Hey there! If you're finding yourself in a bit of a pickle with a debt collection agency, you're not aloneâmany people face disputes over debts they might not even owe. It's essential to address these issues promptly and effectively to protect your rights and financial well-being. In this article, we'll walk you through a reliable letter template you can use to dispute a claim, ensuring you communicate clearly and confidently. So, grab a cup of coffee and keep reading to learn how to take charge of your situation!

Creditor's Information

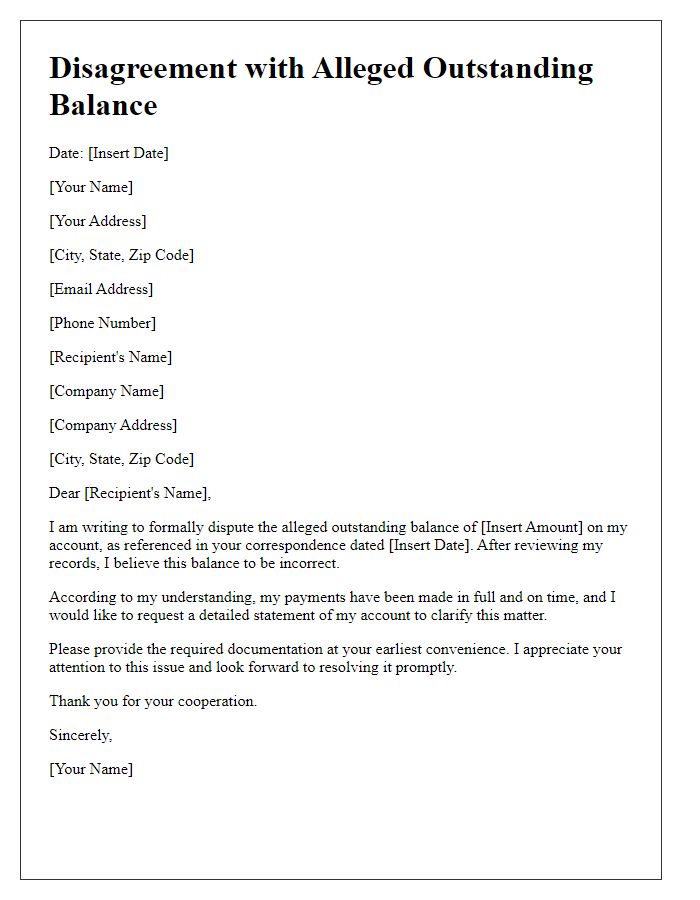

Creditor information forms an essential part of debt collection records, including the creditor's name, which typically identifies the financial institution or company owed money. Account details represent the specific account number associated with the debt, providing a reference for both the debtor and collection agency. The total amount owed reflects the outstanding principal and may include accrued interest or late fees, highlighting the financial obligation. Contact information, such as phone numbers or addresses, ensures communication lines are clear for negotiations or disputes, adhering to regulations outlined by the Fair Debt Collection Practices Act in the United States. Documenting these elements accurately can influence the outcome of any debt dispute process.

