When it comes to dissolving a legal partnership, the process can feel daunting, but it doesn't have to be. Clear communication is key, and a well-drafted letter can help ease the transition for all parties involved. In this article, we'll walk you through the essential components of a dissolution letter, ensuring that your intentions are clearly expressed and legally sound. So, let's dive in and explore how to effectively navigate this important stepâread on for more insights!

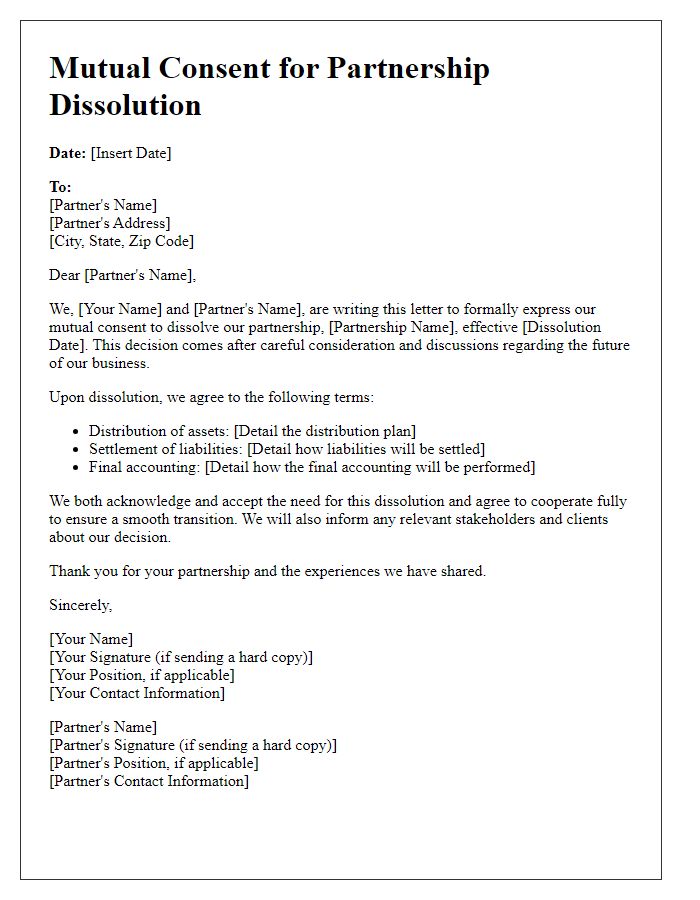

Formal introduction and identification of parties

Dissolution of a legal partnership involves the formal termination of a partnership agreement between the parties involved. The partnership, established on January 15, 2020, between ABC Enterprises, represented by John Doe, residing at 123 Market Street, New York, NY, and XYZ Solutions, represented by Jane Smith, residing at 456 Corporate Plaza, Los Angeles, CA, officially operated in the consulting and marketing industry. Both parties contributed equally to the initial capital of $50,000 and shared profits and losses as outlined in the partnership agreement. Documentation regarding partnership activities and responsibilities was meticulously maintained throughout their collaboration, which has now reached its conclusion due to mutual agreement.

