If you've recently discovered an unauthorized transaction on your account, you're not alone, and taking action is crucial. Many people face this challenge, but knowing how to address it can make all the difference. In this article, we'll walk you through a simple yet effective letter template for initiating legal action against unauthorized charges. Ready to protect your finances? Let's dive in!

Detailed Account Information

In cases of unauthorized transactions, it is crucial to document specific details regarding account information for legal proceedings. Account holder names, account numbers (e.g., Savings Account 123456789 or Credit Card 987654321), and associated email addresses (such as john.doe@email.com) serve as essential identifiers. Date of the disputed transaction (e.g., September 10, 2023) along with the transaction amount (such as $150.00) and merchant details (for instance, Amazon.com) must be included. Unauthorized transaction descriptions should be recorded for clarity, detailing the nature of the discrepancy. Additionally, any prior correspondence with financial institutions (e.g., Bank of America) and documentation of reported fraud incidents should be compiled for reference. This comprehensive account information is critical for legal action, ensuring that all relevant aspects are presented appropriately.

Transaction Details

Unauthorized financial transactions can create significant stress and concern for affected individuals. For instance, credit card transactions--often occurring in various amounts--may appear unexpected on statements, often leading to disputes with financial institutions such as banks or credit card companies. When a transaction exceeds $50, immediate action is typically required to mitigate potential losses, often involving reporting to authorities such as the Federal Trade Commission (FTC). Gathering transaction details--including the date, amount, merchant name, and any reference numbers within 60 days from discovery--is crucial for filing a legal action claim. Documentation, such as bank statements highlighting the unauthorized charges, establishes a timeline and evidential basis for fraud investigation. Legal frameworks governing unauthorized transactions, including the Electronic Fund Transfer Act (EFTA), dictate consumer rights, ensuring protection against wrongful charges. Therefore, awareness and timely reporting can safeguard financial well-being and establish a proficient legal response to rectify the situation.

Unauthorized Transaction Description

Unauthorized transactions, characterized by unapproved access or misuse of financial accounts, often lead to significant distress for account holders. For instance, in cases involving credit cards from institutions like Visa or Mastercard, transactions may be flagged as unauthorized if they exceed the consumer's consent or knowledge. An example includes a fraudulent charge of $500 on a personal account, occurring on August 15, 2023, at an online retailer with a questionable reputation. This incident not only raises concerns about data security but may also necessitate legal action under laws such as the Fair Credit Billing Act, which protects consumers from liability for unauthorized charges. Reporting such incidents promptly to financial institutions, as well as local law enforcement, is crucial for both recovery of funds and prevention of future occurrences.

Legal Basis and Breach

Unauthorized transactions present significant legal challenges, particularly involving electronic funds transfers (EFTs) under regulations such as the Electronic Fund Transfer Act (EFTA) enacted in 1978. Consumers may challenge such transactions if they did not provide consent or if the transaction occurred due to negligence from financial institutions. Statistically, the Federal Trade Commission (FTC) reported over 2.1 million identity theft complaints in 2022, emphasizing the importance of safeguarding financial data. When unauthorized transactions arise, breach of duty typically falls upon financial entities to ensure proper verification. Entities failing to investigate or resolve disputes may face liability, leading to legal actions and potential restitution. In circumstances involving personal accounts, customers generally have a limited liability of $50 if unauthorized transactions are reported within two days, escalating to $500 after 60 days if left unreported. Addressing these incidents swiftly aligns with consumer protection policies and fosters trust in financial systems.

