Are you looking for a concise and effective way to draft an enforceable promissory note? Creating a solid promissory note is crucial for ensuring that both parties understand their obligations and rights. Whether you're lending money or borrowing, having a well-structured letter template can protect your interests and establish clear expectations. Keep reading to explore an invaluable guide that will help you create the perfect promissory note!

Clear Title and Identification

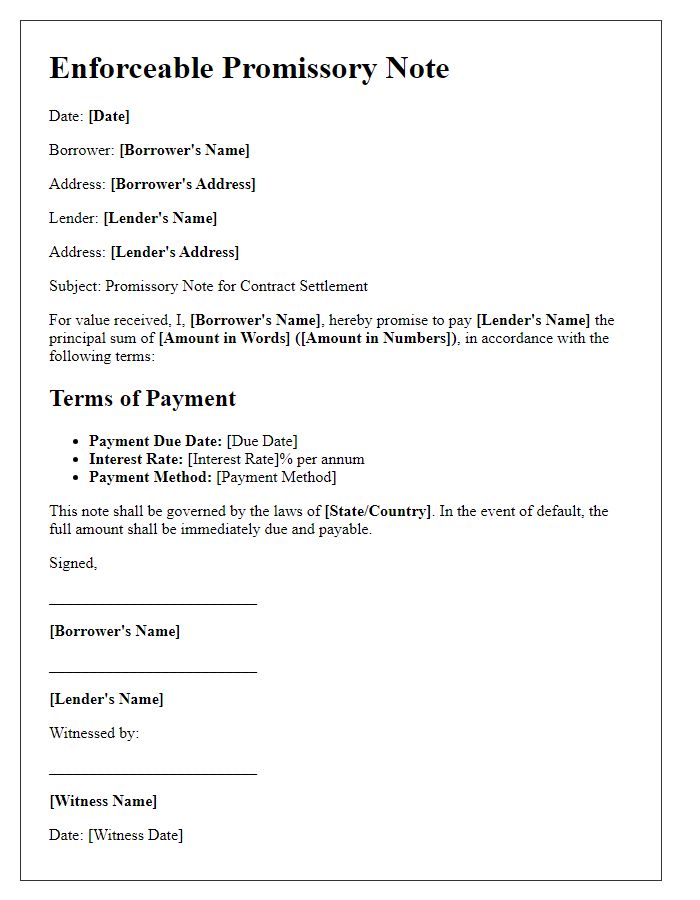

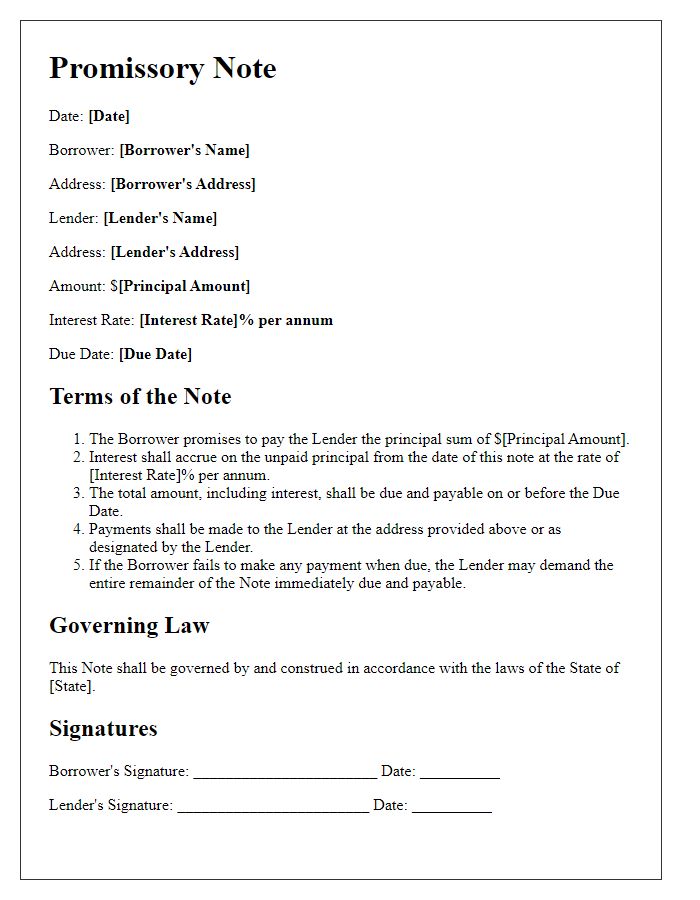

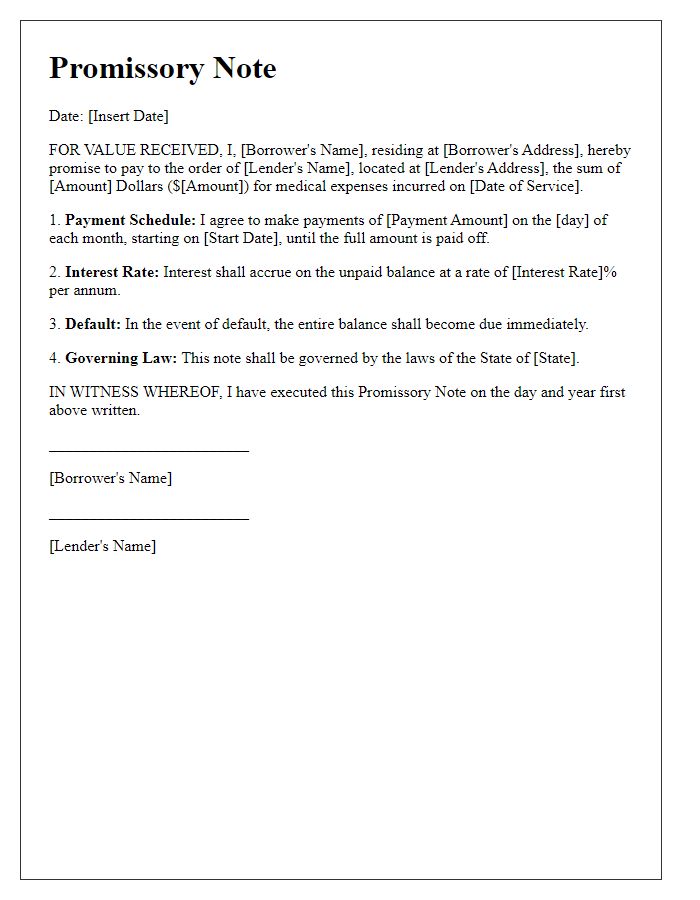

A promissory note is a legal financial document that specifies a borrower's commitment to repay a specified sum to a lender. It is essential to clearly state the title "Promissory Note" at the top of the document for easy identification of the agreement's nature. The borrower's full name, address, and identification number, such as a Social Security Number or Tax ID, must be accurately included to verify their identity and legal standing in the arrangement. The lender's details must be documented with equal clarity, providing their full name, address, and identification number. This information is crucial for establishing the legitimacy of the transaction and protecting the rights of both parties involved, especially in the event of any future disputes or defaults on repayment. Additionally, identifying features such as the date of the agreement and the terms of repayment must be thorough and precise to ensure enforceability under applicable laws.

Specific Payment Terms

Enforceable promissory notes establish clear, specific payment terms essential for legal agreements. Payment terms include principal amount, typically expressed in dollars (e.g., $5,000), interest rate (e.g., 5% annually), and due date (e.g., January 1, 2025). Installment schedules may specify monthly payments (e.g., $500 due on the first of each month). Prepayment penalties may apply, detailing conditions under which early payments incur additional fees. Collateral may secure repayment, adding assurance for lenders. Governing laws (e.g., CaliforniaCivil Code) influence enforcement and applicability. Clarity in these terms ensures enforceability, reducing potential disputes.

Interest Rate Details

A promissory note serves as a legally binding document outlining the borrower's commitment to repay a loan amount. Specific interest rate details play a crucial role in defining the terms of repayment. For instance, a fixed interest rate of 5% per annum may be stipulated, applied to the outstanding principal amount. The date on which interest accrues, such as the first of every month, can influence the total repayment amount. Additionally, any late payment penalties, such as a fee of $25 for payments made after the due date, should also be clearly stated. These details contribute to outlining the financial obligations while ensuring transparency between both parties involved in the loan agreement.

