Are you looking for an exciting financial opportunity? We're thrilled to present you with an exclusive introductory loan rate offer designed to help you achieve your goals more affordably. With lower rates and flexible terms, this is the perfect chance to finance your dreams without breaking the bank. Curious to learn more about how this offer can benefit you? Read on!

Personalized Greeting

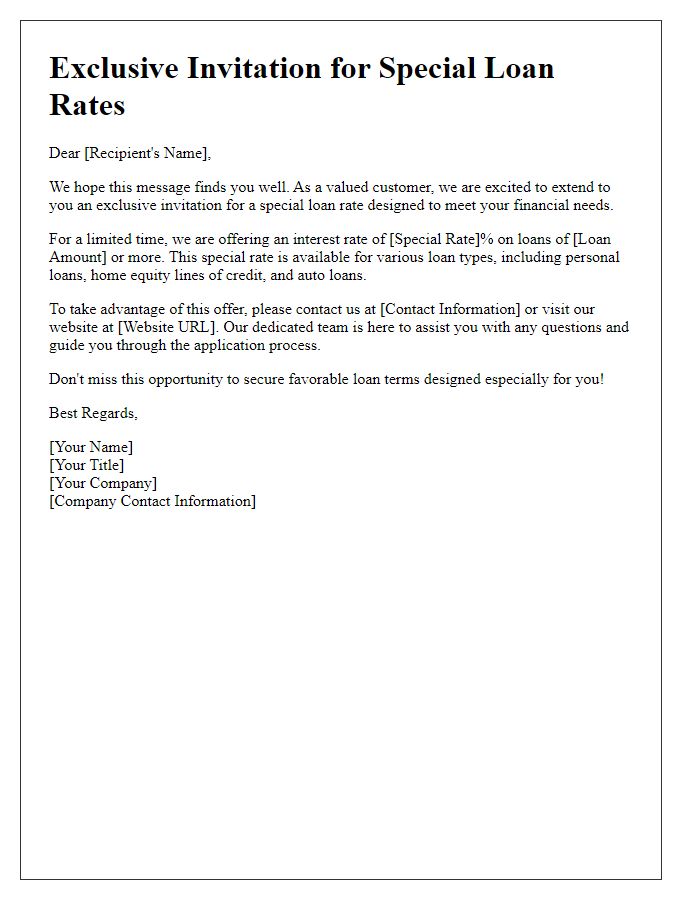

Introducing enticing introductory loan rates can significantly attract potential borrowers looking for financial solutions. A competitive rate, such as 3.5% APR, typically appeals to first-time homebuyers seeking mortgages in urban areas. Highlighting a limited-time offer emphasizing no application fees can motivate applicants to act swiftly. Additionally, including promotional periods, like the first 12 months with a fixed low rate followed by variable rates, creates urgency and a sense of opportunity. Reassuring potential clients about smooth online application processes can enhance customer experience, encouraging hesitant borrowers to engage with lending services.

Clear Loan Benefits Overview

The introductory loan rate offers a significant benefit for borrowers seeking low-interest financing options, often starting as low as 2.5% for a limited initial period (such as 12 months). This promotion can contribute to substantial savings on monthly payments, allowing individuals to allocate funds to other critical areas like savings, investments, or personal expenses. Loan amounts vary, commonly ranging from $5,000 to $50,000, depending on lender policies and borrower creditworthiness. The advantages include not only lower initial payments but also benefits like flexible repayment terms and potential increases in borrowing limit upon successful repayment history. Borrowers must remain mindful of the interest rate reverting to a standard rate (often 4% to 18%) after the introductory period, which can significantly affect total loan costs. Detailed terms and conditions, including fees associated with early repayment or defaults, should be reviewed before acceptance.

