Are you considering taking the exciting step towards homeownership or financing your next big project? Getting your loan pre-qualification confirmed is an essential milestone that can ease your financial worries and set you on the right path. This letter will guide you through the details you need to know and provide a clear template for communicating with lenders. So, let's dive in and explore how to secure your loan pre-qualification with confidence!

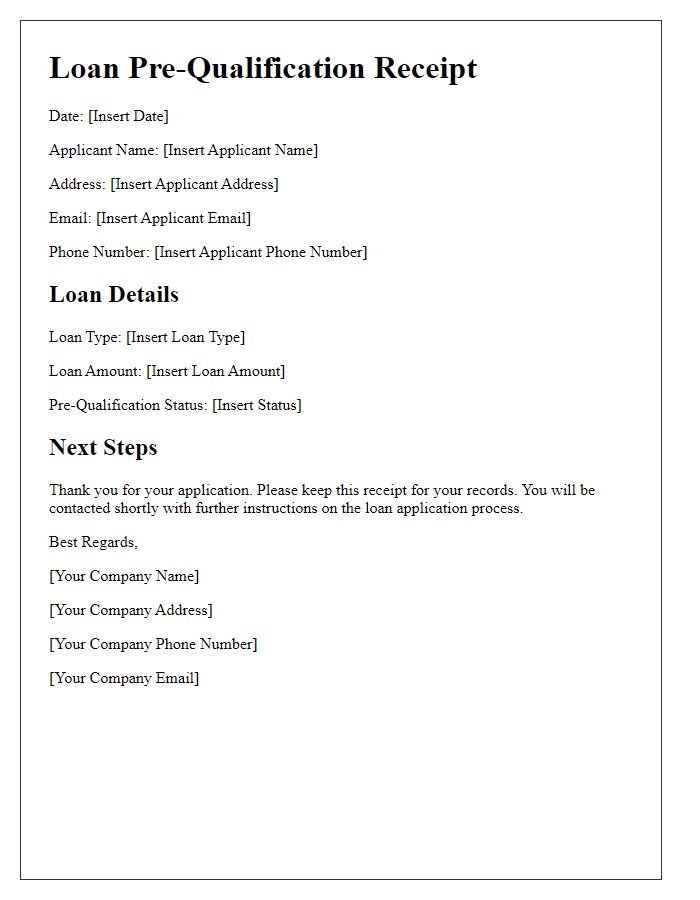

Applicant Information

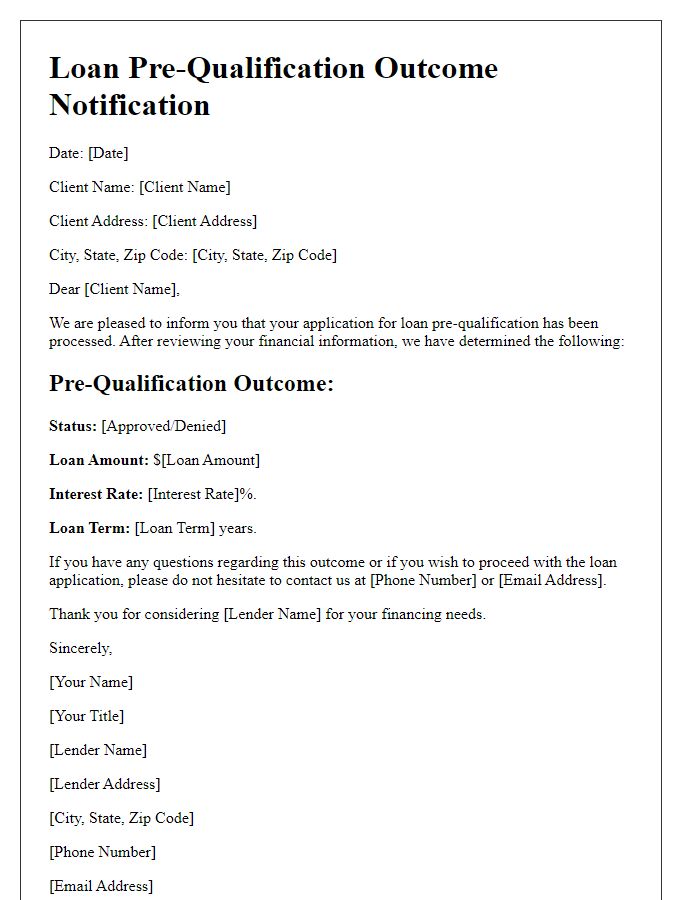

Loan pre-qualification confirmation involves assessing the applicant's financial status to determine eligibility for a mortgage. Key components include income verification, credit score analysis, and debt-to-income ratio evaluation. For instance, a minimum credit score of 620 may be required by lenders like Fannie Mae or Freddie Mac for conventional loans. Applicant information typically comprises full name, social security number, address, employment details, and income amount. Important figures like annual income (usually $50,000 or more) and existing debt obligations (such as student loans or credit card debt) also play a crucial role in determining the applicant's financial health and readiness for a mortgage loan.

