When it comes to protecting your business from the unforeseen dangers of the digital world, understanding how to file a cyber liability insurance claim is crucial. Navigating this process can be daunting, but with the right guidance and a solid template, you can simplify your efforts and ensure you're covered. In this article, we'll break down the steps you need to take and provide you with a helpful letter template to get your claim started. So, let's dive in and empower you to safeguard your business effectively!

Policy Information

Cyber liability insurance provides essential coverage for businesses facing the repercussions of data breaches or cyberattacks. Policyholders, including small and medium enterprises, often seek claims after incidents involving unauthorized access to sensitive customer information or company proprietary data. Coverage limits typically range from $1 million to $10 million, depending on the insurer. Important terms include incident response services, data restoration, and legal fees associated with regulatory fines from entities like the Federal Trade Commission (FTC). Policy numbers and renewal dates are crucial for tracking the coverage history. Many policies also emphasize the requirement for risk management protocols, further highlighting the importance of preventive measures in safeguarding digital assets.

Incident Description

In 2023, a significant ransomware attack targeted a mid-sized healthcare organization based in Atlanta, Georgia. The incident began on April 15 when suspicious email attachments were opened by an employee, leading to the infiltration of the organization's network. Once the malware penetrated the system, it encrypted critical patient data and demanded a ransom of 200 bitcoins, equivalent to approximately $10 million. The breach not only disrupted access to patient records but also halted several vital healthcare operations, risking patient care and safety. Immediate actions included notifying law enforcement and engaging cybersecurity experts to mitigate the damage. Extensive investigations uncovered that over 100,000 patient records were compromised, including personal identification and medical history, raising concerns about potential identity theft and regulatory fines under HIPAA regulations.

Timeline of Events

A comprehensive timeline of events highlights crucial moments during the cyber incident, enabling a clearer understanding of the impacts and responses. On January 5, 2023, at approximately 8:15 AM, suspicious activity was first detected on the corporate network of XYZ Corporation located in San Francisco, California. An alert from the security information and event management (SIEM) system indicated unauthorized access attempts. By January 6, 2023, at around 9:30 AM, the IT department confirmed a ransomware attack that compromised sensitive data, affecting approximately 80,000 customer accounts. Emergency protocols were immediately invoked, including engaging a cybersecurity firm, CyberSecure Solutions, based in New York. By January 7, 2023, the breach was reported to law enforcement, specifically the Federal Bureau of Investigation (FBI), to initiate an investigation. Subsequently, the company faced significant downtime, estimated at 48 hours, which resulted in an operational loss of approximately $500,000. On January 10, 2023, efforts to recover data were initiated, while notifications to affected customers were sent within 72 hours, complying with the California Consumer Privacy Act (CCPA). By January 15, 2023, a public relations strategy was implemented to manage customer relations and rebuild trust after the attack.

Financial Loss Documentation

Cyber liability insurance claims can be crucial for businesses experiencing financial losses due to data breaches or cyberattacks. It is essential to document all relevant financial loss details meticulously. Start by compiling invoices related to remediation efforts, including IT forensic investigations, legal consultations, and notification expenses. Quantify the total downtime experienced, translating this into lost revenue, particularly for high-traffic e-commerce sites. Identify any penalties incurred, such as regulatory fines from organizations like the Federal Trade Commission (FTC) or General Data Protection Regulation (GDPR) violations. Additionally, gather evidence of any reputational damage, which can indirectly lead to long-term financial impacts, such as customer attrition and diminished trust. Thoroughly organize this documentation to enhance the clarity and effectiveness of the claim process.

Contact Information

In the context of a cyber liability insurance claim, having accurate contact information is essential for effective communication and resolution. The claimant should include full name, possibly John Doe, and a primary contact number, such as (123) 456-7890, to facilitate direct conversations. Additionally, providing an email address, for example, johndoe@email.com, ensures that all documentation can be accurately sent and received. The claimant's physical address, like 123 Main Street, Cityville, State, ZIP, is also crucial for formal communication and serves as the official location of the insured entity. Including a backup contact person and their information can also prove beneficial, especially in instances of urgent inquiries or additional clarification regarding the incident or claim process.

