As the seasons change, many of us find ourselves navigating new financial challenges, and that's perfectly okay! Whether it's unexpected expenses or a temporary shift in income, seasonal payment relief can be a lifeline. Here, we'll explore the various options available to you, making it easier to manage your financial well-being. So, grab a cup of your favorite seasonal drink, and let's dive into the details!

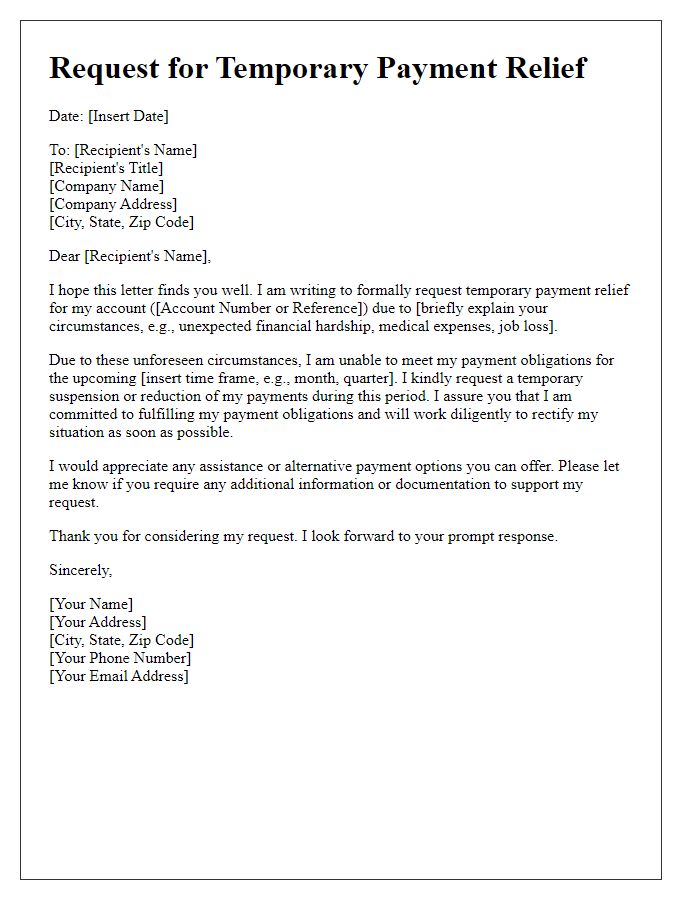

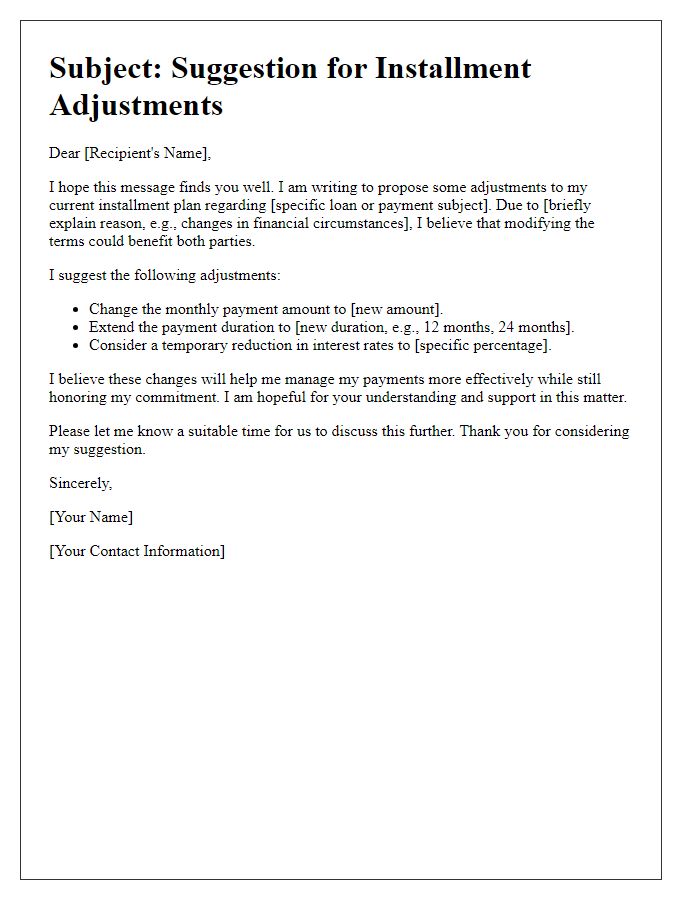

Concise and clear communication

Seasonal payment relief programs offer financial assistance during certain times of the year for individuals or families facing economic difficulties, like winter utility costs or summer cooling expenses. Annual enrollment periods, often from November to March, facilitate applications for assistance, targeting low-income households, seniors, or those with disabilities. Agencies such as the Low Income Home Energy Assistance Program (LIHEAP) provide funding to help cover heating bills