Are you feeling frustrated after your recent loan rejection? You're not alone â many individuals face similar setbacks in their financial journeys. However, understanding how to effectively appeal a rejection can turn your situation around and open doors to opportunities. Join me as we explore a comprehensive letter template that could help you successfully present your case and possibly change the lender's mind!

Clear and Concise Subject Line

Loan rejection appeals often require strong justification and clarity of purpose to effectively communicate the request. A clear and concise subject line for such a letter might read: "Request for Reconsideration of Loan Application Denial - [Your Name/Loan Application ID]." This subject line provides immediate context, identifies the purpose of the correspondence, and ensures that it is easily searchable within administrative systems, facilitating a prompt response from the relevant financial institution's review team. Including specific identifiers adds a layer of professionalism and organization, demonstrating attention to detail crucial for effective communication.

Polite and Respectful Tone

Loan rejection appeals can be addressed with a thoughtful approach. Here is a detailed description of the process and considerations involved in such an appeal. When appealing a loan rejection, the applicant emphasizes specific reasons for the appeal, detailing their financial situation. Financial history highlights factors like credit scores, which often reflect the applicant's payment reliability, and income details, showing the capability to repay the loan. The applicant may include evidence of consistent income, including pay stubs from recent employment or tax documents from the previous year, ensuring to demonstrate a stable financial trajectory. Additionally, the individual can mention their relationship with the lending institution, possibly mentioning prior successful transactions or long-standing accounts, which could convey trust and reliability. It is advisable to express sincere appreciation for the initial consideration of the application, while clearly stating the belief that the rejection may have overlooked some important financial details or circumstances. This structured approach, coupled with necessary documents, increases the chances of a favorable reconsideration from the lending institution.

Reference to Specific Reasons for Rejection

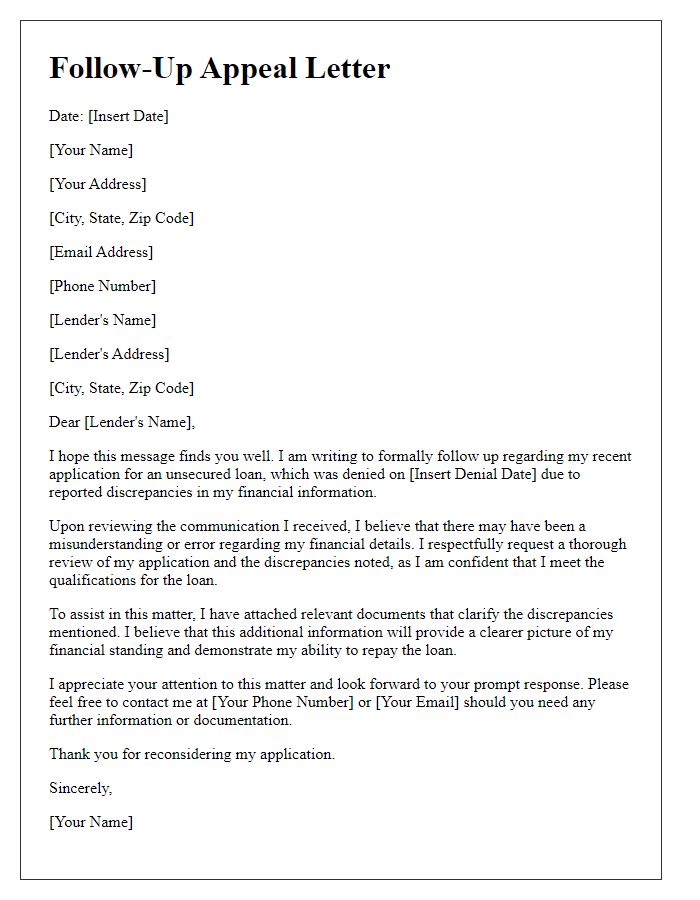

A loan application rejection can be disheartening, particularly when it stems from specific factors such as insufficient credit history, low credit score, or high debt-to-income ratio. For instance, an applicant with a credit score below 650, considered subprime, may face increased scrutiny, despite a steady income of $5,000 per month. Additionally, a debt-to-income ratio exceeding 40% can raise red flags for lenders, signaling potential repayment difficulties. Addressing these specific reasons, such as presenting enhanced financial documentation or demonstrating clearer repayment strategies, can strengthen an appeal. A detailed narrative explaining recent improvements in credit behavior or job stability could also be beneficial in reassessing the initial decision made by the lending institution.