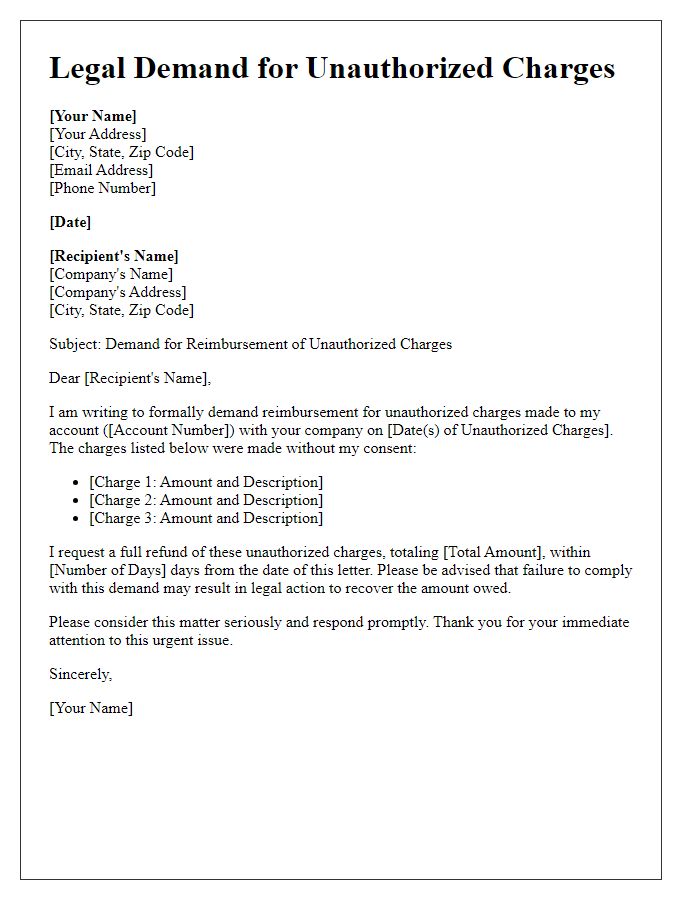

Demand for Resolution

Unauthorized transactions can lead to significant financial distress for individuals and businesses. In cases where fraudulent charges appear on bank statements or credit card accounts, immediate action is critical. Victims should meticulously document the unauthorized transaction details, including the amount (for instance, $250), date (like March 15, 2023), and merchant name (such as an online retailer). Contacting financial institutions promptly, in instances where delay can hinder dispute resolutions, is essential. Additionally, filing a complaint with regulatory bodies like the Federal Trade Commission (FTC) can further bolster the case. Seeking restitution from the party responsible for the unauthorized transaction is a necessary step in mitigating losses and safeguarding future transactions.