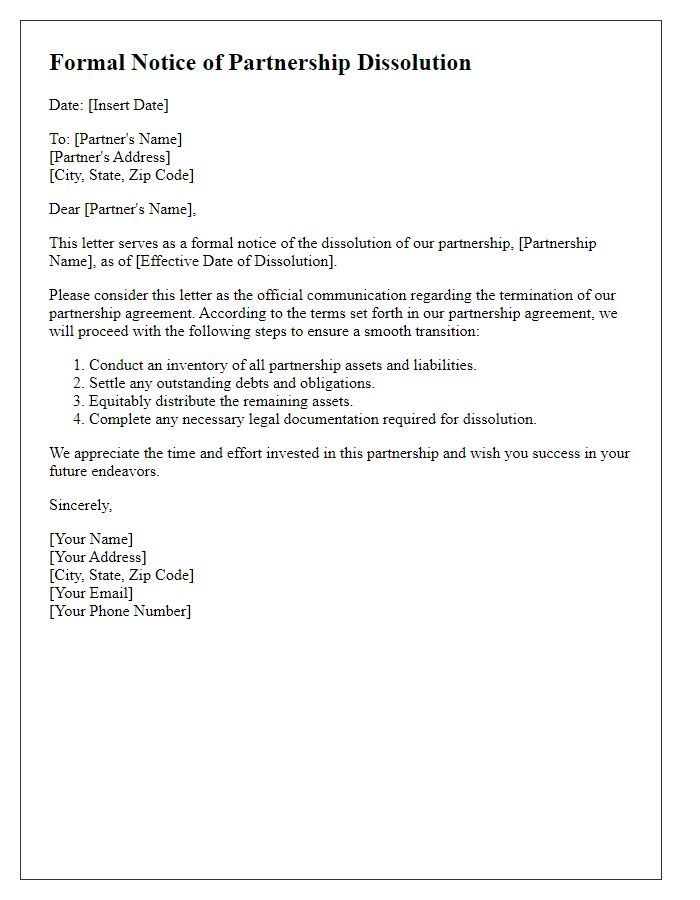

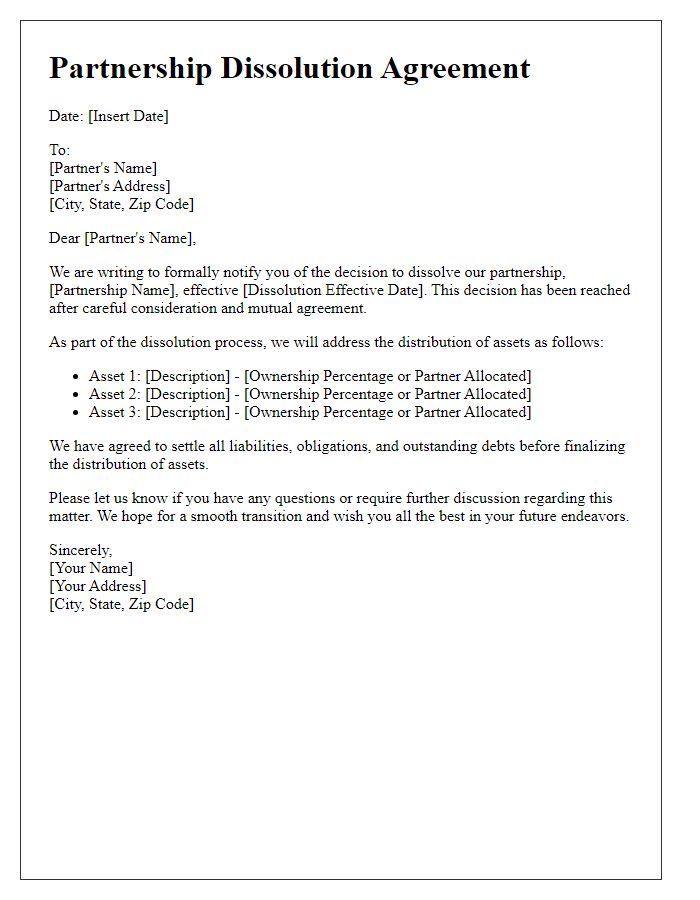

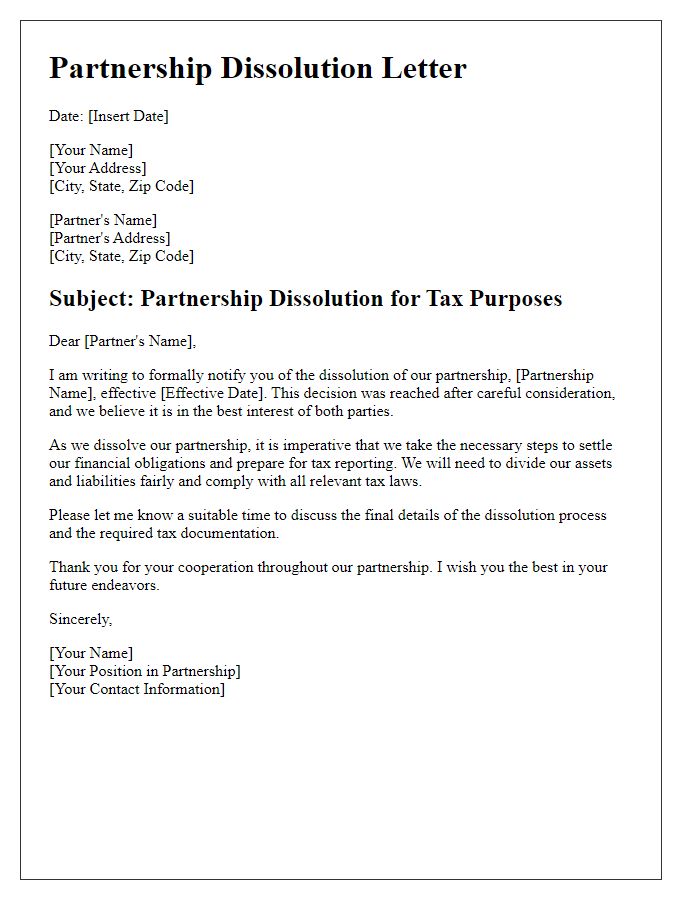

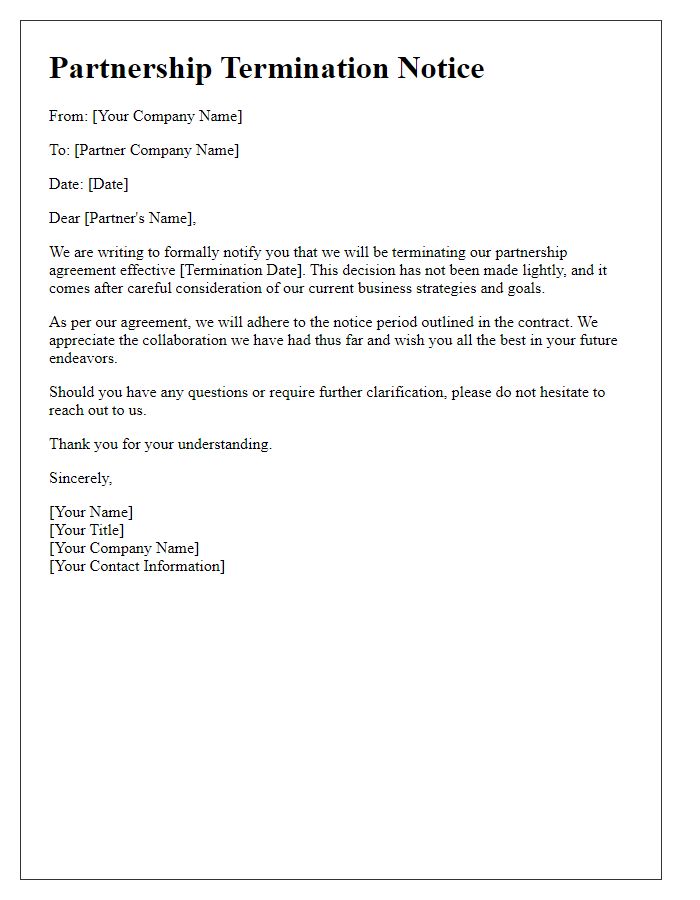

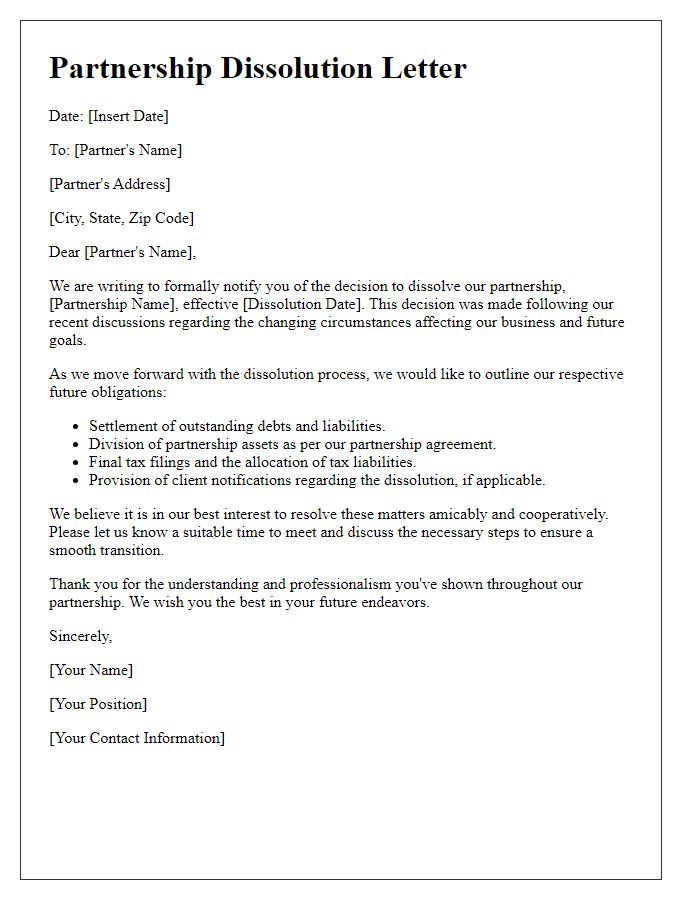

Purpose of the letter

The purpose of the letter is to formally communicate the decision to dissolve a legal partnership agreement, which may encompass various types of partnerships such as general partnerships, limited partnerships, or limited liability partnerships (LLPs). This document serves as an official notice to all involved parties, outlining the reasons for dissolution, any required procedures for asset distribution, and responsibilities related to outstanding liabilities. Key details may include the partnership name, dissolution date, and signatures from all partners to ensure mutual agreement and legal validation. It is essential to adhere to any relevant state laws and specific partnership agreements during this process.