during cold months. Clear and concise communication is essential in outlining eligibility criteria, deadlines for applications, and necessary documentation to ensure timely relief for applicants facing urgent financial burdens.

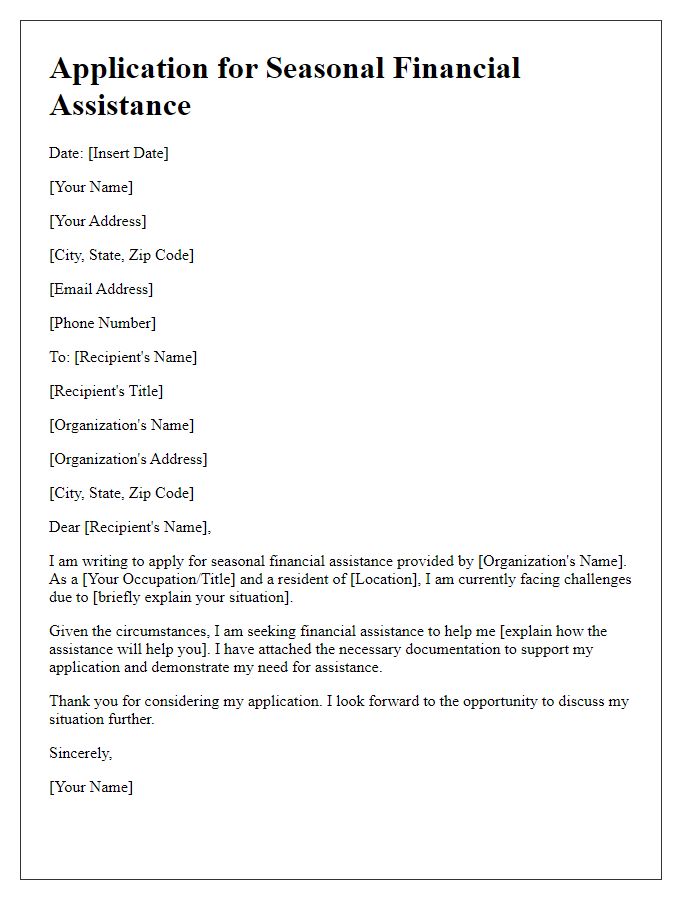

Empathetic and supportive tone

Seasonal payment relief programs assist individuals facing financial difficulties during specific times of the year, such as holidays or harvest seasons. These programs may offer temporary measures, like deferred payments or reduced rates. For example, many agricultural workers in regions like the Midwest USA experience income fluctuations due to harvest cycles, making seasonal relief essential. Effective communication about available options, including application deadlines and required documentation, can significantly ease stress. Support services might provide guidance on budgeting during these challenging times and connecting families to additional resources like food banks or utility assistance programs.

