Are you feeling overwhelmed by the complexities of disputing your loan credit score? You're not alone, as many individuals encounter inaccuracies that can affect their financial decisions. This article will guide you through a straightforward letter template designed specifically for addressing such disputes, helping you reclaim control over your credit profile. So, let's dive in and empower you with the knowledge needed to take action!

Accurate Personal Information

When disputing inaccuracies related to personal information on your loan credit report, it's crucial to emphasize the significance of accurate identity representation. Incorrect personal details, such as your name, address, or social security number, can adversely affect your credit score, making financial products more expensive or unattainable. For instance, a common error involves misreported addresses; this can lead to mistaken identity, where lenders may confuse you with another individual. Furthermore, establishments like Equifax, Experian, and TransUnion are responsible for maintaining your credit profile. Ensuring your personal information aligns with official documents, such as your driver's license or utility bills, can reduce the likelihood of misunderstandings, ensuring proper financial evaluations from lenders, and protecting your creditworthiness across various financial institutions.

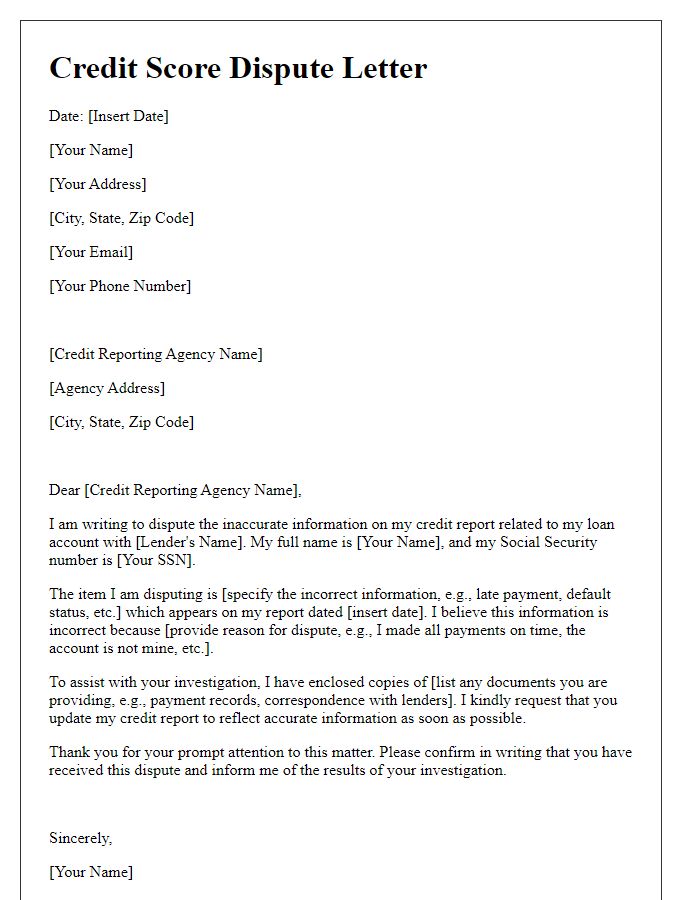

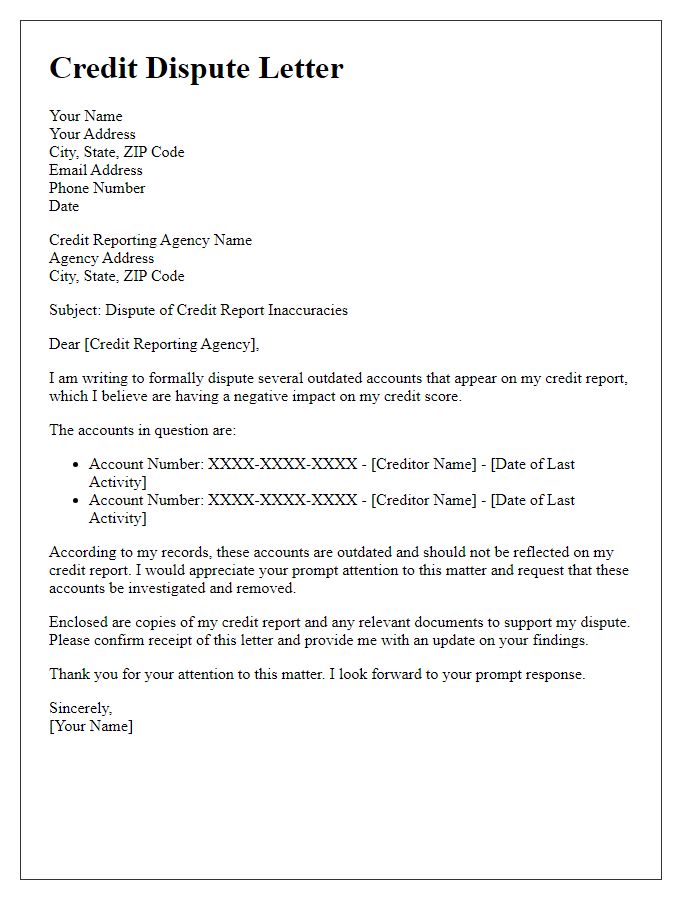

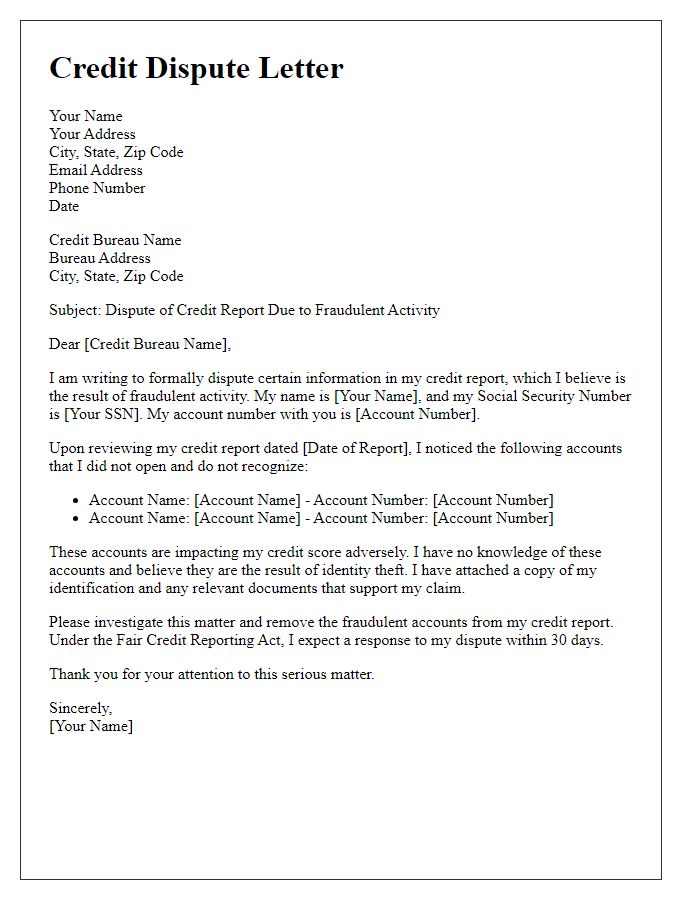

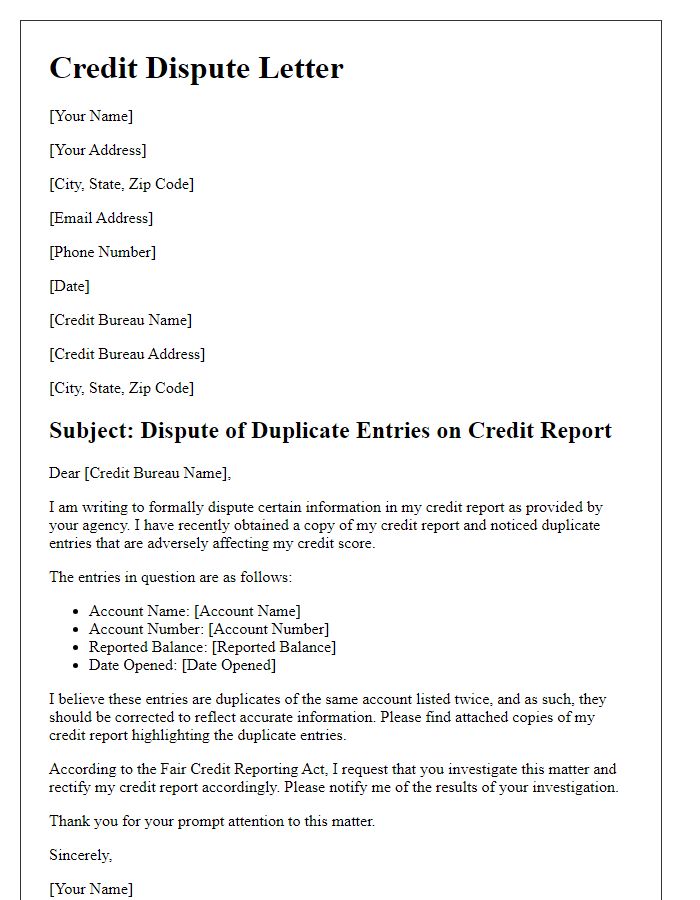

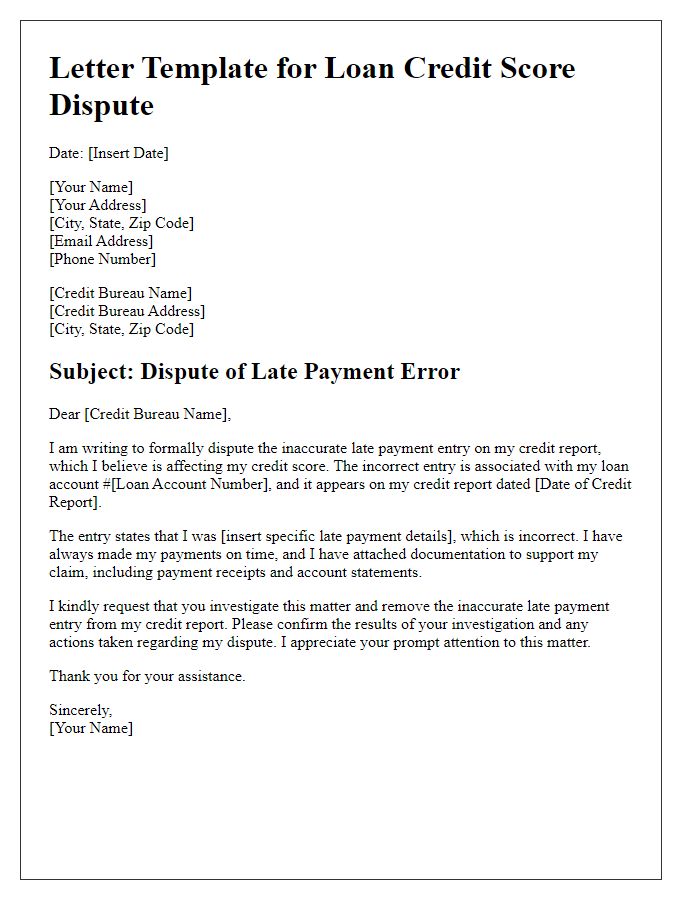

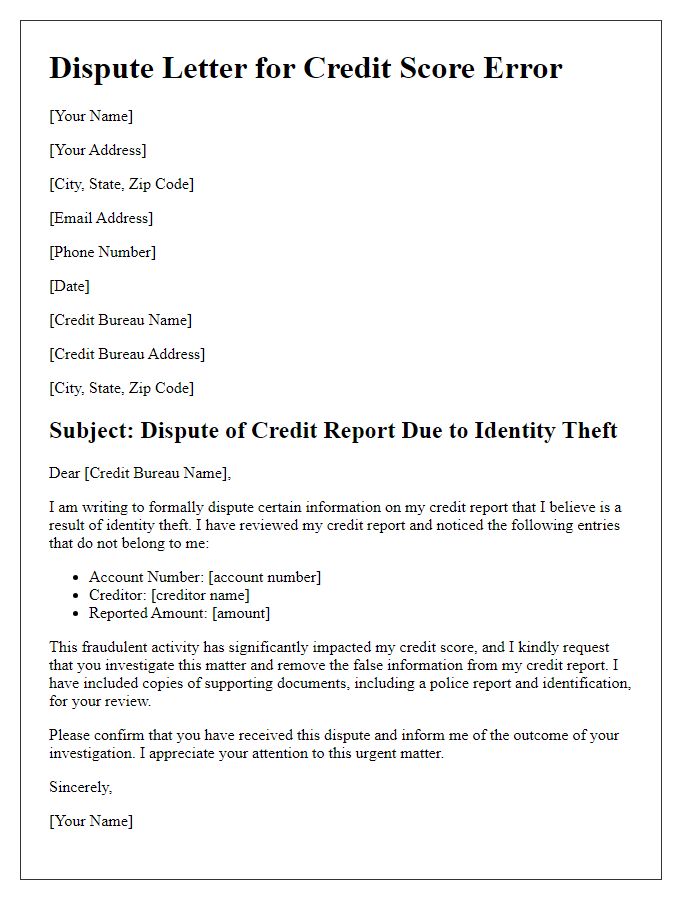

