When it comes to settling an estate loan, understanding the requirements can be crucial for a smooth process. Many individuals find themselves overwhelmed by the paperwork and technicalities involved, but it doesn't have to be that way. By breaking down the necessary steps and clarifying what documents you need, you can navigate this journey with ease. So, if you're ready to simplify your estate loan settlement, keep reading to discover valuable insights and tips!

Borrower's identification and contact information

Borrower's identification includes essential details such as full name, date of birth (typically within the format MM/DD/YYYY), Social Security number (a nine-digit number unique to U.S. citizens), and current address (including zip code). Contact information entails phone number (mobile or landline) and email address, which facilitates communication regarding settlement requirements. Accurate documentation of these details ensures compliance with regulatory frameworks and expedites the loan settlement process. Providing such information also aids in verifying the borrower's identity and financial standing, crucial for estate loans, particularly those involving significant values or intricate properties.

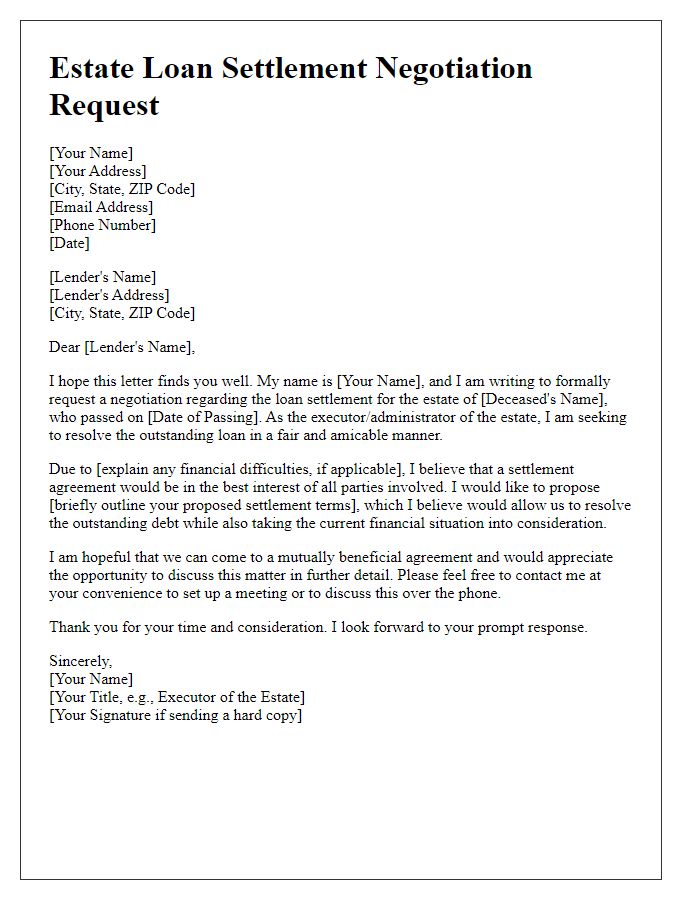

Details of the estate/property being settled

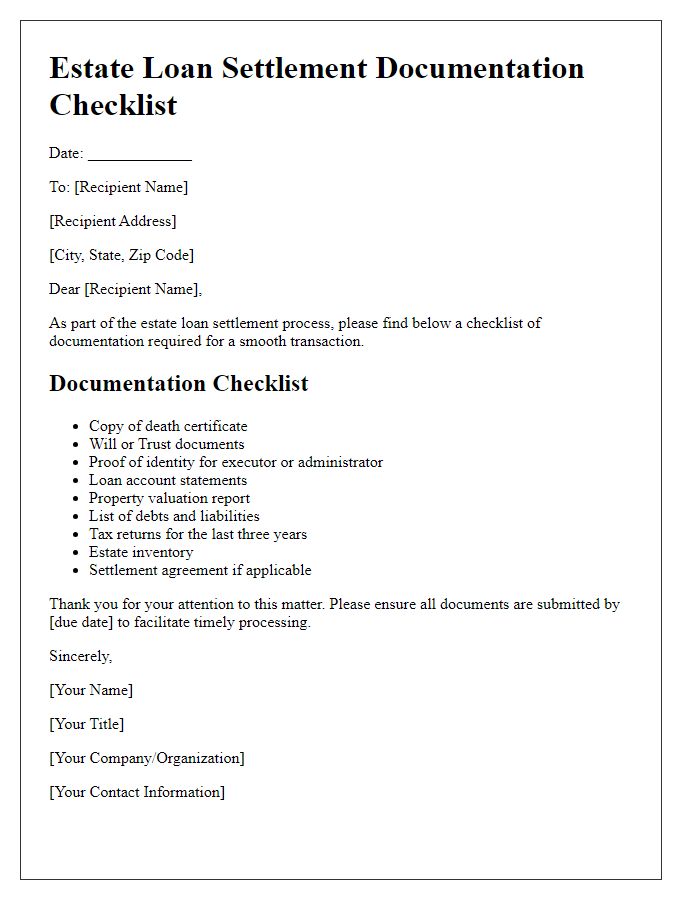

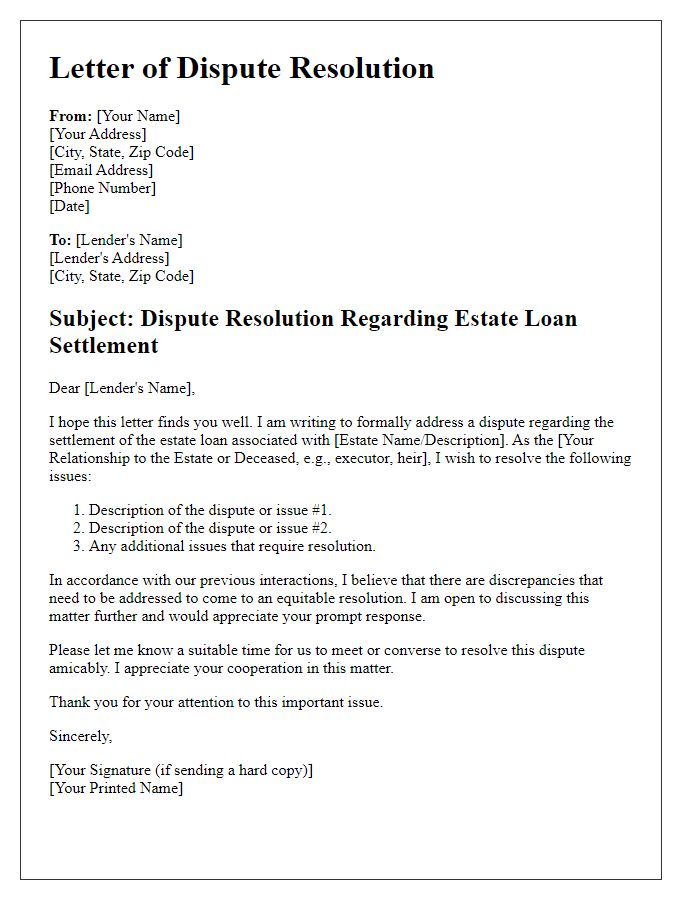

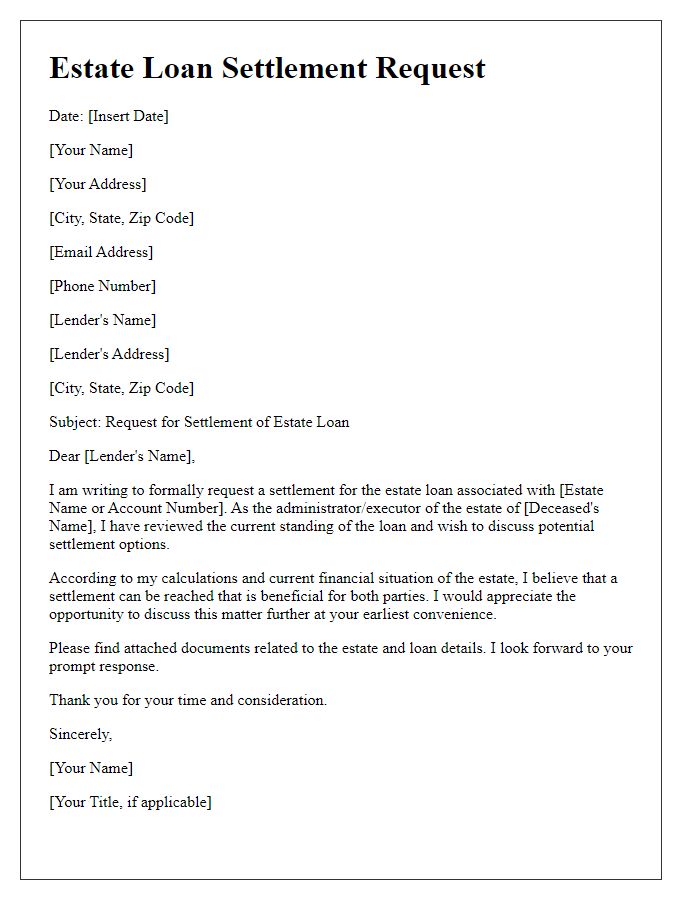

The estate settlement process involves intricate details concerning the asset distribution of various properties, often including real estate, bank accounts, and personal belongings. For example, a residential property located at 123 Elm Street, Springfield, valued at $350,000, may be included in the estate. The estate might also consist of multiple bank accounts with a total balance of $50,000 held at First National Bank and several investment accounts with a combined worth of $150,000 managed by Global Investments. Any outstanding debts, such as a mortgage of $200,000 on the Elm Street property, must also be accounted for in the settlement. Further complexities arise from trust distribution directions, necessitating documentation such as death certificates, wills, and tax returns from the last three years for proper handling and resolution. Logical organization of these assets is essential for smooth settlement under local probate laws, requiring legal and financial consultations throughout the process.

