Are you looking for peace of mind regarding your loan agreement? Writing a confirmation letter can streamline the process, ensuring that both parties are on the same page. In this article, we'll guide you through the key components of a well-structured loan agreement confirmation letter. Ready to learn the essential tips and templates? Let's dive in!

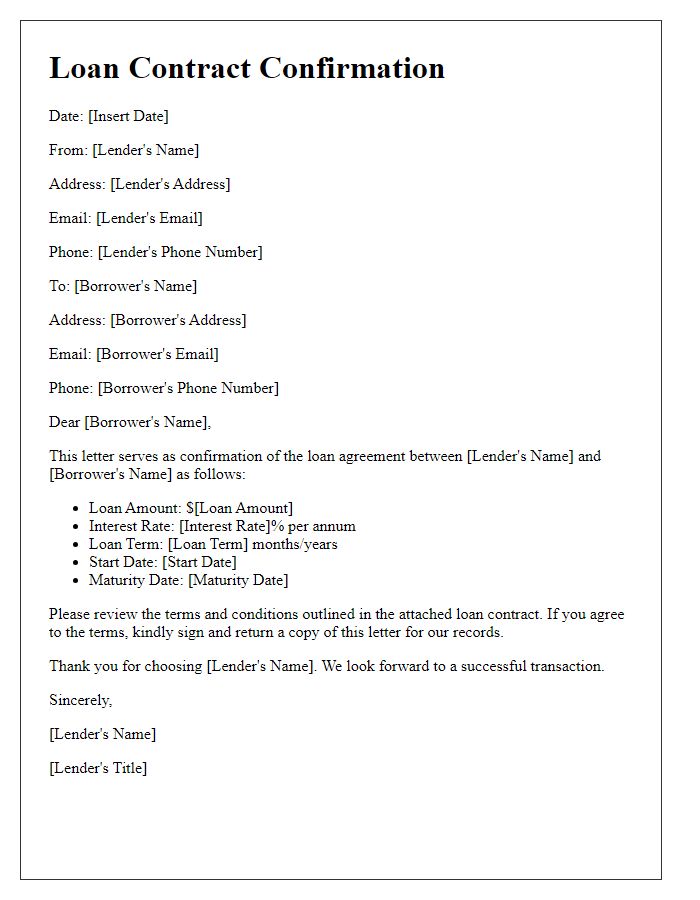

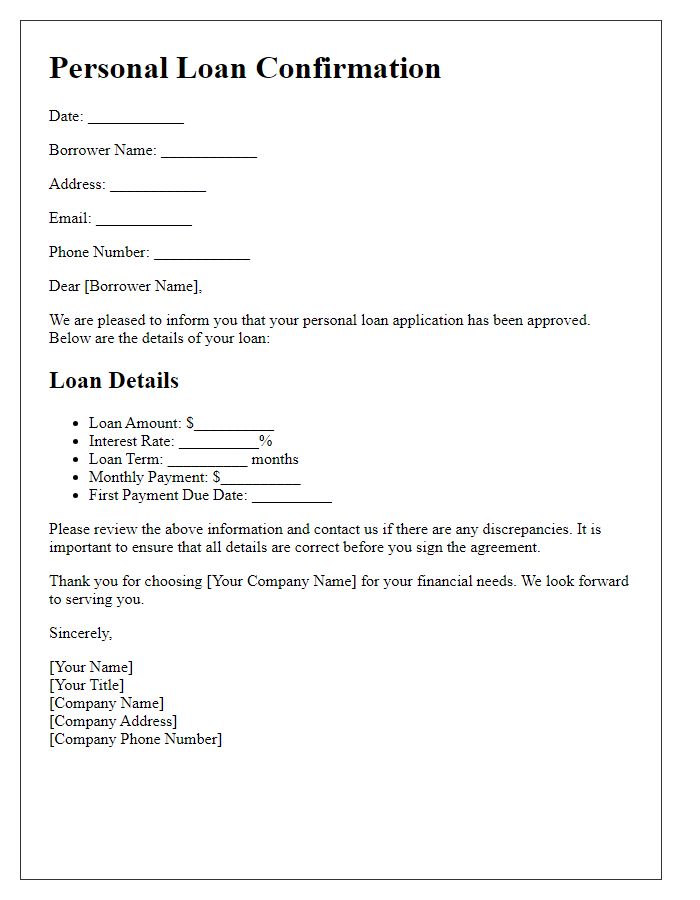

Borrower and lender details

The loan agreement confirmation outlines essential information between the borrower and the lender to formalize the financial arrangement. The borrower, Jane Doe, residing at 123 Maple Street, Springfield, secured a loan of $25,000, while the lender, XYZ Financial Institution, located at 456 Oak Avenue, Springfield, is providing the loan under specific terms. The loan has an interest rate of 5% per annum, with a repayment period of three years, culminating in total repayment of $29,500. Additionally, both