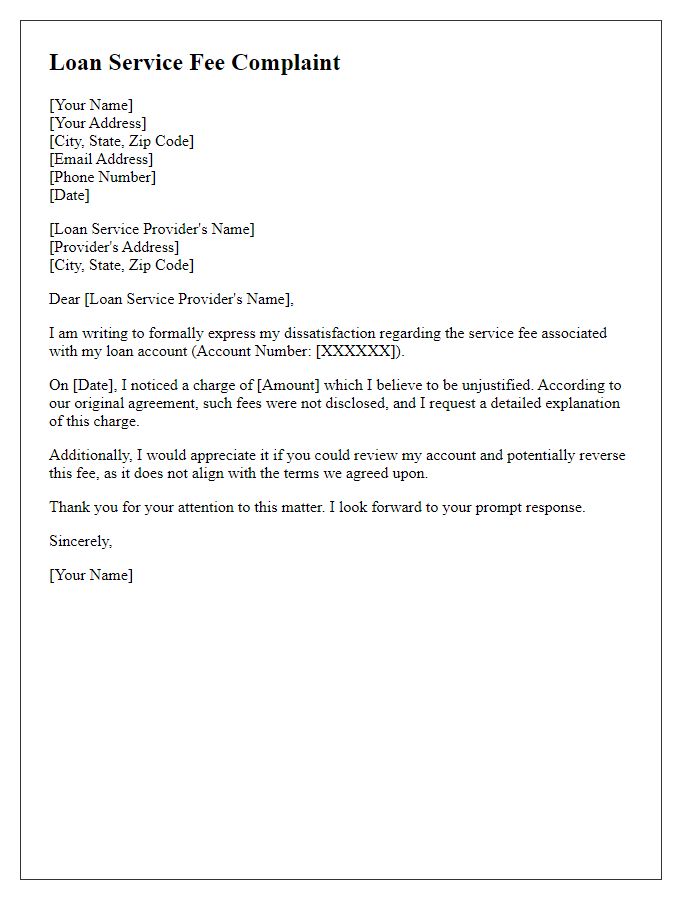

Personal Account Details

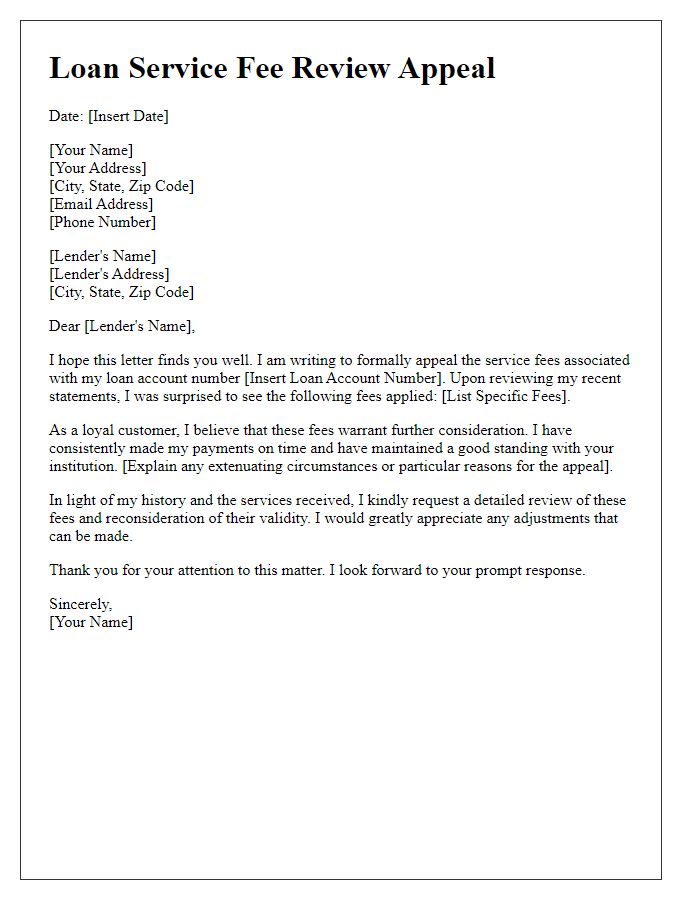

Challenging the loan service fee can significantly impact your financial health. When reviewing statements, pay close attention to fees that appear excessive or unexplained, such as a monthly loan servicing charge of $15, which can accumulate to $180 annually. Documentation should include loan agreements and payment schedules, specifying the initial amounts borrowed, interest rates (often around 5-7%), and total repayment timelines, typically spanning 3-5 years. Additionally, maintain records of all communications with your lender, including dates of contact and the names of customer service representatives. Understanding local regulations, such as the Consumer Financial Protection Bureau guidelines in the United States, can provide leverage during discussions. Addressing these fees requires clarity and persistence to ensure fair treatment and transparent practices.

