Are you curious about how risk-based pricing can impact your financial decisions? In today's fast-paced world, understanding the ins and outs of this pricing strategy is essential for consumers seeking the best value. Whether you're applying for a loan or credit, learning about how lenders evaluate risk can empower you to make informed choices. Join us as we delve deeper into this topic and discover the nuances of risk-based pricingâlet's explore together!

Clear risk assessment criteria

Risk-based pricing notices utilize clear risk assessment criteria to evaluate consumer creditworthiness. Factors such as credit scores, which typically range from 300 to 850, play a significant role in determining interest rates offered by lenders. Other important criteria include payment history, accounting for 35% of the credit score, amounts owed, representing 30%, and the length of credit history, which constitutes 15%. Additionally, geographic location may influence risks; for example, consumers in metropolitan areas may be viewed differently than those in rural regions. Economic trends, such as unemployment rates or inflation statistics, also impact risk assessments. Properly assessing these criteria allows financial institutions to tailor their pricing strategies while managing potential defaults effectively.

Explanation of pricing factors

Risk-based pricing notices inform consumers about how their creditworthiness affects the interest rates applied to loans or credit products. Credit scoring factors, such as payment history (35% of FICO score), credit utilization (30%), and length of credit history (15%), play significant roles in determining pricing. Market conditions and economic indicators, including varying interest rates set by central banks like the Federal Reserve, also influence the final pricing. Geographic risk factors, particularly local economic stability and unemployment rates, further adjust the interest rates offered to borrowers. Additionally, the specific type of loan product, whether a mortgage, auto loan, or credit card, can have unique pricing structures based on associated risks.

Consumer rights information

Risk-based pricing notices provide crucial insights into how lenders assess consumer creditworthiness, impacting interest rates and loan terms. Under the Fair Credit Reporting Act (FCRA), consumers have the right to receive information about the influence of credit reports on their loan offers. Lenders typically analyze various factors, including credit scores, payment history, and outstanding debts, to determine risk profiles. The notification must specify the reason for the pricing, ensuring transparency surrounding decisions made with credit reporting agencies, such as Experian or TransUnion. Consumers also have the opportunity to obtain their credit report for free, allowing them to address potential inaccuracies or improve their credit standing before future loan applications. Timely awareness of these consumer rights, particularly following major legislative changes in 2022, is essential for making informed financial choices.

