If you ever find yourself in the difficult position of needing to dissolve a business partnership, it's crucial to approach the situation with clarity and professionalism. A well-crafted letter not only communicates your intent but also lays the groundwork for an amicable separation. By addressing key details like the reasons for dissolution and the next steps for finalizing the process, you can ensure that both parties are on the same page. Ready to learn how to draft the perfect letter for business partnership dissolution? Keep reading!

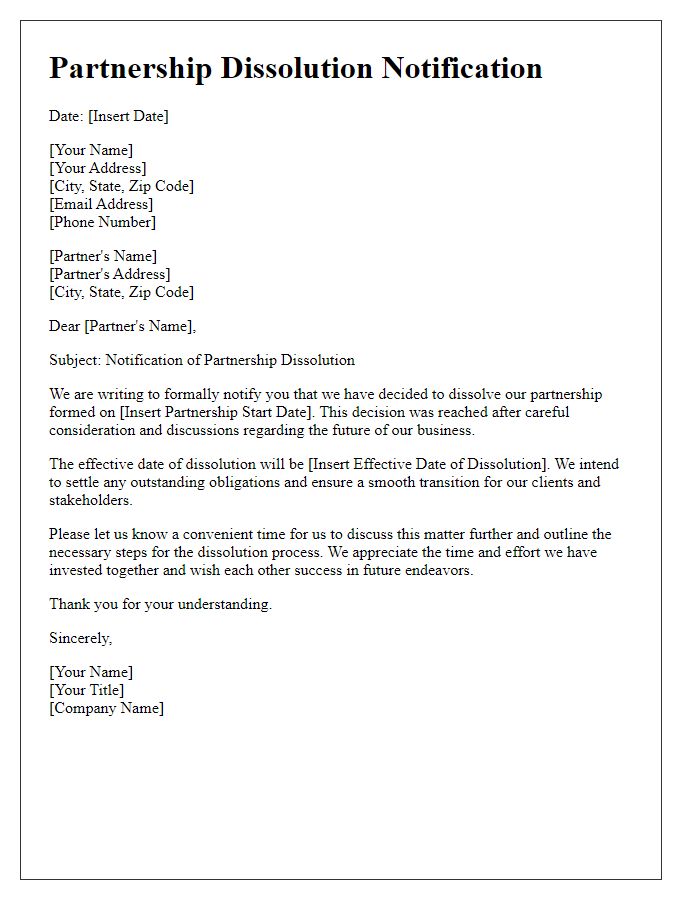

Clear Statement of Intent

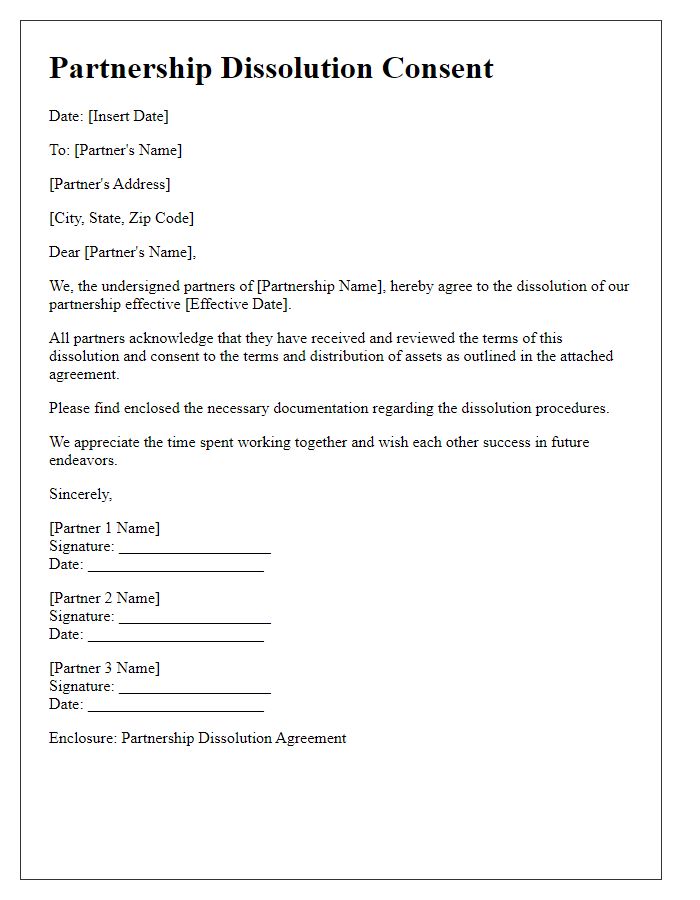

Dissolving a partnership business requires a clear statement of intent to ensure all parties understand the circumstances and terms of the separation. Each partner must recognize that the decision follows extensive discussions, reflecting a mutual agreement. The dissolution process may involve the division of assets, settling of liabilities, and finalizing outstanding contracts or obligations, based on the partnership agreement established at inception. Important considerations include determining the valuation of business assets, such as inventory, equipment, and intellectual property, along with settling financial responsibilities, including debts to creditors. Clear documentation should outline the timeline for the dissolution process, including deadlines for completing asset distributions and final reporting with relevant authorities, ensuring compliance with local regulations.