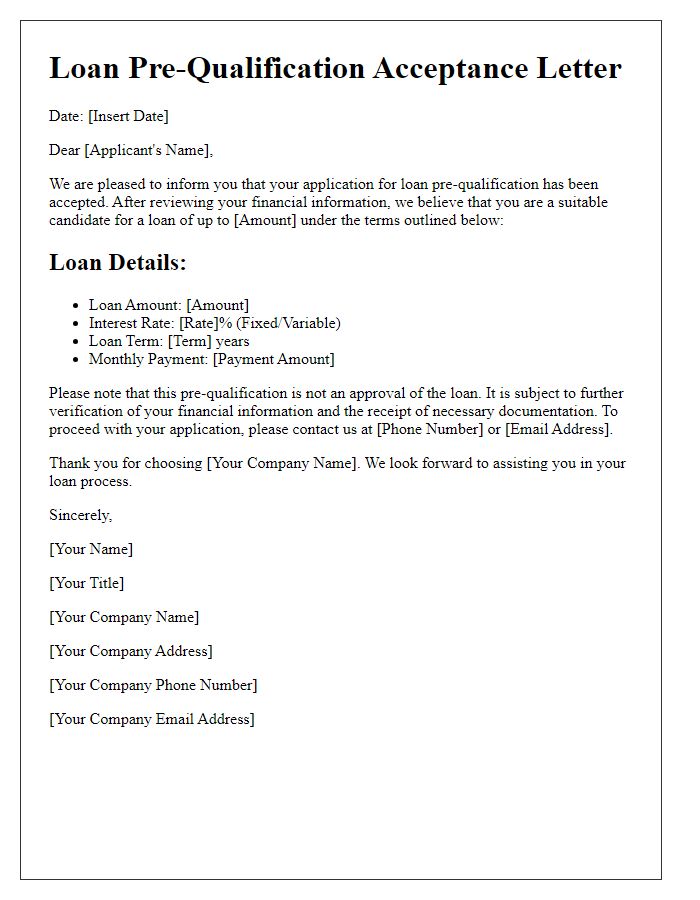

Loan Amount and Type

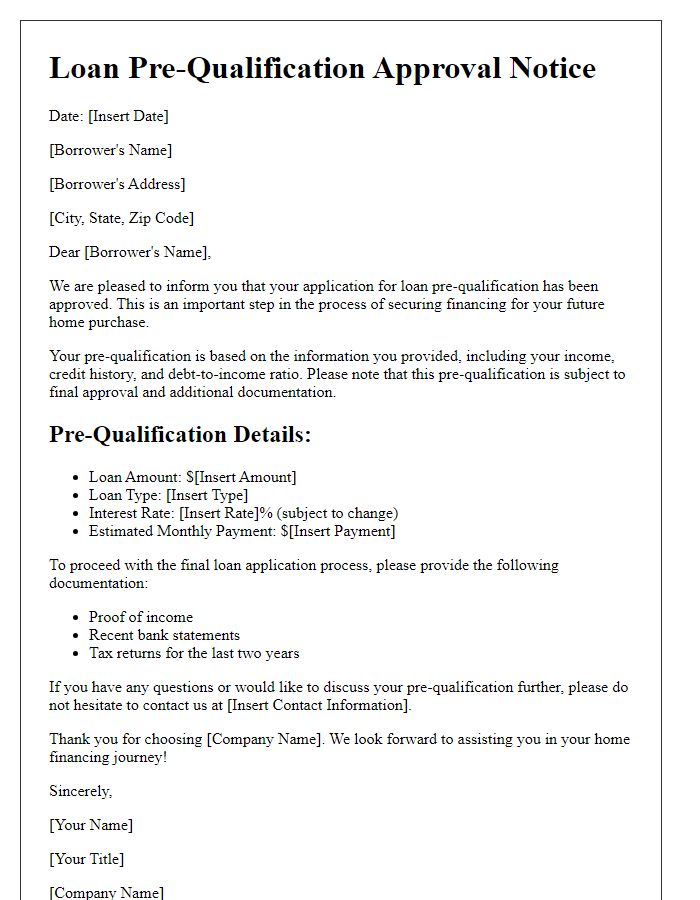

Loan pre-qualification confirmation provides essential details regarding the prospective borrower's eligibility. For example, a loan amount of $250,000 may be designated for a fixed-rate mortgage with a 30-year term. The document outlines the borrower's credit score, which might be at least 620, ensuring favorable terms and conditions. Additionally, the confirmation includes the interest rate, potentially around 3.5%, reflecting current market trends. Furthermore, the loan type could be conventional, FHA, or VA, depending on the borrower's financial profile and eligibility criteria, impacting monthly payments and down payment requirements. All these elements create a clearer understanding of the borrower's financial capabilities and the lender's expectations.

Terms and Conditions

Loan pre-qualification confirmation serves as an important step in the financing process for prospective borrowers. Clear terms and conditions outline the eligibility criteria, which typically include a credit score minimum (often above 620), income verification, and debt-to-income ratio (usually below 43%). A specific loan amount, such as $250,000 for a mortgage, may be contingent on the borrower's financial situation and collateral, like the property being purchased. Time limits for pre-qualification validity may vary, generally lasting 60 to 90 days. Additionally, any fees associated with the loan application must be disclosed, including origination fees, processing costs, or third-party expenses, contributing to overall loan transparency and borrower understanding of their financial obligations.

Financial Status Verification

Financial status verification is a critical step in the loan pre-qualification process. Lenders, such as banks or credit unions, require essential documentation to assess the applicant's creditworthiness and ability to repay. Common documents include recent pay stubs, tax returns, and bank statements, which help establish income levels and financial stability. Credit scores, typically ranging from 300 to 850, play a significant role in determining loan eligibility, with higher scores indicating better creditworthiness. The lender may also consider existing debts, including mortgages, credit card balances, and student loans, assessing the debt-to-income ratio, ideally below 36%. Verification may take several days, with factors such as loan type, amount, and individual lender requirements influencing the timeline. Successful pre-qualification confirms the applicant's financial readiness and allows them to proceed with the home buying or refinancing journey.