Letter Template For Cyber Liability Insurance Claim Samples

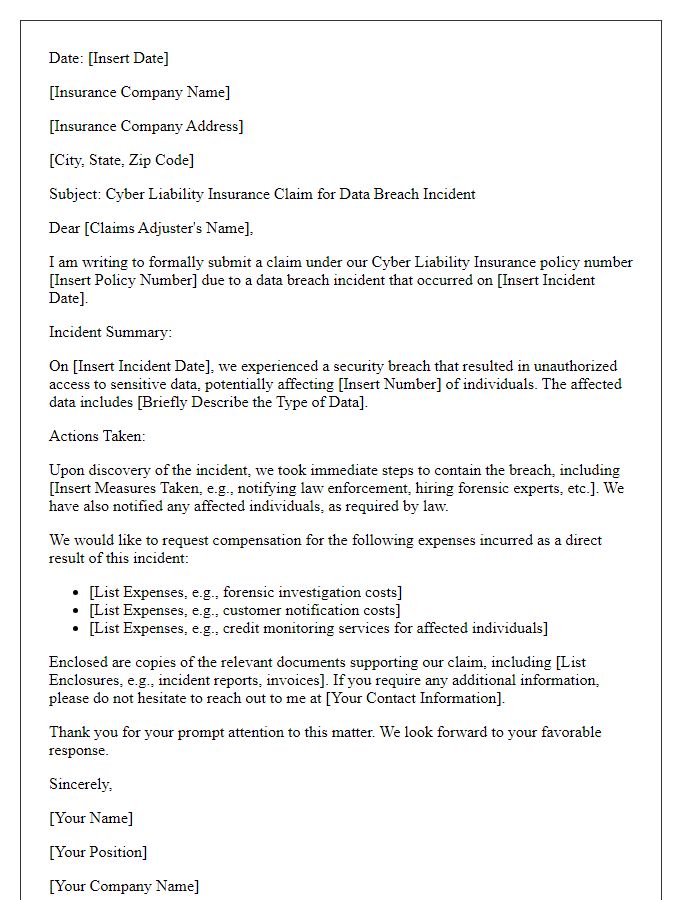

Letter template of cyber liability insurance claim for data breach incident

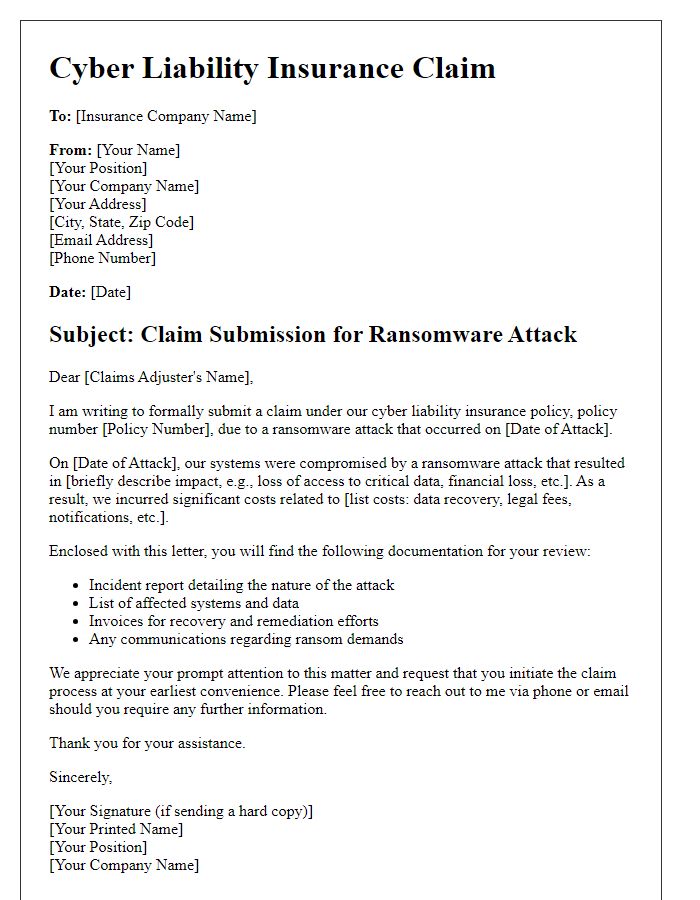

