When it comes to securing a loan or credit, understanding substitute collateral requirements can be a bit of a puzzle. Many find themselves wondering how alternative assets might play a role in their financial journey. Whether you're looking to leverage personal property, investments, or other creative solutions, it's essential to know what lenders typically accept. So, if you're curious about how to navigate these requirements and enhance your borrowing potential, keep reading to find out more!

Salutation and Addressee Information

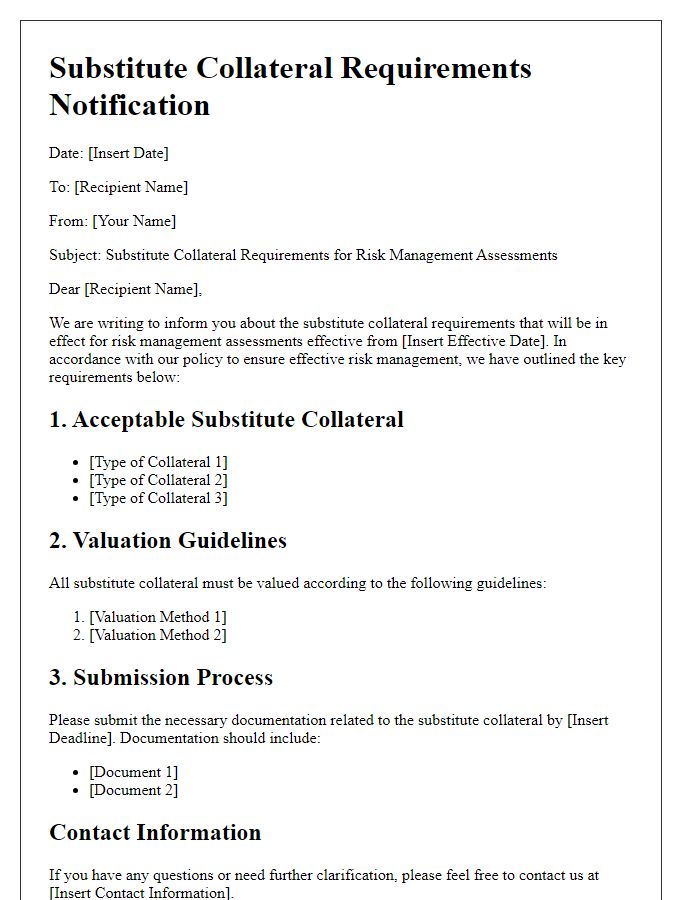

Substitute collateral requirements are critical when managing financial transactions or securities lending arrangements. Regulatory frameworks, such as the Dodd-Frank Act in the United States, necessitate detailed specifications on collateral types, which must typically include high-quality assets like government bonds or other approved securities. Entities like banks or investment firms may request substitutes when original collateral becomes insufficient or ineligible due to market fluctuations. The credit rating of substitutes should meet set standards, often above investment grade (BBB- or higher) to ensure financial stability. Documentation pertaining to collateral must include accurate valuations, described liquidity levels, and clear ownership details, often supported by reports from recognized credit agencies like Moody's or S&P Global Ratings.

Identification of Original Agreement and Collateral

Substitute collateral requirements necessitate clear identification of the Original Agreement, detailing the specific terms and conditions. The collateral, which may include assets like real estate or financial instruments, must also be outlined precisely. For instance, a mortgage (secured by the property at 123 Main St, Anytown, USA) can serve as effective collateral, while other tangible assets might include valuable artwork or machinery. Additionally, financial securities, such as stocks or bonds, might be included to ensure adequate coverage. Understanding the implications of these requirements is crucial in preserving the integrity of the agreement and protecting the interests of all parties involved.

Detailed Description of Substitute Collateral

Substitute collateral is essential in financial transactions to mitigate risk when primary collateral, such as cash or government securities, cannot be provided. This alternative security can include a range of asset classes, such as corporate bonds (issued by companies for funding), real estate properties (including commercial and residential buildings), or other liquid instruments like mutual funds (professionally managed investment portfolios). The value of substitute collateral must be assessed based on current market conditions, ensuring that it meets or exceeds the original collateral requirements. Asset valuation can be influenced by factors like credit ratings, historical performance, and liquidity in the market. In certain cases, guarantees from third parties can also serve as substitute collateral, enhancing the overall creditworthiness of the transaction. Each asset undergoes due diligence processes to evaluate risk and adequacy before being accepted.

Reason for Substitution Request

A request for substitution of collateral may arise due to various factors such as changes in market conditions or asset valuation shifts. Financial entities might seek to replace existing collateral with assets presenting lower risk profiles or higher liquidity, enhancing security against outstanding obligations. Regulatory frameworks, like the Basel III guidelines, could also necessitate adjustments in collateralization strategies to meet capital adequacy ratios. For instance, a corporation may substitute real estate property with Treasury bonds and ensure compliance with lender requirements, which could be more favorable under fluctuating interest rates or credit assessments. This proactive approach helps maintain the financial health and creditworthiness of the involved parties while optimizing risk management.