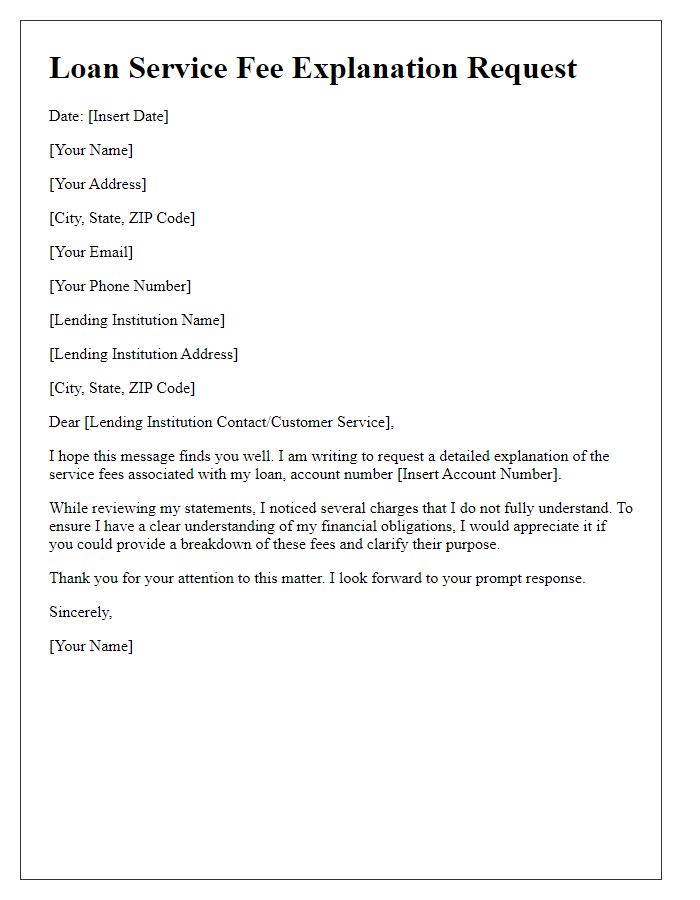

Description of Disputed Fee

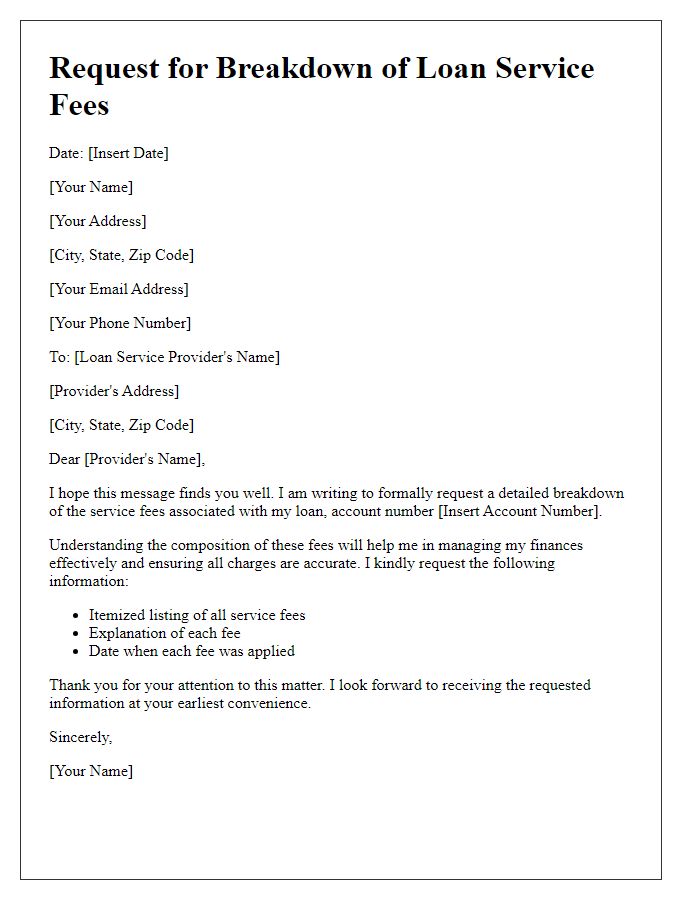

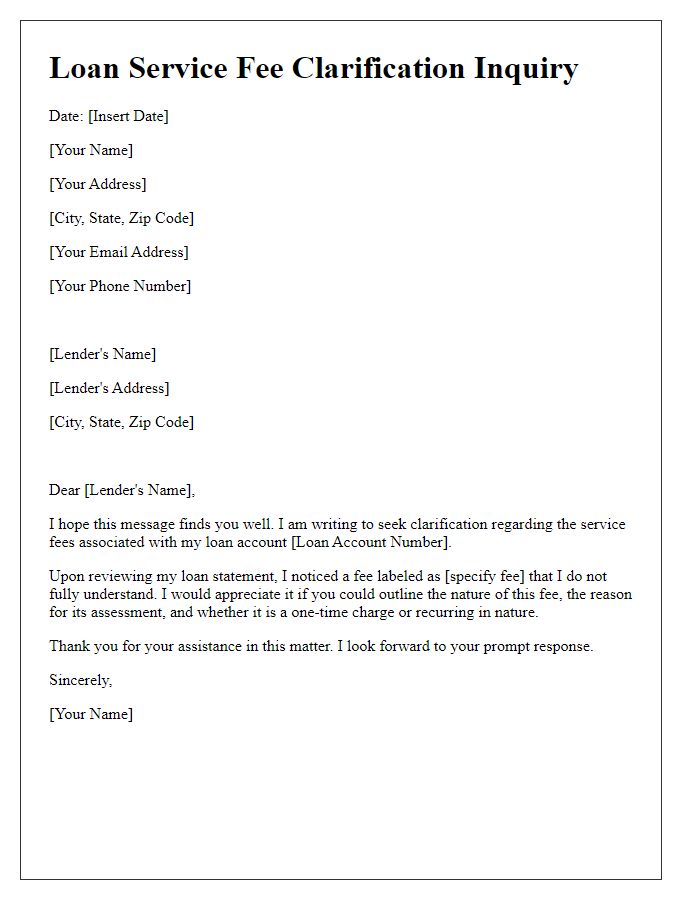

A loan service fee, often charged by financial institutions, can be a significant cost for borrowers. In many cases, such fees may appear on the statement without clear justification. For example, a $300 loan service fee may be labeled ambiguously, lacking details on its purpose, which can lead to confusion. This fee could be categorized as either an origination fee or a processing charge, making it essential for borrowers to seek clarification. Regulations set by financial authorities, such as the Consumer Financial Protection Bureau (CFPB), provide protections against undisclosed fees, ensuring transparency in lending practices. Disputing these fees involves reviewing the loan agreement, which should clearly outline allowable charges, and contacting the service provider for an itemized breakdown of costs incurred. Proper documentation, including account statements and initial agreements, is vital for challenging the disputed fee effectively.