Letter template of cyber liability insurance claim for ransomware attack

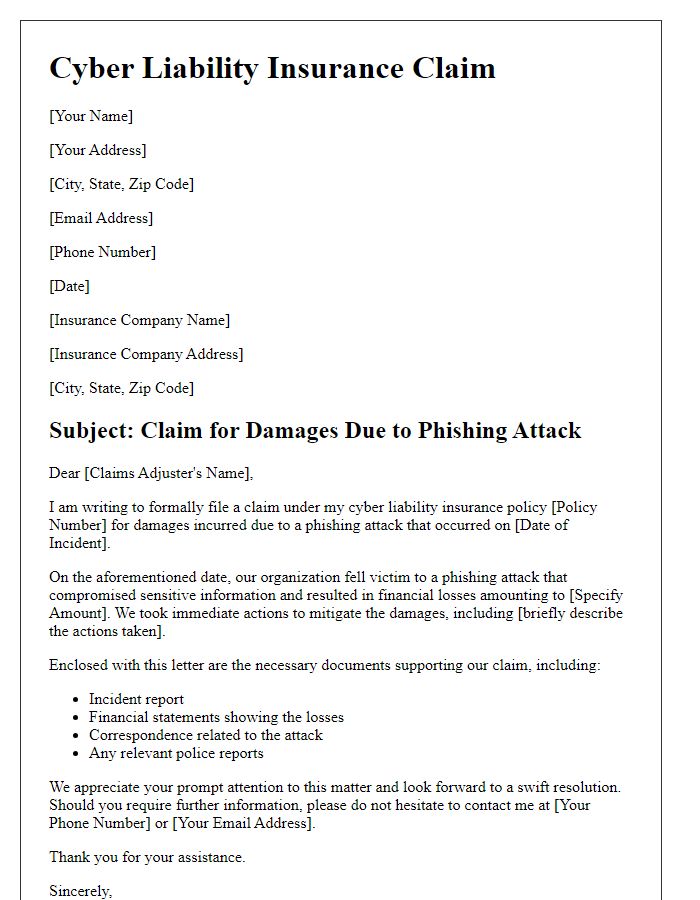

Letter template of cyber liability insurance claim for phishing attack damages

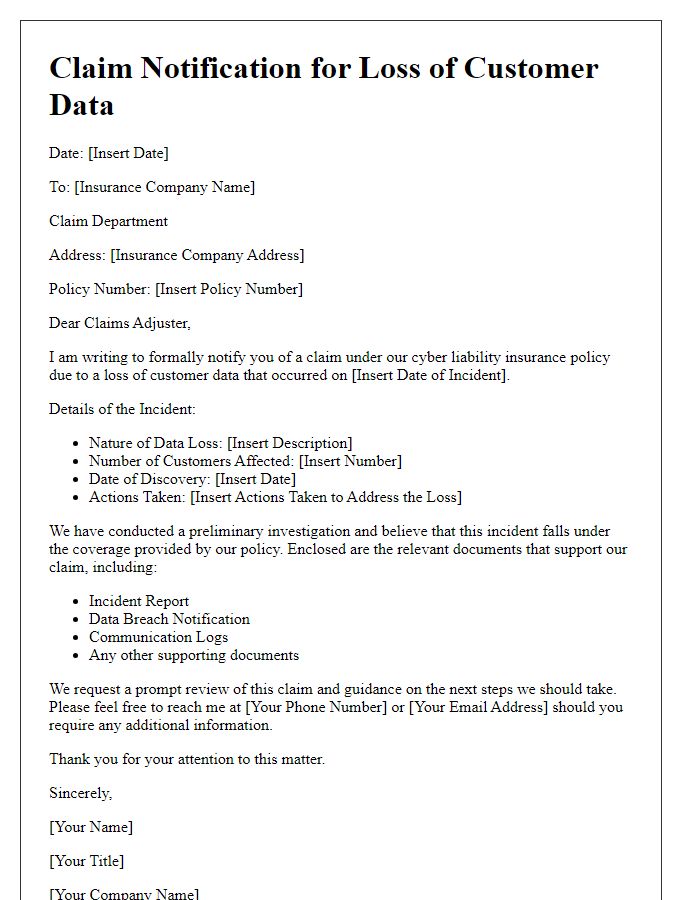