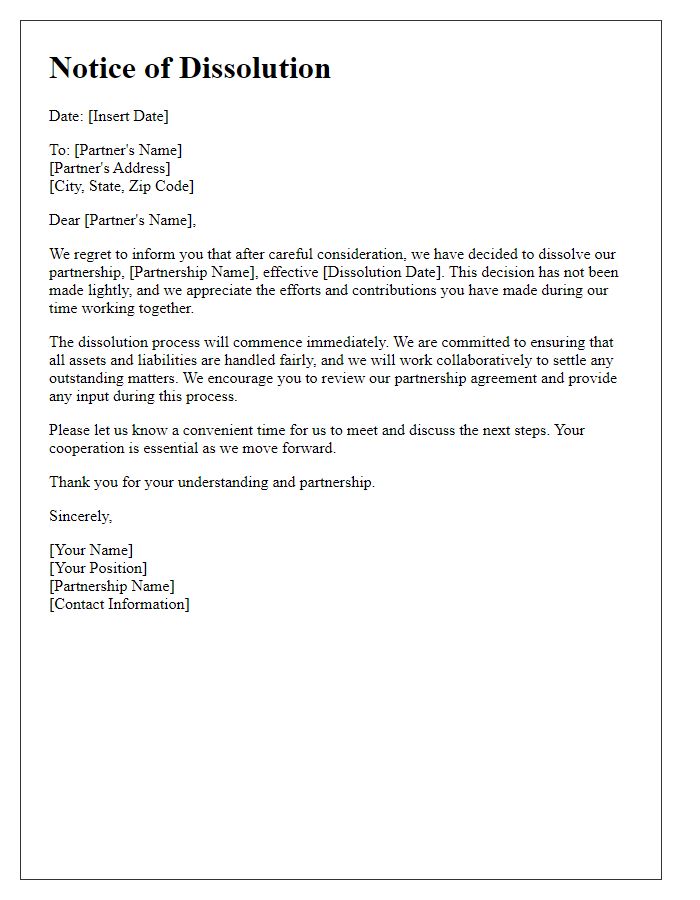

Effective Date of Dissolution

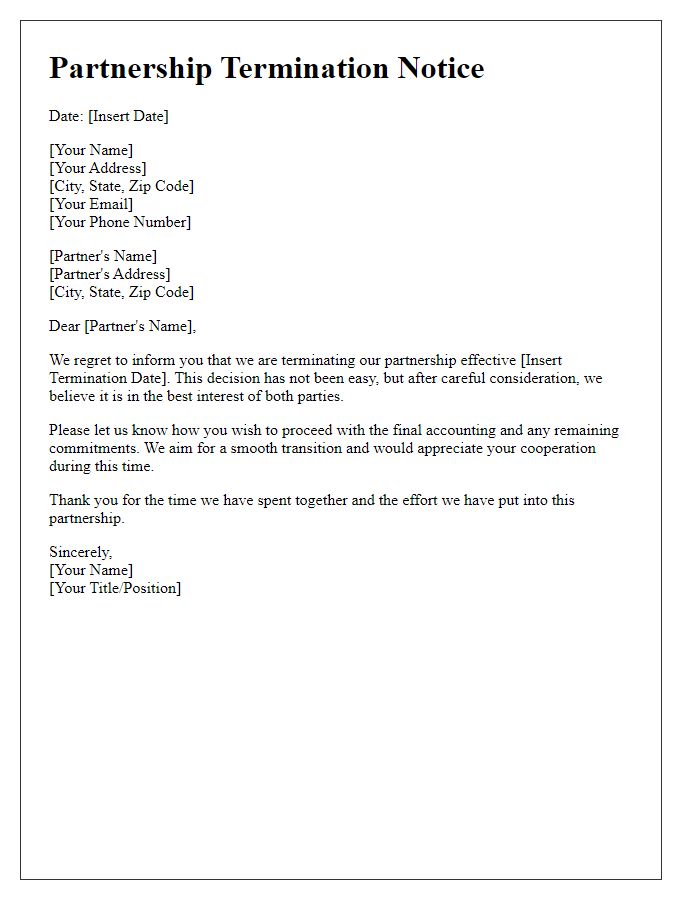

Dissolution of a business partnership, especially in cases where multiple stakeholders are involved, requires careful communication surrounding the effective date of dissolution. The effective date marks the official conclusion of all partnership activities in accordance with the partnership agreement. It is essential to notify all parties, including stakeholders, clients, and vendors, detailing the implications of this date. Any unresolved transactions must be settled prior to this date to ensure a clean break. Additionally, relevant authorities, such as the Secretary of State or local business registrar, must be updated regarding the cessation of operations, ensuring compliance with legal requirements. The effective date, for instance, may be set for December 31, 2023, allowing a structured timeline for the completion of financial obligations and final reporting.