parties acknowledge the provisions related to default and the consequences therein, ensuring clarity in responsibilities and obligations. Proper documentation will be maintained for legal proceedings and future reference, safeguarding both the borrower's and lender's interests.

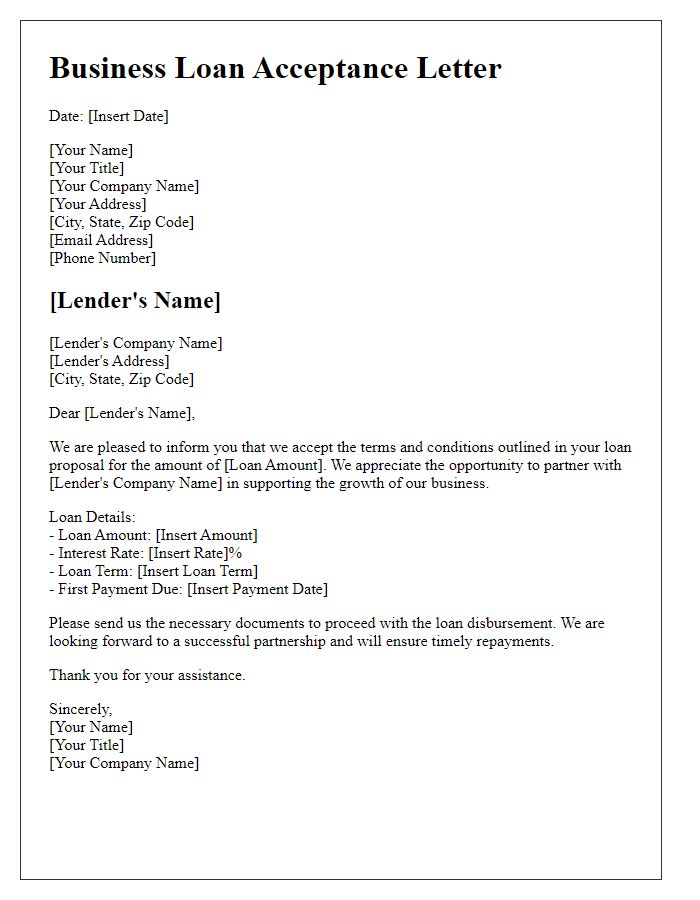

Loan amount and interest rate

A loan confirmation letter details financial terms, including principal amount and interest rate. The principal amount (often in thousands or millions) represents the total money borrowed. The interest rate (fixed or variable) defines the cost of borrowing, expressed as a percentage. For instance, a loan amount of $50,000 with an interest rate of 5% annually signifies the borrower repays $2,500 interest each year. A formal agreement outlines repayment terms, including duration, monthly installments, and penalties for late payments. Clarity in these details ensures both parties understand their financial commitments fully.