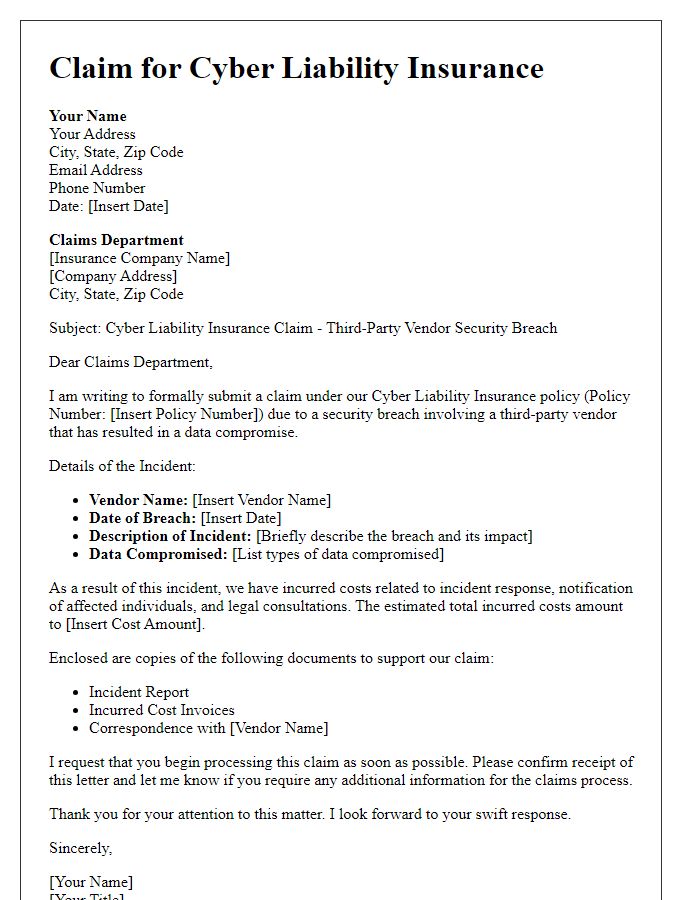

Letter template of cyber liability insurance claim for loss of customer data

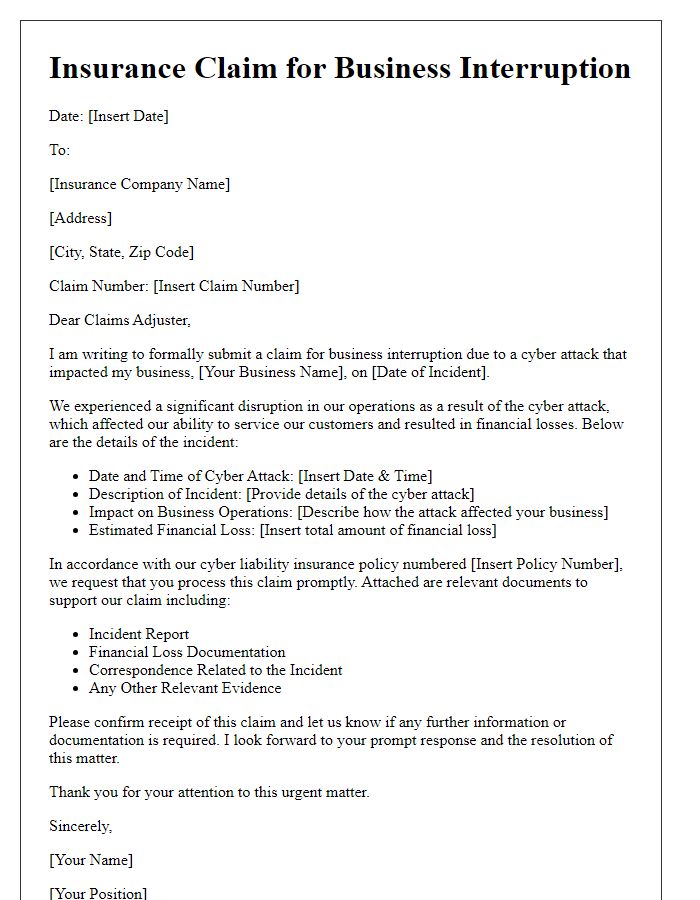

Letter template of cyber liability insurance claim for business interruption due to cyber attack