Default and Penalty Clauses

A promissory note serves as a formal financial document facilitating a borrower's obligation to repay a specified amount over time. Default clauses within this document outline the conditions indicating failure to adhere to agreed repayment schedules. An example includes missing a payment deadline (typically a specified number of days, such as 30 days past the due date). Furthermore, penalty clauses are enacted, highlighting the consequences, which may encompass an increase in the interest rate (potentially by 5% or more above the original rate) or additional fees (often around 2% to 4% of the total amount owed) accrued per missed payment. Legal measures in various jurisdictions can lead to debt collection actions or even foreclosure in cases involving secured loans. Therefore, careful articulation of these clauses is paramount to ensure enforceability and clarity in the borrower's responsibilities.

Signatures and Date

A legally enforceable promissory note requires clear signatures and a date to ensure validity. The borrower's signature, typically located at the bottom of the document, verifies acknowledgment of the loan terms, including the principal amount and interest rate, while the lender's signature affirms acceptance of these conditions. The date must be included immediately following the signatures to establish the timeline of the agreement, marking the official initiation of the loan. This date is crucial for determining repayment schedules and potential breach dates, particularly if legal action becomes necessary. Ensuring that signatures and the date are legible and correctly placed strengthens the enforceability of the promissory note in a court of law.

Letter Template For Enforceable Promissory Note Samples

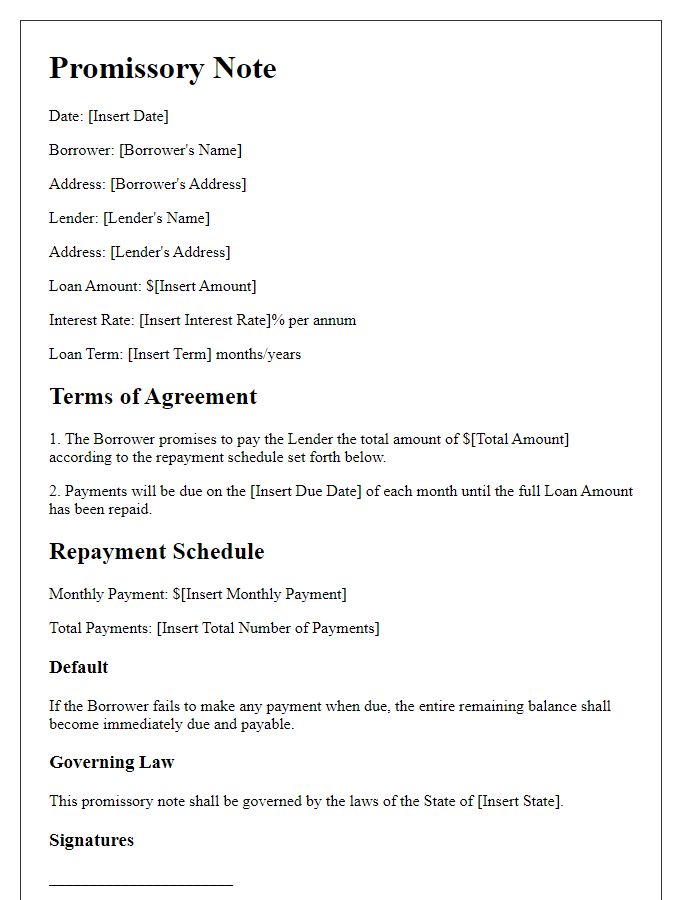

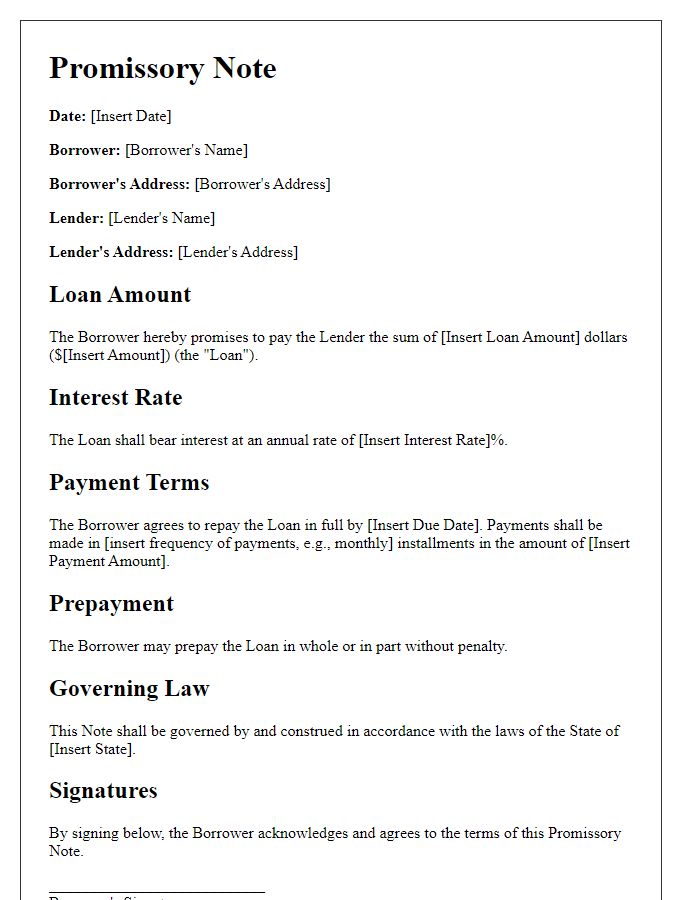

Letter template of enforceable promissory note for personal loan agreement.