Detailed Description of Dispute

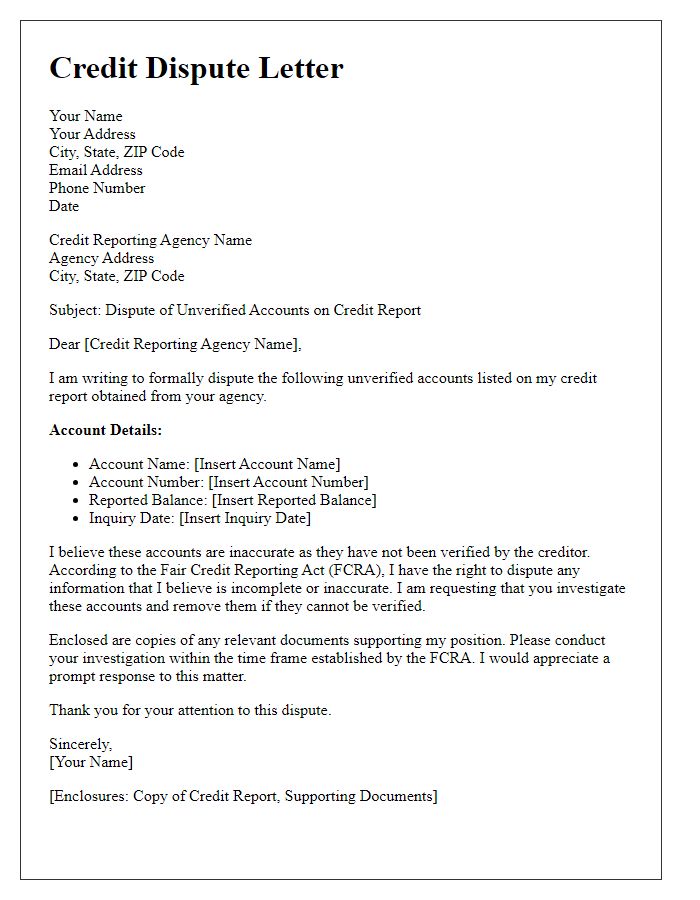

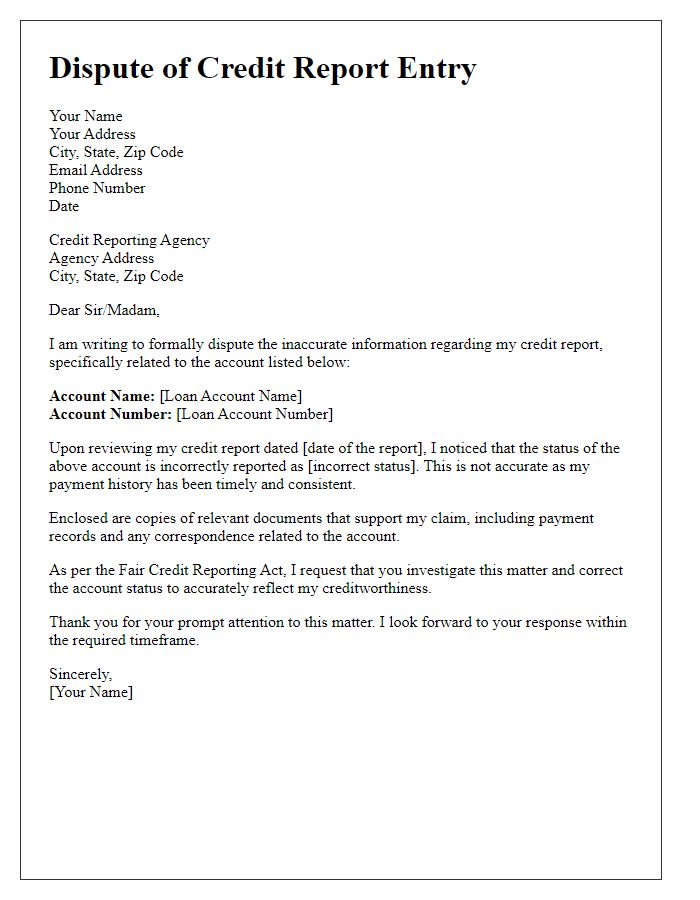

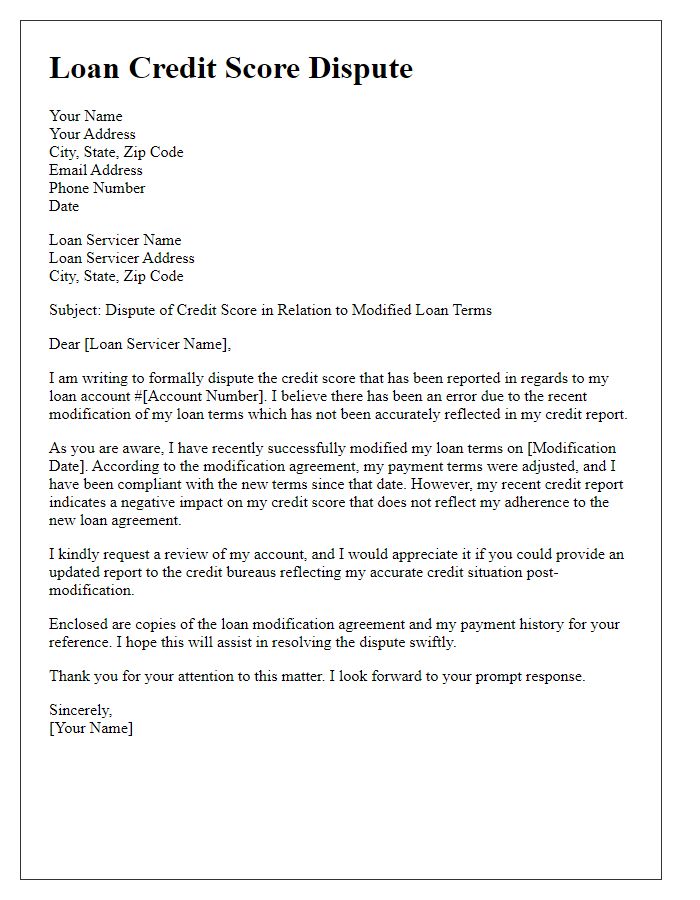

Disputing inaccuracies on a credit report requires clarity and precision. A credit score dispute often arises when individuals notice discrepancies relating to their credit history or specific accounts. For instance, an individual may find a late payment flagged on their report dated March 2023 for an account with XYZ Bank, which had been consistently paid on time. This erroneous late payment can significantly lower the credit score, affecting loan approval chances and interest rates. Details such as the account number, the specific date of the discrepancy, and supporting documents like bank statements or payment receipts should be included in the dispute. Moreover, referencing the Fair Credit Reporting Act can strengthen the case, emphasizing the individual's right to an accurate credit report. Prompt correction can ensure that the credit score reflects true payment behavior, restoring financial credibility.