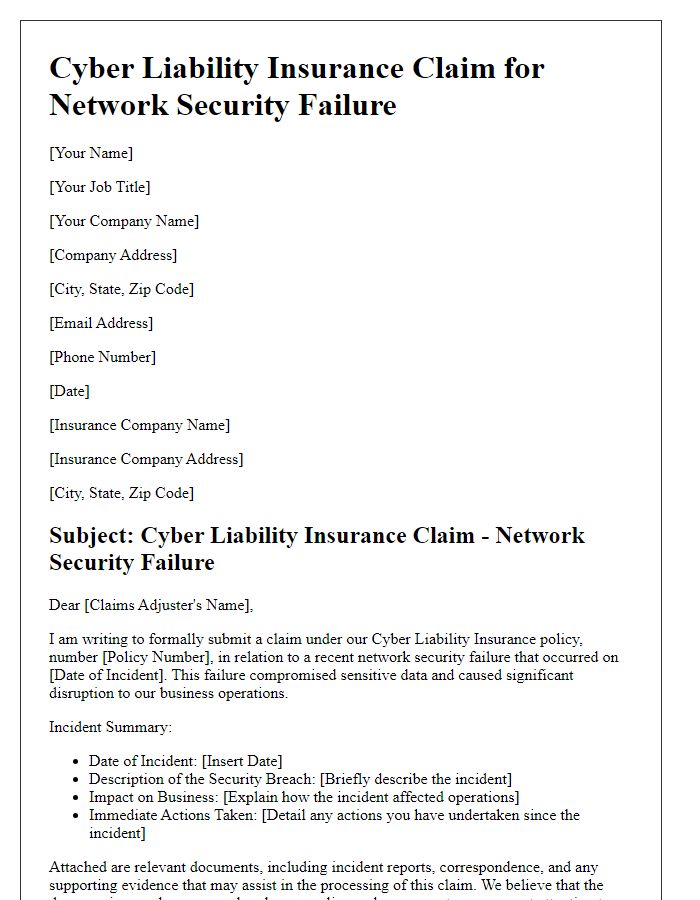

Letter template of cyber liability insurance claim for network security failure

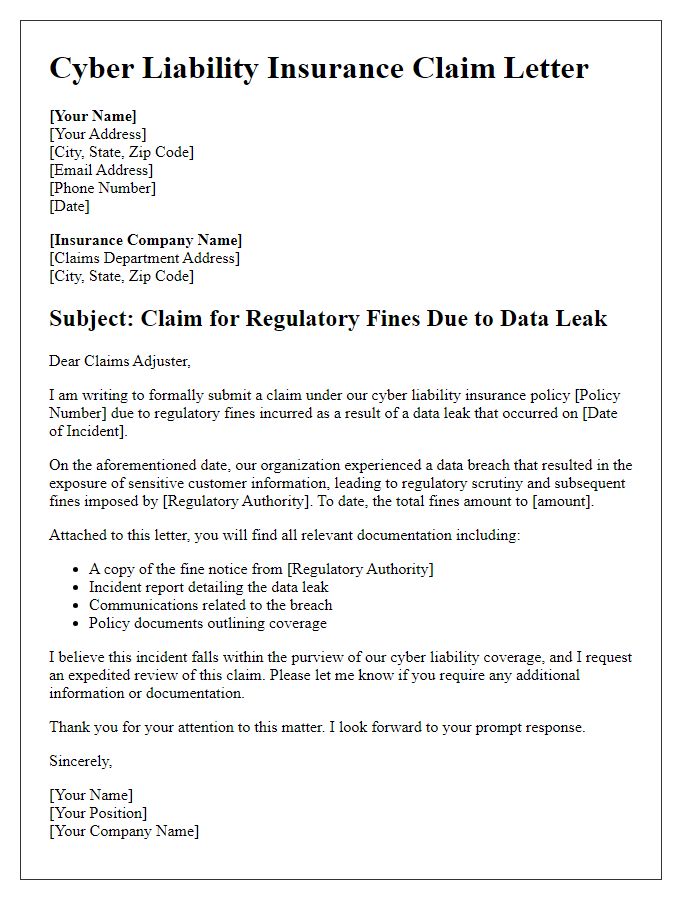

Letter template of cyber liability insurance claim for regulatory fines due to data leak