Account Number

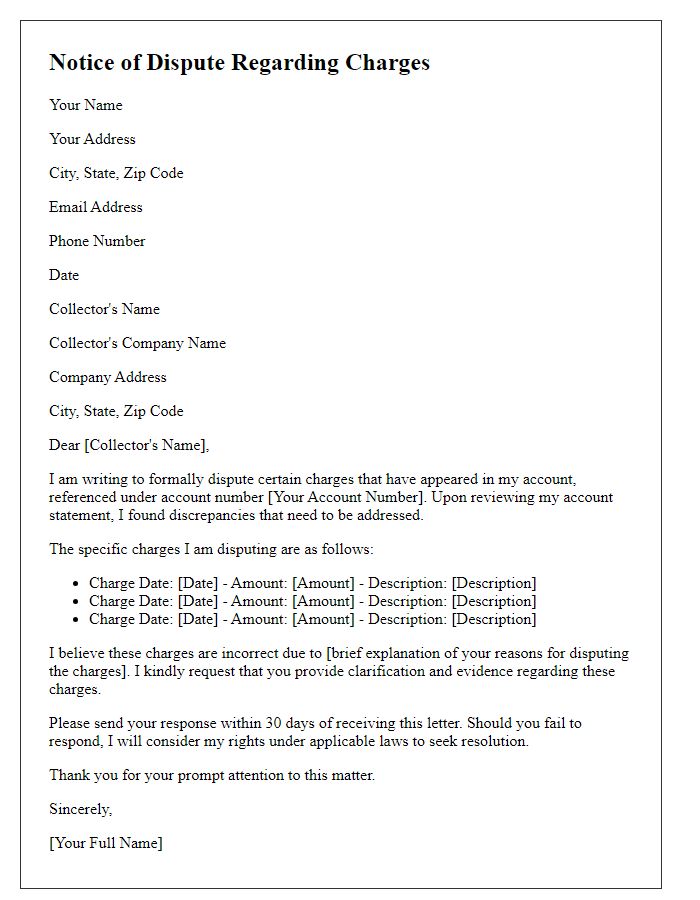

Disputes regarding debt collection practices can significantly impact credit health. In cases like these, an individual often navigates the complexities of communication with agencies such as Equifax or Experian, which maintain credit reports. Account numbers, typically a numerical sequence assigned by the agency, are crucial in identifying specific debts, ensuring accurate representation in records. Employing a formal declaration is essential when contesting inaccuracies, especially in light of the Fair Debt Collection Practices Act, which governs how agencies can interact with consumers. Timely responses, within 30 days of initial contact, are advisable to uphold consumer rights and initiate a resolution process.

Dispute Reason

Disputing a debt requires clear documentation and precise communication. One common reason for dispute relates to inaccuracies in the reported amount owed. Creditors may mistakenly inflate figures due to erroneous interest calculations or unverified charges. Another issue involves identity theft, where an individual may find erroneous collections linked to their name. Inaccurate reporting of payment history can also lead to disputes, as it affects credit scores significantly. Furthermore, it's essential to verify the legitimacy of the debt itself, ensuring it rests with the correct individual or follows proper legal protocols under the Fair Debt Collection Practices Act of 1977 in the United States. Comprehensive records, such as previous correspondence and payment receipts, bolster the dispute claim effectively.

