Are you feeling the pinch of financial strain and considering requesting a payment deferment extension? You're not alone; many find themselves in similar situations, looking for a little extra breathing room. Understanding how to craft a compelling letter can make all the difference in getting that extension approved. Let's dive in and explore the essential elements to include in your request, so you can feel confident in your communication.

Polite and respectful tone

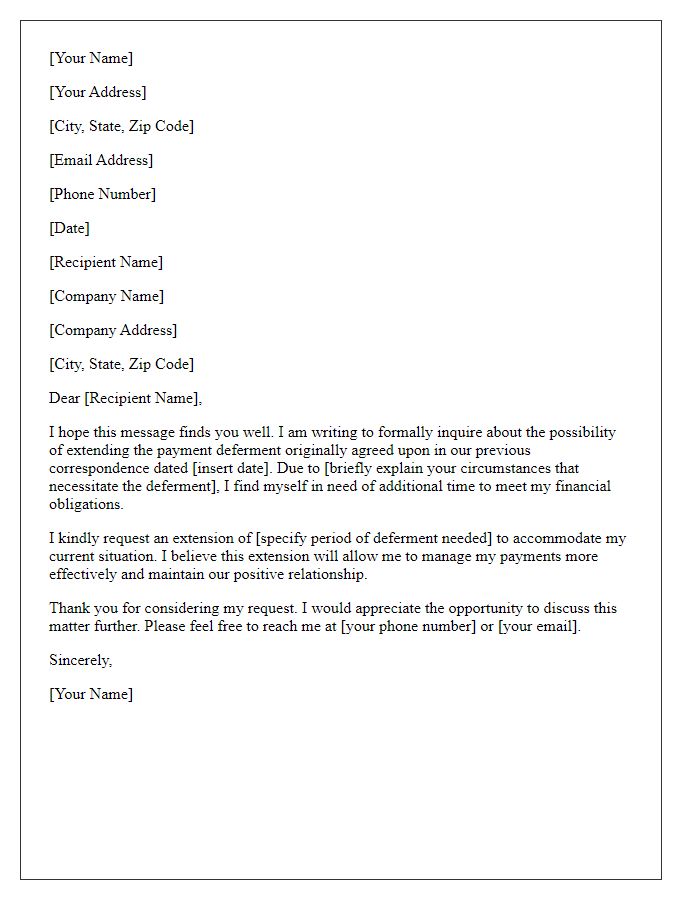

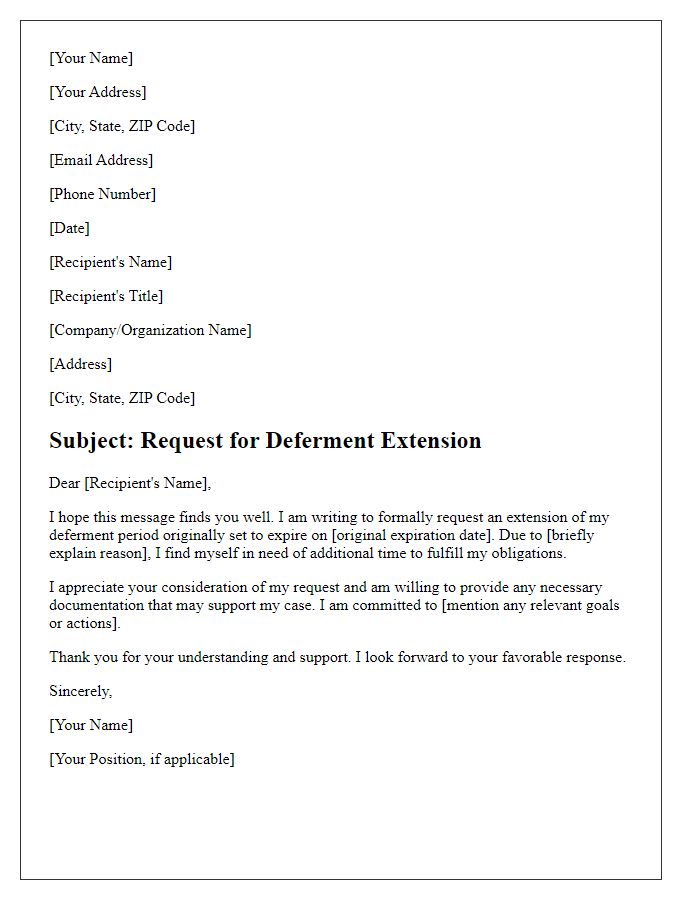

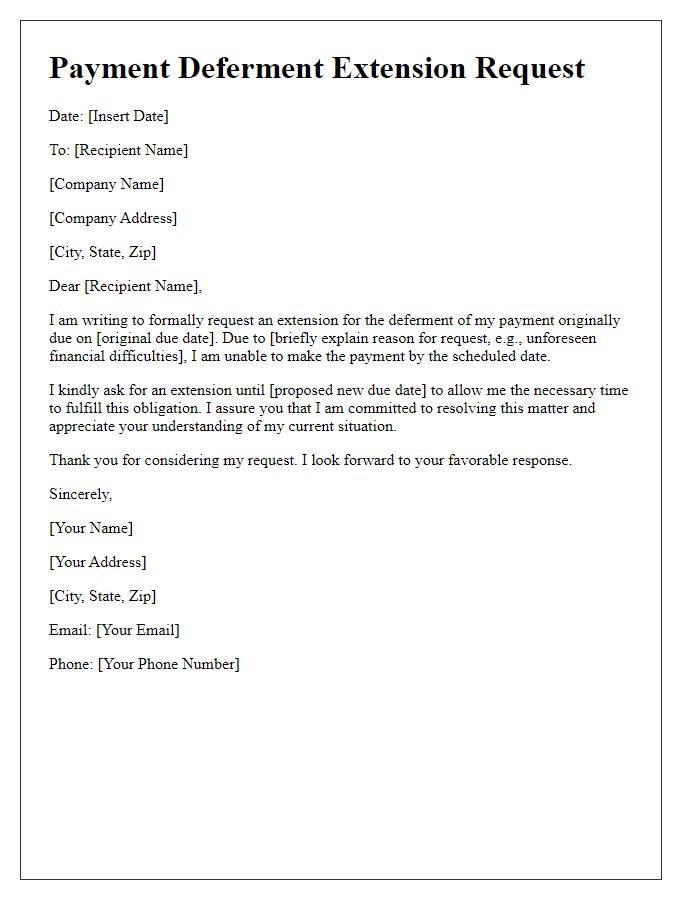

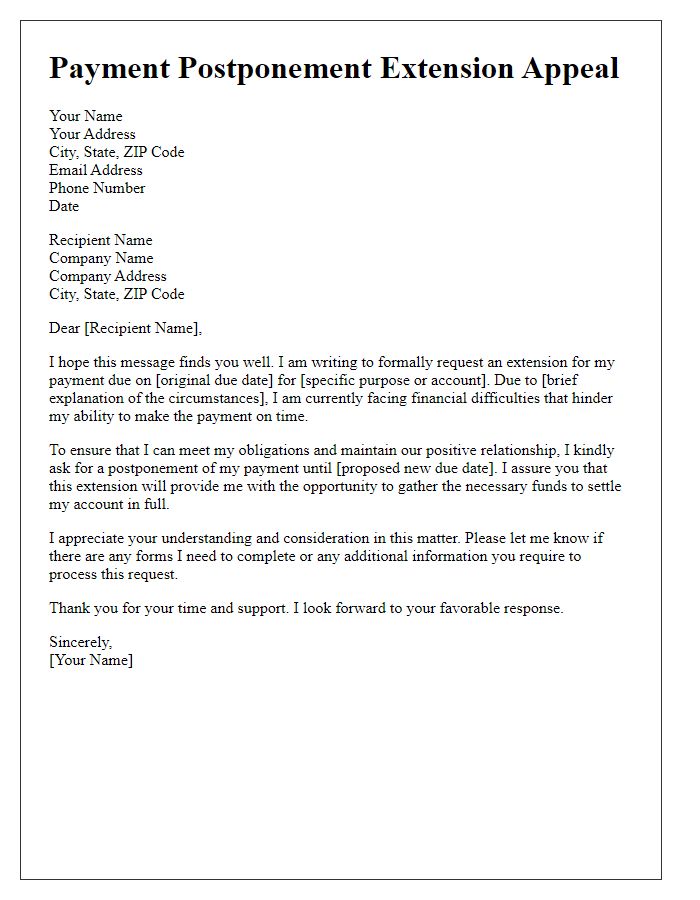

A payment deferment extension request often involves seeking additional time to meet financial obligations. It typically