Are you feeling the financial pinch and considering an unsecured loan? In this article, we'll break down everything you need to know about the approval process, from understanding eligibility requirements to tips on boosting your chances of getting that much-needed funding. With the right approach, securing an unsecured loan can be a straightforward process that opens up new opportunities for you. So, if you're ready to navigate through the world of loans, stick around to learn more!

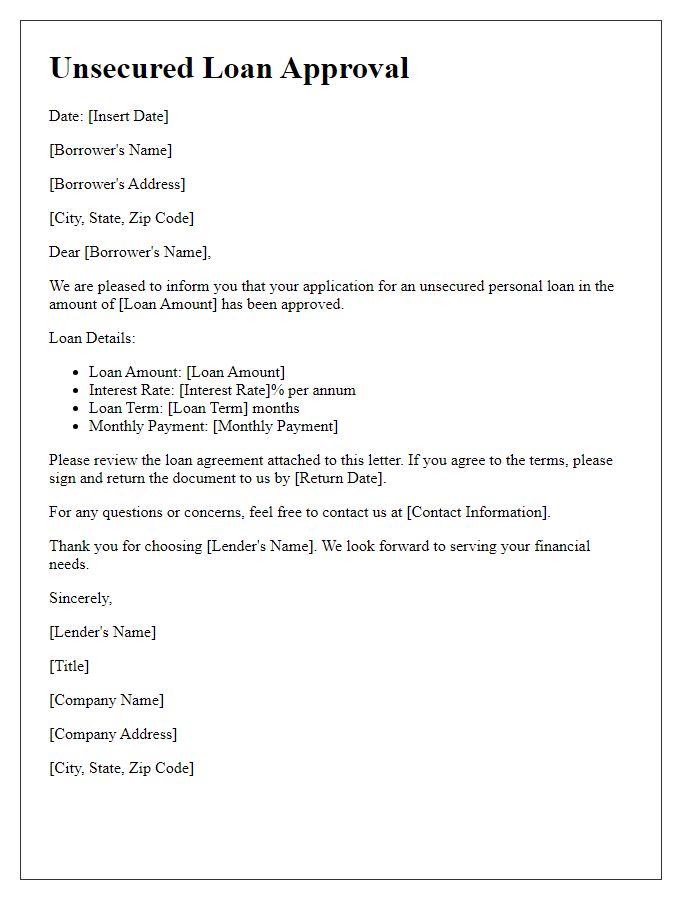

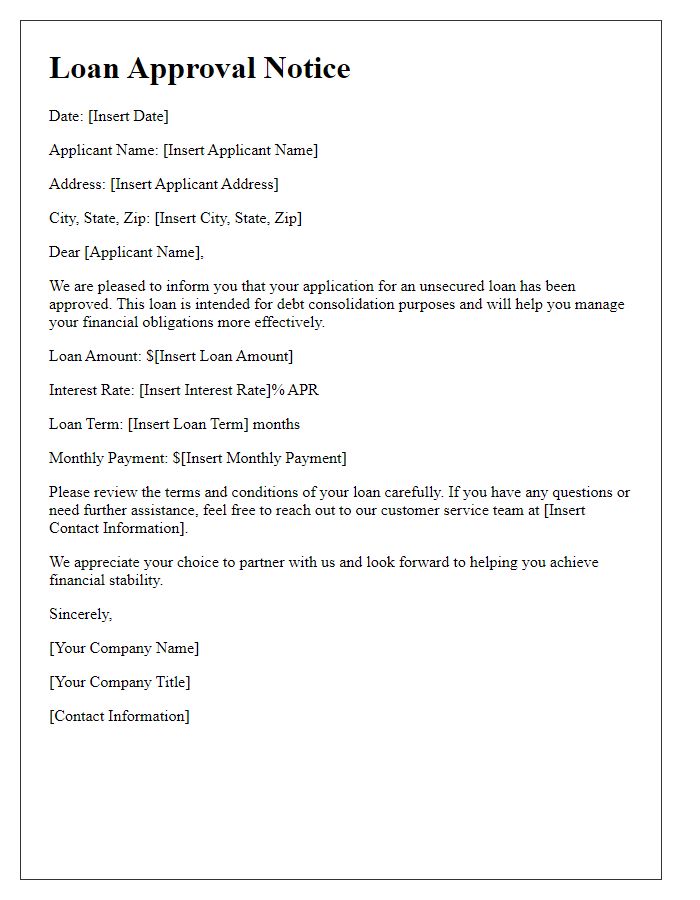

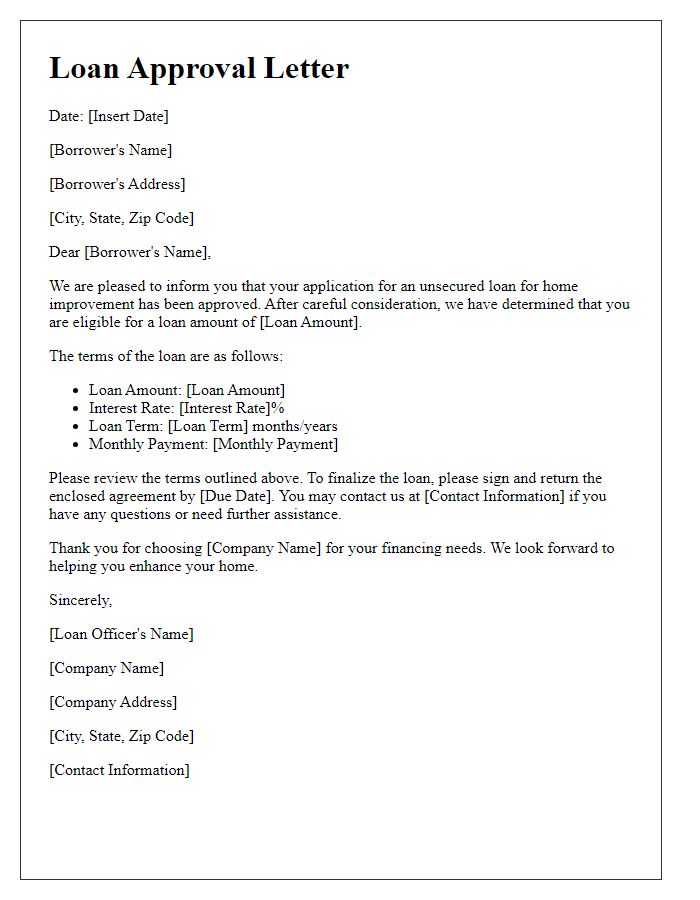

Borrower's personal details and contact information

The unsecured loan approval process necessitates clear documentation of the borrower's personal details and contact information. This typically includes essential identification data such as full name, social security number, and date of birth, with verification usually required through forms of ID like a driver's license or passport. Additionally, contact information must comprise the borrower's residential address, phone number, and email address, which facilitate effective communication. Lenders often require this information to assess creditworthiness, complete background checks, and establish a reliable correspondence method regarding loan terms, repayment schedules, and other relevant financial obligations.