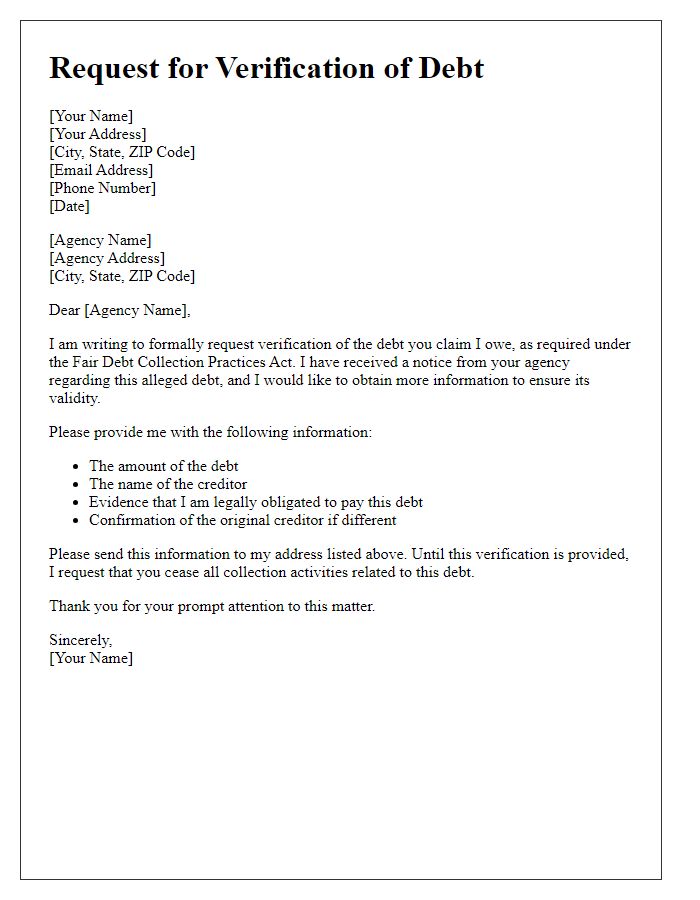

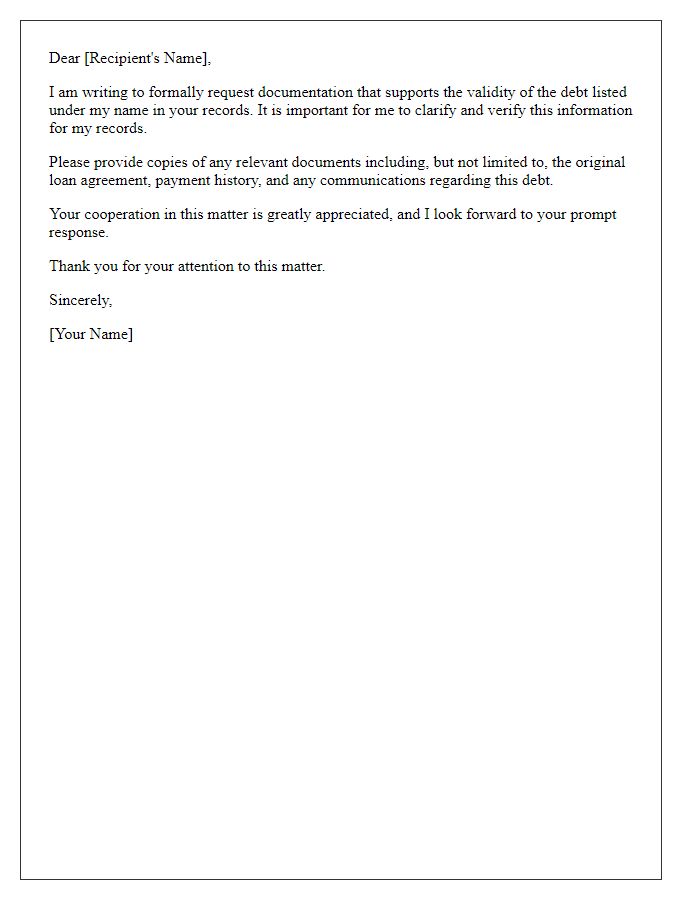

Request for Verification

When a consumer receives a debt collection notice from an agency, it is crucial to ensure the legitimacy of the claim. The Fair Debt Collection Practices Act (FDCPA) mandates that consumers have the right to request verification of the debt. This request should include pertinent information such as the creditor's name, the original amount owed, and any relevant account numbers to ensure proper identification of the disputed debt. Failure to verify the alleged debt can result in the agency ceasing collection efforts. Documentation of the request should be sent via certified mail to ensure a record of correspondence. This proactive approach can protect consumer rights and prevent fraudulent claims in the debt collection process.