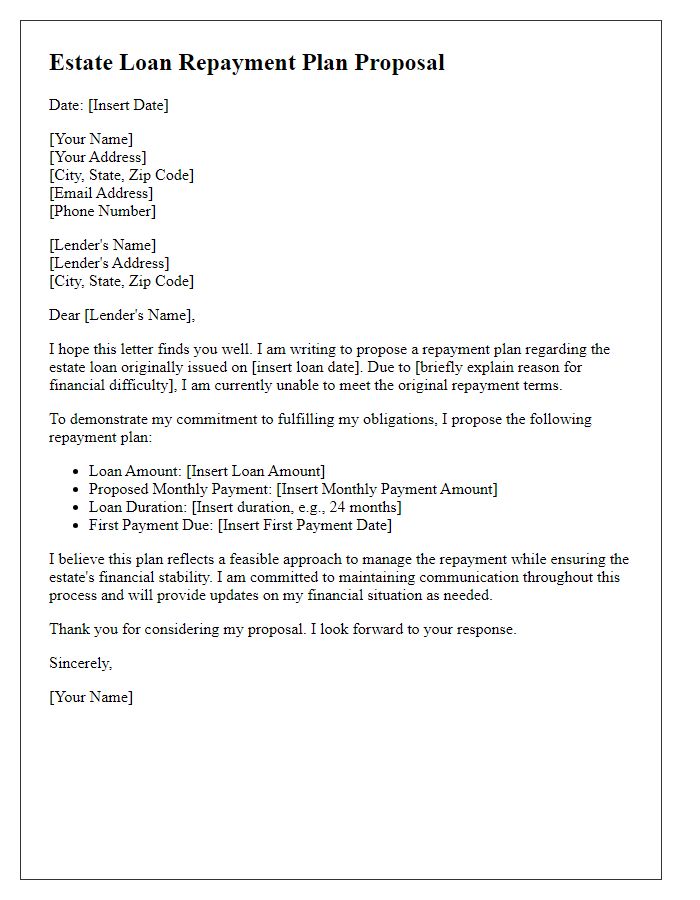

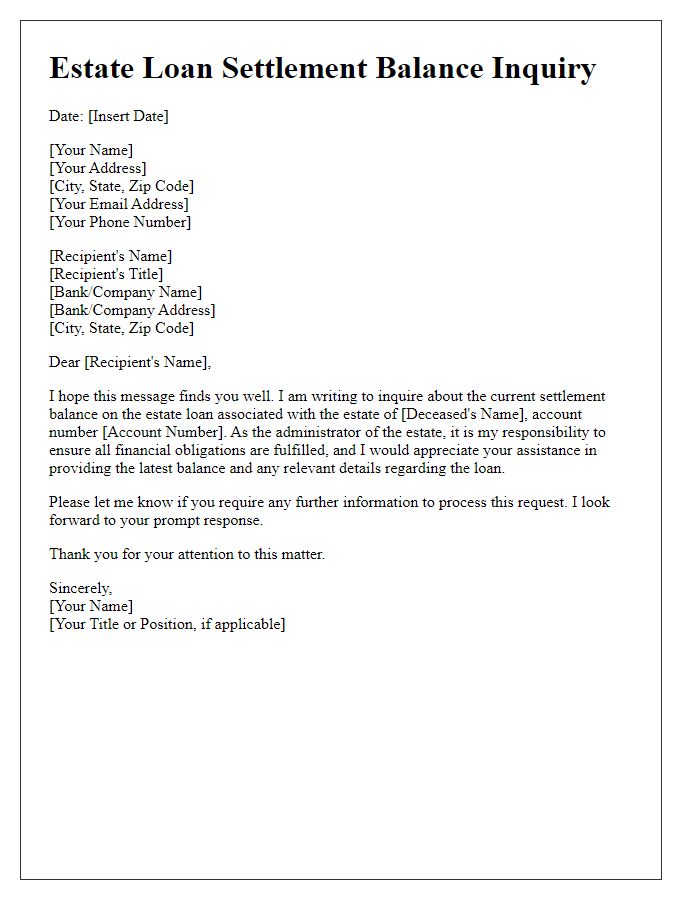

Loan account number and outstanding balance

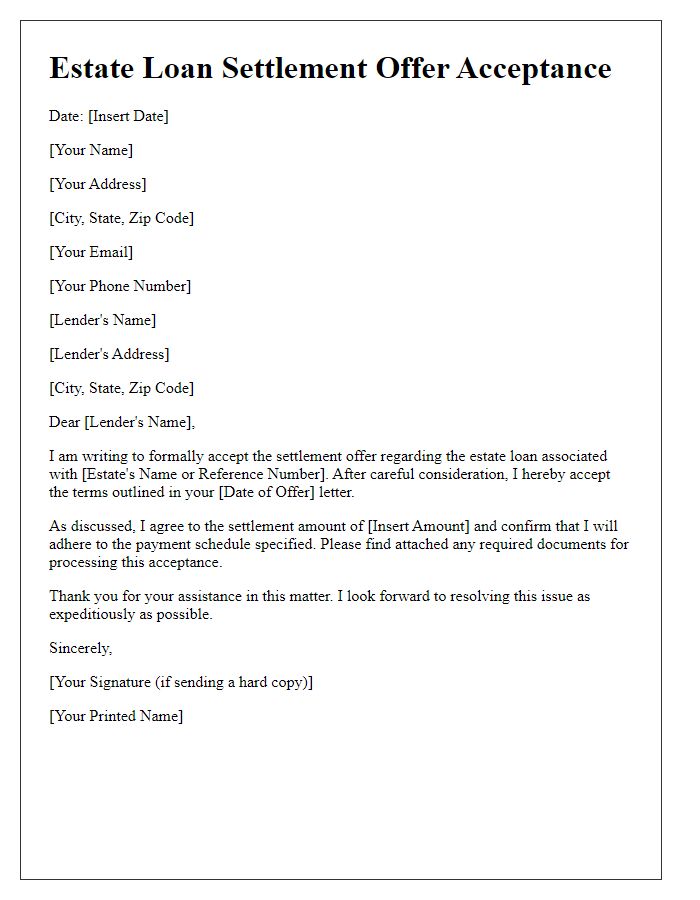

The estate loan settlement process requires specific documents and information to ensure compliance and accuracy. Essential details include the loan account number, which uniquely identifies the borrowing account associated with the estate, and the outstanding balance, reflecting the total amount due at the time of settlement. These figures play a crucial role in calculating the final payoff amount, allowing for effective negotiation with lenders. Additional documentation may include the death certificate of the deceased, relevant estate paperwork, and identification for the estate representative, ensuring all parties understand the financial responsibilities tied to the settlement.