Supporting Documentation

Disputing a loan credit score requires meticulous documentation to support claims of inaccuracies. Personal credit reports from agencies like Experian provide a comprehensive summary of credit history. Documentation may include recent bank statements highlighting transactions, payment records proving on-time payments, and correspondence with creditors showcasing dispute resolutions. Providing evidence from loan agreements, such as mortgage statements or auto loan documents, strengthens the case against erroneous negative entries. Additionally, including identity verification materials, such as government-issued photo ID or recent utility bills, underscores the legitimacy of the dispute. This robust collection of supporting documentation establishes a clearer narrative for credit bureaus.

Clear Request for Resolution

Disputing inaccurate information on a credit report is crucial for maintaining a healthy financial profile. Individuals may encounter discrepancies that could impact loan eligibility and interest rates. The Fair Credit Reporting Act (FCRA) allows consumers to challenge erroneous data. Documenting the dispute with key details such as the credit reporting agency name, account numbers, and specific inaccuracies is essential. Including supporting evidence like payment receipts or correspondence with lenders strengthens the case. Timely resolution of disputes can enhance credit scores, ultimately providing access to better loan terms and opportunities.

Contact Information for Follow-up

A loan credit score dispute can significantly impact an individual's financial opportunities. Accurate contact information is essential for timely communication and resolution. Include full name, current address, and a phone number where the individual can be reached, ensuring all details are up-to-date. An email address can provide an additional avenue for correspondence, facilitating a quicker response from financial institutions or credit agencies. A reference number (if applicable) related to the dispute can streamline the follow-up process, allowing for easier tracking of the case. Furthermore, specific instructions on the preferred method of contact can enhance the efficiency of resolving the dispute, fostering clarity between the individual and the concerned parties.

Letter Template For Loan Credit Score Dispute Samples

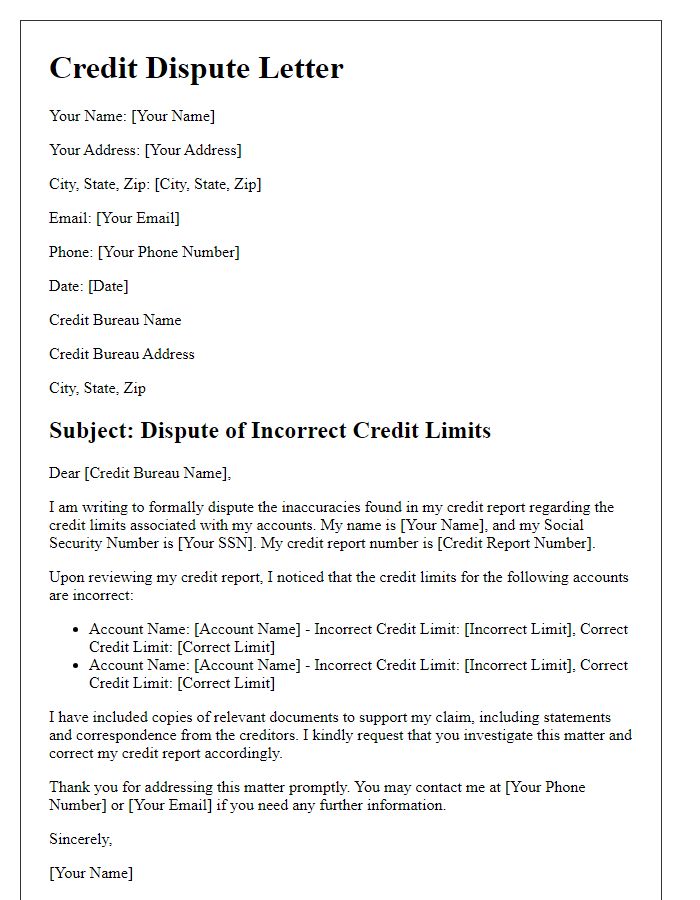

Letter template of loan credit score dispute for incorrect credit limits

Comments