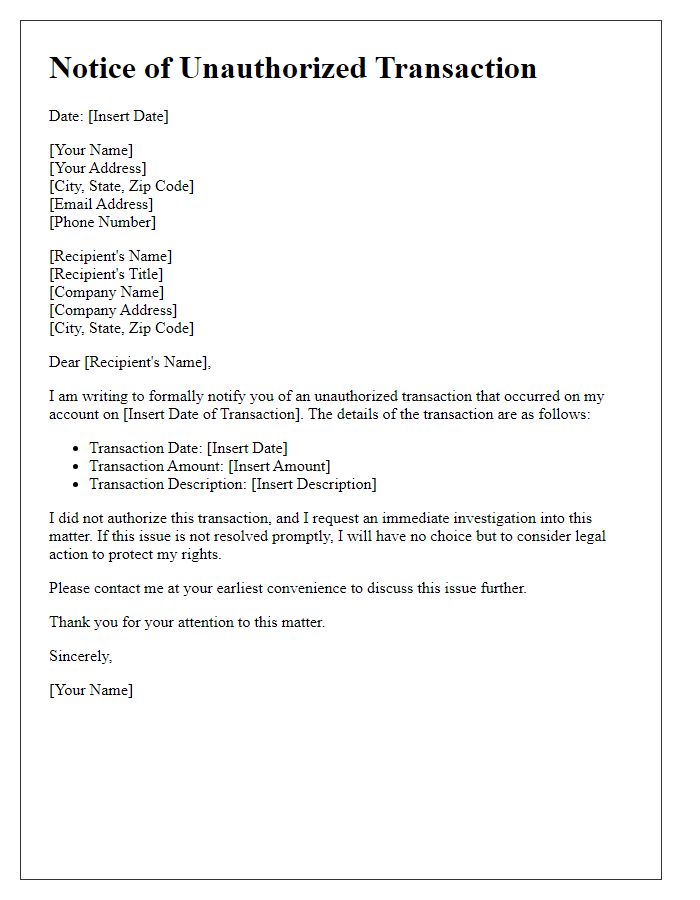

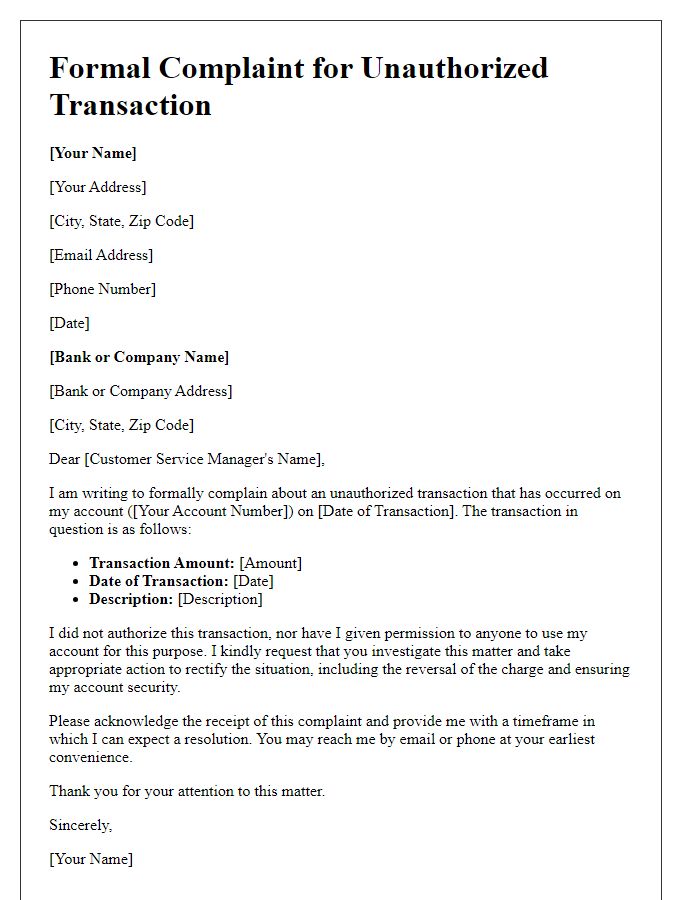

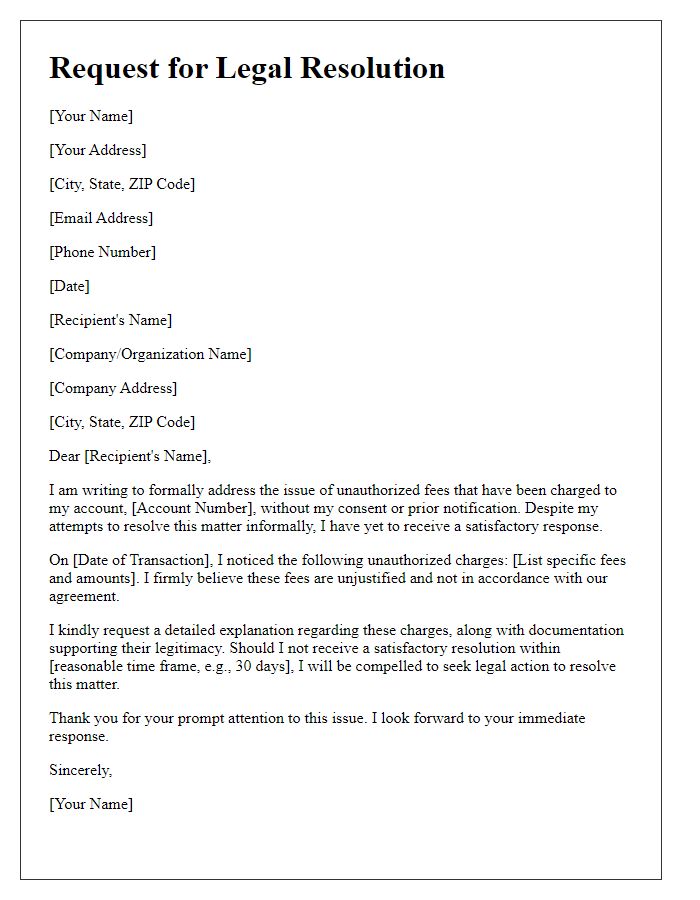