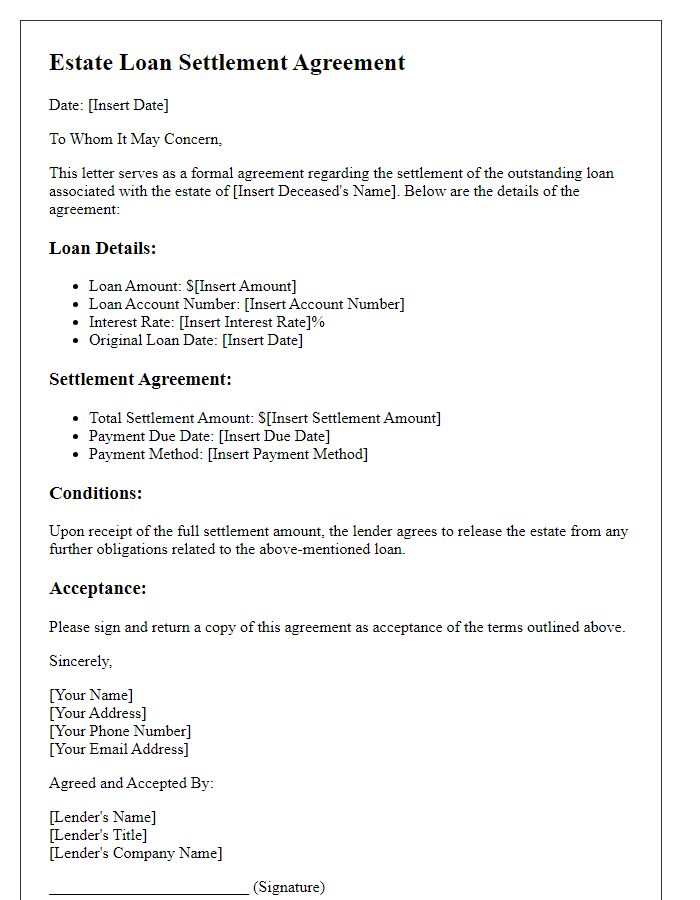

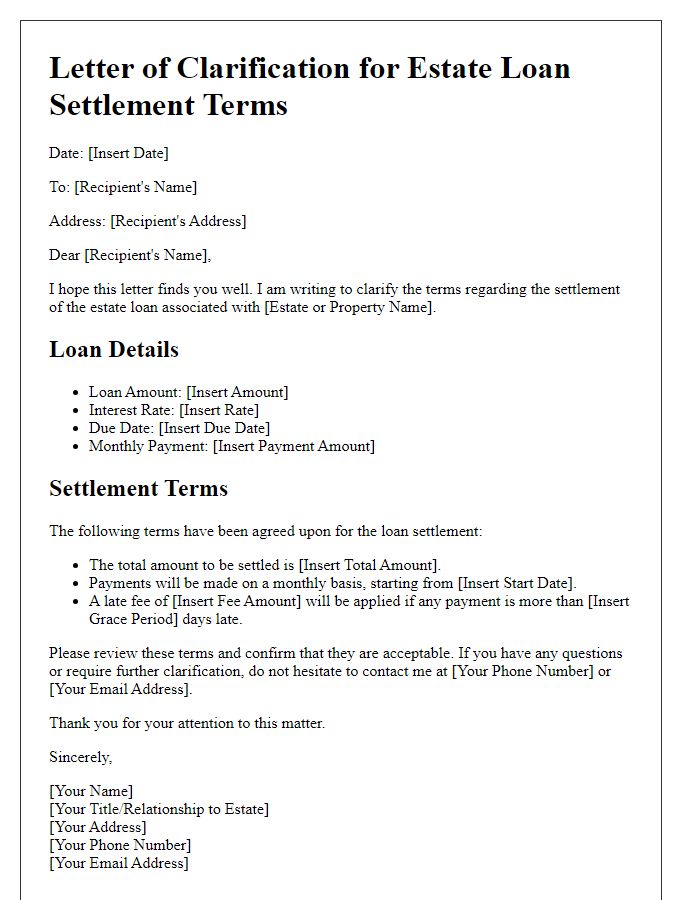

Payment instructions and due date

The estate loan settlement process involves specific financial obligations that must be met to ensure compliance with legal requirements. Payment instructions outline the method of payment, which may include wire transfer, certified check, or online payment portal, depending on the lender's policies. The due date for the payment often falls within 30 days of receiving the settlement notice, ensuring timely processing. Failure to meet the payment deadline may result in penalties or delays in the estate disbursement process. It's essential to confirm the total payment amount, which includes principal, interest, and any applicable fees, to avoid any discrepancies.