Evidence or Supporting Documents

Loan rejection appeals often require supporting documents to bolster the argument for reconsideration. Essential documents include the loan application (detailing financial information), credit report (highlighting credit scores and history), income statements (such as recent pay stubs or tax returns), and bank statements (showing available funds and saving patterns). Additionally, any correspondence received from the lender (such as rejection letters or comments on the denial), evidence of improved credit situations (like recent debt repayment or increased income), and a personal statement explaining circumstances can significantly strengthen the appeal. Gathering comprehensive and organized documentation increases the chances of successfully overturning the initial loan decision.

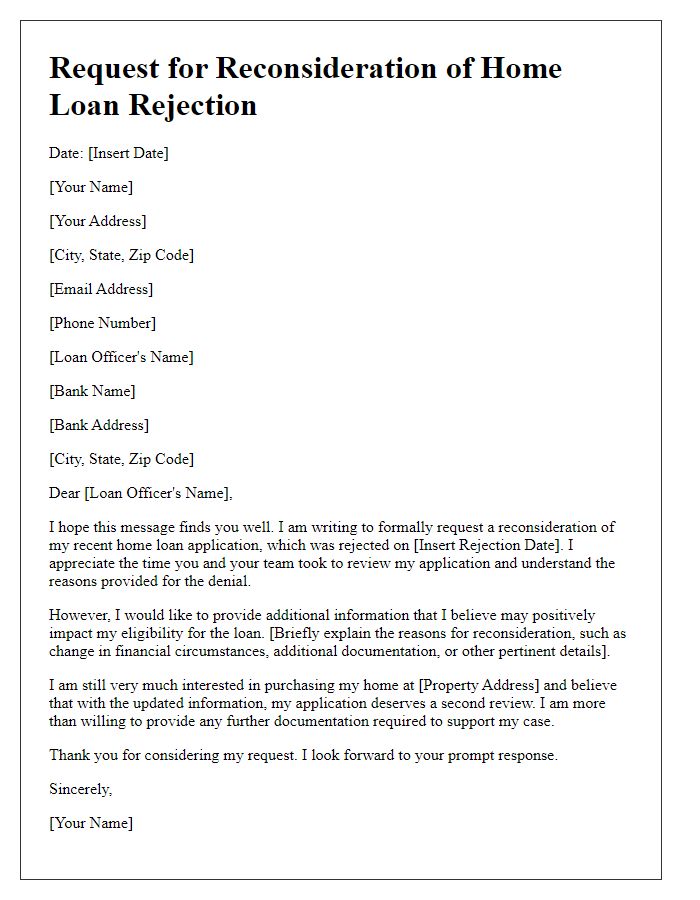

Request for Reconsideration or Next Steps

Loan rejection can significantly impact financial plans and future endeavors. Affected individuals should directly reach out to the lender, gathering necessary documentation illustrating their financial circumstances. Highlight changes in income, credit score improvement, or significant employment stability since the initial application. Include specific loan types, such as FHA or conventional loans, as these can have differing requirements. Address the lender's concerns noted in the rejection letter, which may include debt-to-income ratio or insufficient credit history, and propose a plan to rectify these issues. Timely communication within 30 days of the rejection can demonstrate proactive engagement, potentially increasing the chance of reconsideration.