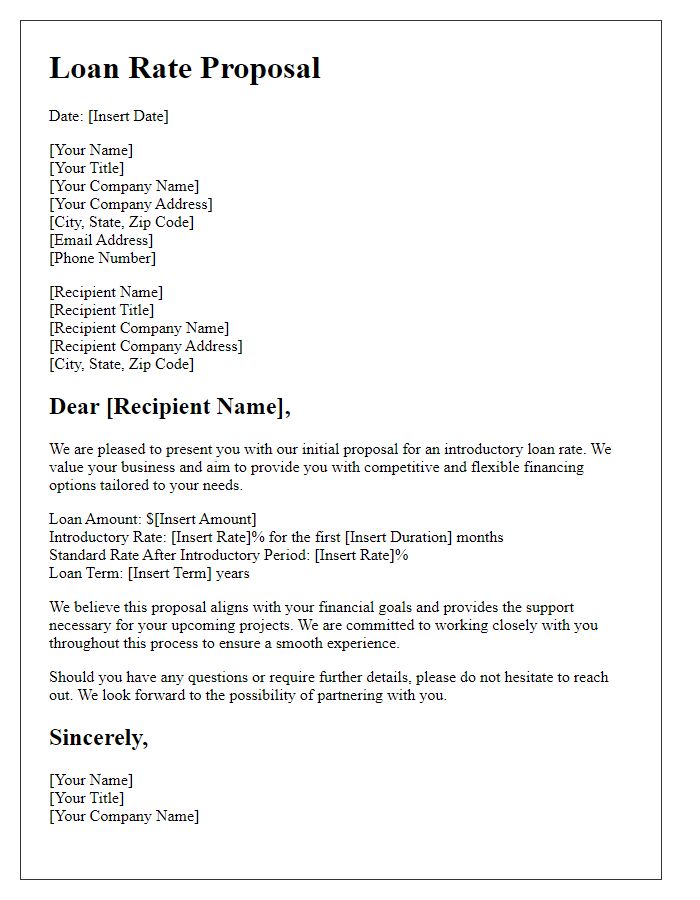

Introductory Rate Details

An introductory loan rate offer can significantly impact borrowing decisions, influencing financial planning and monthly payments. Typically, this offer presents a reduced interest rate (often around 0% to 3% lower than the standard rate) for an initial period, usually lasting from six months to two years. This rate can apply to personal loans, mortgages, or credit cards, providing potential savings in interest costs during the offer duration. Financial institutions such as banks or credit unions typically promote these rates to attract new customers, often tied to specific criteria such as credit score requirements or loan amounts. Understanding the terms, including conversion to a standard rate and any associated fees after the introductory period, allows borrowers to assess the long-term financial implications of accepting this offer.

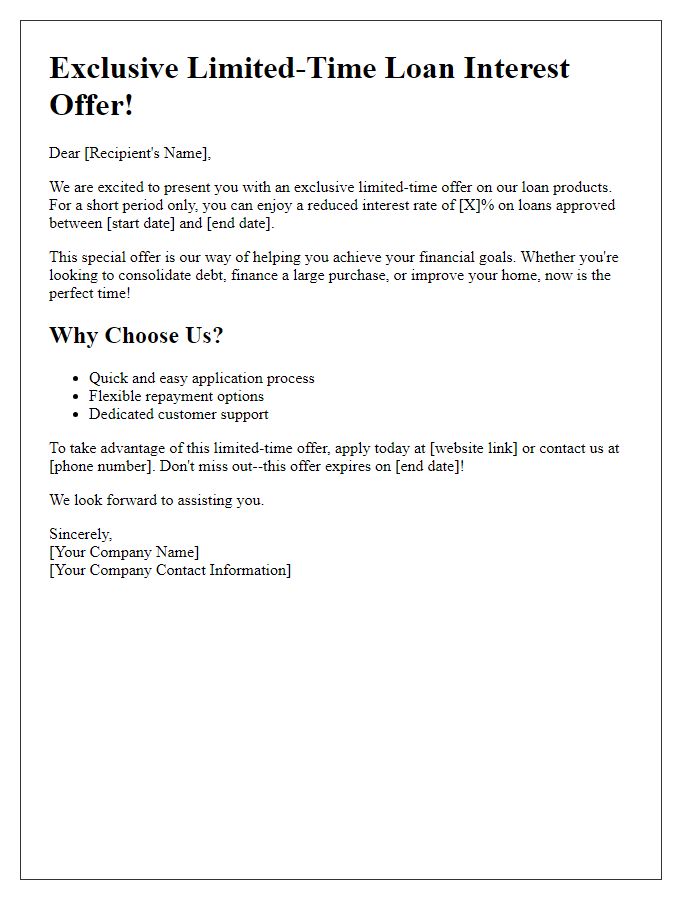

Call-to-Action Statement

Introducing a competitive introductory loan rate offer designed to assist borrowers in achieving their financial goals. This limited-time opportunity features an interest rate starting as low as 2.99% for the first 12 months, making it an attractive option for home purchases or refinancing existing loans. With loan amounts available from $10,000 to $500,000, individuals can draw on resources to invest in their properties or consolidate debt. Applications can be submitted online or in-person at our branch locations across major cities like New York, Los Angeles, and Chicago. Act now to secure your low rate and take control of your financial future before this offer expires!

Contact Information and Support

Introductory loan rate offers can attract potential borrowers seeking favorable financing options. Loan terms may feature rates as low as 2.99% for the first year, applicable for amounts ranging from $5,000 to $50,000. For assistance, clients can reach customer support at 1-800-123-4567, Monday through Friday, 8 AM to 8 PM EST. Websites may offer online chat options and a comprehensive FAQ section, providing detailed information on eligibility requirements, application procedures, and repayment plans. Additionally, secure documentation, such as proof of income and credit history, may be required for processing loan applications efficiently.

Comments