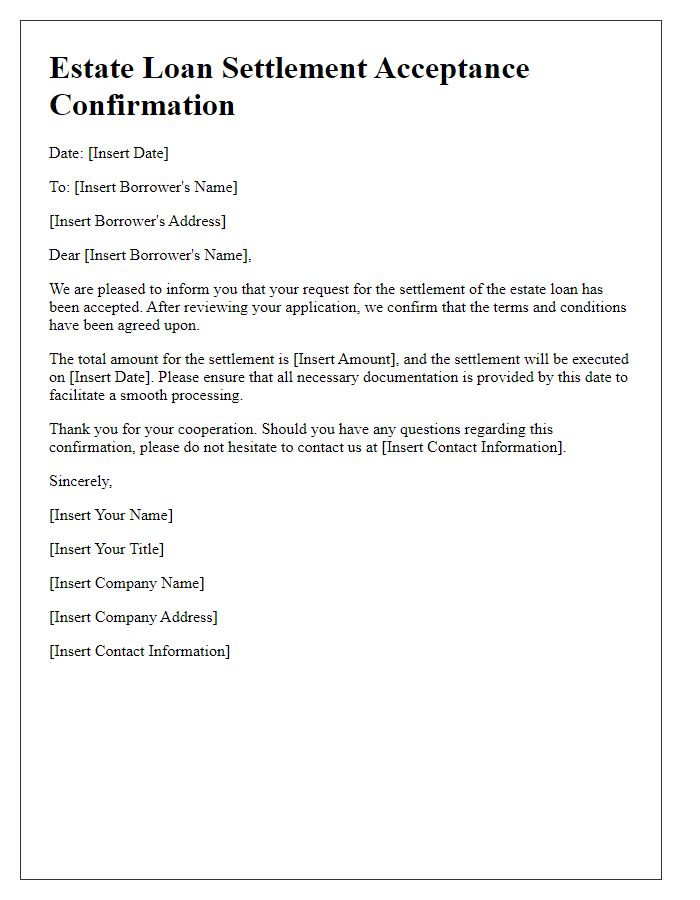

Contact details for further inquiries and support

Estate loan settlements require precise documentation and timely communication. Essential contact details, including a dedicated support line (for example, 1-800-555-0199), must be clearly provided to ensure borrowers can reach customer service representatives familiar with estate loan regulations. Inquiries may center around necessary legal documents, such as the death certificate, asset appraisals, and beneficiary designations, which are crucial for processing settlements efficiently. Additionally, email addresses (for instance, support@estatefinance.com) can facilitate rapid responses and support during the settlement process, minimizing delays and ensuring compliance with estate lending practices.

Comments