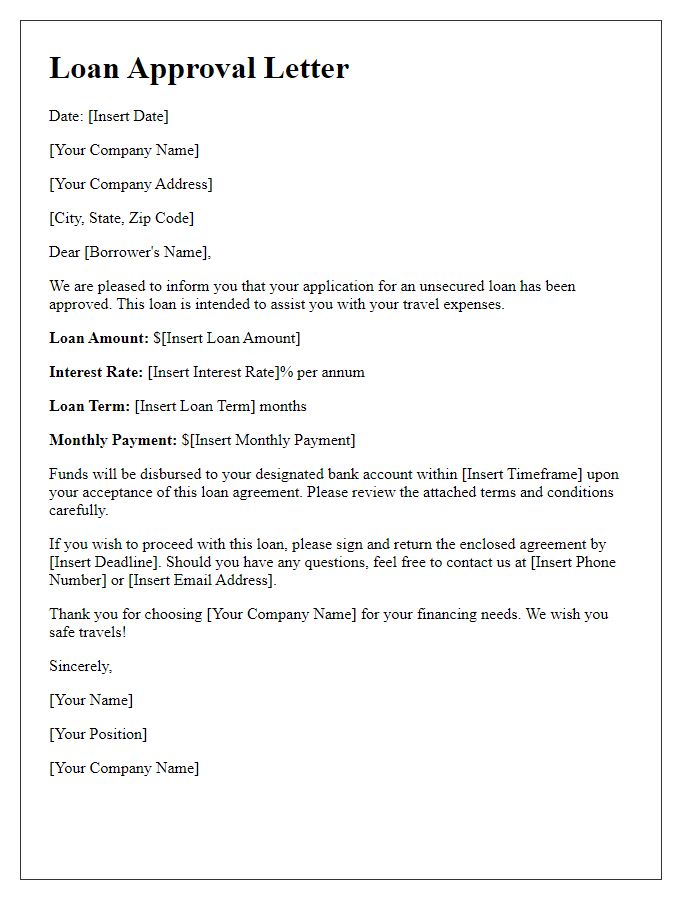

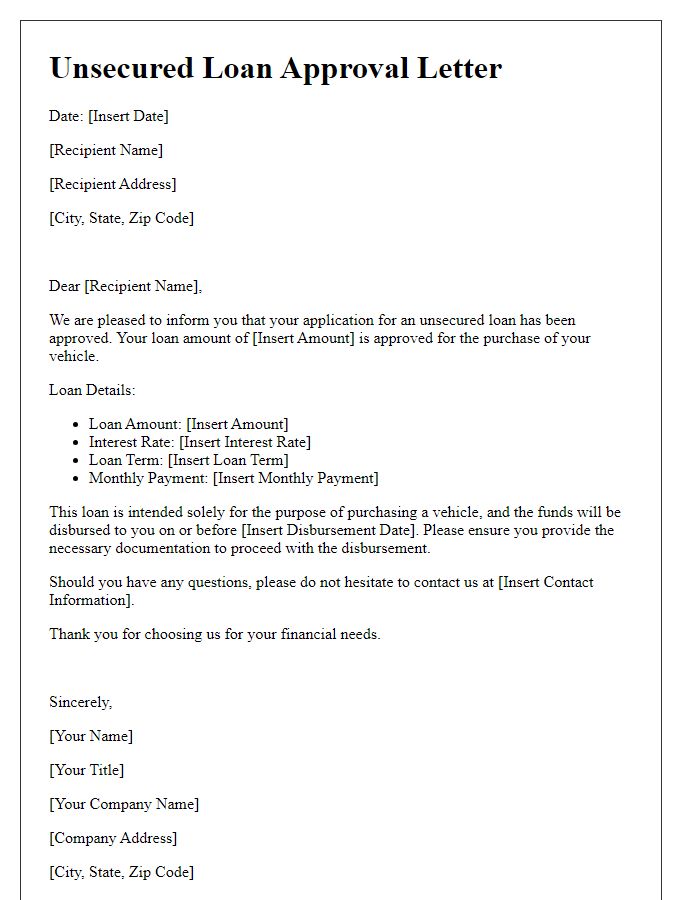

Loan amount, interest rate, and repayment terms

An unsecured loan, which does not require collateral, usually comes with varying loan amounts based on borrower eligibility and lender policies. Typical loan amounts range from $1,000 to $50,000. Interest rates for unsecured loans can vary significantly, generally between 5% to 36% APR, depending on creditworthiness, loan term, and current market conditions. Repayment terms for these loans often span from 1 to 7 years, with monthly payments structured to accommodate the borrower's financial situation. Borrowers should note that the total repayment amount will include both the principal and accrued interest, potentially leading to financial strain if not managed prudently.