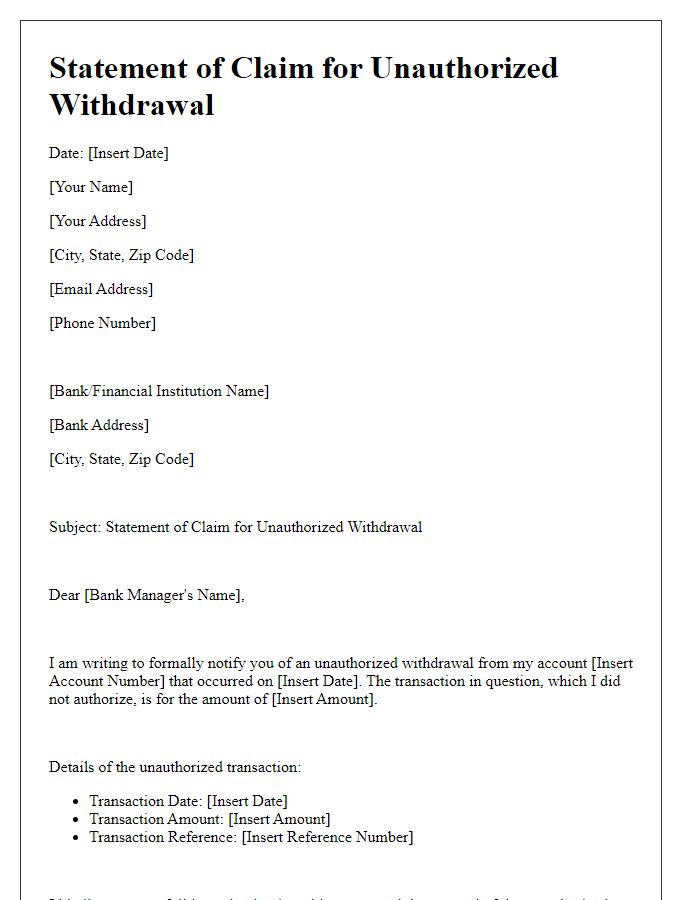

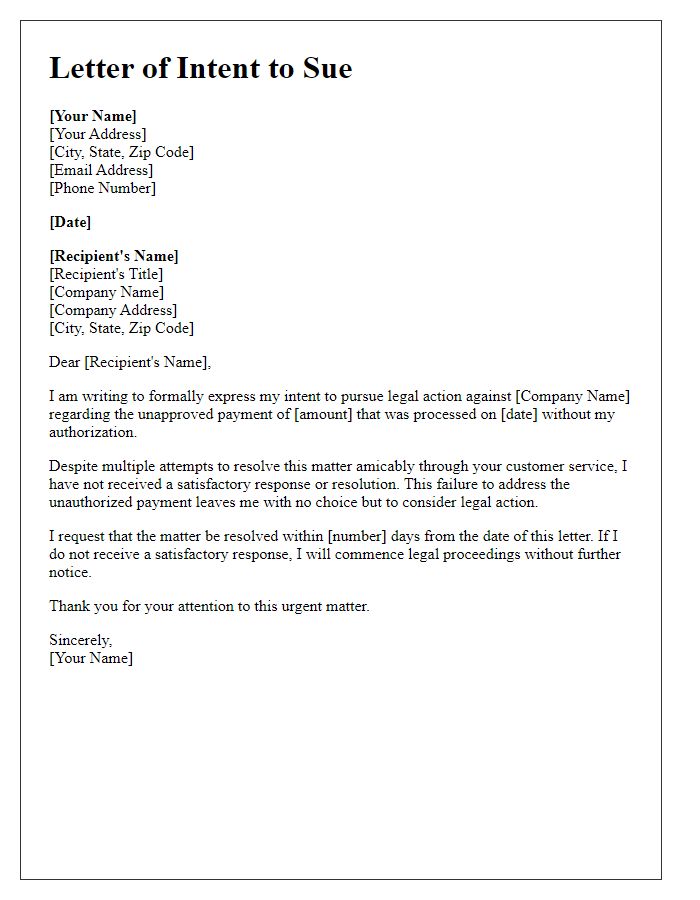

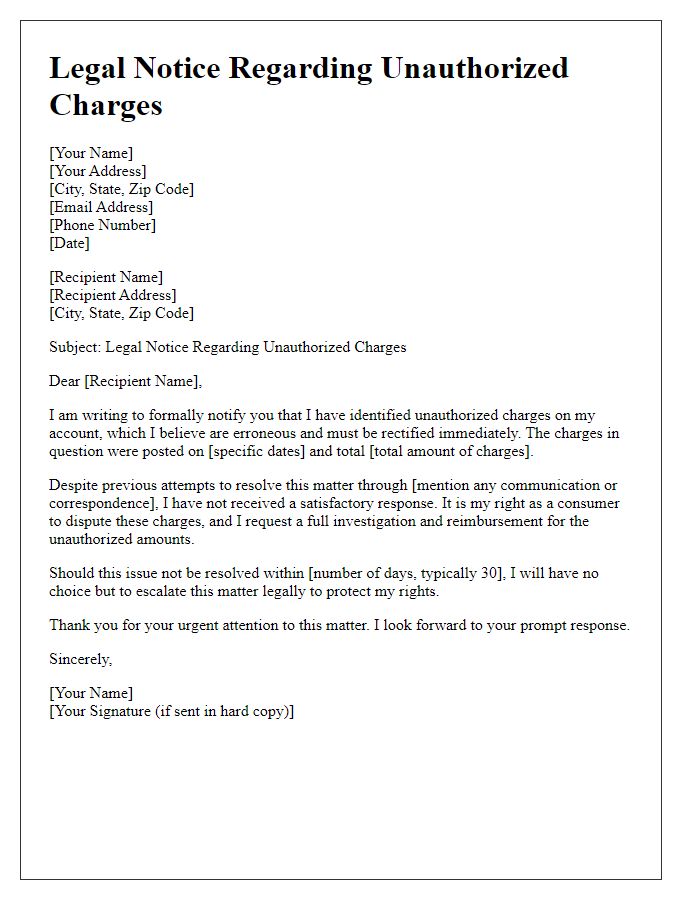

