Navigating the loan application process can often feel like an uphill battle, especially when you've been faced with a denial. It's essential to understand the proper way to appeal this decision, ensuring that your voice is heard and your circumstances are taken into account. In this article, we'll guide you through the intricate steps of crafting a compelling appeal letter, providing tips and examples to bolster your case. Ready to turn your loan application dreams into reality? Let's dive in!

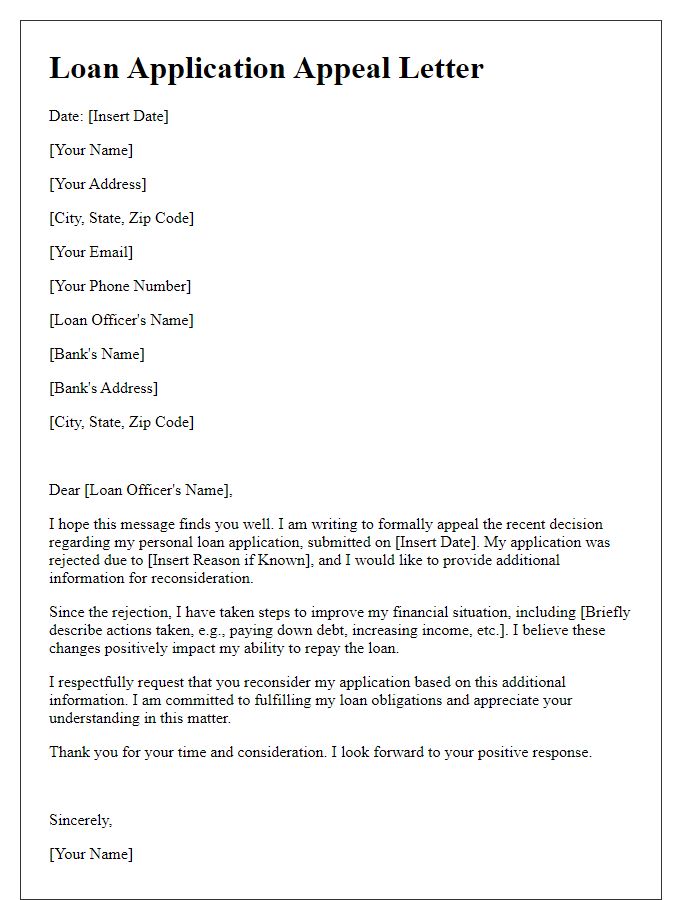

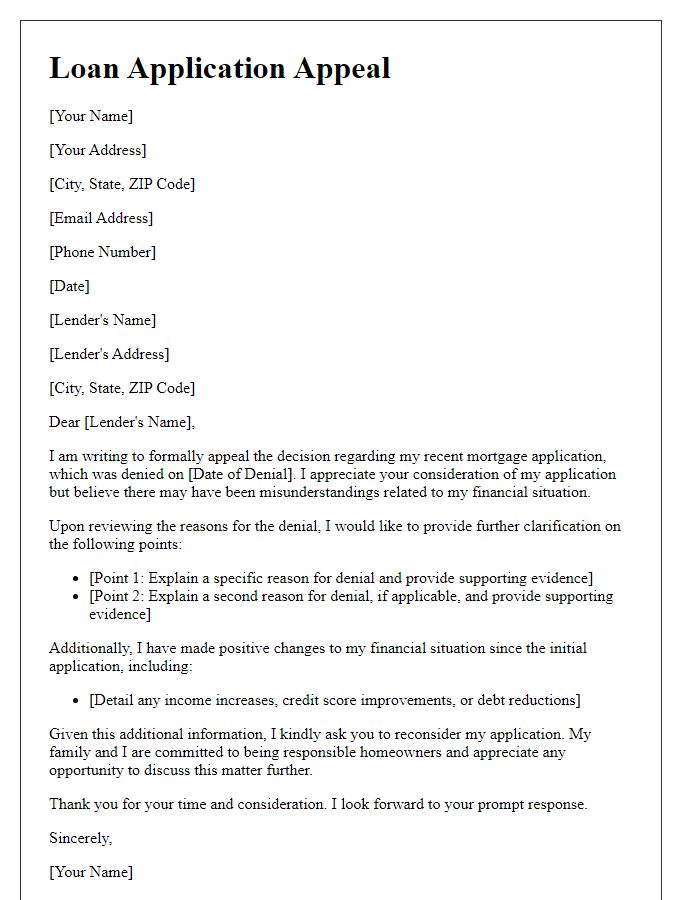

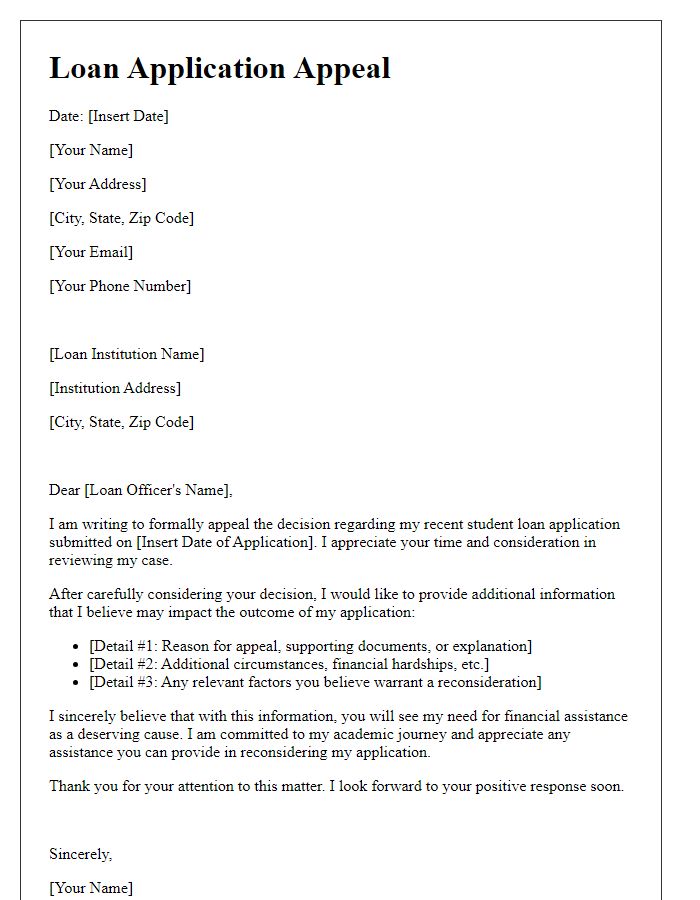

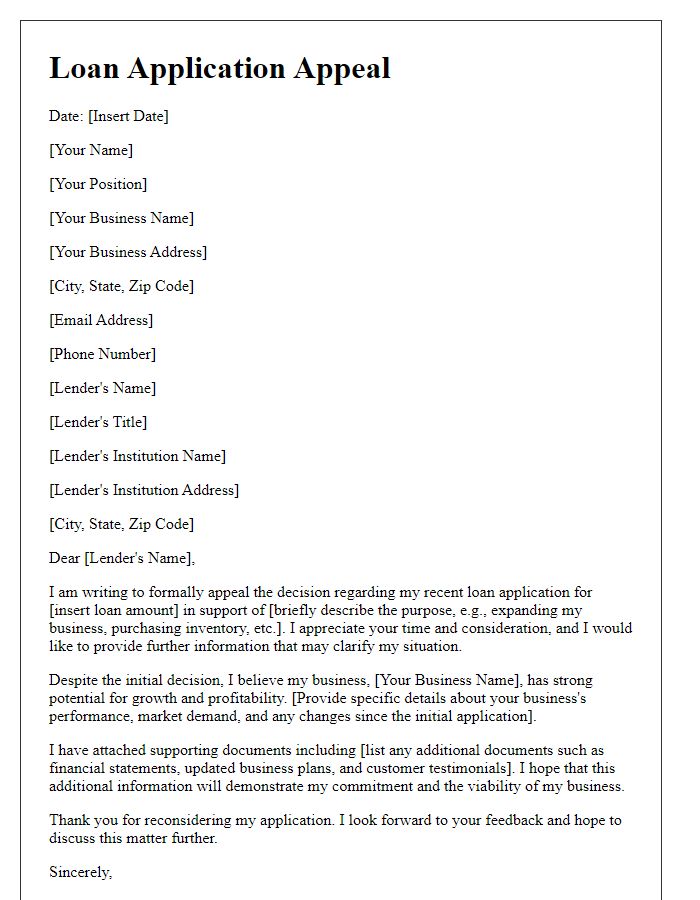

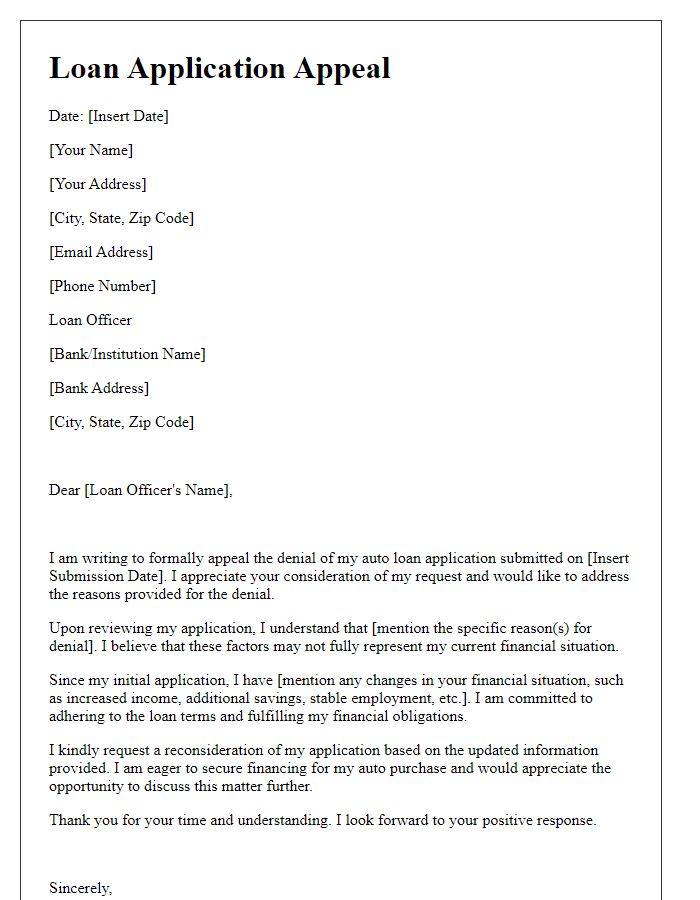

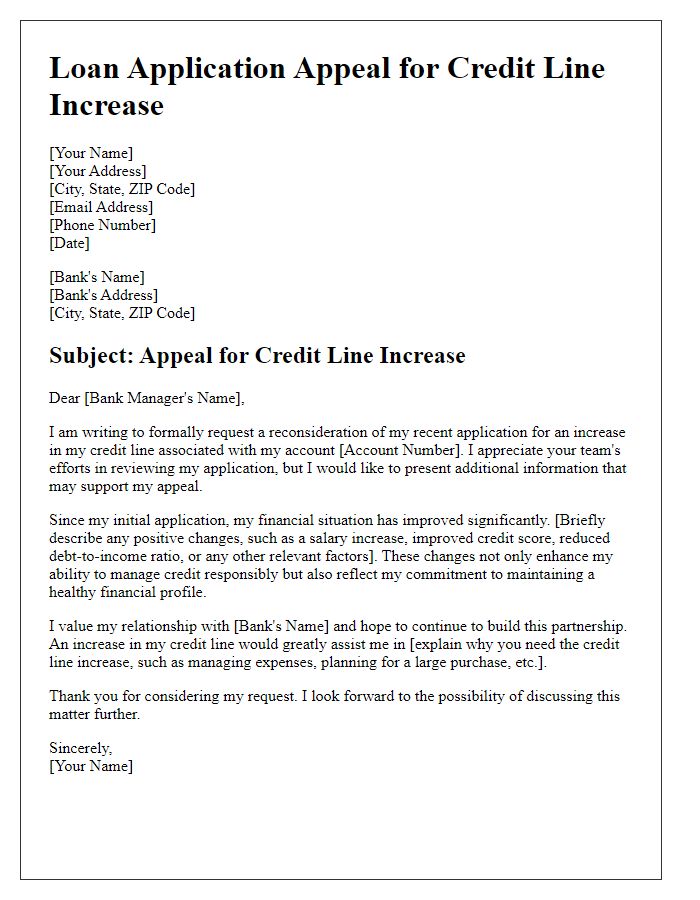

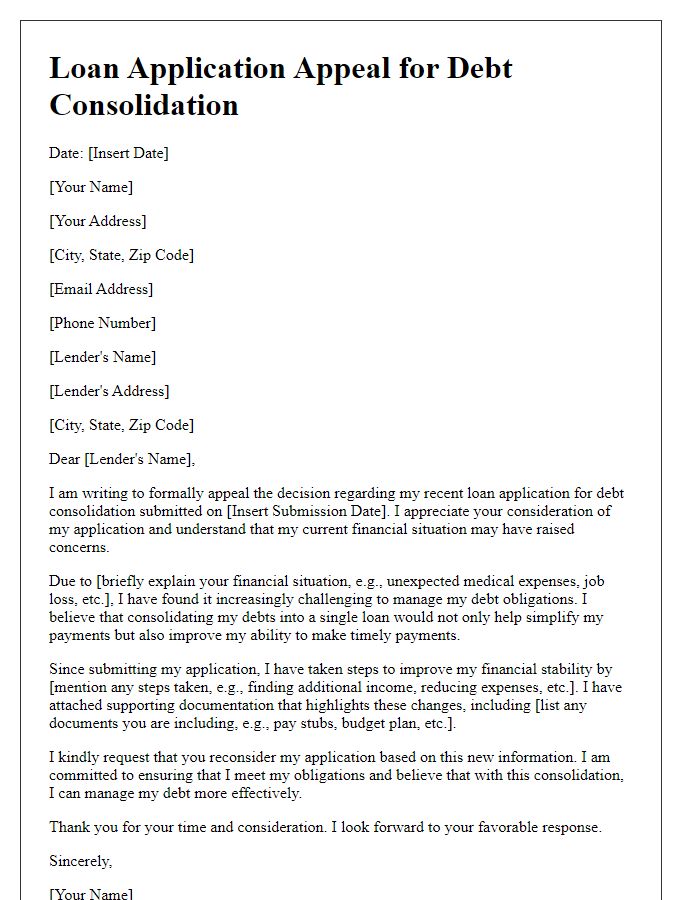

Personal Information

When applying for a loan, providing detailed personal information is essential for assessment by financial institutions. Applicants typically include full names, residential addresses (including city and ZIP code), date of birth (to confirm age), Social Security numbers (for identity verification), and contact numbers (both mobile and home). Employment details, such as job title and length of employment, also contribute to the assessment of financial stability. Additionally, annual income figures (gross and net) are crucial for evaluating repayment ability. Further, including information about any existing debts or loans, such as credit card balances or mortgage loans, helps create a comprehensive financial profile for underwriters.