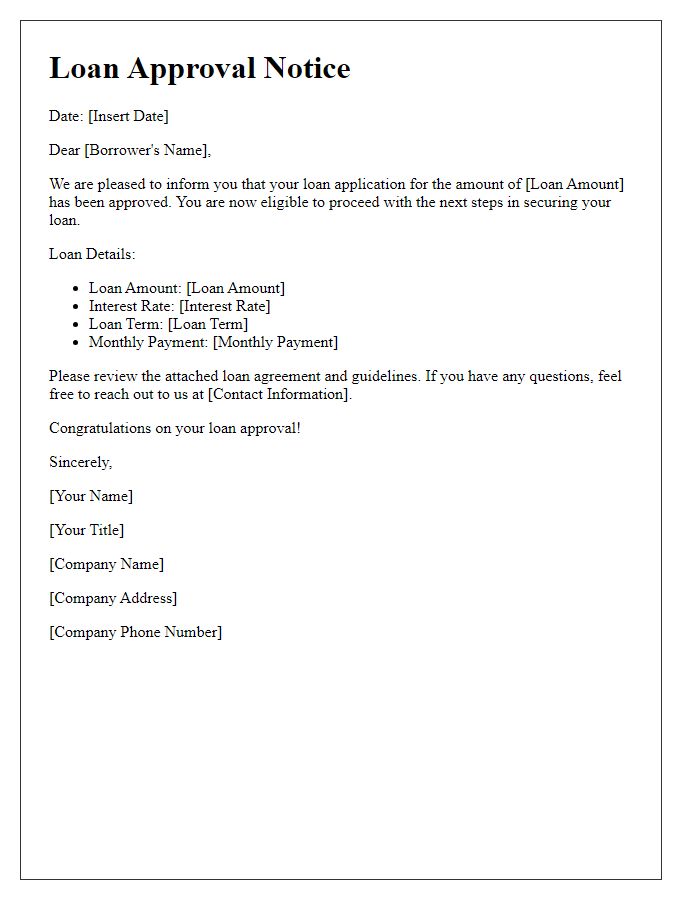

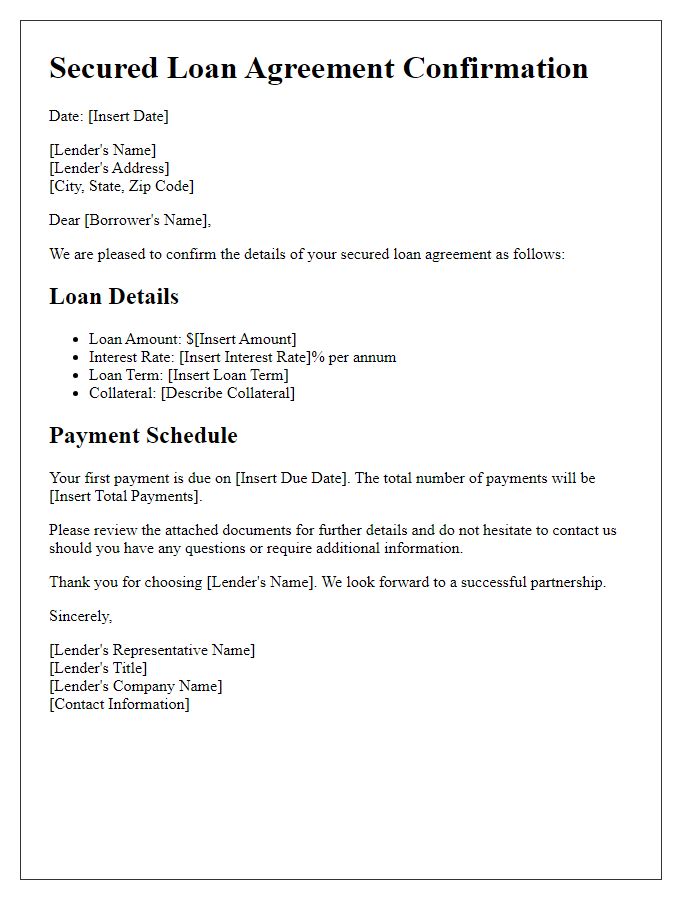

Repayment terms and schedule

The loan agreement outlines the repayment terms and schedule for the borrower, reflecting a loan amount of $50,000 issued by a financial institution such as Wells Fargo Bank. This agreement specifies a fixed interest rate of 5% APR, which translates to a monthly payment of approximately $1,060 over a term of five years. The initial payment is due on January 1, 2024, with subsequent payments due on the first of each month. In addition, provisions for late fees of $50 for payments received after the 15th of the month are included, ensuring timely payment compliance. The borrower must also provide proof of income and maintain a minimum credit score of 650 throughout the loan term, as stipulated in the agreement.

Collateral and security agreements

In loan agreements, collateral and security agreements involve specific assets used to secure the loan. Commonly, real estate (such as homes or commercial buildings) serves as collateral, with values often assessed by professional appraisers. Additionally, personal property, including vehicles or equipment, may be included as security assets. Legal documents, such as UCC filings, are essential