outlines the reasons for the request, such as unexpected personal circumstances or financial hardship, and emphasizes a commitment to fulfilling the original agreement in the future. This type of letter is usually addressed to a creditor or financial institution, expressing appreciation for their understanding and support in a challenging time. Providing specific details about the payment arrangements, including original due dates or terms, can strengthen the request. Clear articulation of one's intent to maintain communication and resolve the outstanding balance is crucial in fostering goodwill with the recipient.

Clear reason for deferment

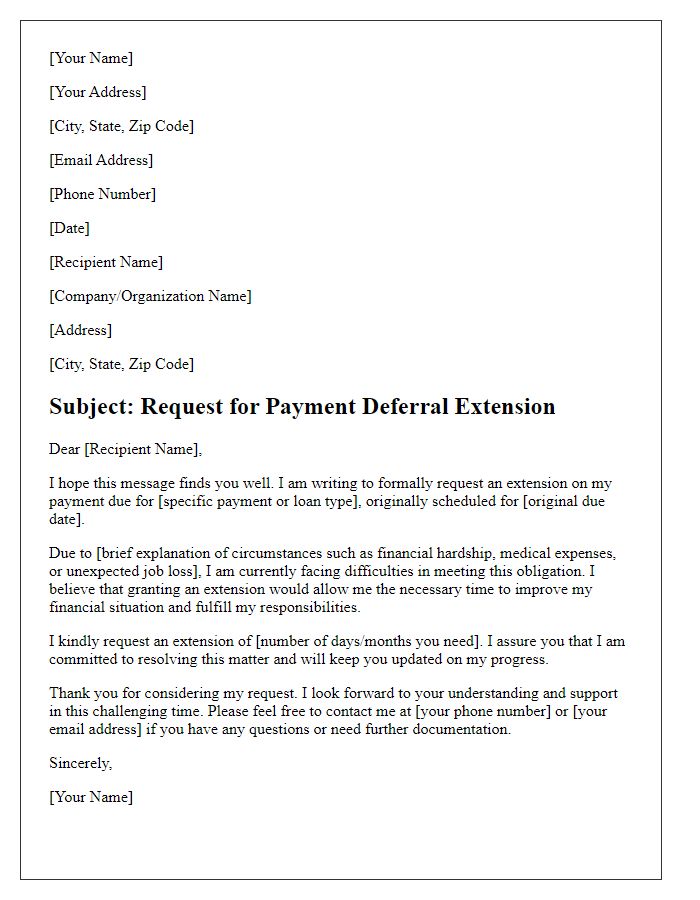

During economic downturns, individuals may experience unexpected financial challenges that hinder timely payment obligations. A common reason for requesting a payment deferment extension includes job loss or temporary unemployment, which significantly impacts regular income. For instance, the unemployment rate might spike to 8% during a recession, leading to increased financial strain on many households. Additionally, medical expenses can unexpectedly arise, with the average hospitalization costs ranging from $15,000 to $30,000 in the United States. This financial pressure makes it difficult to meet existing payment deadlines. Organizations often provide options for deferment to support customers facing such hardships, acknowledging the necessity of flexibility in financial agreements during challenging times.