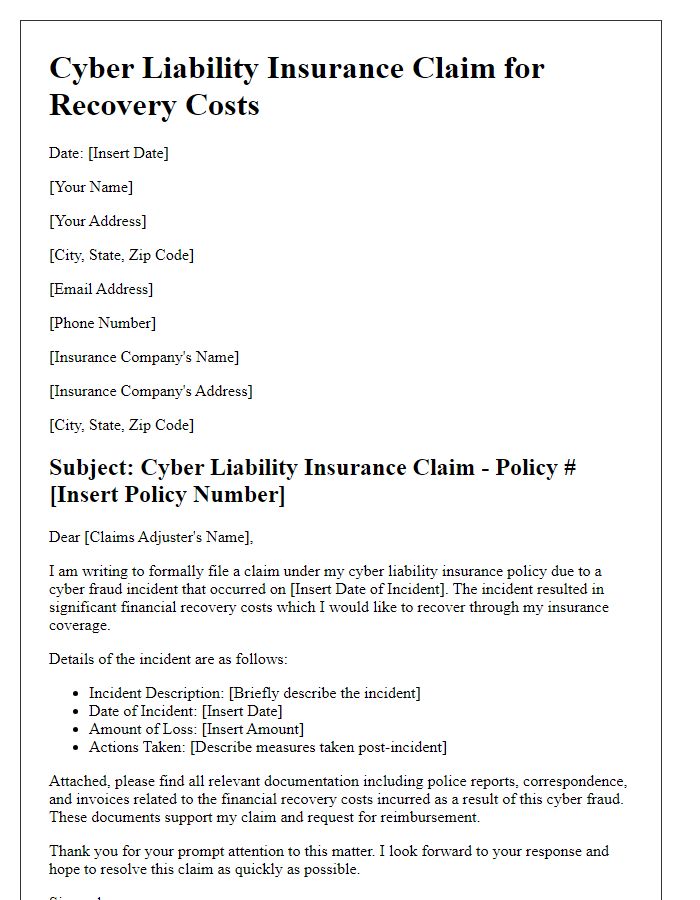

Letter template of cyber liability insurance claim for recovery costs from cyber fraud

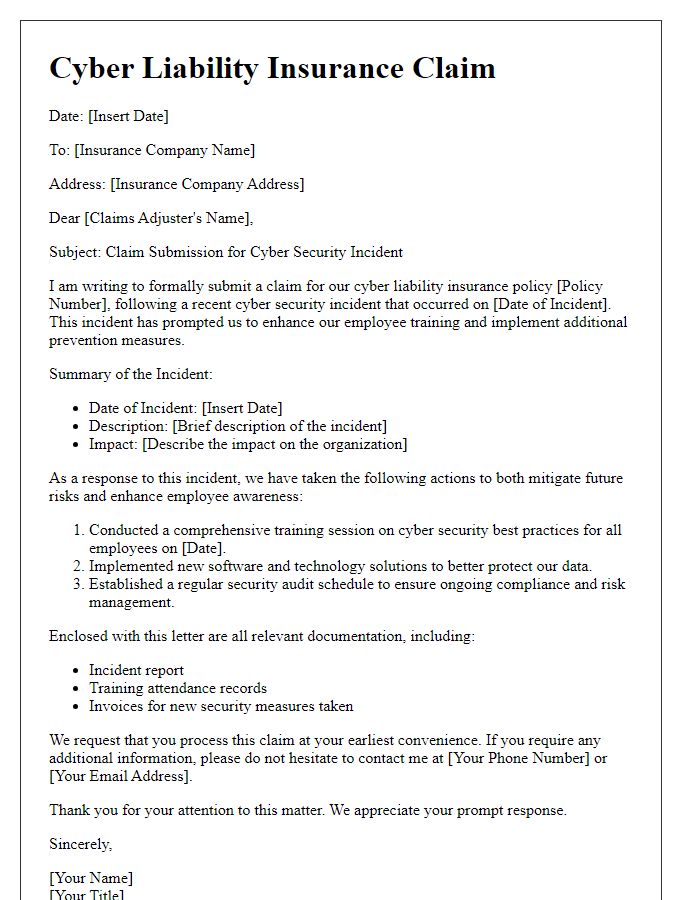

Letter template of cyber liability insurance claim for employee training and prevention measures

Comments