Contact Information and Next Steps

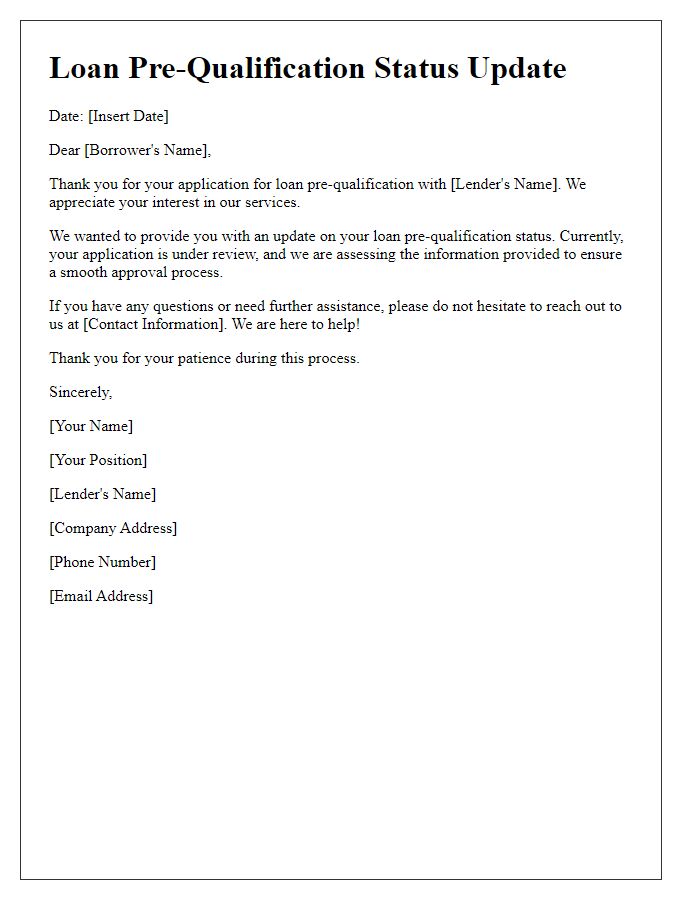

Loan pre-qualification confirmation provides essential information for prospective borrowers. Contact information typically includes the lender's name, phone number, and email address, ensuring that clients have access to assistance and inquiries. Next steps involve gathering necessary documentation, such as income verification (like pay stubs or tax returns), identification (such as a driver's license or passport), and details of outstanding debts. Borrowers should expect a follow-up within a designated timeframe, often 3 to 5 business days, to discuss terms and conditions tailored to their financial profiles. This confirmation enhances the borrowing process's clarity and prepares candidates for potential loan approval.

Letter Template For Loan Pre-Qualification Confirmation Samples

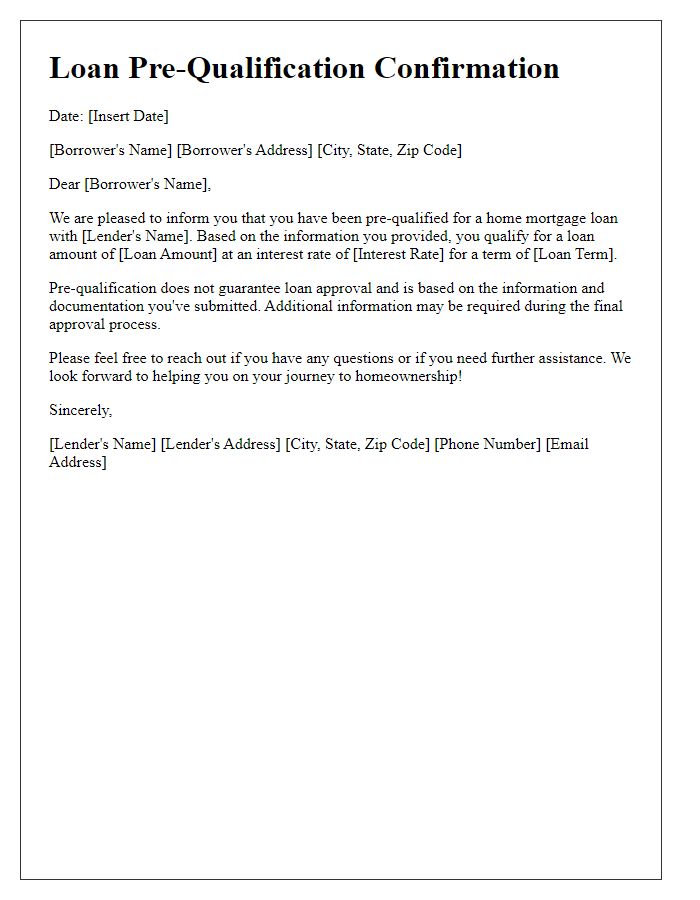

Letter template of loan pre-qualification confirmation for home mortgage

Comments