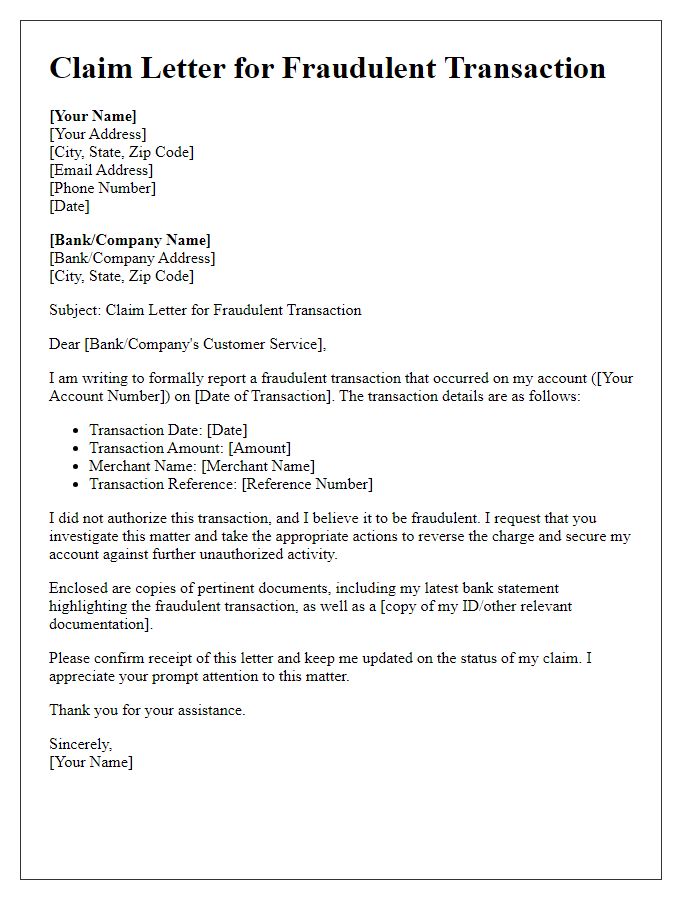

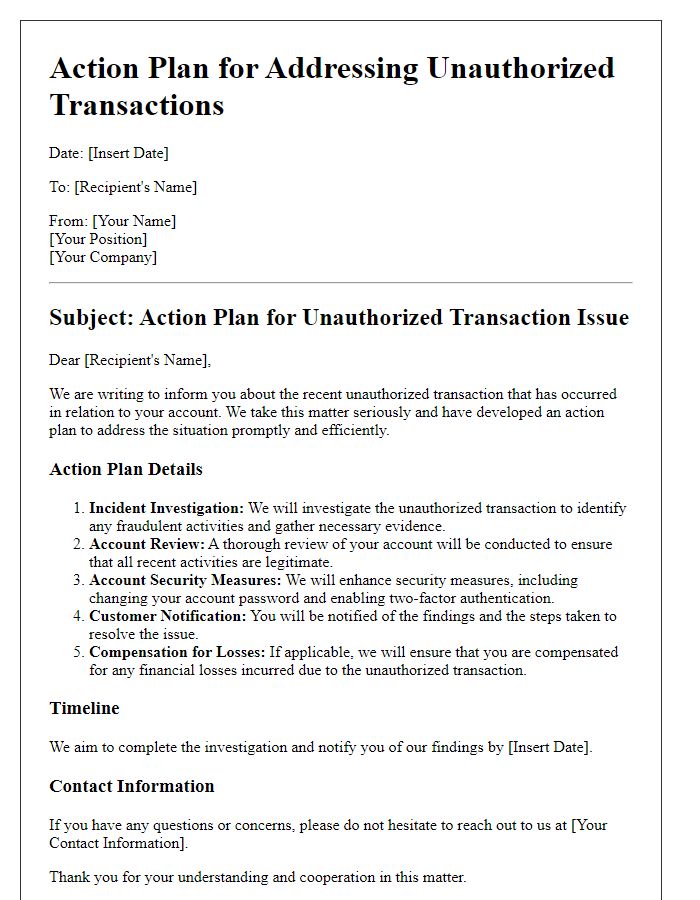

Letter Template For Unauthorized Transaction Legal Action Samples