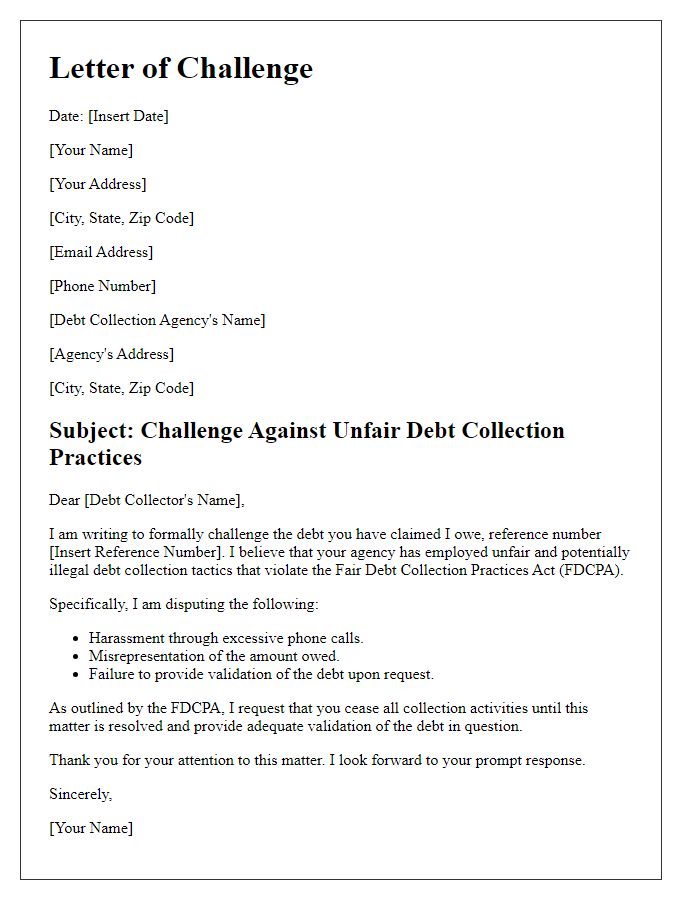

Consumer Rights Statement

A debt collection agency's practices must comply with the Fair Debt Collection Practices Act (FDCPA), enacted in 1977 to protect consumers from abusive tactics. Under this regulation, consumers have specific rights, including the right to dispute debts and request validation of alleged debts within 30 days from receipt of a notice. A dispute may arise in various situations, such as when a consumer suspects an error in the account balance or believes the debt may have originated from a fraudulent transaction. Key provisions of the FDCPA prohibit harassment, misleading information, and improper communication during the collection process. Consumers should document all correspondence with collection agencies, maintaining records of phone calls, letters, and any payment agreements. Additionally, it is advisable to send a written request for debt verification to the agency, ensuring delivery through certified mail for tracking purposes, which reinforces the consumer's position in any potential dispute over the alleged debt.