Letter Template For Appealing Loan Rejection Samples

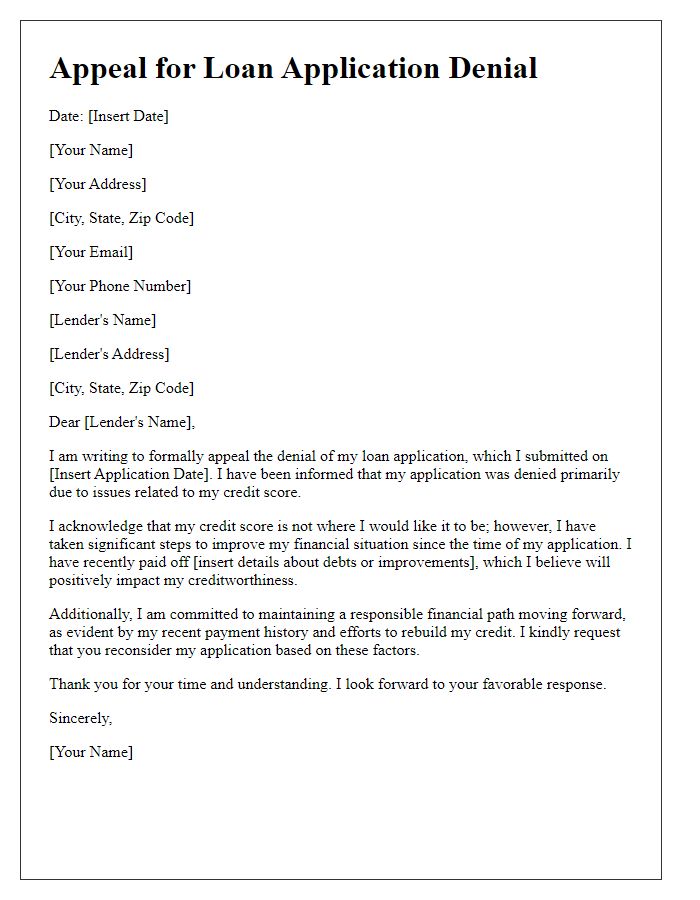

Letter template of appeal for loan application denial due to credit score issues.

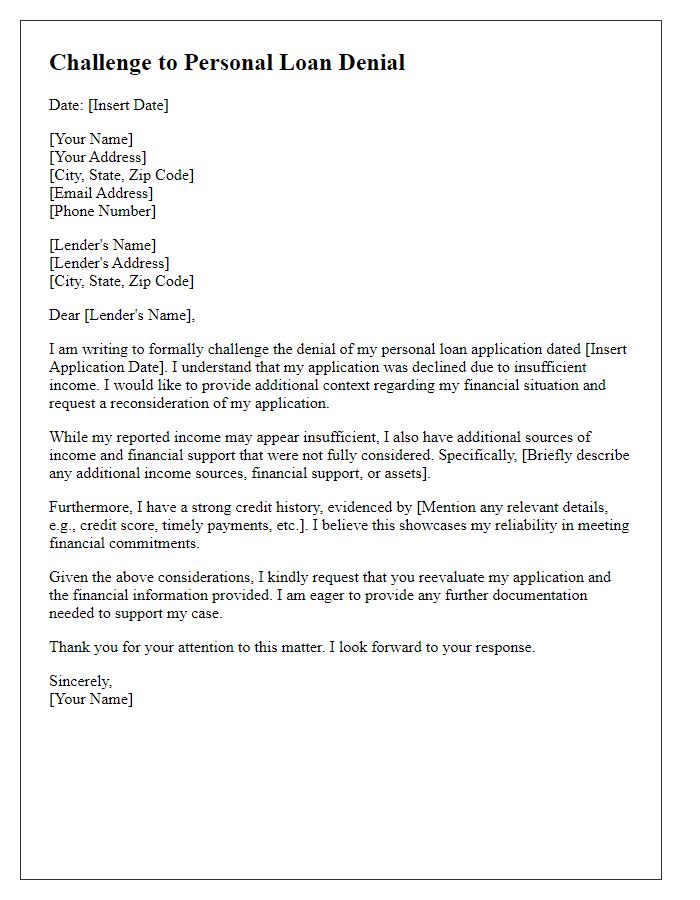

Letter template of challenge to personal loan denial based on insufficient income.