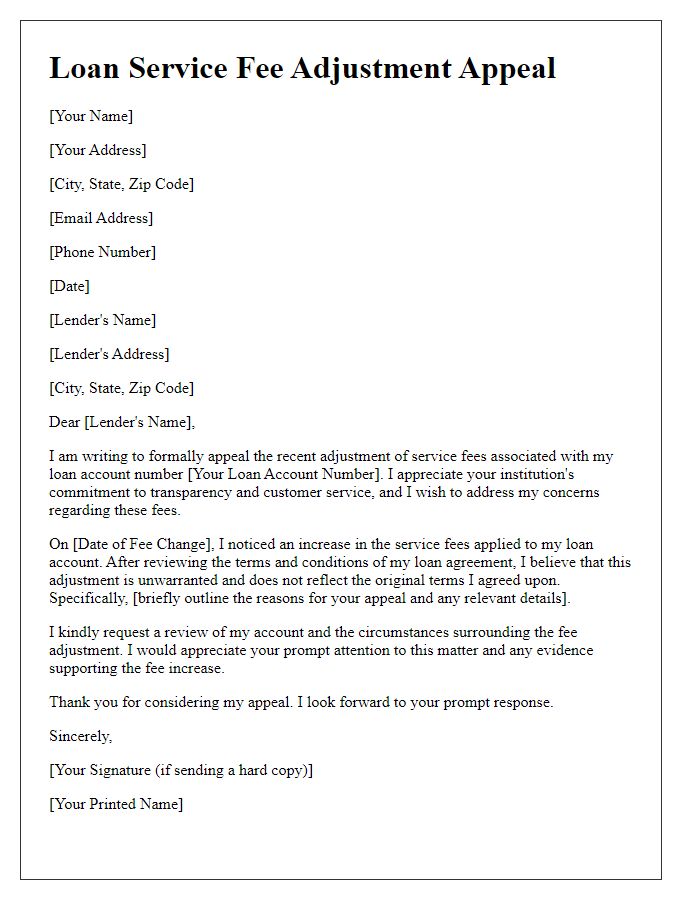

Specific Request for Resolution

Facing unexpected loan service fees can lead to financial strain for borrowers. Specific cases involve companies such as Wells Fargo or Bank of America, known for their diverse loan products. In instances of disputed fees, it's essential to identify the initial loan agreement terms detailing any service fees, typically presented in the Truth in Lending Act disclosures. Documenting the fee amount--often ranging from $25 to $500--alongside the nature of the dispute such as late fees or processing fees, is crucial for clarity. Seeking a resolution may also involve contacting the Consumer Financial Protection Bureau (CFPB) if internal appeals are unsuccessful. Engaging in this process ensures the borrower's rights are upheld, while providing a clear channel for resolution directly with the lender.