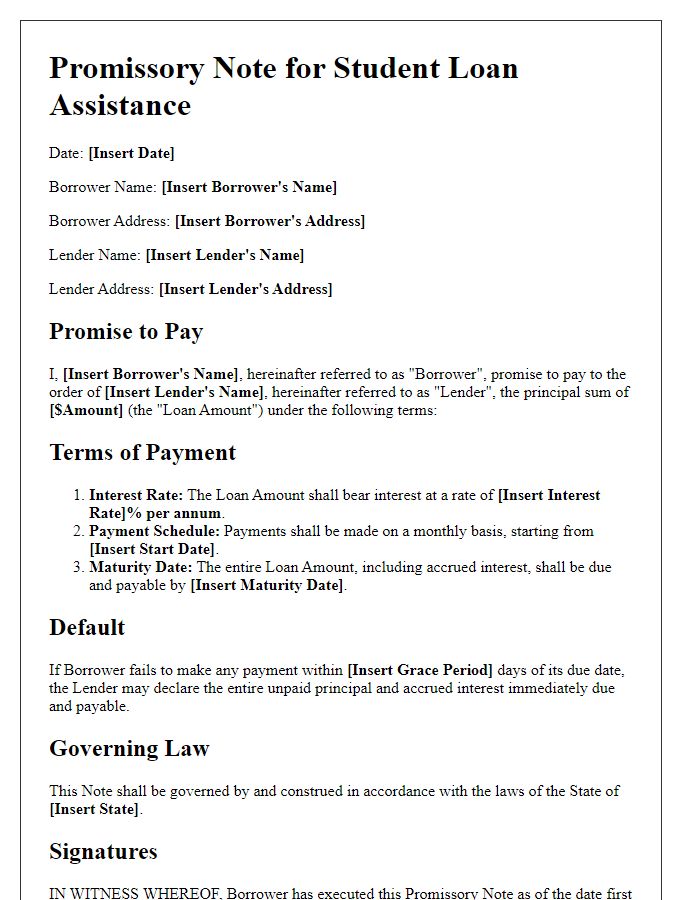

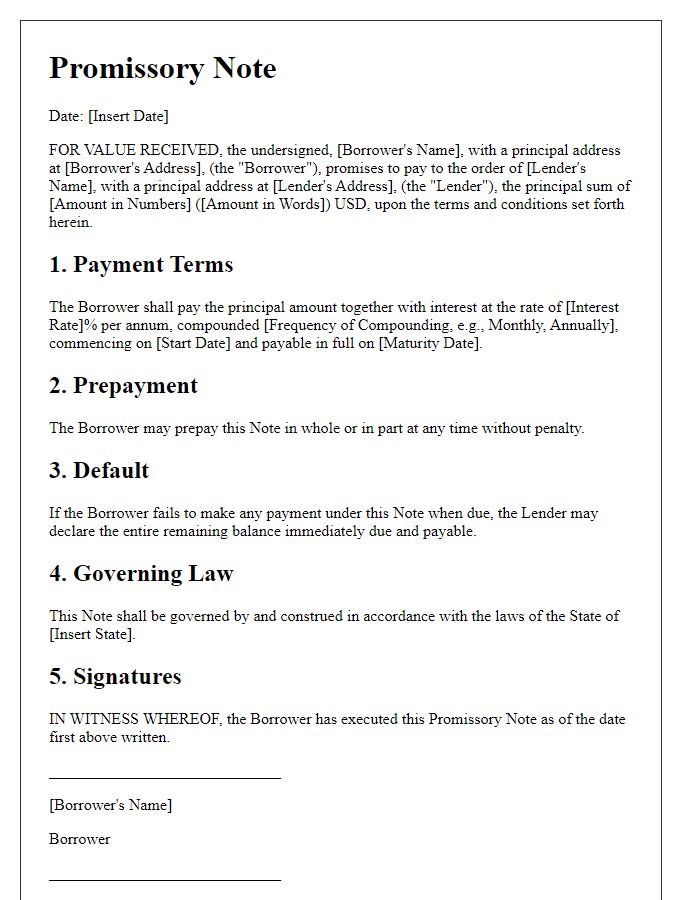

Letter template of enforceable promissory note for student loan assistance.