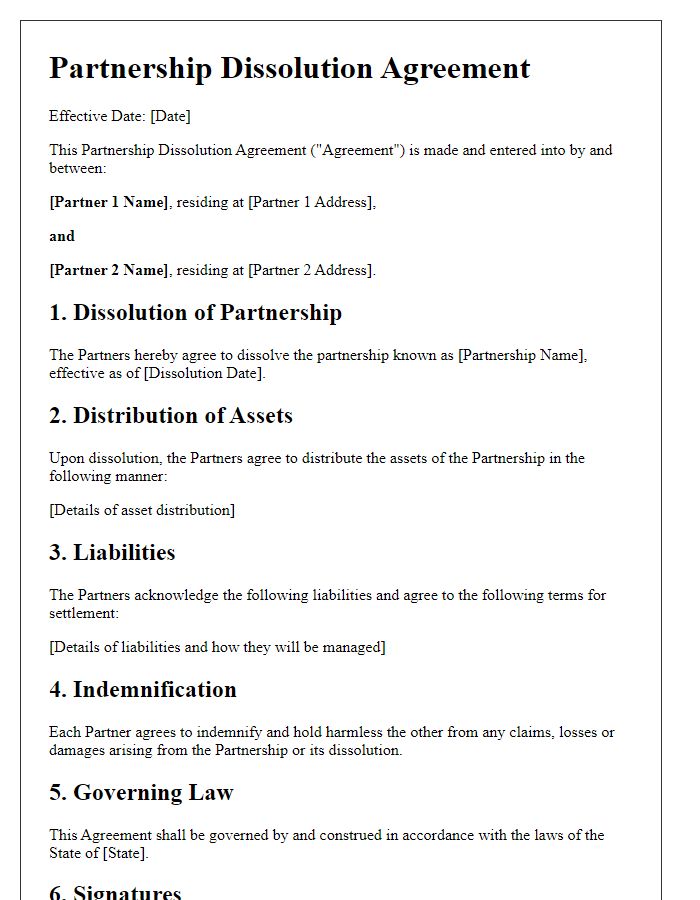

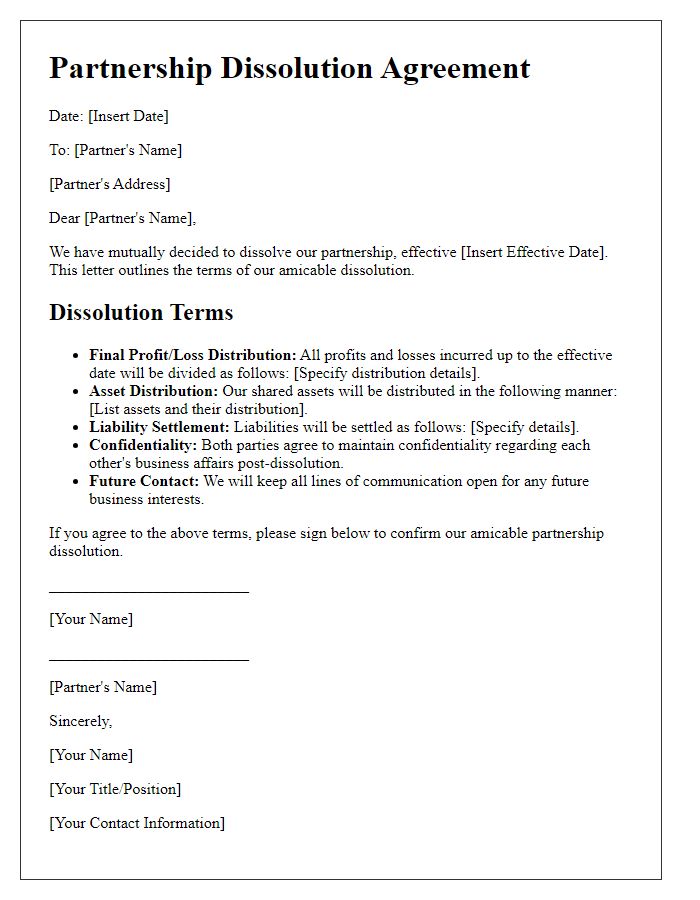

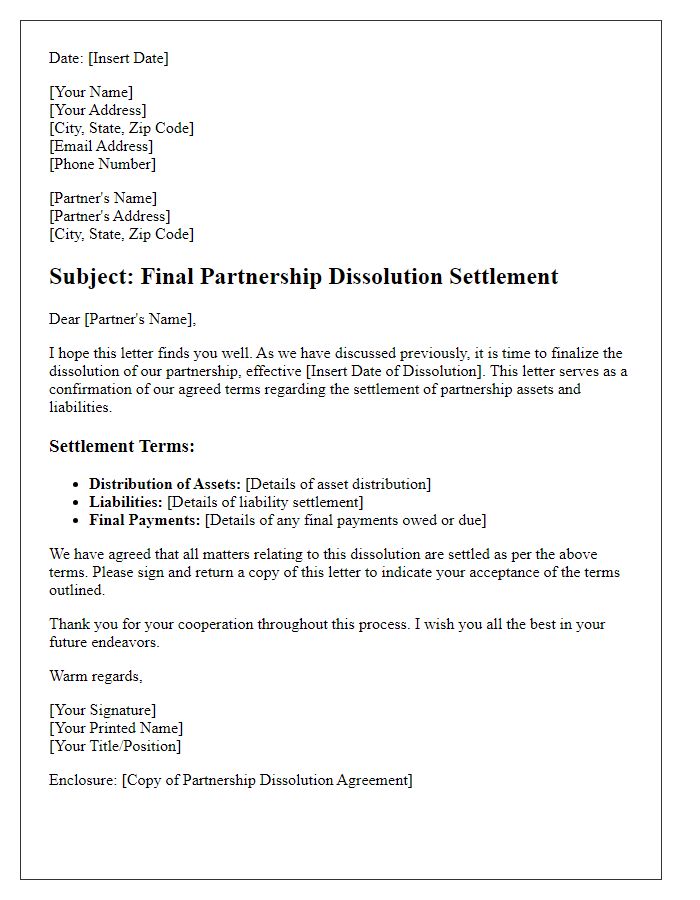

Details of the dissolution agreement

Dissolution of a legal partnership involves formal agreements outlining the terms of separation between partners, including asset distribution, liability settlement, and ongoing obligations. Specific details include the effective date of dissolution, which may be stipulated as the end of the fiscal year, such as December 31, 2023. Asset division arrangements outline how tangible assets, such as office equipment and inventory valued at $50,000, will be allocated. Liabilities, including outstanding debts of $30,000 to vendors, must be clearly defined, with specific partners agreeing to assume responsibility. The dissolution agreement commonly includes a clause about confidentiality, protecting sensitive information, particularly if the partnership operated in sectors like legal or financial services. Following finalization, partners must file the dissolution documents with the state's Secretary of State office to formally dissolve the business entity.