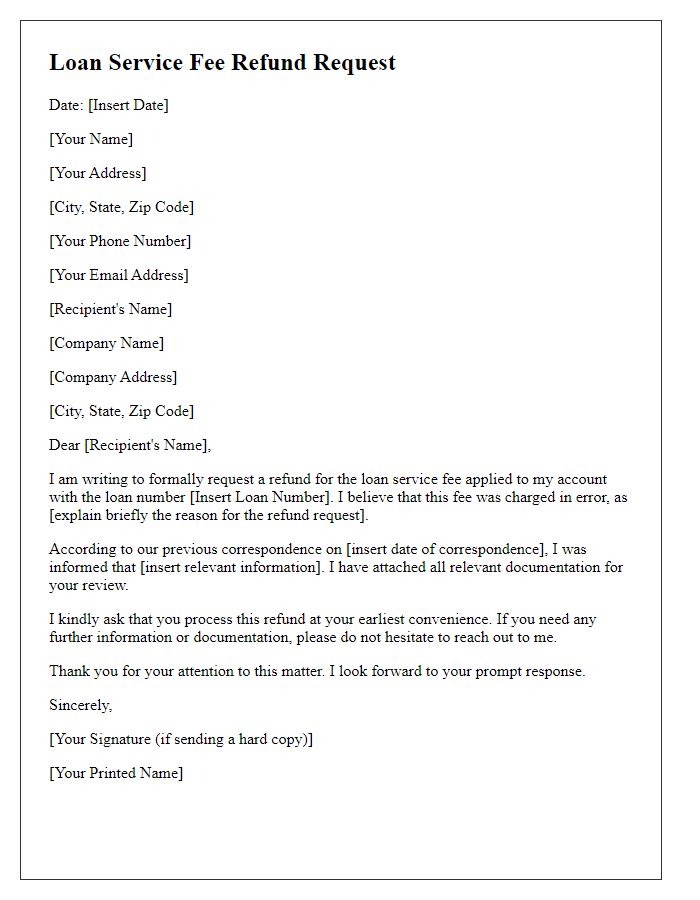

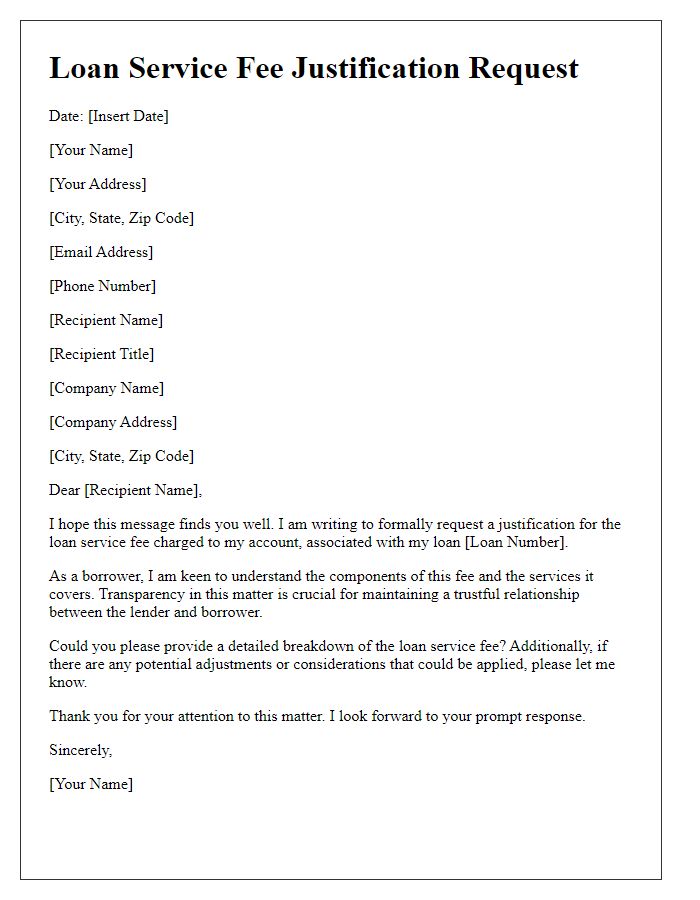

Supporting Documentation

The process of disputing a loan service fee requires detailed documentation to support your claim. Essential documents include the original loan agreement, outlining the fee structure and associated charges. Recent transaction statements from the lending institution, highlighting the disputed fees, provide crucial evidence. Correspondence with customer service representatives can demonstrate attempts to resolve the issue informally. Gathering records of similar fees charged to other customers may strengthen your argument. Ensure to include any state or federal regulations that pertain to improper or excessive loan service fees, enhancing the legitimacy of your challenge. Comprehensive documentation can significantly impact the outcome of your dispute.

Contact Information for Follow-Up

Loan service fees often present challenges for borrowers, particularly when they exceed permissible limits or lack transparency. Depending on the lending institution, fees may include application fees, origination fees, or prepayment penalties, which can collectively amount to hundreds or even thousands of dollars. In various regions such as the United States or the United Kingdom, regulations set forth by agencies like the Consumer Financial Protection Bureau (CFPB) outline permissible fee structures, requiring lenders to disclose all fees clearly before contract finalization. For consumers seeking to challenge these service fees, it's crucial to maintain comprehensive documentation including loan agreements, fee breakdowns, and any correspondence with the lender. Furthermore, reaching out to financial regulatory bodies or legal aid organizations can provide essential support during the dispute process, reinforcing the borrower's position when negotiating loan terms or seeking refunds on unjustified fees.

Comments