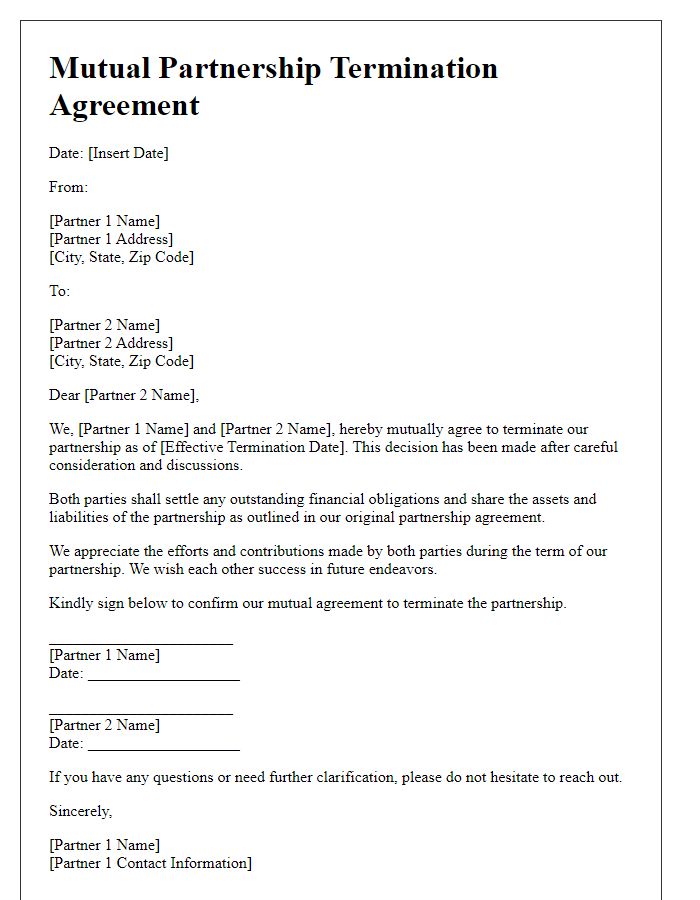

Asset and Liability Division

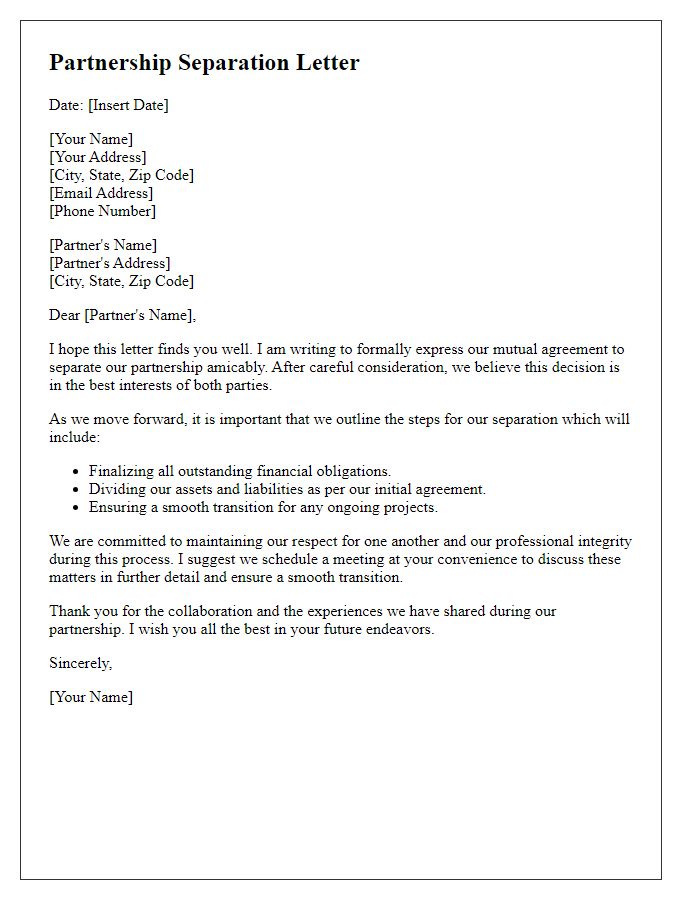

Partnership dissolution involves the careful division of assets and liabilities among partners based on the initial agreement or legal standards. Assets, such as property, inventory, and cash reserves, need appraisal to determine fair market value, influencing the division strategy. Liabilities, including outstanding debts and contractual obligations, require a complete audit to ascertain total amounts owed. Each partner's share must reflect their initial investment and operational contributions, adhering to either specified partnership terms or default state dissolution laws. Tax implications of asset liquidation or transfer must also be considered, as the Internal Revenue Service (IRS) may impose liabilities based on gains or losses during dissolution. Legal documentation ensures compliance, delineating responsibilities to prevent future disputes.