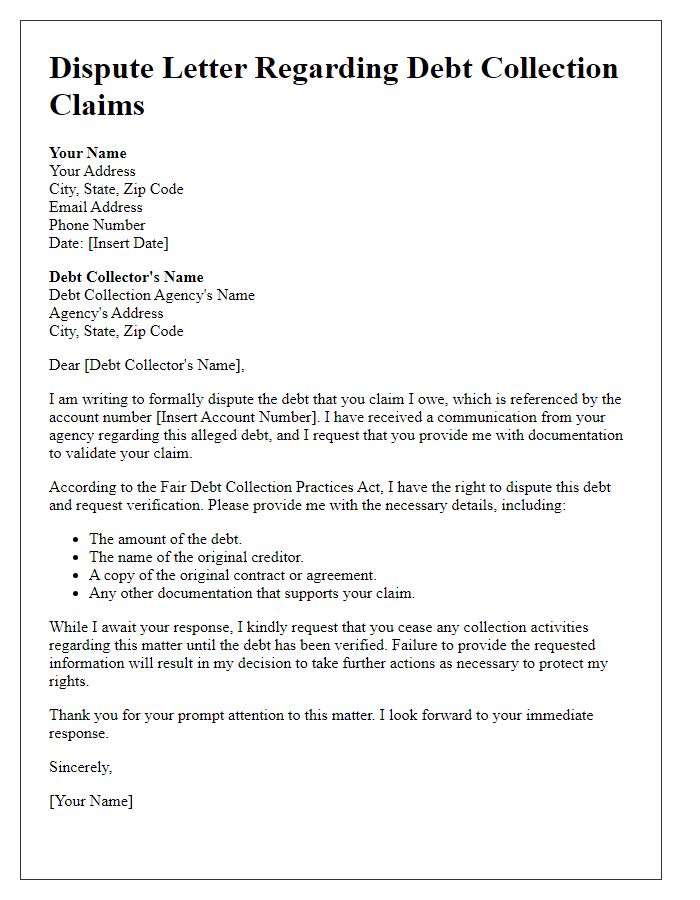

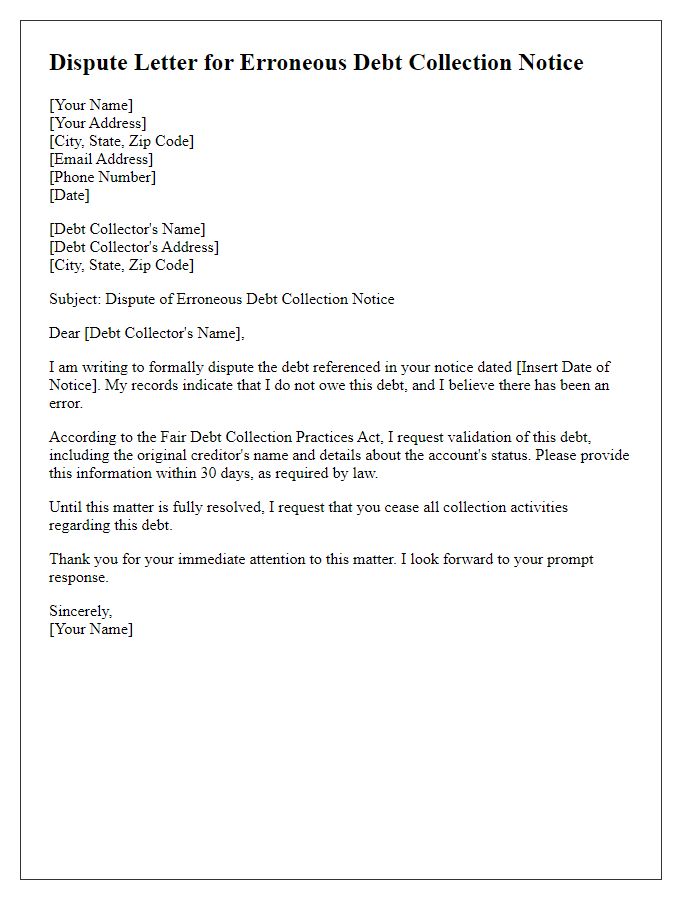

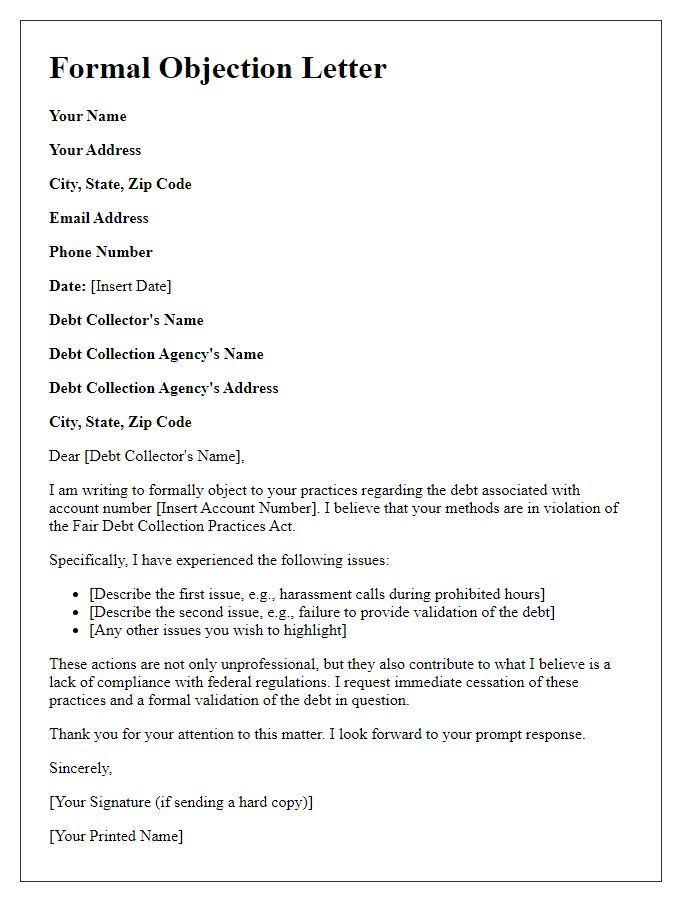

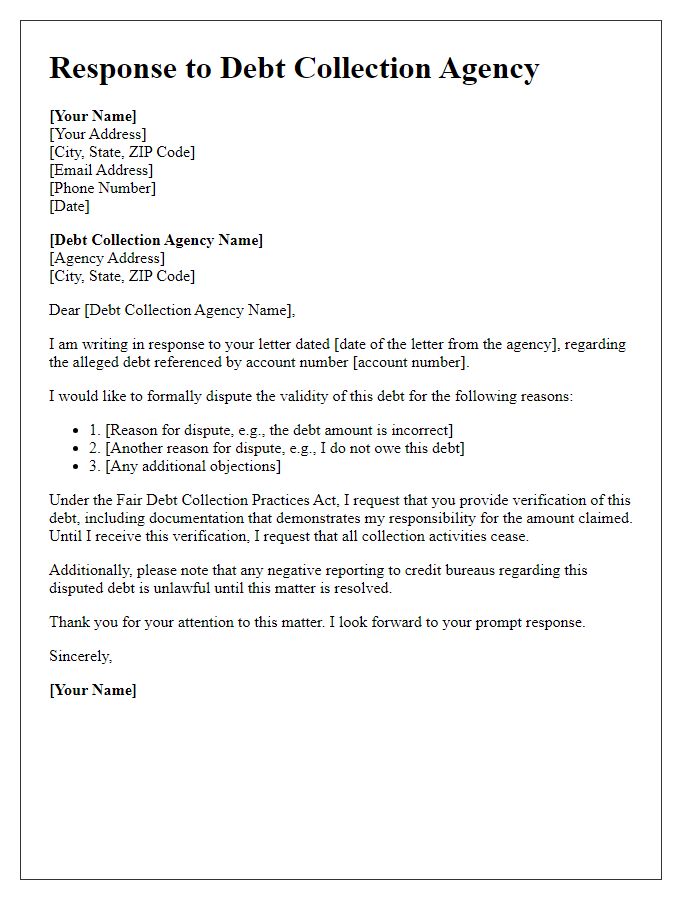