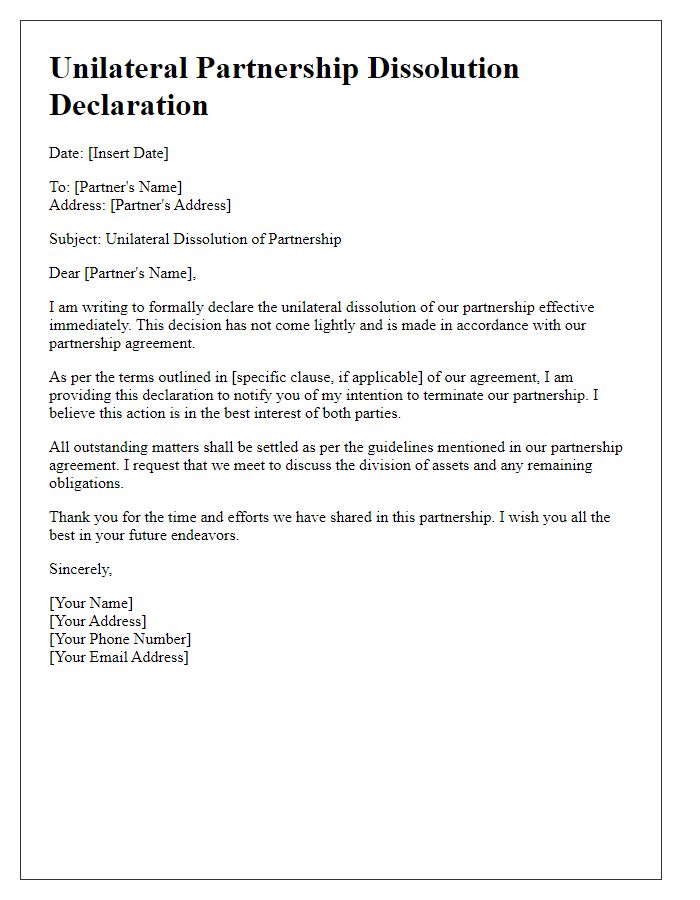

Obligations and responsibilities post-dissolution

The dissolution of a legal partnership involves various obligations and responsibilities that must be clearly outlined to ensure a smooth transition for all parties involved. After the formal dissolution date, typically designated by a signed agreement, partners must address outstanding financial responsibilities, including the settling of debts accrued during the partnership, which could amount to thousands of dollars depending on the business's size. Moreover, the distribution of assets, such as equipment valued at significant market prices, must be agreed upon, with consideration given to any contractual obligations that extend beyond the dissolution. Legal documents, such as the Partnership Agreement, often stipulate the terms of asset division and liability handling, necessitating careful review. Additionally, partners may need to finalize tax obligations with local authorities (such as the IRS in the United States) to prevent future complications or audits. Finally, it is essential to ensure that any ongoing contractual commitments with clients or service providers are managed appropriately to mitigate risks of breach and maintain goodwill in the industry.

Contact information for further correspondence

Legal partnership dissolution entails formal communication detailing the process and terms of ending a business partnership. This typically involves essential information, including the names of the partners, partnership details, reason for dissolution, and any necessary financial settlements. Ensuring clarity on responsible parties for outstanding obligations is crucial. A registered address, phone number, and email address are important for further correspondence related to the dissolution. Partners should also document the distribution of assets and liabilities to prevent future disputes. Legal representation may be advisable to navigate the complexities involved in the dissolution process effectively.

Comments