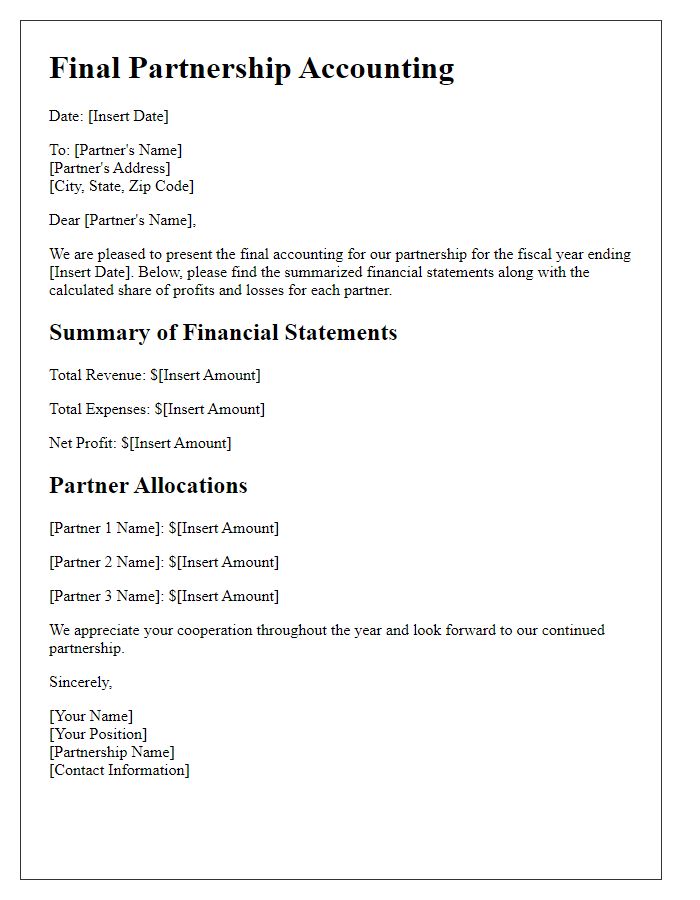

Roles and Responsibilities during Transition

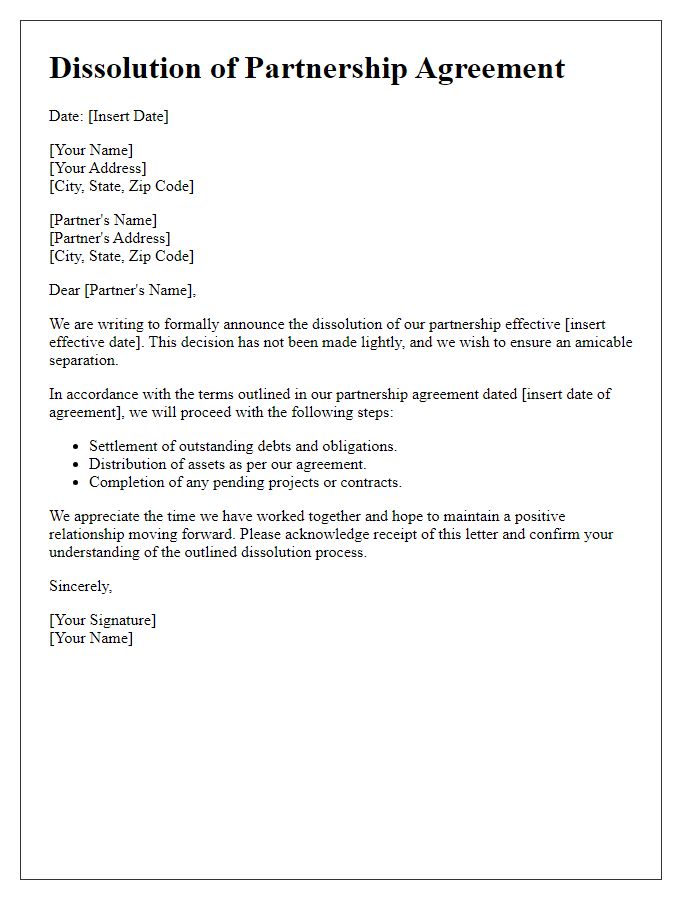

The dissolution of a partnership business requires meticulous attention to roles and responsibilities to ensure a smooth transition. Each partner must provide a detailed accounting of assets, including inventory, equipment, and receivables, often assessed through a formal valuation process. Legal documents, including partnership agreements from prominent jurisdictions like Delaware or California, must be reviewed to clarify dissolution clauses. Communication with stakeholders, such as employees, creditors, and customers, is critical, with plans for notifying them being implemented. Financial responsibilities include settling debts and liabilities, with final tax filings prepared based on the business's operating structure, whether an LLP or general partnership. Asset distribution should follow the agreed-upon terms in the partnership operating agreement, with clear documentation of each partner's share. It is essential to create a timeline to ensure that all necessary steps are taken in a timely manner, facilitating an organized closure while maintaining transparency throughout the process.