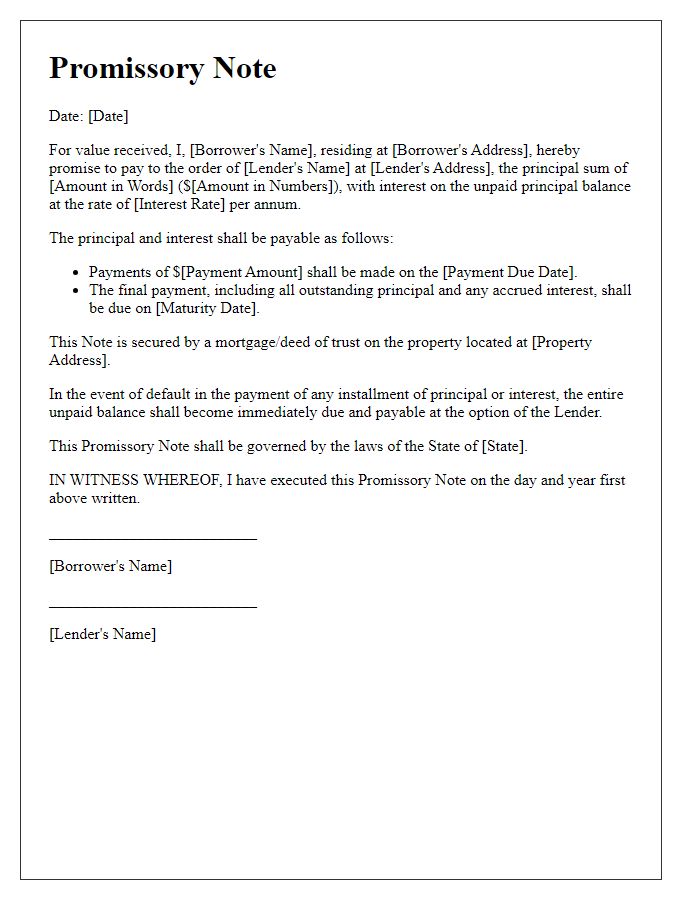

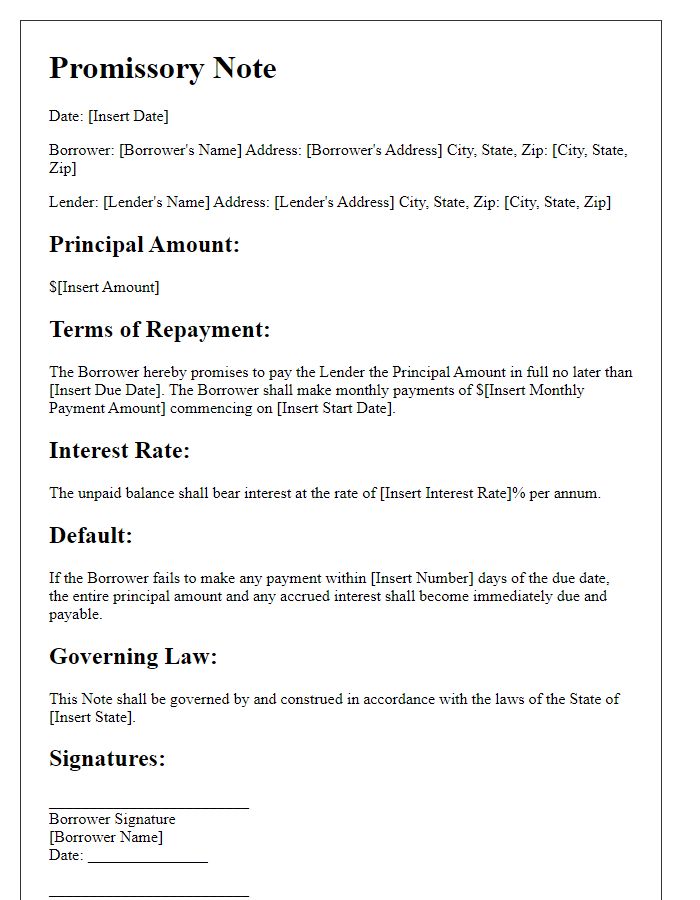

Letter template of enforceable promissory note for real estate transaction.

