Are you ready to navigate the intricate world of legal auditing? In this article, we'll break down the essential procedures that ensure your organization remains compliant and accountable. Whether you're a seasoned professional or new to the field, understanding these processes is vital for success. Join us as we delve deeper into the nuances of legal audits and their far-reaching implicationsâread on to discover more!

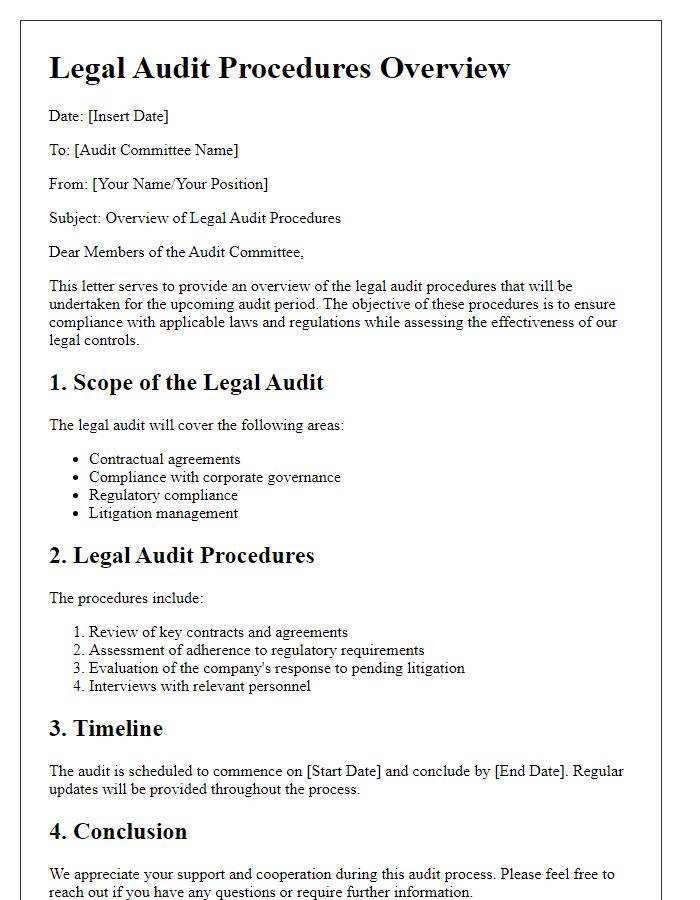

Objective of the Audit

The legal audit procedures aim to ensure compliance with regulatory standards and identify potential risks related to corporate governance, financial practices, and operational efficiency. This comprehensive evaluation will involve thorough examination of legal documents, including contracts, policies, and governance frameworks. Key areas of focus include adherence to laws specific to the jurisdiction, assessment of internal controls, and identification of areas requiring corrective actions to mitigate legal risks. The audit's objective is also to enhance transparency and accountability within the organization, ultimately promoting better decision-making processes and protecting stakeholder interests. The findings will contribute valuable insights for future strategic planning, ensuring long-term sustainability and legal integrity.

Scope of the Audit

The scope of the legal audit encompasses a comprehensive review of compliance with regulatory frameworks, including but not limited to anti-money laundering laws, data protection regulations such as the General Data Protection Regulation (GDPR), and corporate governance standards. Documentation review will involve contracts, agreements, and corporate filings, ensuring alignment with legal obligations and risk management practices. The audit will take place over a six-week period, beginning April 1, 2024, and concluding on May 15, 2024, emphasizing key operational areas located within New York City. Moreover, interviews with legal compliance officers and relevant stakeholders will facilitate a thorough understanding of current processes and potential areas for improvement within the organization.

Schedule and Timeline

The upcoming legal audit procedures will commence on November 1, 2023, and are expected to conclude by November 30, 2023. These audits will encompass a thorough review of compliance with local regulations and organizational policies, focusing on areas such as contract management, employee agreements, and intellectual property rights. The audit team, comprised of experienced legal professionals, will be conducting interviews with department heads and reviewing key documents during this period. All departments, including Human Resources, Finance, and Operations, must ensure that relevant materials are available and organized for smooth access. They should be prepared for potential follow-up inquiries until the final report is generated in early December 2023, outlining findings and recommendations for addressing any identified deficiencies.

Required Documentation

Legal audits require comprehensive documentation to ensure compliance and accuracy in reviewing organizational practices. Essential documents include contracts, such as service agreements and non-disclosure agreements, which outline obligations and rights between parties. Financial records, including balance sheets and income statements, reflect the fiscal health of the organization and adherence to regulatory standards. Furthermore, employee records, encompassing hiring documentation and performance evaluations, help assess compliance with labor laws. Internal policies and procedures need to be examined to verify alignment with legal requirements. Additionally, licenses and permits validate the operational legitimacy of the business in accordance with local regulations. Each of these documents plays a critical role in the thorough evaluation of legal adherence and risk management processes.

Contact Information and Support

Legal audit procedures ensure compliance and regulatory adherence within an organization. During a legal audit, contact information for key personnel such as corporate counsel, compliance officers, and auditors must be clearly defined. This includes names, titles, telephone numbers, and email addresses. Providing support resources, such as access to legal databases (e.g., LexisNexis, Westlaw) and guidelines for document requests, enhances communication during the audit process. Establishing a reliable contact point facilitates timely responses to inquiries and streamlines information flow, vital for maintaining compliance with laws and regulations. Comprehensive support ensures all stakeholders are informed and equipped to navigate the audit efficiently.

Letter Template For Legal Audit Procedures Announcement Samples

Letter template of legal audit procedures communication for compliance updates.

Letter template of legal audit procedures disclosure for internal review.

Letter template of legal audit procedures clarification for employee inquiries.

Letter template of legal audit procedures request for document submission.

Comments