Letter Template For Debt Collection Agency Dispute Samples

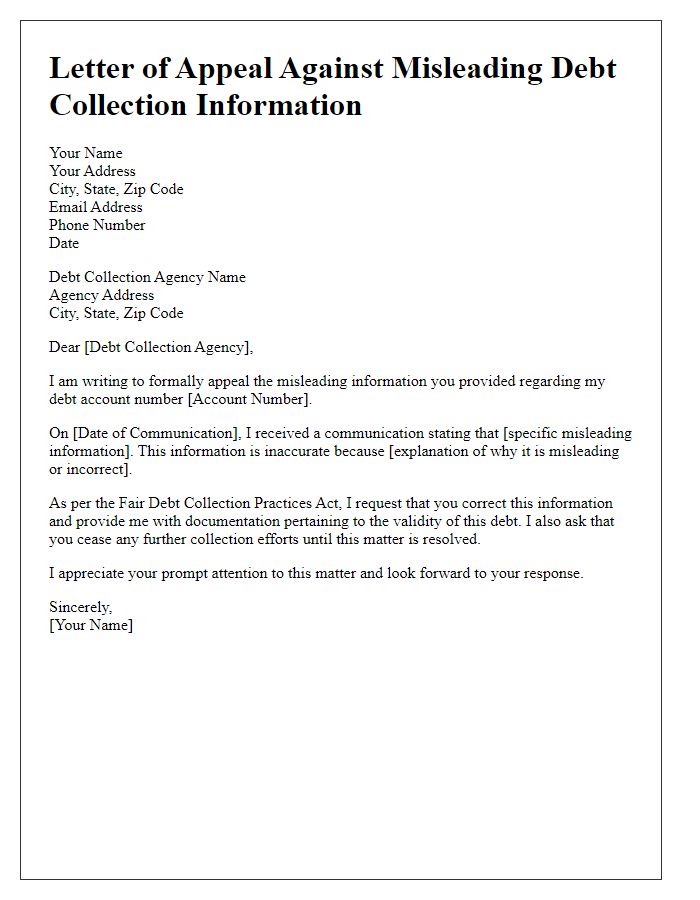

Letter template of appeal against misleading debt collection information

Comments