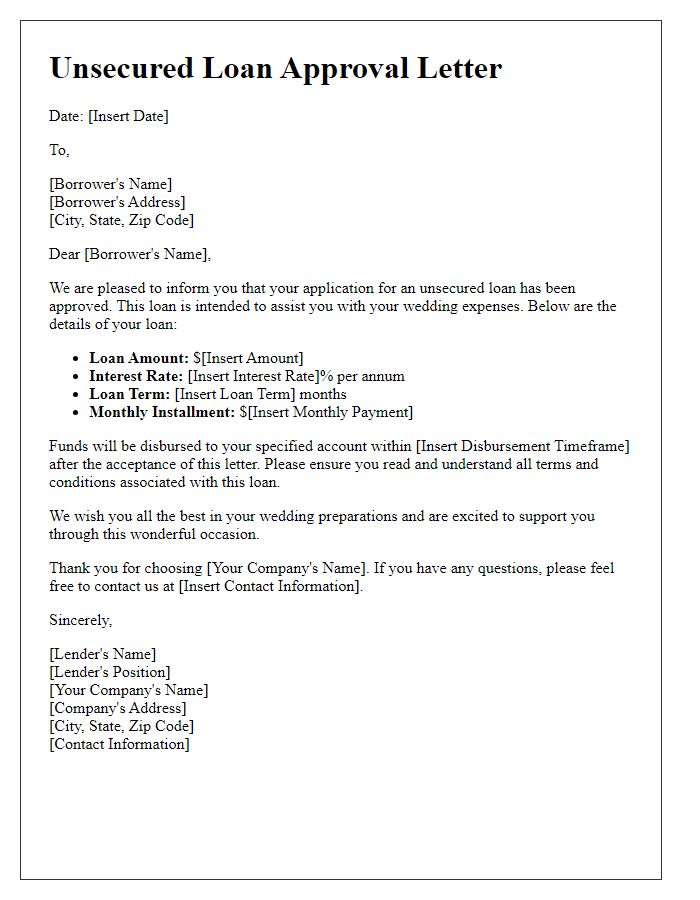

Approval conditions and any stipulations

Unsecured loans offer financial assistance without requiring collateral, making them accessible for various personal or business needs. Approval conditions often include a minimum credit score threshold, typically around 650, along with proof of stable income or employment history to assess the borrower's ability to repay. Lenders may also stipulate a maximum debt-to-income ratio, often no higher than 40%, to ensure responsible lending practices. Additional requirements may involve documentation such as bank statements, tax returns, and a formal application detailing the purpose of the loan. Interest rates vary, typically ranging from 5% to 36%, depending on the borrower's creditworthiness. Timely repayment is crucial, as missed payments can lead to penalties and adversely affect credit scores.

Disbursement process and timeline

The unsecured loan approval process generally involves several key steps that ensure a smooth disbursement in financial institutions like banks or credit unions. Initially, applicants should complete a detailed application form, providing essential information such as personal identification (to verify identity), credit history (an assessment tool indicating reliability), and income statements (proof of financial capability). After submission, the underwriting team reviews these documents, typically within 3 to 5 business days, to assess risk and determine eligibility. Upon approval, the borrower receives a formal loan offer, which includes terms and conditions like interest rate (usually ranging between 5% to 36% depending on the borrower's credit score), repayment period (often between 1 to 5 years), and monthly payment amounts. Once the borrower accepts the offer, the final review occurs, and funds are generally disbursed within 1 to 3 business days, deposited directly into the borrower's bank account or provided through a check. Timely communication throughout this timeline is crucial to maintain clarity and build trust between the lender and borrower.

Contact information for queries and support

When seeking assistance regarding unsecured loan approval inquiries, one should refer to the official contact information provided by the lending institution. Typically, these details include a dedicated customer service hotline, often operational during business hours (e.g., 8 AM to 6 PM, Monday to Friday), and an email address for written correspondence. Additionally, many financial institutions maintain an online chat feature accessible through their website, ensuring prompt responses. For more complex issues or specific support, a physical branch location may offer in-person consultations. Always verify the contact details listed on the institution's official website for the most accurate information.

Comments