Contact details for inquiries

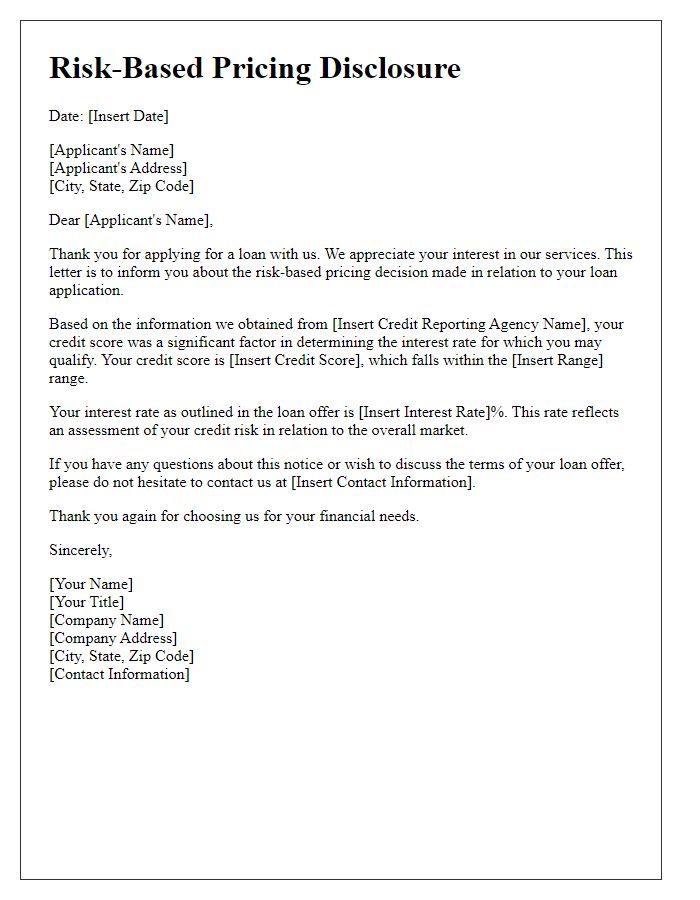

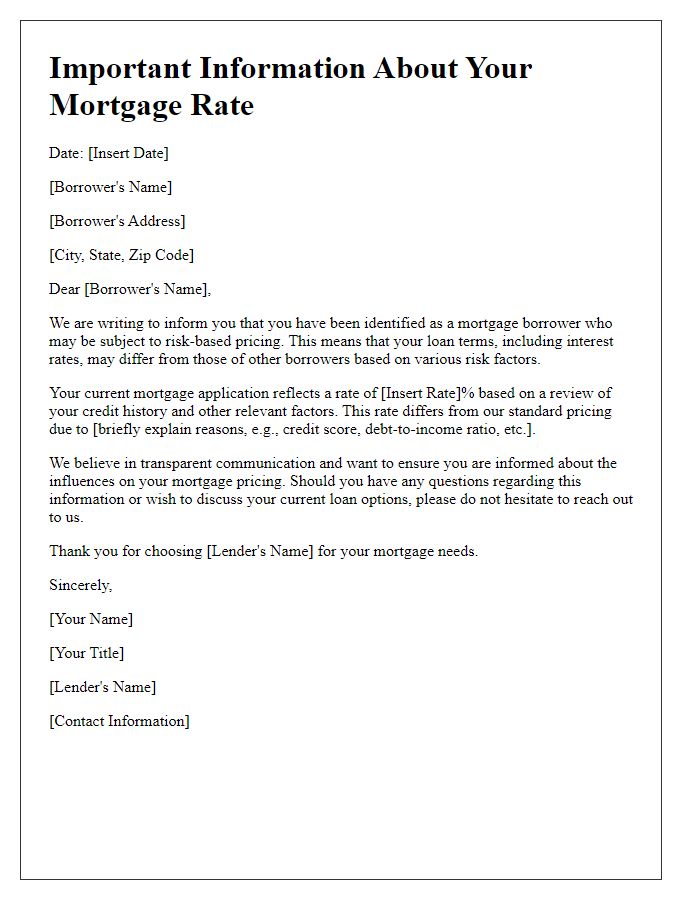

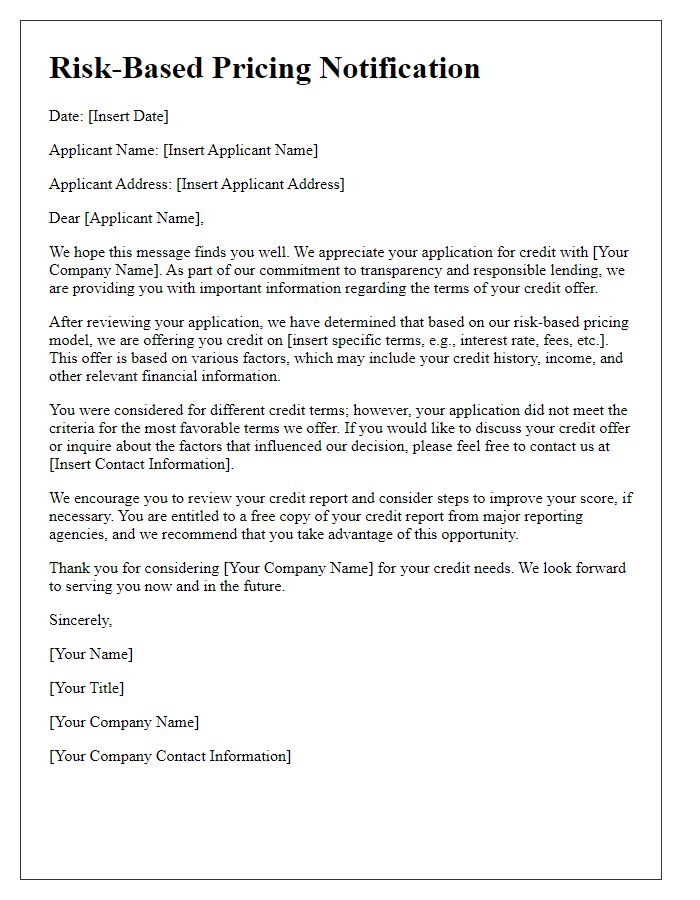

A risk-based pricing notice informs consumers about the credit terms they receive based on their credit risk assessment. This notice typically includes essential contact details for inquiries, emphasizing customer support and transparency in communication. For assistance, consumers can reach the customer service team via telephone at (555) 123-4567, available from 9 AM to 5 PM EST, Monday through Friday. Alternatively, inquiries can be directed to the designated email address at support@example.com for written communication. Additionally, consumers may visit the company's official website at www.example.com for more information and access to resources related to credit policies and terms.

Legal compliance statement

Risk-based pricing notices inform consumers about the credit decisions influenced by their credit histories. These notices must comply with the Fair Credit Reporting Act (FCRA), which mandates transparency regarding how credit scores affect loan terms, such as interest rates. Entities issuing these notices must ensure clarity in language and provide consumers with details on how to obtain their credit scores from reporting agencies like Equifax, Experian, and TransUnion. Additionally, legal requirements emphasize the importance of timely delivery within a specified period following a credit report inquiry, which can impact consumer perceptions and decisions regarding future financial commitments. Compliance safeguards against potential litigation stemming from misleading information or inadequate disclosures.

Letter Template For Risk-Based Pricing Notice Samples

Letter template of risk-based pricing notification for credit card users

Letter template of risk-based pricing communication for auto loan seekers

Letter template of risk-based pricing explanation for insurance policyholders

Letter template of risk-based pricing update for personal loan customers

Letter template of risk-based pricing summary for student loan applicants

Letter template of risk-based pricing information for commercial loan clients

Letter template of risk-based pricing letter for home equity line of credit users

Comments