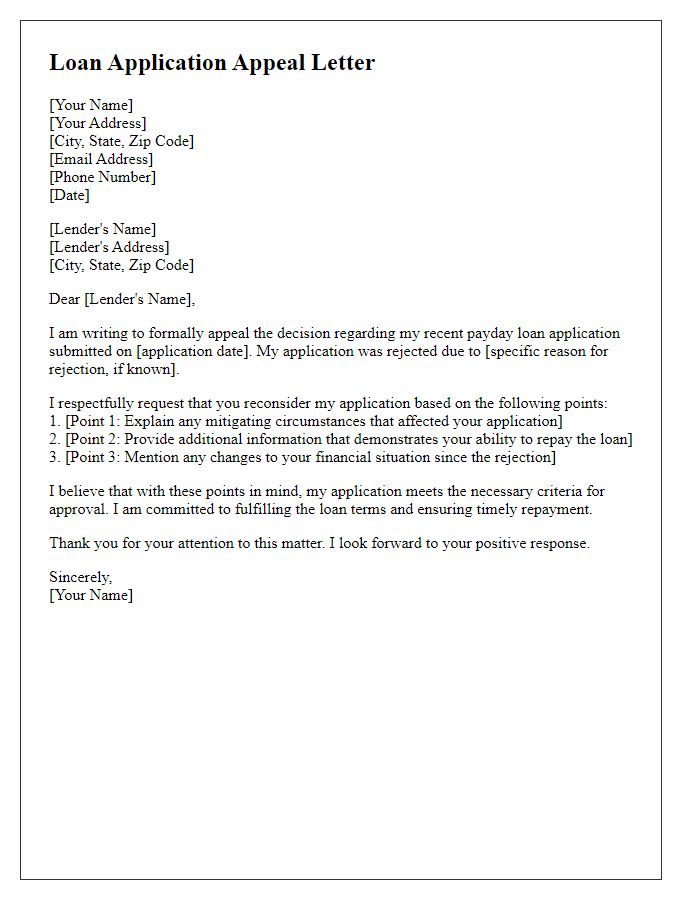

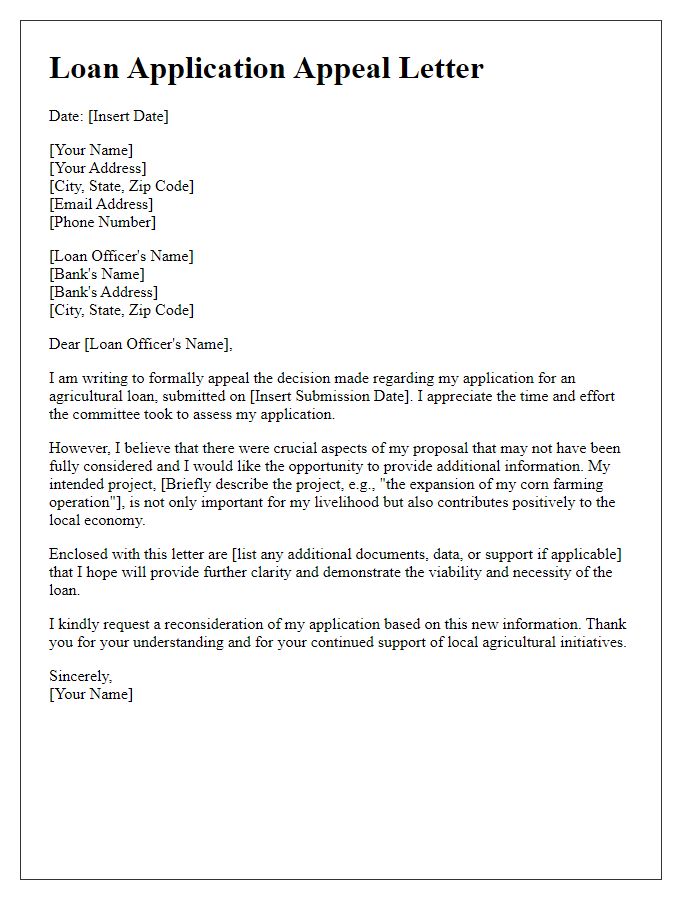

Loan Application Details

Loan applications can encounter a variety of challenges that may necessitate an appeal, especially in cases of denial. Key details involved in the appeal process include the Loan Application ID, which serves as an essential reference for tracking and reviewing the original submission. Furthermore, the applicant's credit score, typically measured on a scale from 300 to 850, plays a critical role in determining eligibility and can significantly impact the outcome of the appeal. Events surrounding the application, such as changes in employment status (for instance, employment history over the last two years) and income fluctuations, can also influence the lender's reconsideration. Moreover, providing detailed documentation, including proof of assets (bank statements, investment portfolios) and debt obligations, is crucial to present a comprehensive picture of financial health to the lending institution. Lastly, geographic location (such as the specific state or city where the applicant resides) can affect loan terms based on regional economic conditions or housing market dynamics.

Reason for Appeal

Inadequate credit history can significantly impact the approval of loan applications, particularly for first-time borrowers. A limited credit score, often below 650, indicates potential risk to lenders, impacting their assessment and decision-making process. Additionally, a recent increase in debt-to-income ratio, exceeding 40%, can further exacerbate concerns regarding loan repayment capacity. Recent financial events, such as job loss or medical emergencies, can negatively affect an applicant's financial stability and raise red flags. Highlighting mitigating factors, such as steady employment history over five years and consistent monthly savings of at least 20% of income, could demonstrate financial responsibility and potentially sway lenders towards reconsideration of the loan application.