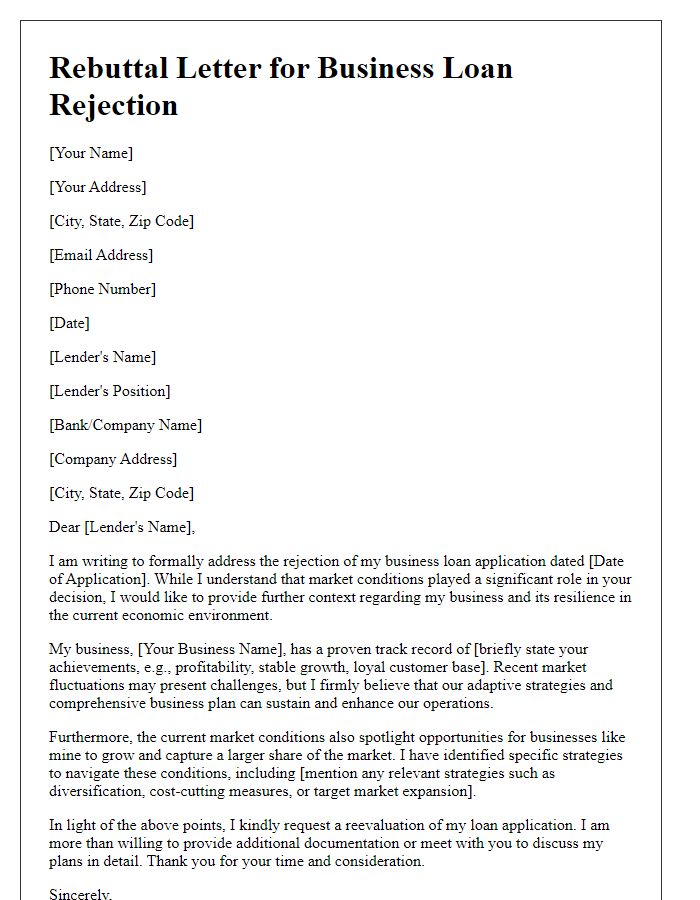

Letter template of rebuttal for business loan rejection due to market conditions.

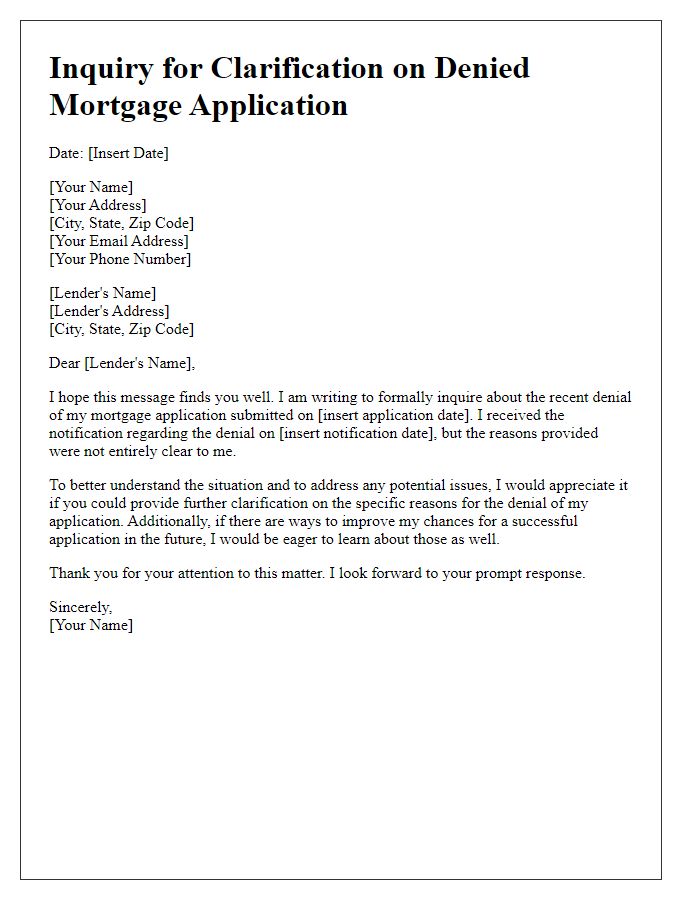

Letter template of inquiry for clarification on denied mortgage application.