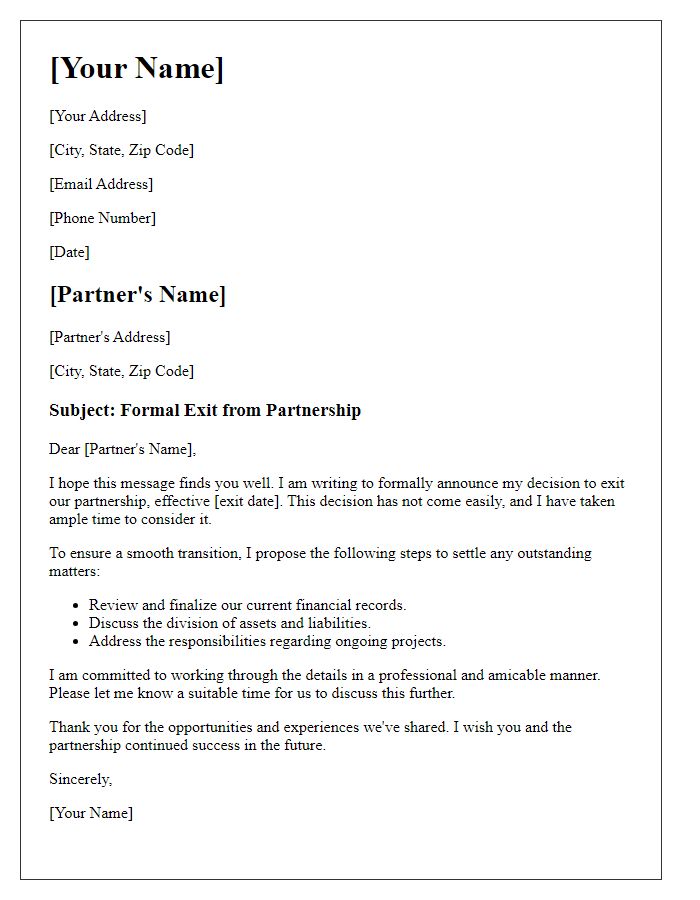

Confidentiality and Non-compete Agreements

Dissolving a partnership business requires careful consideration of confidentiality and non-compete agreements to protect the interests of all parties involved. Confidentiality agreements ensure that sensitive information, such as financial records, client lists, and proprietary methods, remains protected after dissolution. Each partner must agree to refrain from disclosing such information to competitors or outside entities, which can be crucial in maintaining the integrity of the business's reputation and client relationships. Additionally, non-compete agreements prevent former partners from starting a competing business within a specific geographic area, often limited to one year, ensuring that the existing business maintains its market share and customer base. These agreements must define the scope, duration, and geographic limitations clearly to avoid future disputes and litigation, ultimately creating a smoother transition for all parties involved as they move forward separately.

Comments