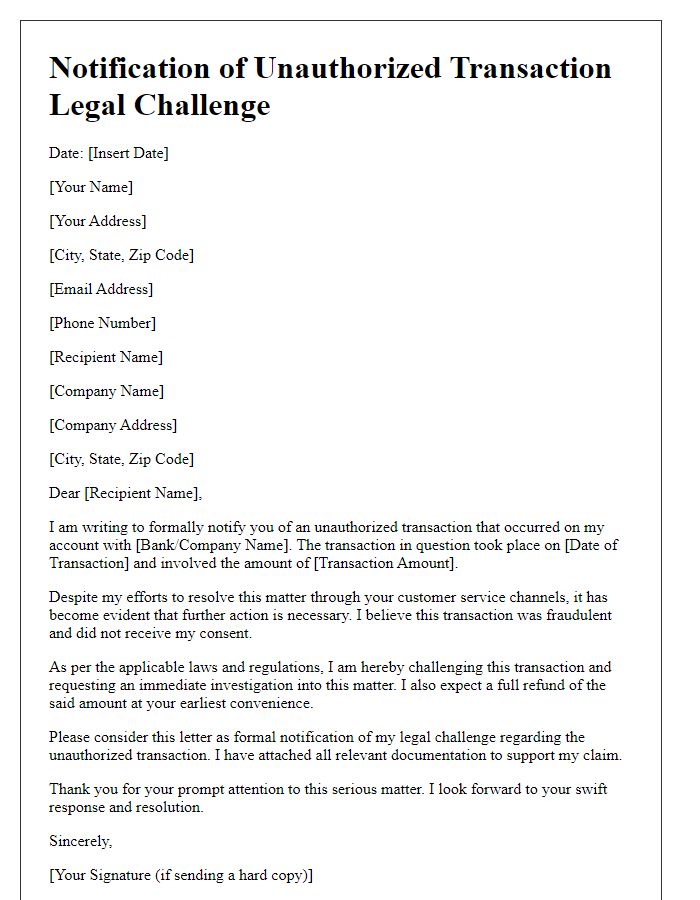

Letter template of Notification of Unauthorized Transaction Legal Challenge

Comments