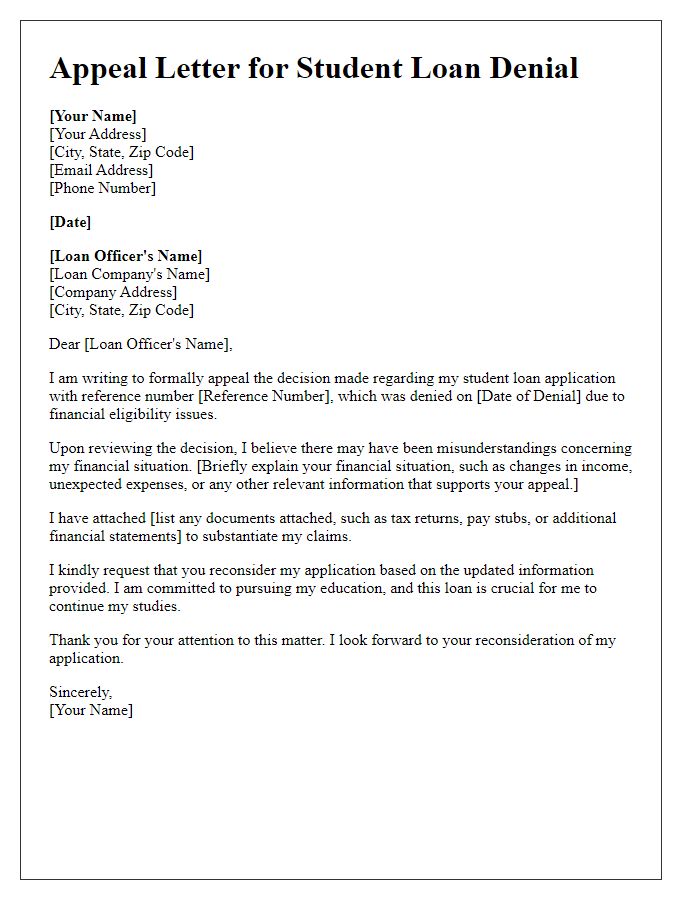

Letter template of appeal regarding denied student loan for financial eligibility.

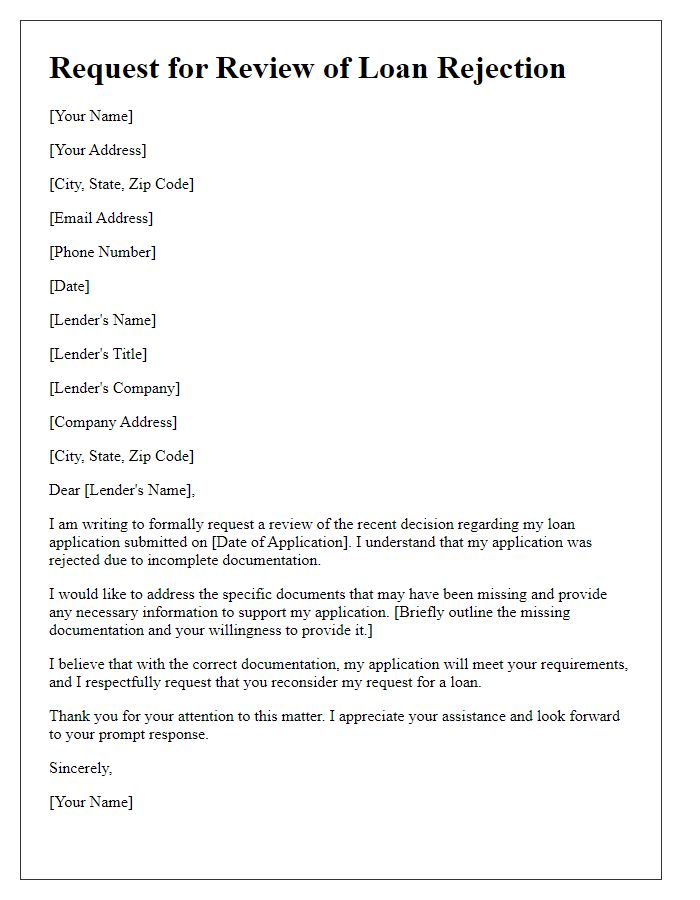

Letter template of request for review of loan rejection stemming from incomplete documentation.