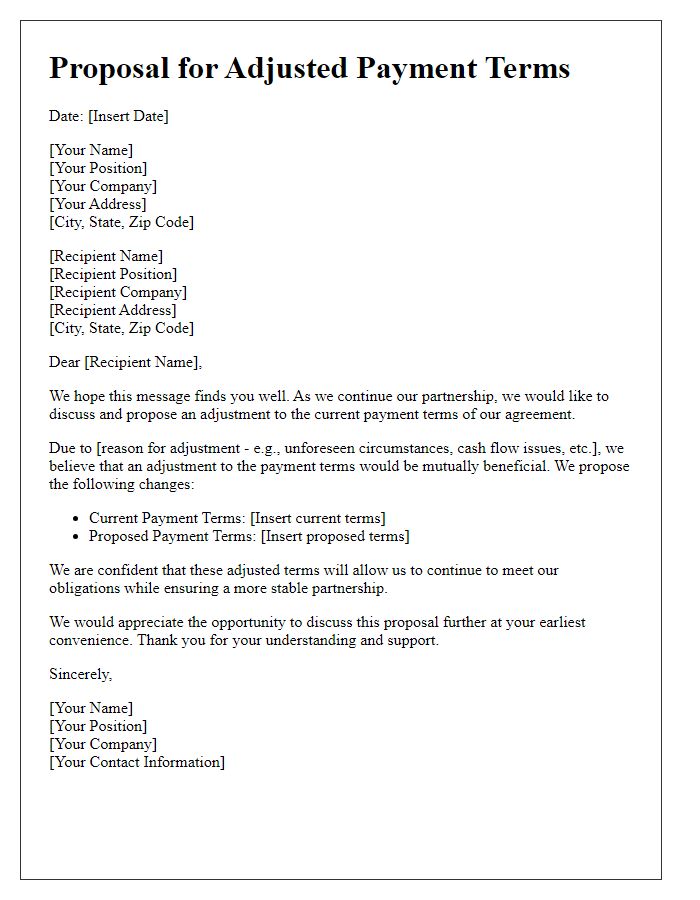

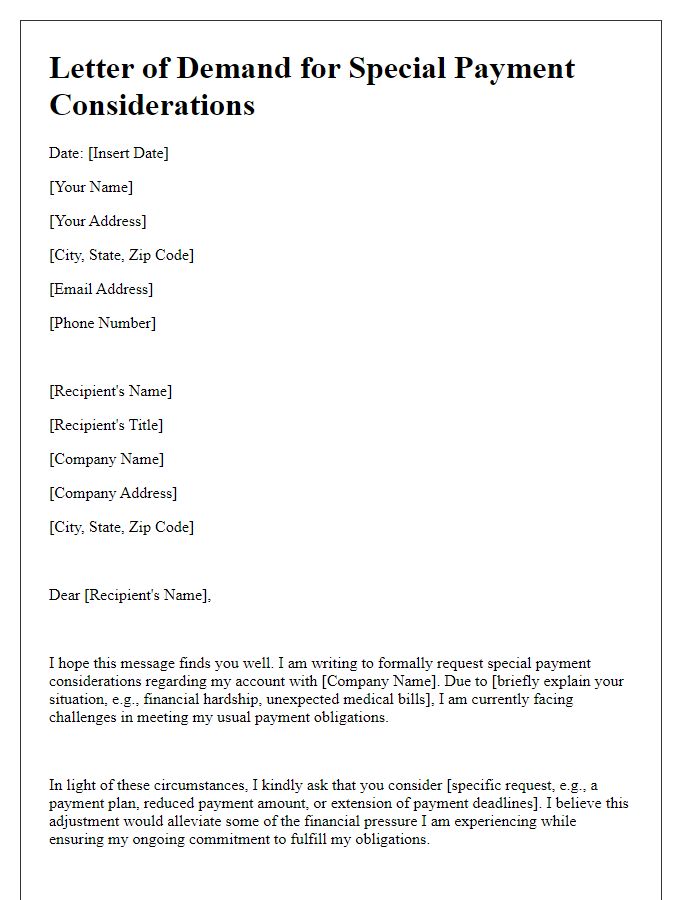

Detailed explanation of relief terms

Seasonal payment relief programs provide temporary financial assistance designed for individuals experiencing difficulty in managing their payments during specific times of the year, such as winter holidays or back-to-school season. Eligibility criteria usually include income levels (often defined as below 200% of the federal poverty line) and must be documented through tax returns or pay stubs. This relief typically allows participants to defer payments, which can include mortgages, utility bills, or loan repayments, without incurring late fees. Terms of these programs might specify a grace period, such as three months, after which regular payments must resume, with the possibility of negotiating additional payment plans based on individual circumstances. Organizations administering this relief can include local non-profits, community action agencies, or government entities, often funded by state or federal grants designed to support low-income residents during challenging financial times.

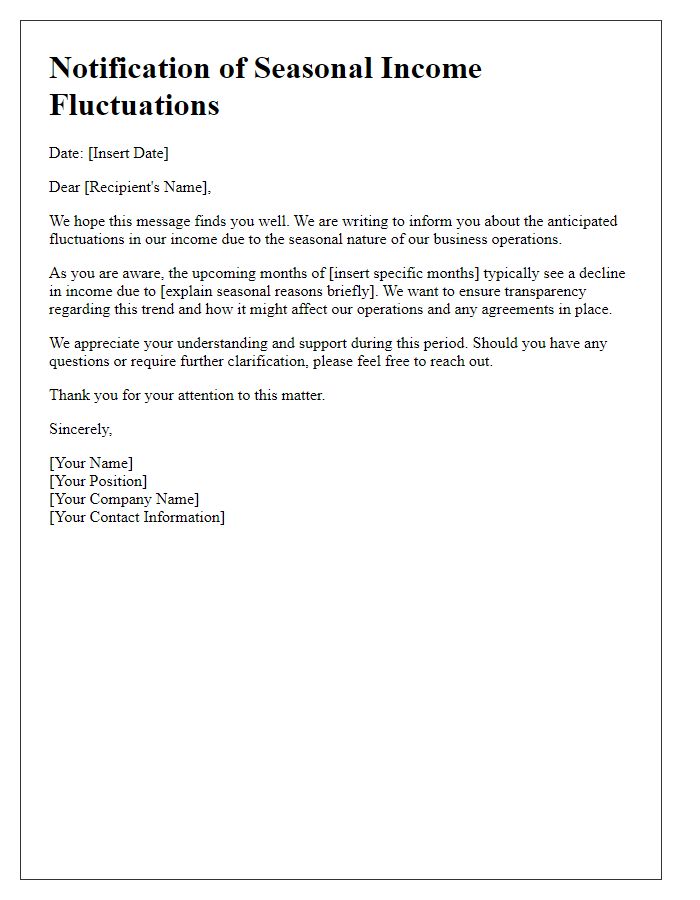

Contact information for assistance

Seasonal payment relief programs provide essential support for individuals during financial hardship. Organizations like community banks and local non-profits often offer assistance options tailored for agricultural workers, holiday retail employees, or tourism sector staff facing fluctuating incomes. Contact information typically includes phone numbers or email addresses specific to regional offices, ensuring personalized support and guidance. It is crucial that affected individuals reach out promptly to secure needed assistance and explore available options. Resources such as government subsidy programs and financial counseling services can also contribute to effective financial planning during challenging seasons.

Personalization and customer segmentation

Seasonal payment relief programs are designed to assist customers experiencing temporary financial difficulties related to specific times of the year, such as holidays or back-to-school seasons. Personalization targets individuals based on demographics, purchasing behaviors, and financial backgrounds. Customer segmentation involves categorizing clients into distinct groups, such as families, students, or retirees, to tailor payment solutions that address unique challenges faced by each segment. Effective communication through personalized letters highlights the benefits of relief programs while considering the economic context, ensuring empathy and understanding of the customer's situation. Utilizing data analytics can further refine outreach efforts, maximizing customer engagement and participation in these essential relief initiatives.

Comments