for establishing the lender's claim over the collateral in case of default. Details surrounding the loan amount, interest rates, and repayment terms are outlined, ensuring clarity and legal enforceability for both parties involved. Accurate descriptions and valuations of collateral help mitigate risks and clarify the lender's security interests.

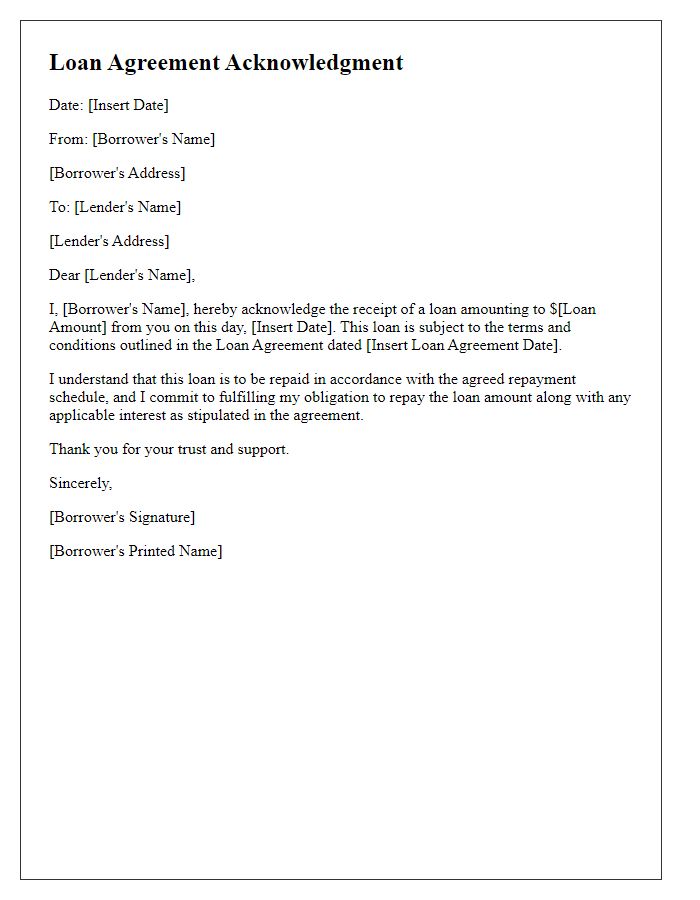

Signatures and date of agreement

A loan agreement confirmation requires specific details to ensure clarity and enforceability. The agreement typically contains essential information such as the borrower's full name, loan amount (e.g., $10,000), interest rate (e.g., 5% per annum), repayment period (e.g., 24 months), and payment dates (e.g., the first payment is due on March 1, 2024). It is vital to include the lender's full name and address, along with the borrower's contact details to establish clear communication. The following section should indicate both parties' signatures with corresponding dates, demonstrating mutual consent and a legally binding contract, which will safeguard interests and expectations. Additionally, specifying any terms regarding default, late fees (e.g., $50), and prepayment options is essential for comprehensive agreement clarity.

Comments