Supporting Documentation

An effective loan application appeal requires comprehensive supporting documentation that strengthens your case. Essential documents may include your credit report, showcasing your credit score and payment history as of October 2023. Provide income verification, such as recent pay stubs (from the last two months), W-2 forms, or tax returns for the past two years from the IRS, illustrating your financial stability. Include bank statements from the last three months, detailing your savings and checking account balances. Additionally, present a detailed explanation of any adverse events (such as job loss or medical expenses) that may have impacted your financial situation, supported by relevant bills or termination letters. If applicable, offer evidence of assets, such as real estate appraisals or vehicle titles, demonstrating your capability to secure the loan. Ensure all documents are organized and clearly labeled for reviewers, facilitating an efficient evaluation process.

Request for Reconsideration

A loan application appeal involves a formal request for reevaluation of a previously denied loan application. Applicants often provide additional documentation such as improved credit scores, recent tax returns, or proof of stable income to strengthen their case. The appeal may be directed to the financial institution's lending department, typically within a 30-day window from the initial denial date, prompting an internal review process. Specific details about the loan type--such as a mortgage loan for a home in California or a personal loan for debt consolidation--can highlight the intended use of the funds and demonstrate responsibility. Successful appeals often include a personal narrative, emphasizing unique circumstances such as medical emergencies or job loss that may have affected financial standing. Supporting documents such as bank statements and reference letters can enhance credibility during this critical reconsideration phase.

Comments