Specific extension date

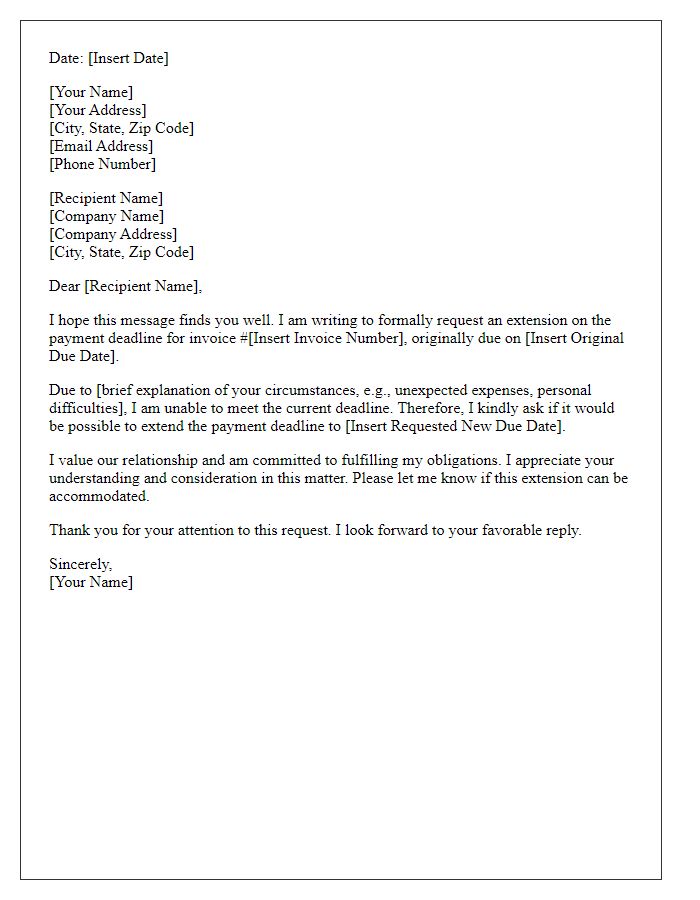

A payment deferment extension request typically involves a formal context where individuals or organizations seek additional time to settle outstanding payments. This could be pertinent in situations involving financial institutions, service providers, or rental agreements. A detailed explanation of the current financial circumstances warrants attention, alongside a requested specific extension date to ensure clarity. Financial terms such as "payment dates," "outstanding balance," or "due amounts" should be defined, while adhering to any pre-existing agreements that might influence the extension process. This communication often necessitates polite language, maintaining a respectful tone throughout the discussion.

Financial hardship explanation

Financial hardship often results from unexpected events such as job loss, medical emergencies, or significant life changes. Individuals or families may struggle to meet monthly obligations due to reduced income or increased expenses. Payment deferment extension can provide critical relief, allowing time for recovery and stability. Many organizations offer programs or options for assistance during such times. By explaining specific circumstances and providing supporting documentation, such as income statements or medical bills, individuals can strengthen their request for a payment deferment extension. Each case should consider the policies of the creditor, showcasing genuine efforts to maintain communication and fulfillment of obligations.

Assurance of future payment

Severe economic disruptions often lead individuals and businesses to request payment deferment extensions. Financial obligations, like mortgages and personal loans, can become burdensome during challenging times. Financial institutions may require detailed information regarding current income levels, ongoing expenses, and potential recovery plans. This process typically involves submitting documentation to demonstrate the ability to resume regular payments. Ensuring timely communication with creditors increases the chance of favorable outcomes, as willingness to fulfill obligations remains crucial. Being proactive and transparent throughout this process fosters trust and understanding between parties involved, enhancing the likelihood of obtaining an extension.

Comments