Letter template of enforceable promissory note for family loan arrangement.

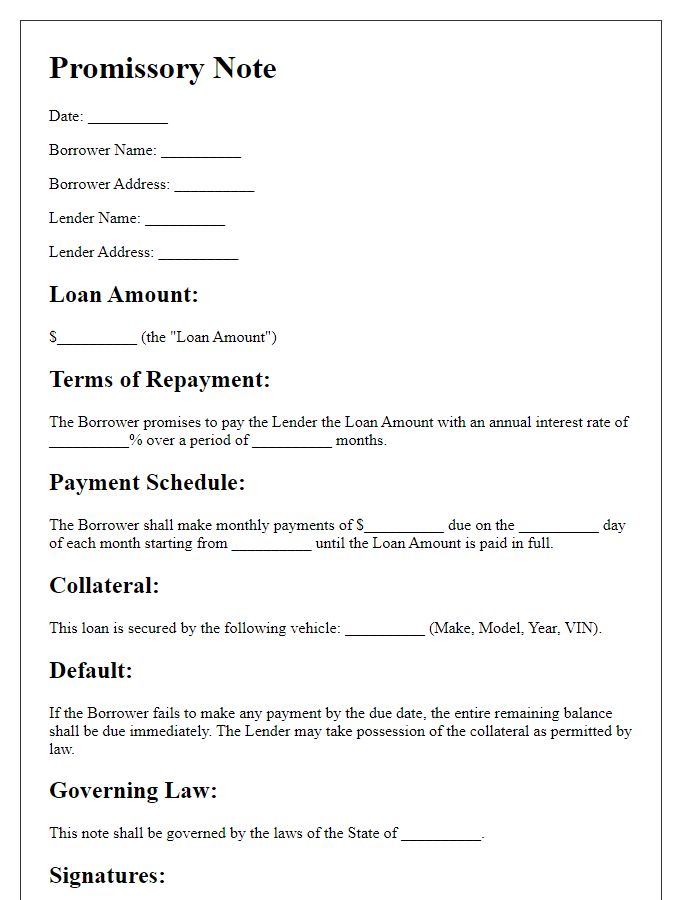

Letter template of enforceable promissory note for vehicle purchase loan.

Comments