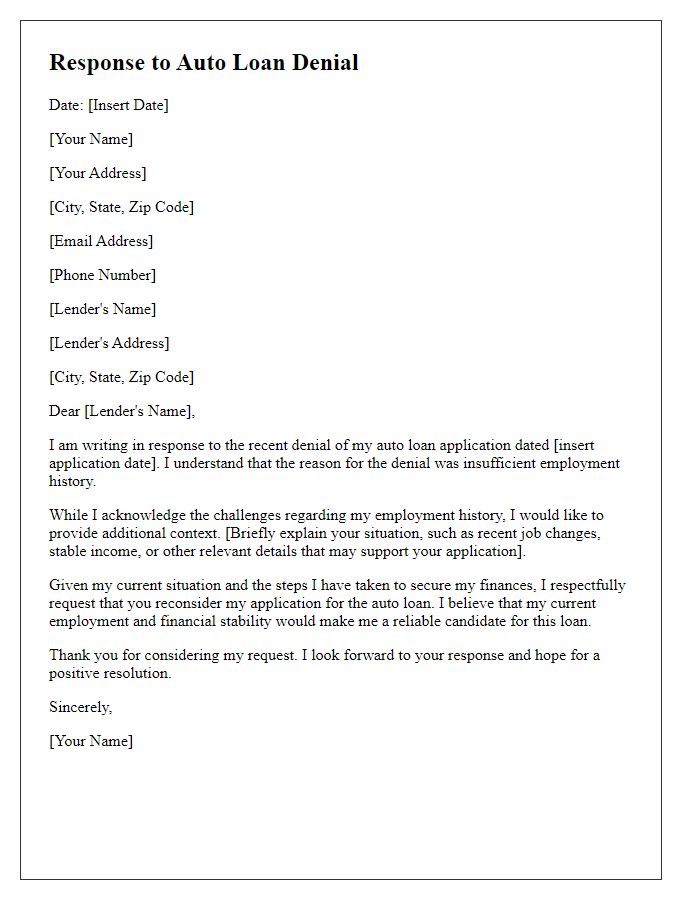

Letter template of response to auto loan denial for insufficient employment history.

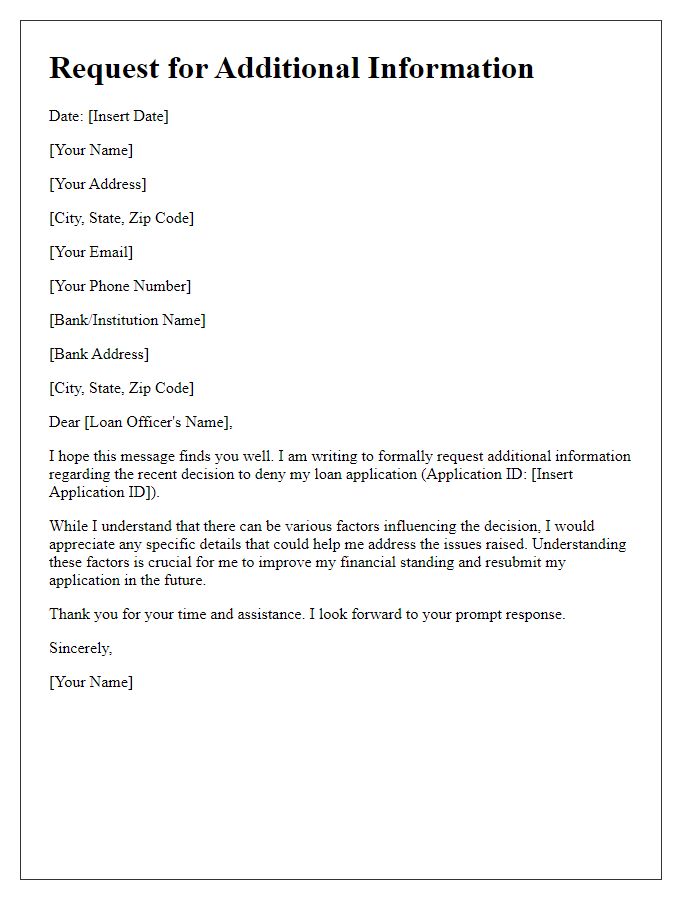

Letter template of submission for additional information after loan rejection notice.

Comments