Assurance of Compliance and Legal Confirmation

The assurance of compliance and legal confirmation regarding substitute collateral requirements plays a vital role in financial agreements. Entities involved, such as banks or financial institutions, often outline specific conditions pertaining to substitute collateral, which refers to an alternative asset accepted to secure an obligation. Legal confirmation ensures adherence to regulations set forth by governing bodies, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA), which mandate proper documentation and evaluation of collateral value. Compliance requirements may include proper risk assessments, valuation reports, and adherence to margin requirements, ensuring that the substitute collateral meets the necessary standards to secure the transaction effectively. Additionally, proper legal validation serves to mitigate risks associated with defaults or fluctuations in asset values, protecting the interests of both lenders and borrowers in the dynamic financial landscape.

Letter Template For Substitute Collateral Requirements Samples

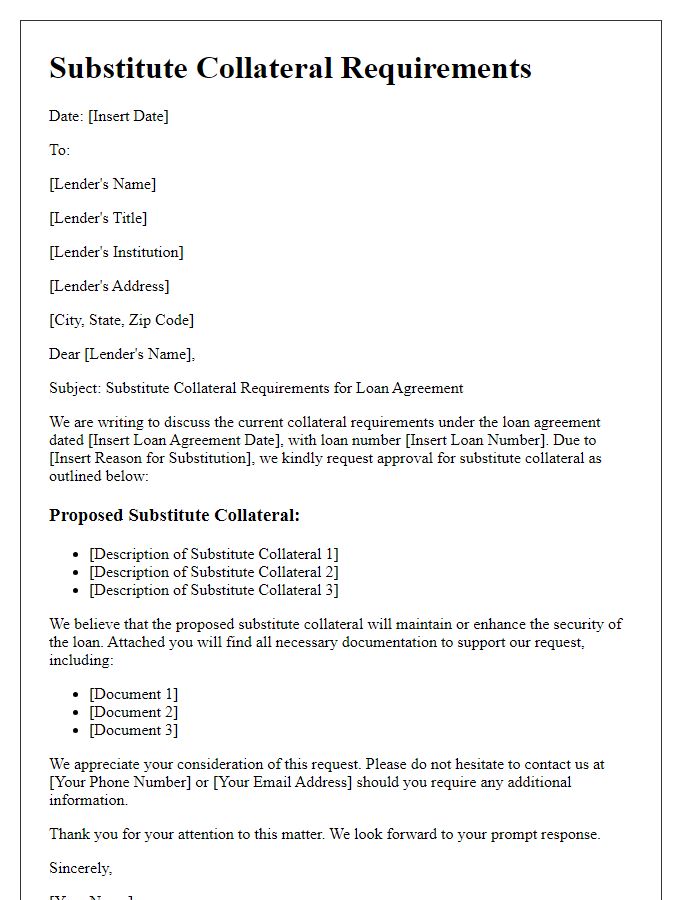

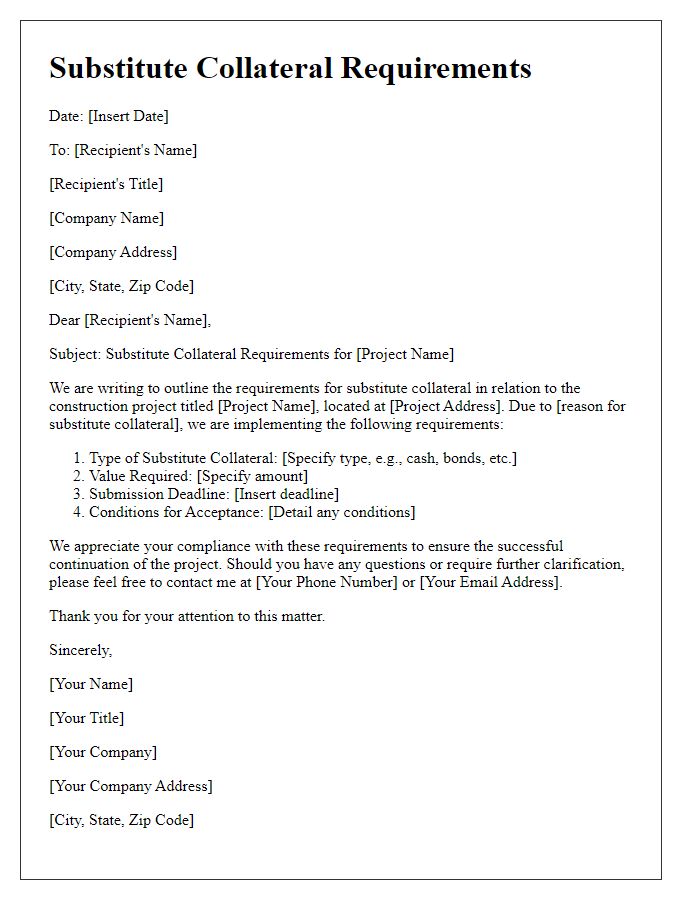

Letter template of substitute collateral requirements for loan agreements

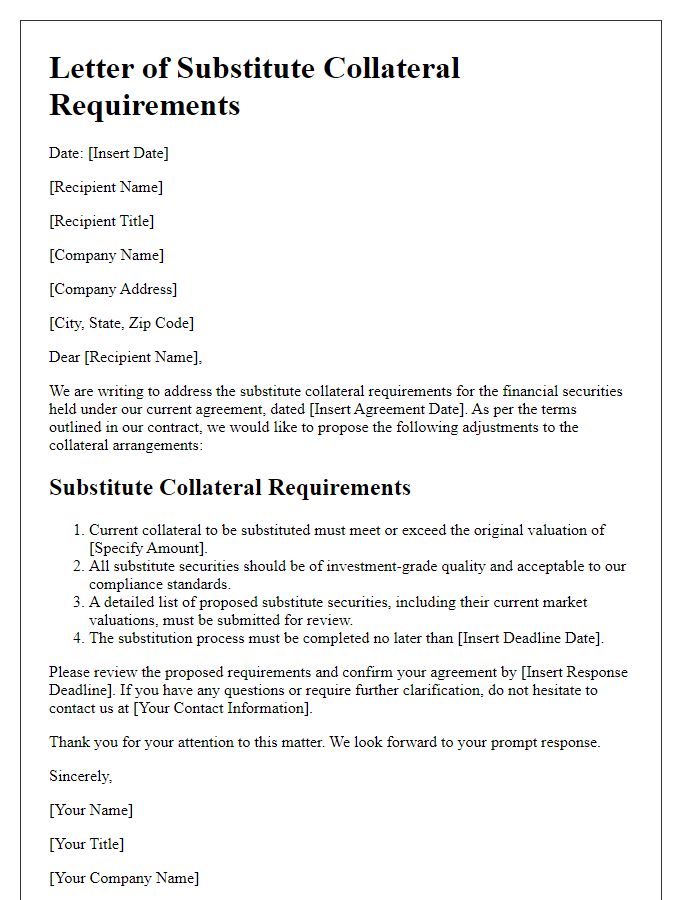

Letter template of substitute collateral requirements for financial securities

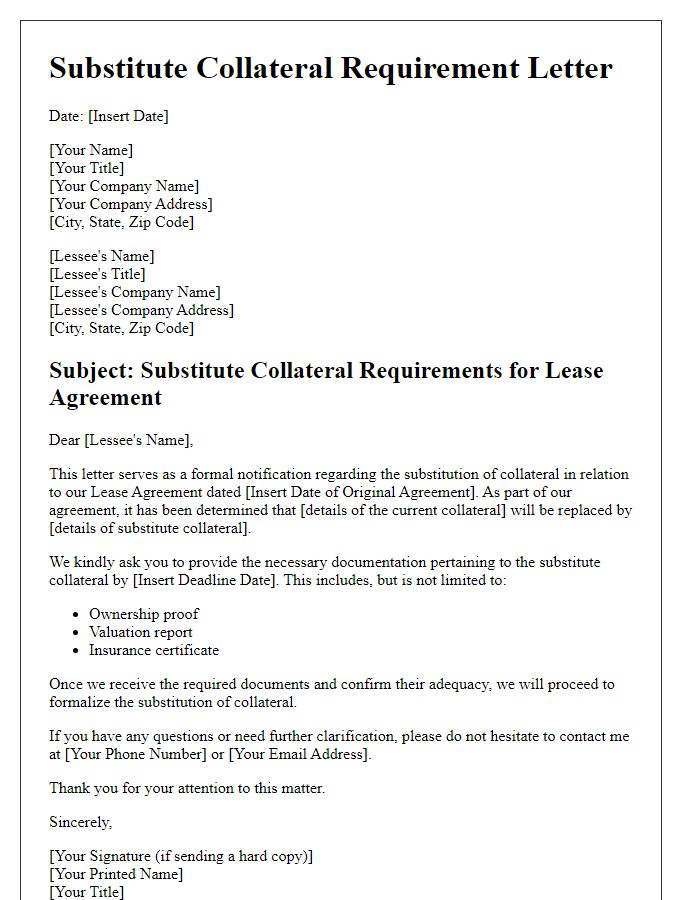

Letter template of substitute collateral requirements for lease agreements

Letter template of substitute collateral requirements for credit facilities

Letter template of substitute collateral requirements for derivative contracts

Letter template of substitute collateral requirements for real estate transactions

Letter template of substitute collateral requirements for business agreements

Letter template of substitute collateral requirements for investment purposes

Letter template of substitute collateral requirements for construction projects

Comments